Ocean Power Technologies, Inc. (OPTT) saw a growth in revenue for the fiscal third quarter (ended January 31). Unfortunately, the revenue did not translate into a bottom-line improvement.

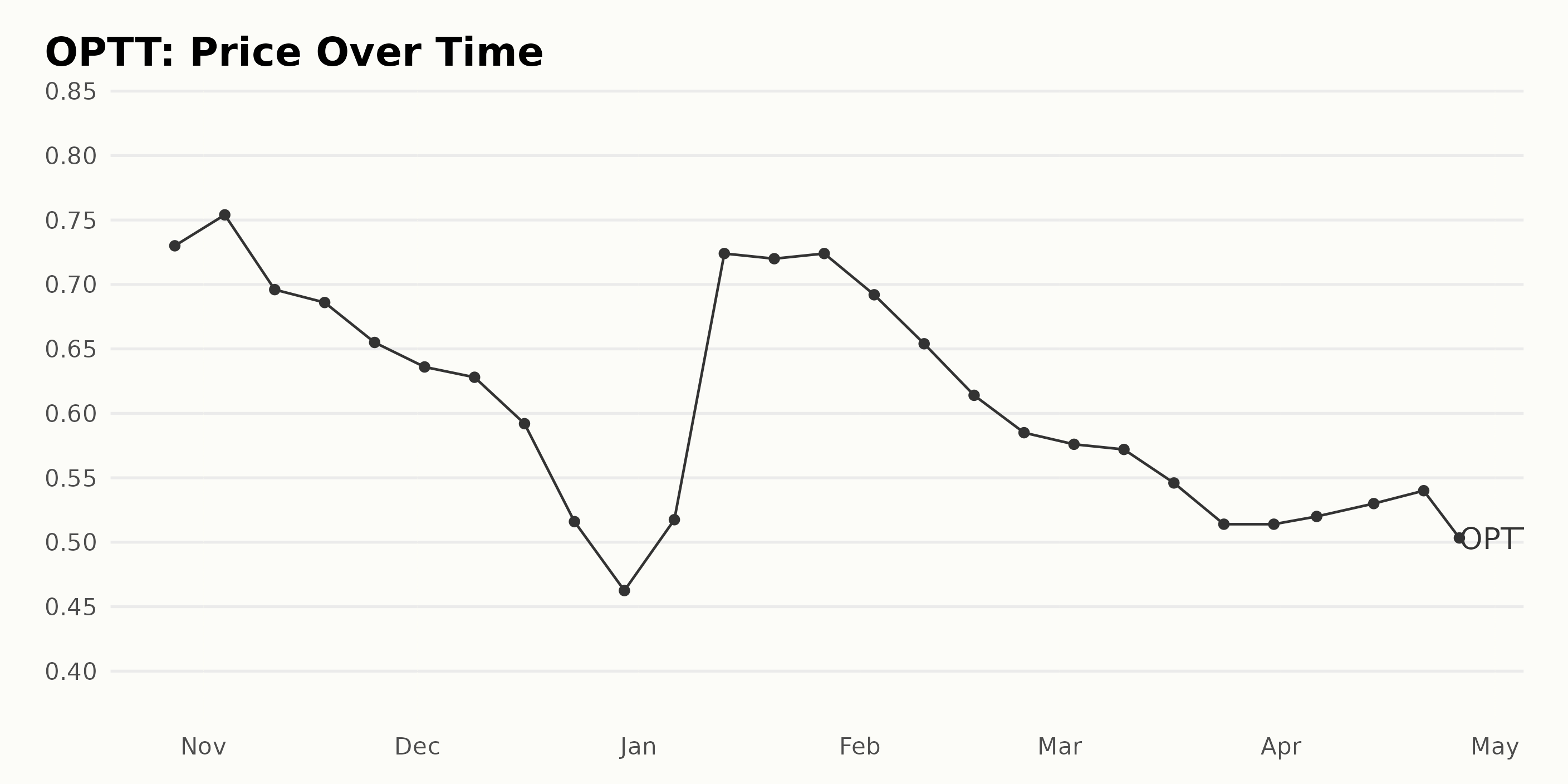

The company’s revenues increased 51.7% year-over-year to $734 thousand. On the other hand, its net loss and net loss per share came in at $6.09 million and $0.11, up 11.3% and 10% from the prior-year period, respectively. The stock closed its last trading session at $0.49, lower than its 50-day moving average of $0.55 and 200-day moving average of $0.73, indicating a downtrend.

On further examination of OPTT's key financial metrics, this stock might be best avoided now.

Analyzing Ocean Power Technologies Inc.'s (OPTT) Metrics Over Time

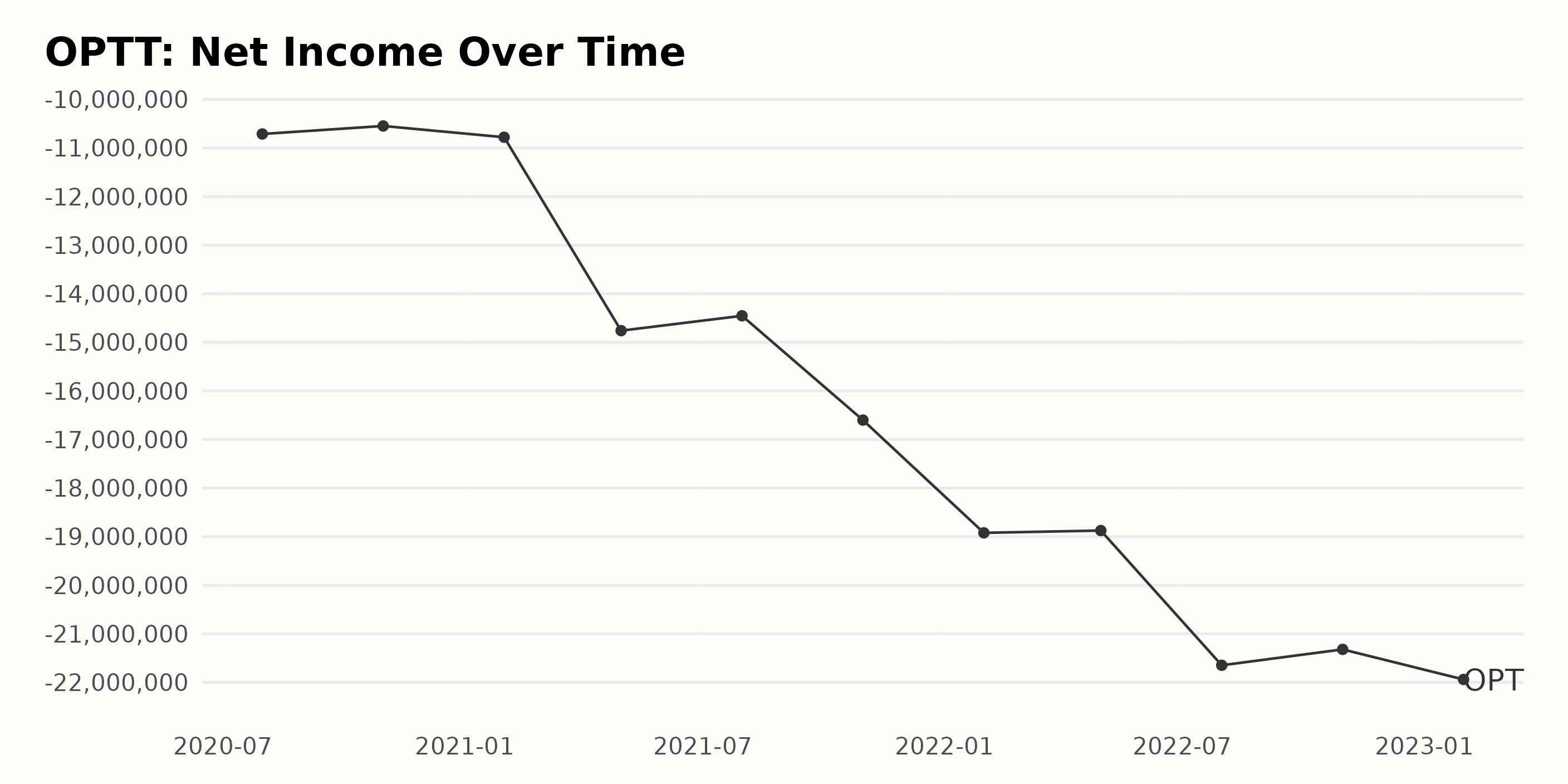

The net income of OPTT has fluctuated between -$10.71 million (July 2020) and -$21.94 million (July 2023), with the most recent value being -$21.94 million (July 2023). The overall trend of the series is an increasing one, with a growth rate of -28.2%.

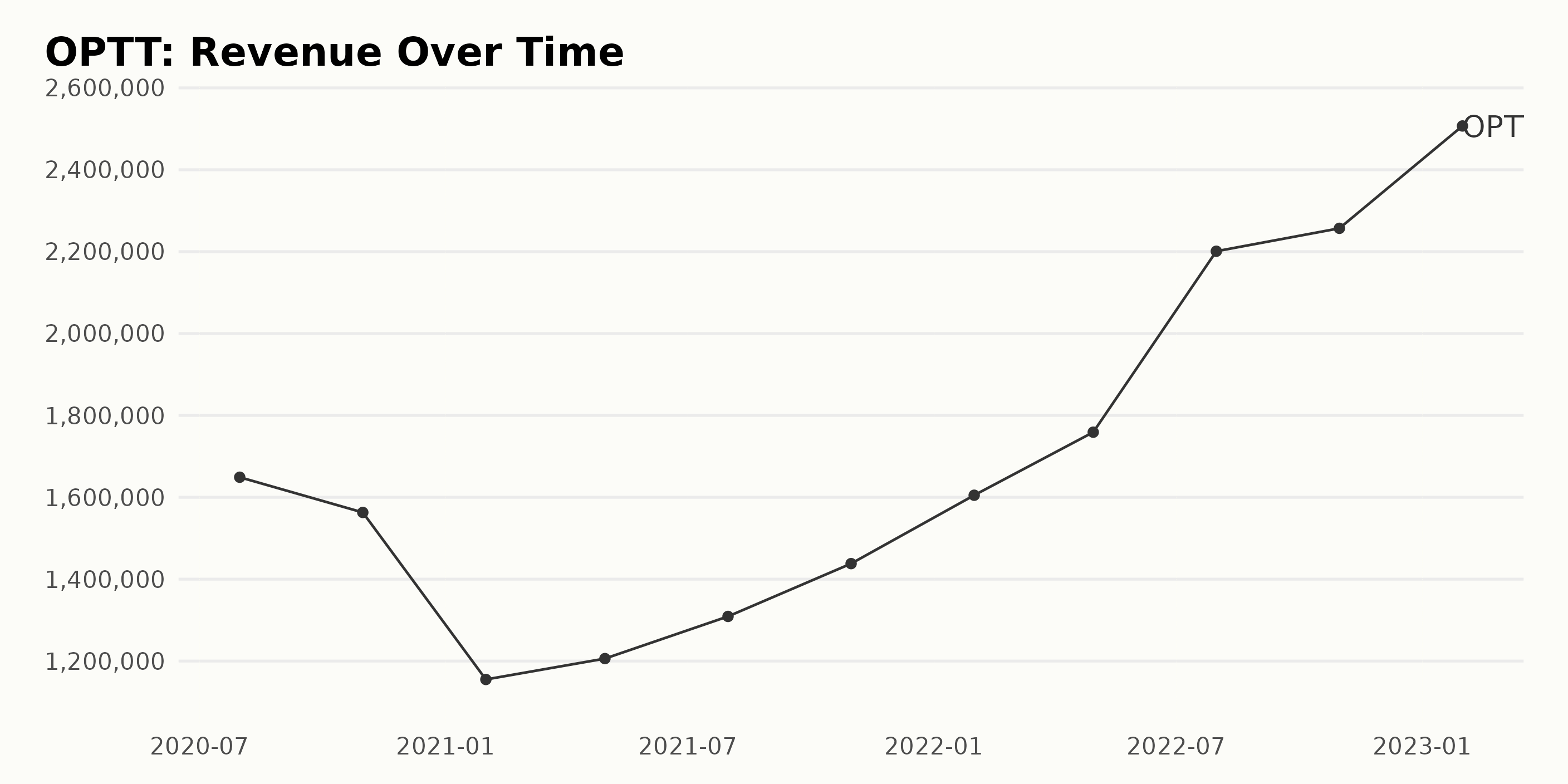

OPTT’s revenue has been steadily increasing with fluctuations. The revenue for July 2020 was $1.65 million, which dropped to $1.56 million in October 2020 before slightly falling to $1.16 million in January 2021. It then rose again to $1.21 million in April 2021 and grew further to $1.31 million in July 2021 before reaching a peak of $1.44 million in October 2021.

From there, revenue increased further to $1.61 million in January 2022 and $1.76 million in April 2022. It then shot up dramatically to $2.20 million in July 2022 and $2.26 million in October 2022 before finally reaching an even higher peak of $2.51 million in January 2023. Over this three-year period, OPTT’s revenue has grown by 54% ($1.04 million).

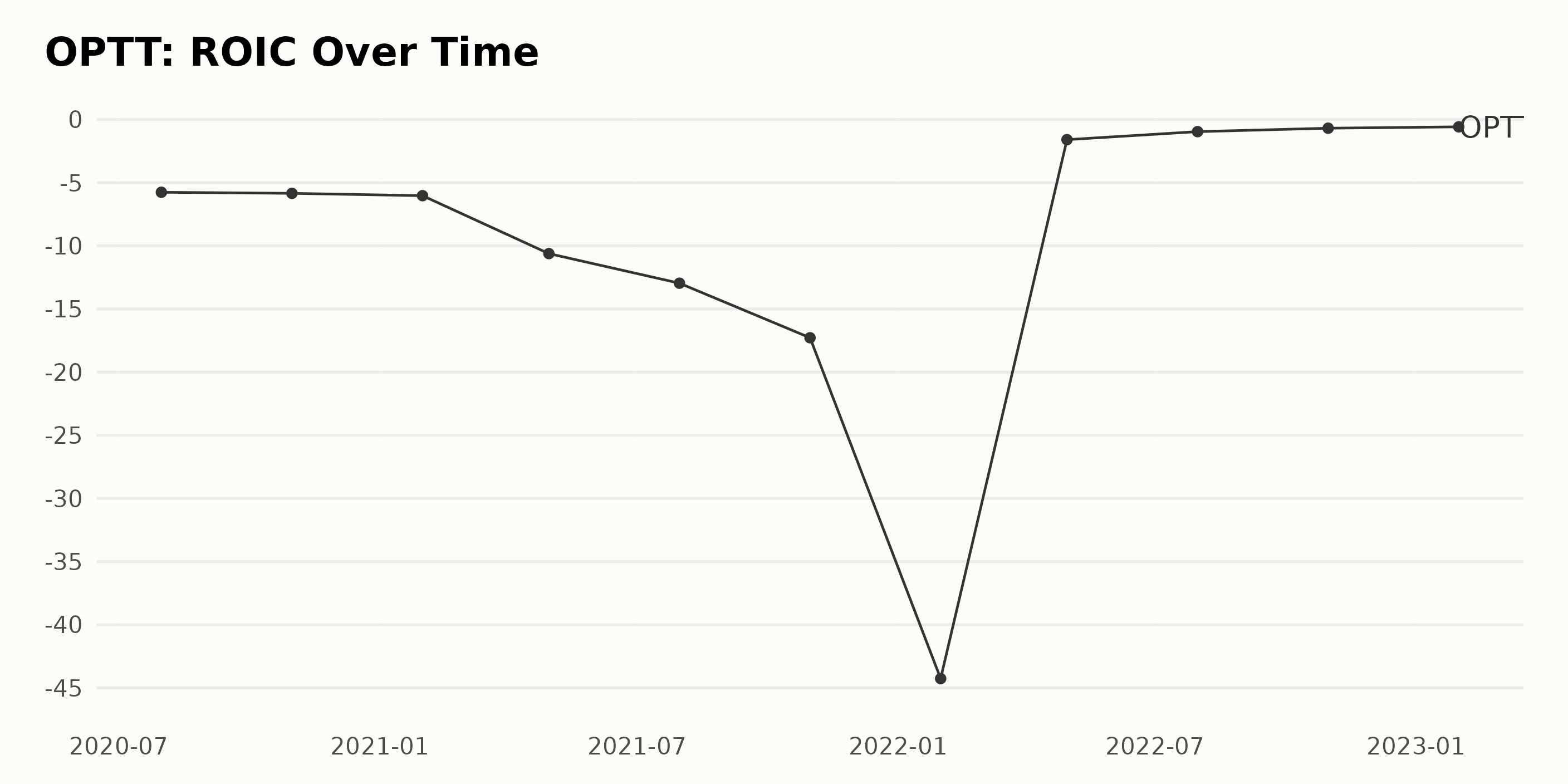

The ROIC of OPTT has seen a steep overall decline from -5.76 in July 2020 to -0.58 in January 2023. In the last two years, this ROIC has decreased at a steeper rate, dropping 44.26% from January 2022 to April 2022 and another 31.4% after that. The most recent reported value of -0.58 was a decrease of 22.41% relative to the previous report in October 2022.

OPTT Share Price Trend: Downward to April 21, 2023

The trend of OPTT’s share price over this period was generally downward. It started at $0.73 on October 28, 2022, and decreased gradually until March 31, 2023, when it hit its lowest point at $0.51. The trend then shifted slightly upward, reaching a high of $0.54 on April 21, 2023, before dropping back down to $0.505 on April 26, 2023. Here is a chart of OPTT's price over the past 180 days.

