Bionano Genomics, Inc. (BNGO) has garnered attention with its Saphyr system, a third-generation optical mapping solution offering quick, high-throughput, long-range genome mapping and structural variation detection capabilities critical for genomic research. The number of installed Saphyr systems reached 259 as of the first quarter of 2023, marking a 47% increase compared to the same period last year.

“We are leveraging our investments in the commercial organization and evidence development to drive adoption of the Saphyr system,” stated Chris Stewart, Bionano’s Chief Financial Officer.

Despite growth in its top line, BNGO’s bottom line is in the red. The company reported a net loss of $37.12 million in the first quarter.

Furthermore, BNGO faces the threat of delisting. On May 30, 2023, the company received a letter from The Nasdaq Stock Market LLC, notifying that its common stock had closed below the minimum required bid price of $1.00 per share for 30 consecutive trading days preceding the date of the Notice. Bionano now has 180 calendar days following the date of the Notice to comply with the Minimum Bid Price Requirement.

Given these uncertainties, BNGO could be a high-risk investment. In this article, we will delve deeper into the metrics that support our bearish case.

Analyzing BNGO’s Financial Performance: Net Income, Revenue, and Gross Margin, Trends

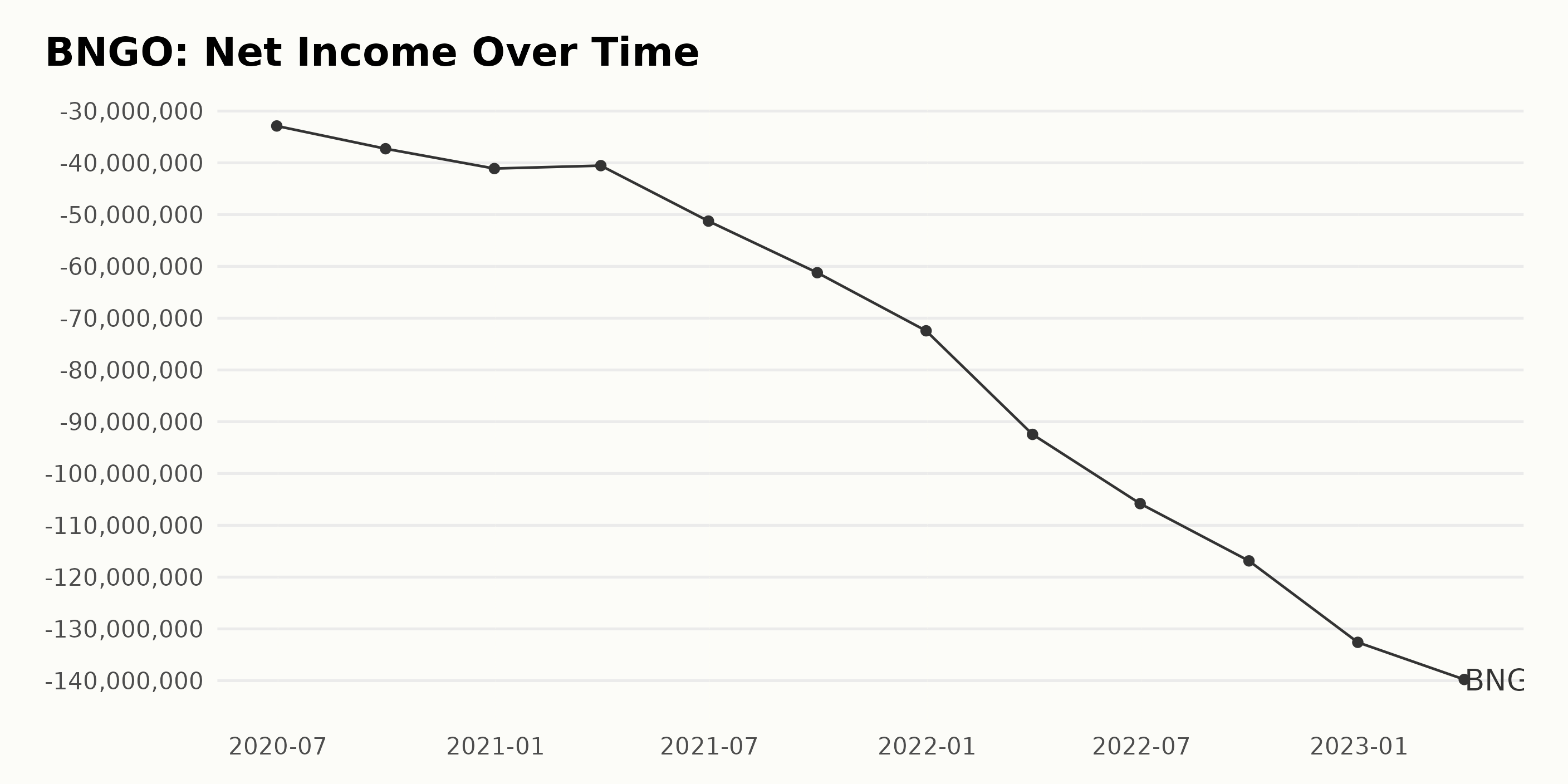

The trend and fluctuations of BNGO’s trailing-12-month net income over the given data series can be summarized as follows:

- June 2020: -$32.88 million

- September 2020: -$37.28 million

- December 2020: -$41.11 million

- March 2021: -$40.54 million

- June 2021: -$51.26 million

- September 2021: -$61.22 million

- December 2021: -$72.44 million

- March 2022: -$92.44 million

- June 2022: -$105.81 million

- September 2022: -$116.87 million

- December 2022: -$132.60 million

- March 2023: -$139.77 million

BNGO’s net income has consistently been negative throughout the series. More recent data and the last value (March 2023) show a significant increase in net loss, reaching -$139.77 million. The net income has generally worsened over time.

The trend and fluctuations of the BNGO’s trailing-12-month revenue can be summarized as follows:

- June 2020: $8.42 million

- September 2020: $7.3 million

- December 2020: $8.5 million

- March 2021: $10.54 million

- June 2021: $13.21 million

- September 2021: $15.67 million

- December 2021: $17.98 million

- March 2022: $20.51 million

- June 2022: $23.32 million

- September 2022: $25.89 million

- December 2022: $27.8 million

- March 2023: $29.52 million

BNGO has generally experienced a consistent growth in revenue from June 2020 to March 2023. The company’s revenue increased from $8.42 million in June 2020 to $29.52 million in March 2023, which is approximately a growth rate of 250.83%. More recently, from December 2022 to March 2023, the revenue increased from $27.8 million to $29.52 million, showing a steady upward trend.

BNGO’s gross margin has experienced fluctuations over the past few years. Here’s a summary of the trend:

- June 30, 2020: 34.4%

- September 30, 2020: 36.9%

- December 31, 2020: 32.6%

- March 31, 2021: 33.6%

- June 30, 2021: 33.3%

- September 30, 2021: 30.7%

- December 31, 2021: 21.5%

- March 31, 2022: 18.0%

- June 30, 2022: 16.0%

- September 30, 2022: 16.9%

- December 31, 2022: 21.4%

- March 31, 2023: 24.2%

While there have been some ups and downs, the general trend has been a decline in BNGO’s gross margin since June 2020. From a peak of 36.9% in September 2020, the gross margin dropped to its lowest point in June 2022 at 16.0%. However, more recent data has shown a slight recovery, with the most recent value at 24.2% as of March 2023. The growth rate between the first and last values in the series represents a decrease of approximately 29.5%. Emphasizing the more recent data and the last value demonstrates a recovering trend in the gross margin after reaching its lowest point.

Analyzing BNGO’s Share Price Fluctuations: December 2022 - June 2023

Over this period, BNGO’s share price has been on a downward trend. The share price initially slightly increased and peaked at $1.86 on February 3, 2023. However, following this peak, the stock price declined consistently over the weeks, reaching its lowest point at $0.67 on May 5, 2023, and May 26, 2023. From there, it sees a modest recovery to $0.74 on June 15, 2023. Overall, the growth rate of BNGO’s share price portrays a clear decelerating trend over the addressed period. Here is a chart of BNGO’s price over the past 180 days.

Analyzing BNGO’s POWR Ratings

BNGO has an overall F rating, translating to a Strong Sell in our POWR Ratings system. BNGO has consistently been rated an F since December 24, 2022. It is ranked #381 out of the 383 stocks in the Biotech category. It also has an F grade in Stability, Sentiment, and Quality and a D in Momentum.

Stocks to Consider Instead of Bionano Genomics, Inc. (BNGO)

Other stocks in the Biotech sector that may be worth considering are Alkermes plc (ALKS), Semler Scientific Inc (SMLR), and Biogen Inc. (BIIB) -- they have better POWR Ratings.

Is the Bear Market Over?

Investment pro Steve Reitmeister sees signs of the bear market’s return. That is why he has constructed a unique portfolio to not just survive that downturn...but even thrive!

Steve Reitmeister’s Trading Plan & Top Picks >

BNGO shares were trading at $0.73 per share on Friday afternoon, down $0.01 (-1.47%). Year-to-date, BNGO has declined -50.00%, versus a 15.63% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Bionano Genomics (BNGO) a Buy or Sell this Week? appeared first on StockNews.com