( click to enlarge )

( click to enlarge )I alerted readers and twitter followers to Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA) as a possible breakout play several times last week. After drifting for weeks, the stock finally broke out of a consolidation with a large volume on Friday and reached a new three-month high. Due to the overbought readings I took profits and will wait for a pull-back to reenter.

( click to enlarge )

( click to enlarge )WidePoint Corporation (NYSEMKT:WYY) slumped again on Friday, hitting its lowest level in more than four weeks. The stock closed just above the 1.42 level 50EMA. I believe now is the time to start trying to catch this knife with a tigh stop loss. Some technical indicators such as CMF and A/D remain strong. Any bounce from here could move to 1.75. Let's see if that happens on Monday. The potential growth of the company is very attractive.

( click to enlarge )

( click to enlarge )Zogenix, Inc. (NASDAQ:ZGNX) stalking. I would like to see this stock close over 4.55 before getting involved. Both MACD and RSI are not showing any signs of weakness yet. As long as the stock trades above $4.17 EMA13, the short-term trend is considered intact.

( click to enlarge )

( click to enlarge )Superconductor Technologies, Inc. (NASDAQ:SCON) is pulling back on low-volume. I'm currently accumulating the stock. OBV indicator remains pointing upward.

( click to enlarge )

( click to enlarge )Oncolytics Biotech, Inc. (NASDAQ:ONCY) is forming a rounding-bottom formation on the daily chart. This is a medium-term reversal pattern. 1.74 EM9 zone keeps holding the upside. Technical indicators have turned slightly bullish with MACD crossing over the zero-line. 1.91 level in the daily seems to be capping the upside for now. A clear break above this level should take the price up to 2.2-2.30 area. Long setup.

( click to enlarge )

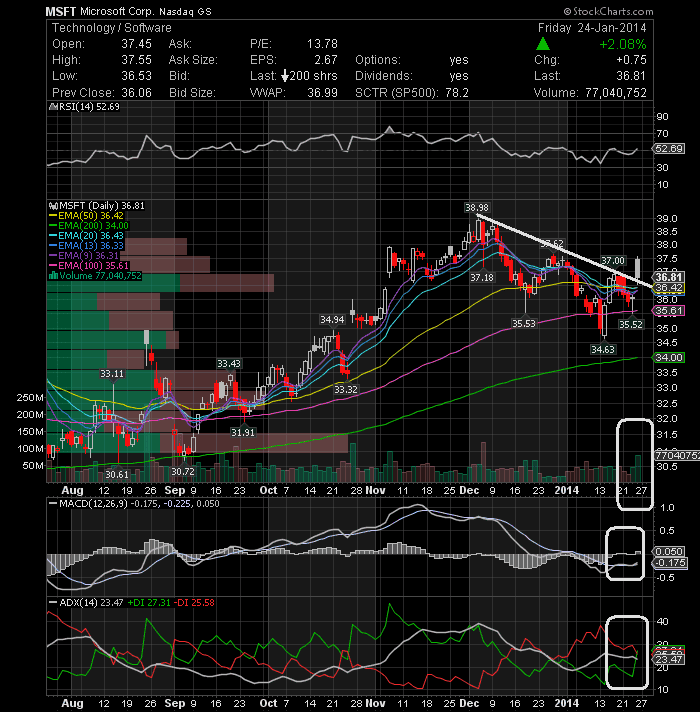

( click to enlarge )Microsoft Corporation (NASDAQ:MSFT) Broke out of the downtrend line in place since December as well as its 50-day EMA yesterday. The strong volume that accompanied the breakout is very bullish for the stock. The MACD has just issued a buy signal. The push should continue for the days, if not weeks ahead. Worth watching next week.

( click to enlarge )

( click to enlarge )Vringo, Inc. (NASDAQ:VRNG) Potential breakout play next week. Watching over 4 with resistance at 4.14. The MACD has inched higher and moved away from the zero line, which is very Bullish. Keep it on watch.

( click to enlarge )

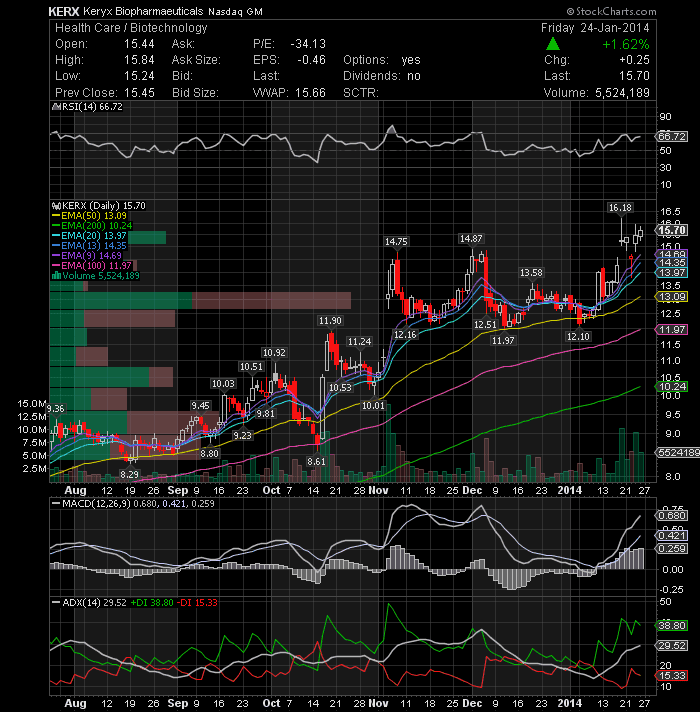

( click to enlarge )Keryx Biopharmaceuticals (NASDAQ:KERX) is on my watch list for next week. The stock price can potentially set-up well for a swing-trade, if it breaks through the key resistance level at 16.18.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC