Nikola Corporation (NKLA) designs and manufactures heavy-duty commercial Battery-Electric Vehicles (BEV) and Hydrogen-Electric Vehicles (FCEV), and energy infrastructure solutions.

The company is focusing on its North American operations after its first-quarter topline missed expectations. Its first-quarter revenue came in at $11.1 million, versus the $12.5 million expected, while its non-GAAP loss per share stood at 26 cents, in line with expectations.

NKLA announced a realignment to conserve cash by selling its share of a European joint venture with Italian heavy-truck maker Iveco Group for $35 million in cash and 20.6 million NKLA shares that Iveco will return. In addition, this month, the company also announced another restructuring measure by liquidating the assets of battery maker Romeo Power.

Given this backdrop, let’s look at the trends of NKLA’s key financial metrics to understand why it could be wise to avoid the stock now.

NKLA Financial Health in Shaky Ground: Alarming Three-Year Trend Analysis

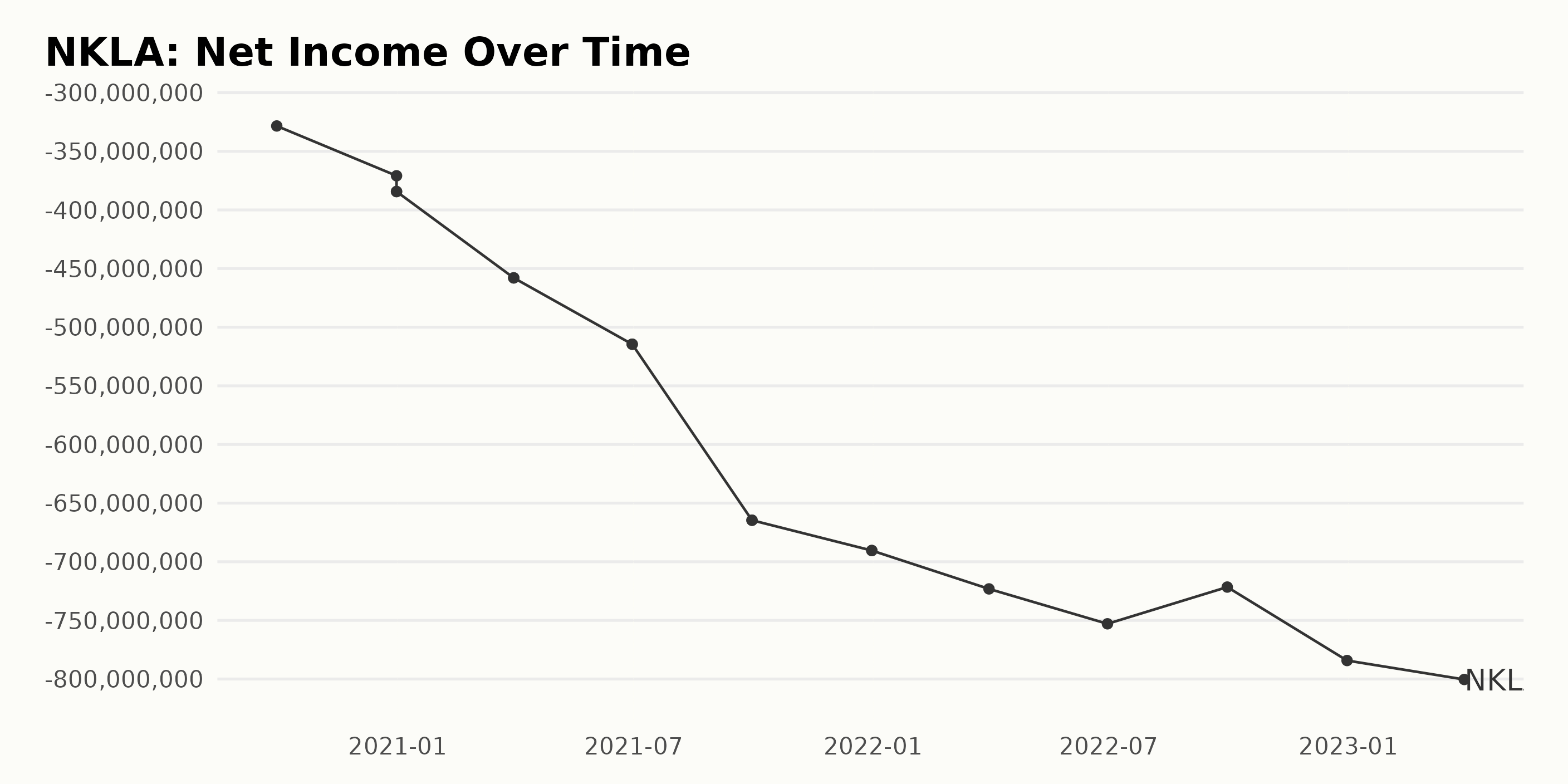

The NKLA's trailing-12-month net income has shown consistent negative growth from 2020 through 2023. The increase in losses signifies a trend of financial instability within the company.

- On September 30, 2020, the net income was -$328.39 million.

- A steady increment in losses was observed in the subsequent months, with losses heightening to -$370.87 million and -$384.31 million by December 2020, respectively.

- In 2021, the net income further declined, reaching -$457.93 million in March, -$514.52 million in June, and then a sharp tumble to -$664.61 million in September. It fell further to a recorded -$690.44 million as of December 2021.

- NKLA commenced 2022 with further slashed net incomes of -$723.16 million in March and -$752.92 million in June. However, a slight reprieve occurred in September, with the value slightly improving to -$721.59 million.

- This short relief didn't last, and by the end of 2022, the net income significantly declined again to -$784.24 million.

- As of the latest data point in March of 2023, NKLA's net income staggered at -$800.39 million, marking the lowest in the series.

In conclusion, NKLA's net income reports have illustrated a drastic decline over the reported period causing an unfavorable atmosphere in the company's financial health.

From the first recorded figure of -$328.39 million in September 2020 to the last available data showing -$800.39 million in March 2023, NKLA witnessed an approximated escalation of their losses by around 143.7%. More recent data reveal a greater intensity in losses, reinforcing the criticality of the firm’s fiscal situation.

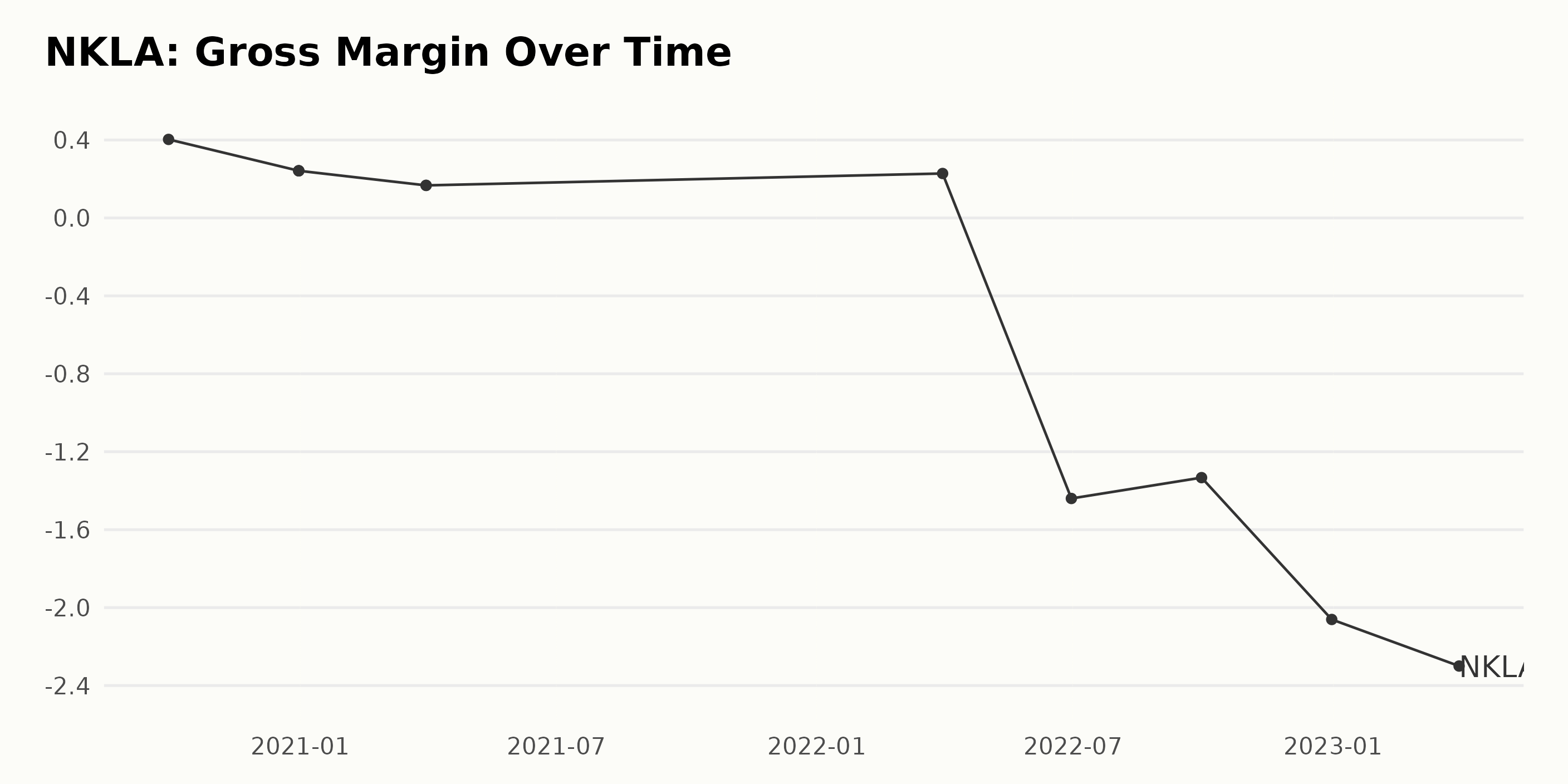

The gross margin for NKLA has demonstrated considerable fluctuations and a downward trend from September 2020 to March 2023. The following is a summarized review of the highlighted trends and fluctuations:

- In September 2020, NKLA’s gross margin was at its peak, standing at 40.3%.

- Significant reductions in gross margin value were observed in the last quarter of 2020 and the first quarter of 2021, with the values lowering to 24.2% and 16.7%, respectively.

- The year 2022 started with an increase in the first quarter as gross margin rose to 22.8%. However, a severe and continuous drop began afterward, leading to negative values.

- By June 2022, the gross margin had plummeted to -144%, marking the onset of the negative gross margin period.

- Despite some fluctuation, the negative gross margin trend persisted till the end of the series data in March 2023, reaching as low as -230%.

In terms of growth rate, measured from the first value to the last value, NKLA experienced a significant gross margin decrease of approximately 570%. Please note that the data emphasize the most recent years, and the extreme dip in gross margin in the later quarters highlights potentially alarming financial strain. This might require further analysis and context for complete understanding.

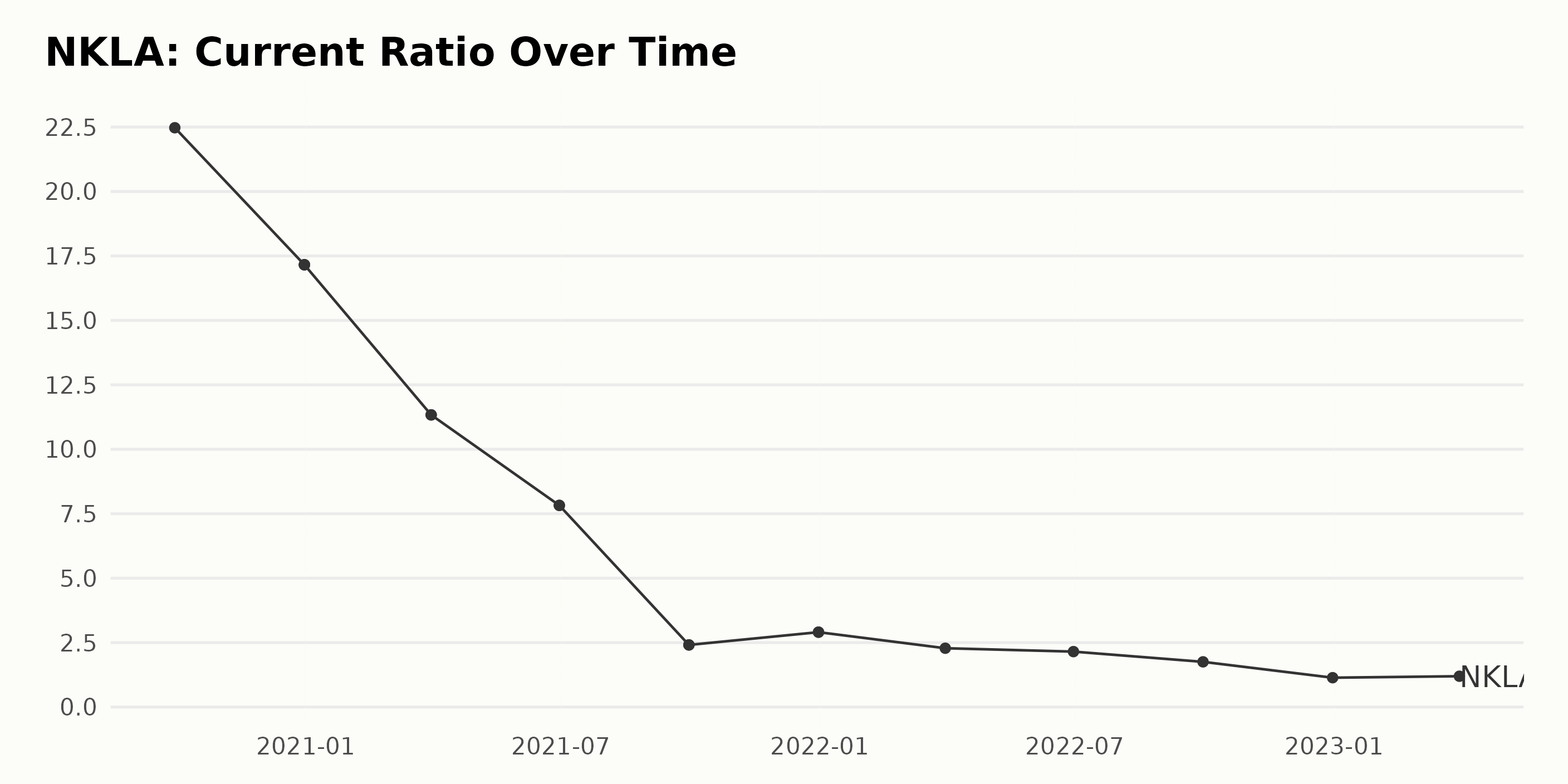

The data represents the current ratio of NKLA from September 2020 to March 2023. Here's a summary of NKLA’s current ratio based on relevant data:

- NKLA started with a current ratio of 22.47 in September 2020.

- The current ratio saw a steady decline over time. By December 2020, the ratio had decreased to 17.16.

- Afterward, in the first quarter of 2021, the ratio declined even further to 11.33.

- The downward trend continued throughout 2021, resulting in a current ratio of 2.91 by the year's end.

- The year 2022 began with a current ratio of 2.28 in the first quarter, slightly dropping to 2.15 in the second quarter, reducing further to 1.75 in the third quarter, and ending with a significantly low ratio of 1.14 in the fourth quarter.

- Moving into 2023, the first quarter saw a marginal increase with a current ratio of 1.20.

Upon calculating the growth rate by measuring the last value from the first value, there was a decrease of approximately 95% in the current ratio from September 2020 to March 2023.

This highlights a significant contraction in NKLA's liquidity/short-term financial health during this period. Critical points:

- The most significant drop was experienced between June 2021 (Current Ratio = 7.82) and September 2021 (Current Ratio = 2.41).

- Despite this general downtrend, there has been a small uptick in the current ratio from 1.14 at the end of 2022 to 1.20 by the end of March 2023.

This downward trend in the current ratio indicates that NKLA has been increasingly unable to meet its short-term liabilities with its short-term assets, which could signal potential problems in managing its working capital. However, the small increase in the first quarter of 2023 might suggest an improvement in this area, but it warrants careful monitoring.

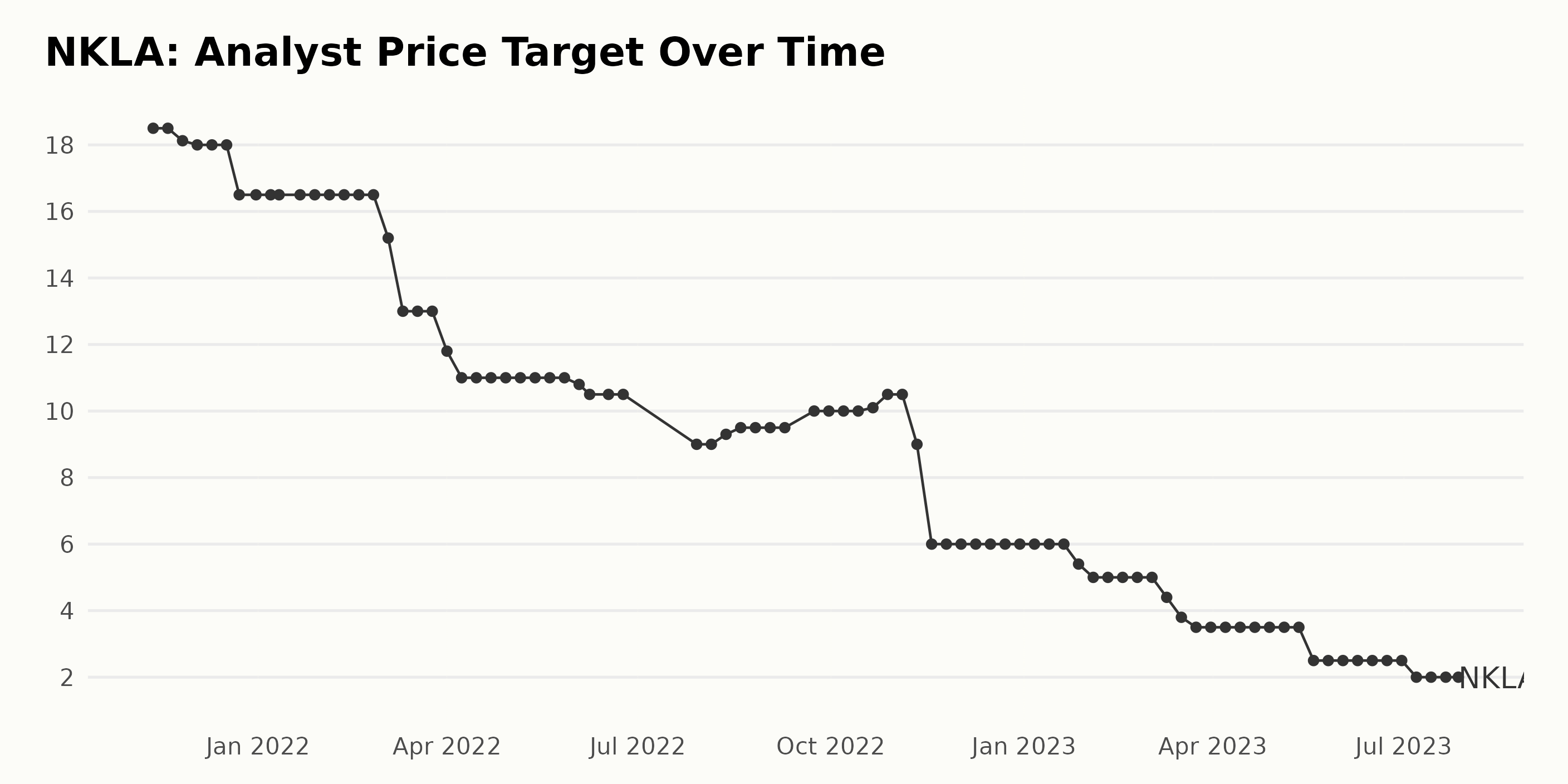

The Analyst Price Target (APT) of NKLA over time illustrates a significant downward trend. Highlights of the data include:

- A high point of an APT value of $18.5 in November 2021.

- A steady decline started from December 23, 2021, when the APT decreased to $16.5 from $18.0.

- Between February and March of 2022, the APT sharply declined from $16.5 to $15.2 and then again to $13. The APT decreased gradually, reaching 11 by April 1, 2022.

- The decline slowed as the value hovers around $10.5-$11 between April and September 2022.

- From November 2022 to January 2023, the APT stabilizes at $6 after a substantial drop from $10.5.

- Between January and March 2023, the APT sees another significant decline from $6 to $3.5, with occasional fluctuations.

- The APT has recently declined sharply from $3.5 in May to $2 in July 2023.

The last value of the APT for NKLA on July 27, 2023, was $2. This data reflects a negative growth rate from the first to the previous value, indicating a substantial decrease in the APT over this period.

Understanding NKLA's Six-Month Stock Performance: A Journey of Highs and Lows

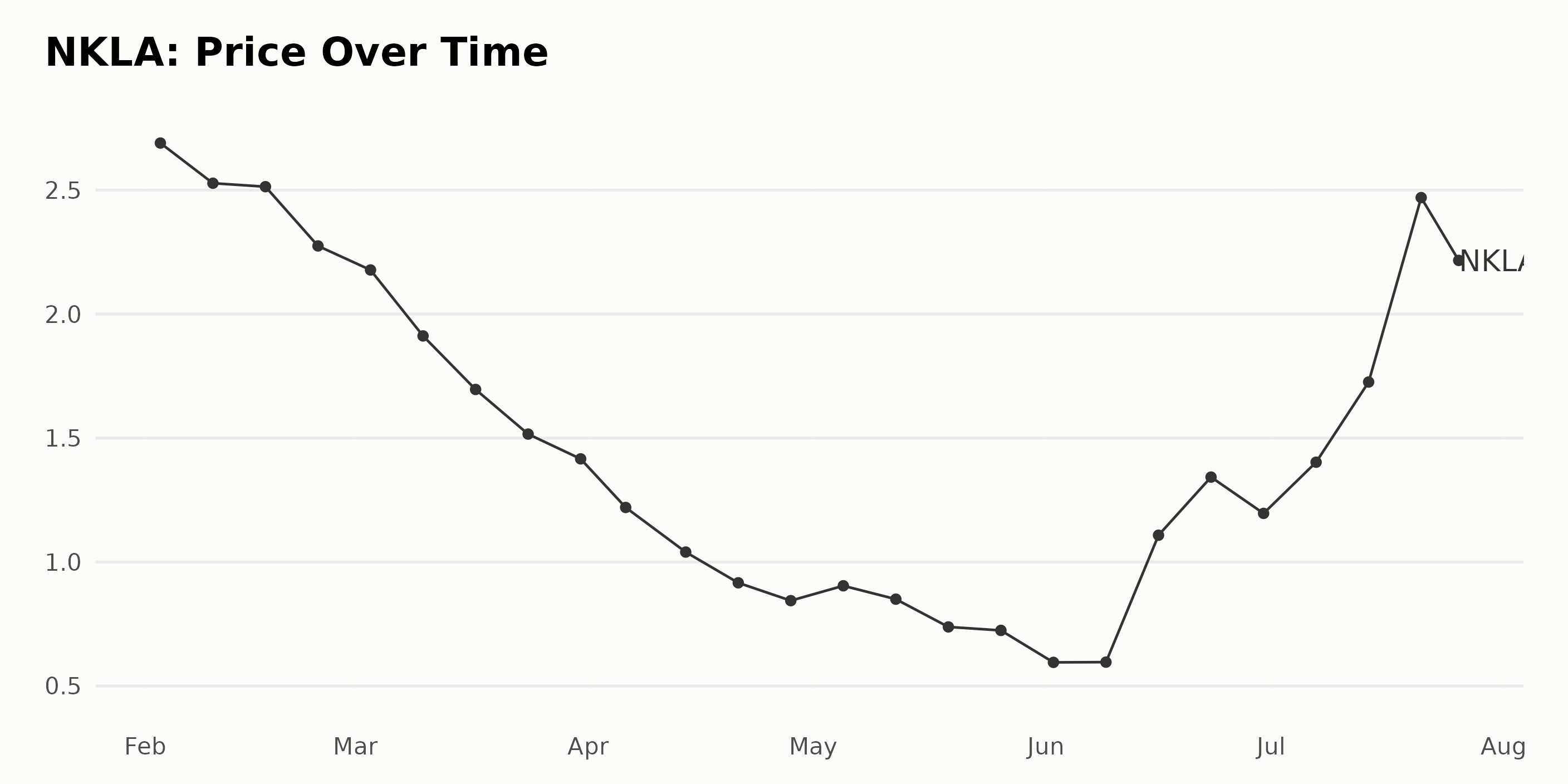

Upon analysis of the provided data, the share price of NKLA has demonstrated a fluctuating trend from February 2023 to July 2023. Here is a complete breakdown:

February 2023: The NKLA share price starts at $2.69 on February 3 and witnesses a gradual decrease throughout the month, ending at $2.28 on February 24. This represents an approximate decrease of 15%.

March 2023: This downward trend continues in March, with the share price starting at $2.18 on March 3 and closing at $1.42 by the end of the month. This marks a significant decrease of approximately 35%.

April 2023: In April, the downward trend accelerates further. The share price started at $1.22 and plummeted to $0.84 by the end of the month. This showcases a marked decrease of about 31%.

May 2023: The NKLA share price seems to stabilize somewhat in May, starting at $0.90 and ending at $0.72, a decline of roughly 20%.

June 2023: In June, however, there's a noteworthy shift — after a shaky start, the share price rises sharply from $0.60 to $1.34, marking an impressive increase of over 120%.

July 2023: This upward swing gains momentum in July, with the NKLA share price skyrocketing from $1.40 at the beginning of the month to close at $2.25 by July 26.

Overall, during this period, the NKLA share price has shown an initial decelerating downward trend followed by an accelerating upward trend from June onwards. It started at $2.69 in February and went down to as low as $0.59 in June before bouncing back up to close at $2.25 by late July.

Here is a chart of NKLA's price over the past 180 days.

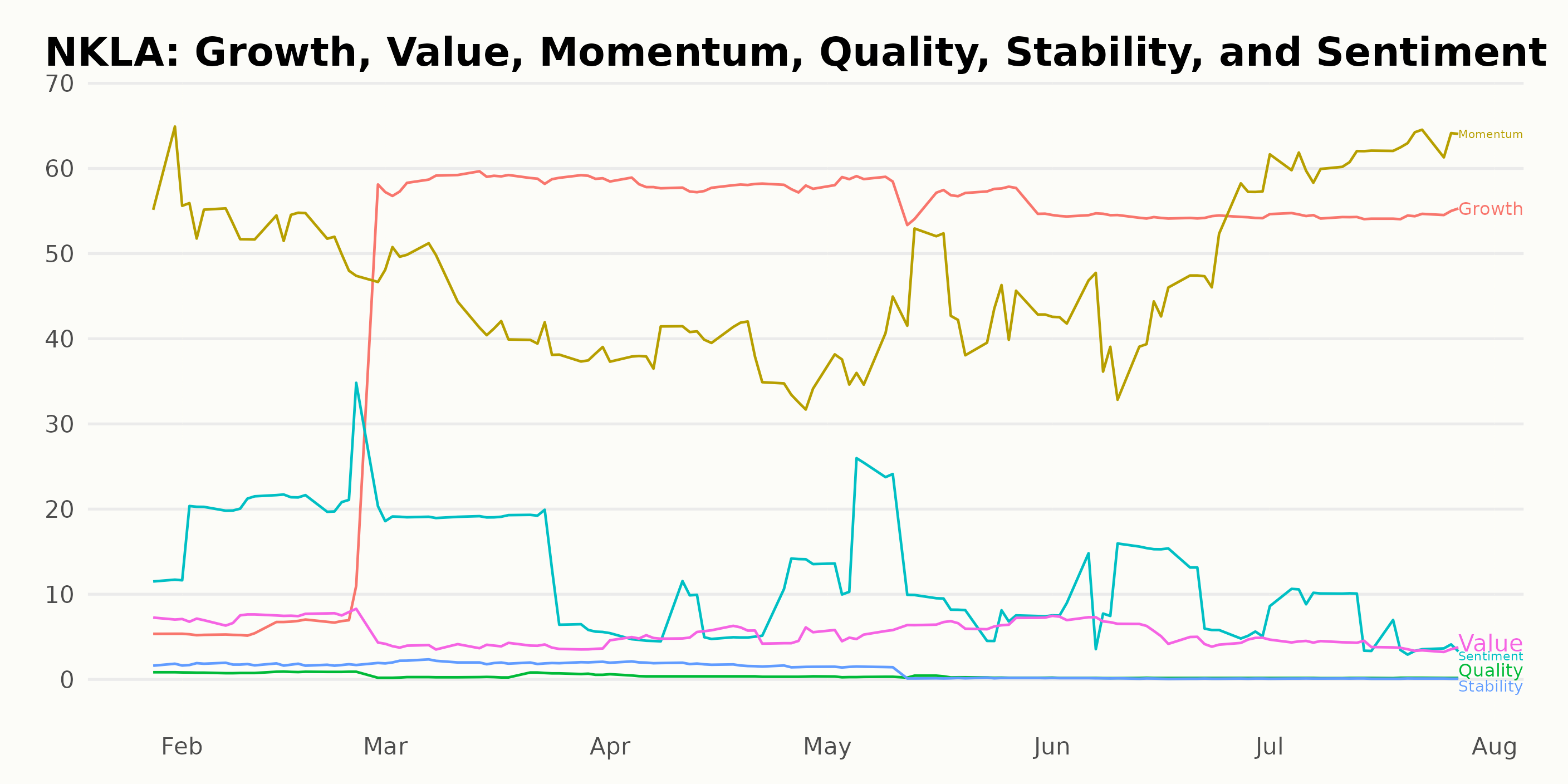

Analyzing NKLA's Momentum, Growth, and Sentiment POWR Ratings for January-July 2023

Based on the provided data, the POWR Ratings grade for NKLA in the Auto & Vehicle Manufacturers category is documented as follows: POWR Grade: F (Strong Sell). Below are some noteworthy points related to its rank in category:

- As of July 26, 2023, the latest value is recorded to be #52 within the 55 stocks in its category.

- Over the timeline from January 28 to July 26, 2023, rank has improved overall. Note: Given the POWR grade of F (Strong Sell) and its rank, it's clear that NKLA has significant room for improvement in terms of its performance compared to other stocks in its category.

The three most important dimensions of the POWR Ratings for NKLA from January to July 2023 were Momentum, Growth, and Sentiment. Here's an overview of these dimensions over this period.

Momentum

- In January 2023, NKLA had a Momentum score of 60, indicating strong upward price movement.

- By February 2023, the Momentum dropped to 52.

- The Momentum score then declined during March, April, May, and June, reaching its lowest at 38 in April 2023.

- However, by July 2023, the Momentum score had increased significantly again, up to 62.

Growth

- The growth dimension for NKLA started low at 5 in January 2023.

- There was a minor increment in February 2023, bringing it up to 9.

- From March 2023, there was a drastic increase in the Growth score, peaking at 59 that month.

- Chairing the next few months, the Growth score slowly decreased to 54 by July 2023.

Sentiment

- Starting with a Sentiment score of 12 in January 2023, NKLA’s sentiment fluctuated over the next few months between 8 (April) and 21 (February).

- Despite these fluctuations, by July 2023, it had fallen to 7, showing negative sentiment toward NKLA’s future.

These trends show significant changes in the Momentum, Growth, and Sentiment POWR Ratings for NKLA over this period.

How does Nikola Corporation (NKLA) Stack Up Against its Peers?

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Bayerische Motoren Werke Aktiengesellschaft (BMWYY), Mercedes-Benz Group AG (MBGAF), and Subaru Corporation (FUJHY) - they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

NKLA shares were trading at $2.18 per share on Thursday afternoon, down $0.07 (-3.11%). Year-to-date, NKLA has gained 0.93%, versus a 20.21% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Nikola Corporation (NKLA): Should Investors Buy or Sell This Week? appeared first on StockNews.com