The headlines on Friday are bragging about stocks making new highs since the bear market began a year ago. This is breeding a fresh round of optimism that the new bull market is soon at hand.

Yes, technically speaking stocks are up over 20% on the S&P 500 from the October lows. But digging below the surface shows a much less bullish picture making this feel like yet another in a long line of sucker’s rallies before stocks head lower again.

Full details on why that is the case along with trading plan to follow in this week’s market commentary.

Market Commentary

Let’s start with the headline statements.

That being with the S&P 500 (SPY) closing at 4,205 today it has risen just over 20% from the October lows of 3,491.

Second, the S&P 500 is up +9.5% in 2023 alone and made new highs today.

These are both very bullish statements and will make some bears consider throwing in the towel. But before doing that please consider the following chart comparing the equally balanced version of the S&P 500 (RSP) versus the index which is dominated by technology mega caps:

Yes, that -0.4% loss for the equal weighed version of the S&P 500 provides a stark contrast from the bullish version of the market that some are trying to sell us.

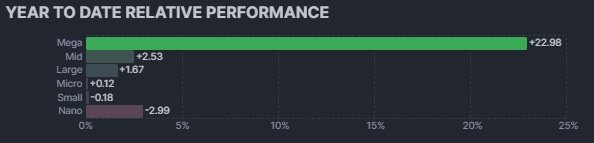

Now let’s share some corresponding facts from FinViz as we break down year to date results by market cap:

There we see that the S&P 500 gain of 9.5% on the year is a total fallacy as it is ONLY accumulating to the few mega caps that have bolted ahead by 23%.

These moves were only amplified this week as NVDA had that stellar beat on Wednesday evening engorging the mega caps once again into the Friday close.

What Does It REALLY Mean?

That investors are in actually in Risk Off mode. That they only feel safe invested in a small group of the best long term holdings like FAANG and a few of their closest buddies. Very few other groups are feeling the love...and thus, hard to say that this feels like the start of the new bull market.

Remember that new bull markets are brought on by BROAD BASED buying of stocks with smaller, growthier stocks leading the way. That’s because those same stocks were the most beaten down allowing for dramatic bounces from oversold bottoms.

THAT IS NOT HAPPENING NOW!

And thus, there is just no way for me to be bullish. Especially as the recent round of enthusiasm was about the resolution of the debt ceiling deal which I discussed earlier in the week as a side show distraction.

This feels like there are only 2 choices from here:

First, the bull market is real which leads to a broadening out of stock groups moving higher. Especially small caps which again are flat on the year.

For this to happen bears would need to throw in the towel. This is going to be hard to do at the moment with the Fed committed to higher rates through end of the year where they even admit that they except a recession to happen before inflation is finally under control.

A true Fed pivot to start lowering rates is the likely catalyst to get the bears on board of the bullish bandwagon. Those thinking that will happen at the upcoming meeting on June 14th are hitting the meth pipe a bit too hard given an array of recent statements from multiple Fed officials that they have MORE WORK TO DO.

Also emboldening the Feds view was a higher than expected PCE Price Index report on Friday. With the Fed being “data dependent” this sign of inflation still being too hot will only further embolden them to keep rates aloft through end of the year.

The second, and more likely outcome, at this stage is that we are getting set up for a serious correction. This is where this mega cap mirage of a rally out of steam allowing the real Risk Off trepidation of investors to head into a broad based retreat for the overall market.

And yes, this sell off could extend to a return of the bear market...but for that to happen we need to see stronger proof that a recession is a near certainty reawakening the bear from its recent slumber.

The reason for PROOF of recession is that investors are tired of hearing about the “possibility” of recession. That is kind of like the Boy Who Cried Wolf at this stage. Investors will need to see blood dripping from those fangs to believe recession is truly here and thus time to sell off stocks in earnest.

For me this continues to be the highest probable outcome. I explained it in full in this recent article: Why Steve Reitmeister is Becoming More Bearish.

The quicker version is to remind folks that 12 of the last 15 times the Fed has raised rates they created a recession...not a soft landing as intended.

This time around the Fed is enacting the most aggressive rate hiking regime in history. And they admit that a recession is the likely outcome to put an end to inflation.

So, if the Fed is predicting this outcome...and usually becomes worse than they expect...and they have their hands on the driving wheel...then recession and deeper bear market is the most likely outcome.

That potential correction probably starts once the Debt Ceiling deal is done and investors look around to find nothing more to cheer. Or perhaps its right after the 6/14 Fed rate hike announcement where Powell has to remind investors ONCE AGAIN that their work is far from done...and rates will not go down til 2024...and yes, they still predict a recession before all is done.

Again, I think this is the most likely outcome. But still possible that recession never comes and a real bull market emerges. The environment for that just is not at hand...and thus warning folks not to get pulled into the suckers rally underway now.

How should you invest at this time?

More on that in the section below...

What To Do Next?

Discover my balanced portfolio approach for uncertain times. The same approach that has beaten the S&P 500 by a wide margin in recent months.

This strategy was constructed based upon over 40 years of investing experience to appreciate the unique nature of the current market environment.

Right now, it is neither bullish or bearish. Rather it is confused and uncertain.

Yet, given the facts in hand, we are most likely going to see the bear market coming out of hibernation mauling stocks lower once again.

Gladly we can enact strategies to not just survive that downturn...but even thrive. That’s because with 40 years of investing experience this is not my first time to the bear market rodeo.

If you are curious in learning more, and want to see the hand selected trades in my portfolio, then please click the link below to start getting on the right side of the action:

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.53 (+0.13%) in after-hours trading Friday. Year-to-date, SPY has gained 10.25%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post The Fallacy of the Bullish Argument appeared first on StockNews.com