Global movie-theater chain AMC Entertainment Holdings, Inc. (AMC) surged in popularity among meme traders during the pandemic, only to face a sobering reality when it erased all its 2020-2021 gains due to its shaky fundamentals.

Last month, the company reported its first quarter results, beating the consensus revenue estimate driven by successful theatrical releases.

Adam Aron, Chairman and CEO of AMC, said, “AMC theatres across the globe welcomed nearly 48 million guests in the first quarter thanks to the continued strength of James Cameron’s AVATAR: THE WAY OF WATER and the knockout power of first quarter releases like Marvel’s ANT-MAN AND THE WASP: QUANTUMANIA, CREED III, SCREAM VI, SHAZAM! FURY OF THE GODS and JOHN WICK CHAPTER 4.”

As more moviegoers flocked to theaters, revenue for the cinema chain operator rose 21.5% to $954.40 million in the first quarter, topping expectations by 1.7%. Despite improving foot traffic, AMC’s financial hardship is not over yet, with its bottom line remaining in the red and its massive debt load.

AMC has total debt of $9.66 billion, with net debt at $9.15 billion and total cash at $495.60 million. Moreover, its trailing-12-month operating cash flow came in at negative $523.40 million, while its levered free cash flow stood at negative $149.20 million, raising questions about its ability to pay down debts.

Its huge debt pile and lack of profitability signal a bumpy ride ahead for AMC.

In this article, we will delve into some of the key metrics that explain the company’s struggles.

Tracking the Trends in AMC’s Financials

AMC’s net income has largely experienced fluctuations, with a general downward trend. Starting at negative $280.58 million on June 30, 2020, its final value came in at negative $87.17 million on March 31, 2023. Meanwhile, from June 30, 2022, to March 31, 2023, net income declined 8.9%, from negative $81.76 million to negative $87.17 million, respectively.

AMC’s revenue has experienced both fluctuations and a trend over the past three years. Compared to the first recorded revenue of $3.72 billion on June 30, 2020, the latest reported revenue of $4.08 billion on March 31, 2023, indicates a steady growth rate of 9.4%. There have been considerable fluctuations throughout this period, with the revenue highs recorded at $4.09 billion in September 2022 and the lows at $449.2 million in March 2021. Overall, the series reveals that the company’s revenue has grown positively.

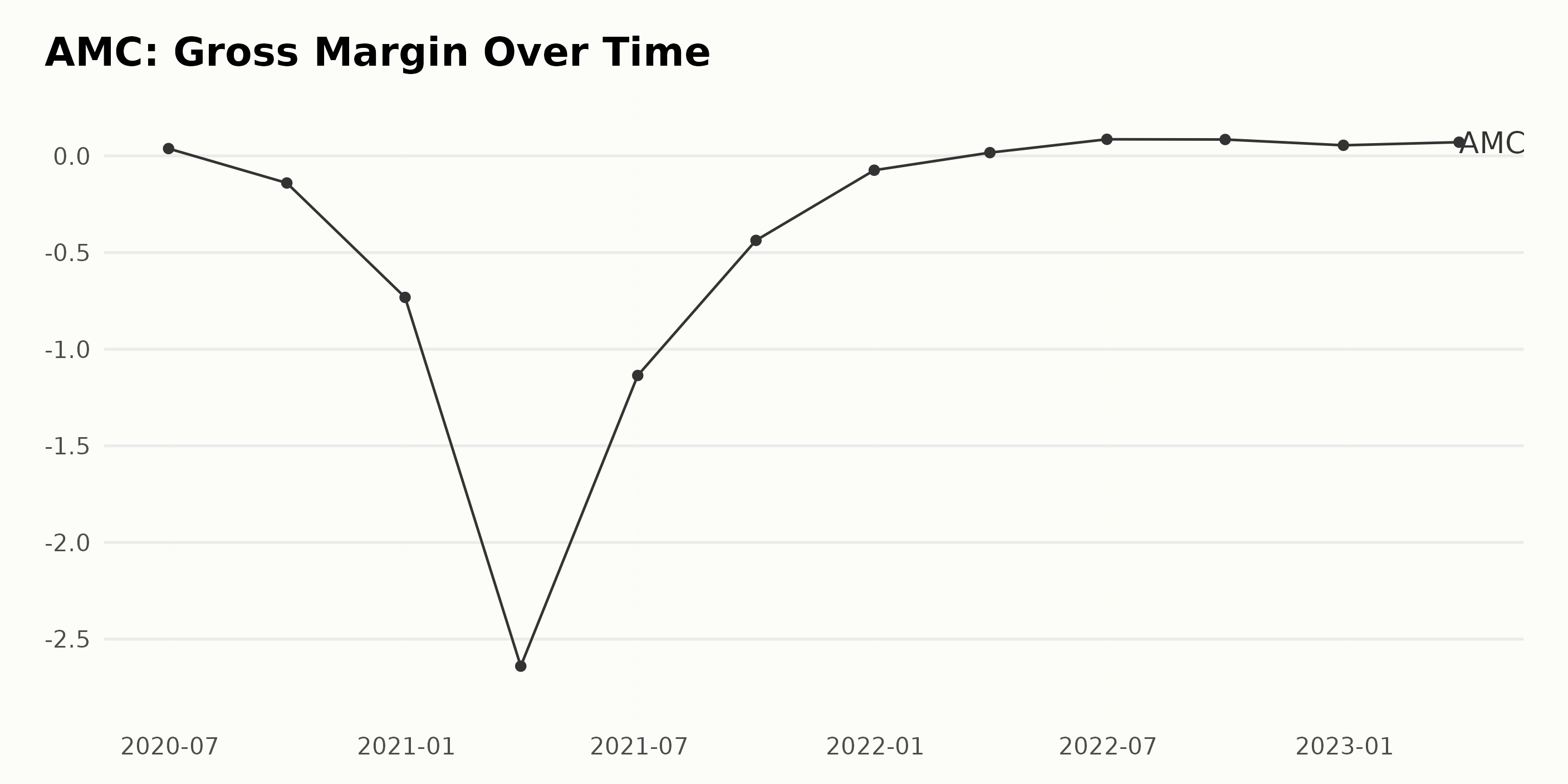

The company’s gross margin has fluctuated, but there appears to be an overall decreasing trend. In June 2020, the gross margin was 3.8%, but in December 2021, it dropped to negative 7.4%. The most recent figure in March 2023 indicates a decrease of 85.3% from the initial figure reported.

AMC’s current ratio has experienced a steady decline from June 2020 (0.39) to March 2023 (0.43). The greatest decrease in the ratio was between December 2020 and March 2021. This was followed by a sharp increase from March 2021 (0.64) to June 2021 (1.29) before gradually dropping to 0.53 at the end of December 2022. The overall growth rate for the series is negative 0.36.

AMC Share Price Plummets then Recovers Over 180 Days

AMC’s share price began at $6.12 on December 9, 2022, and dropped to its lowest point of $4.00 on December 30, 2022, before rising again. From then until June 5, 2023, the share price has fluctuated between $4.00 and $6.84. Overall, the growth rate has decreased from December 9, 2022, to June 5, 2023. Here is a chart of AMC’s price over the past 180 days.

Unfavorable POWR Ratings

AMC has an overall D rating, translating to a Sell in our POWR Ratings system. AMC is ranked the last out of the five stocks in the Entertainment - Movies/Studios category.

AMC has an F grade for Stability and a D for Value, Sentiment, and Quality.

Stocks to Consider Instead of AMC Entertainment Holdings Inc. (AMC)

Other stocks that may be worth considering are Boyd Gaming Corporation (BYD), Comcast Corporation (CMCSA), and Century Casinos, Inc. (CNTY) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

AMC shares were trading at $4.65 per share on Tuesday afternoon, up $0.02 (+0.43%). Year-to-date, AMC has gained 14.25%, versus a 12.06% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Should Investors Buy AMC Entertainment (AMC) This Week? appeared first on StockNews.com