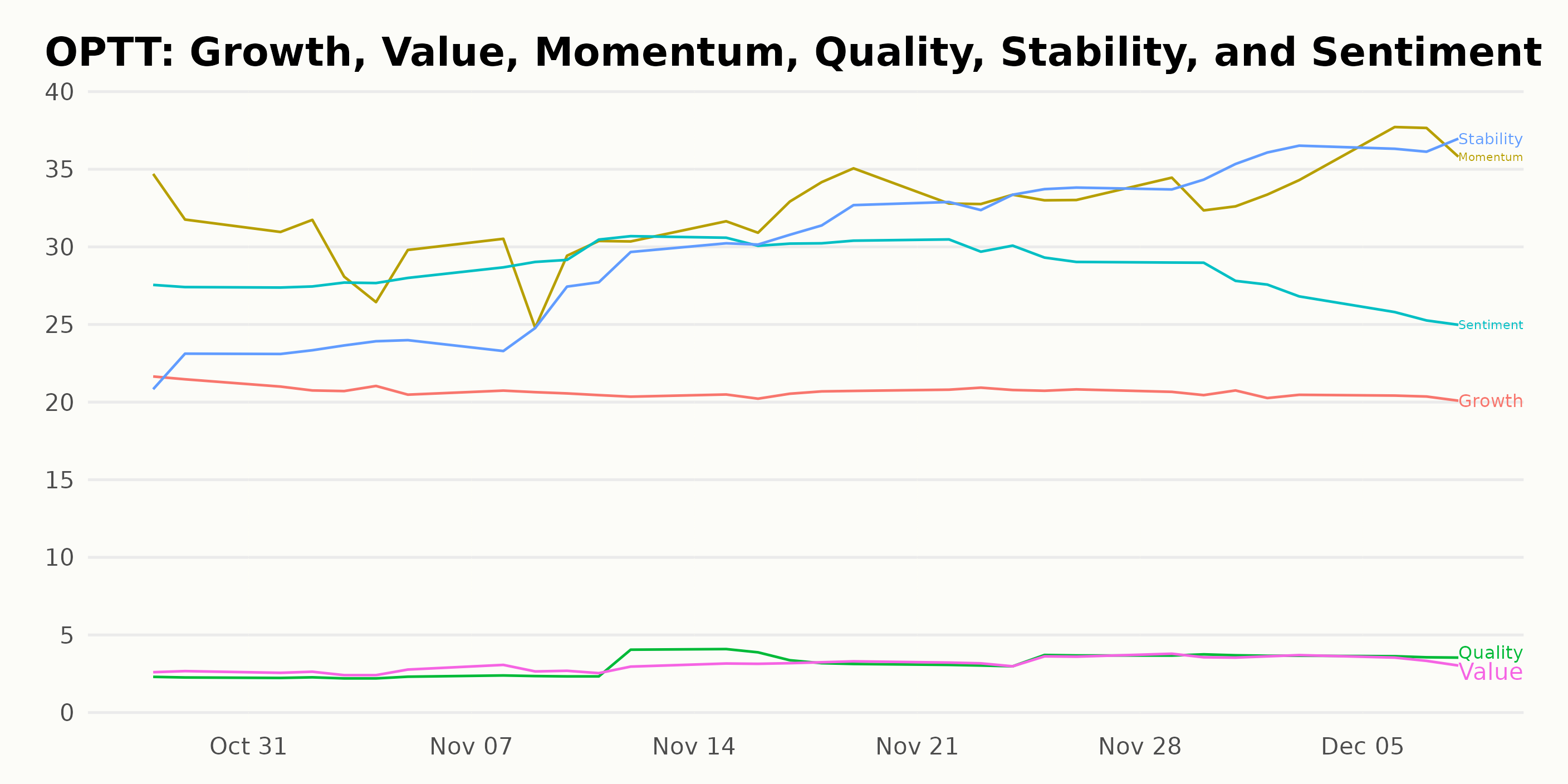

OPTT POWR Ratings: High Momentum & Stability, Low Quality

OPTT's latest overall POWR Ratings grade is F, which translates to a Strong Sell in our proprietary rating system, and it is ranked last in the Water category of stocks (which has 13 stocks total). This grade has remained consistent at an F since October 29, 2022.

The POWR Ratings for OPTT on the three most noteworthy dimensions are Momentum, Stability, and Quality. Momentum has the highest ratings, with an average of 33 out of a maximum score of 100 from October 29 to December 8, 2022. Stability also had a high rating, with an average score of 31 across the same time period.

Quality has the lowest rating, showing a slight increase over time - the average score was at 2 on October 29th, 3 on November 12th, 4 on November 19th, and 3 on November 26 and December 8. Overall, these POWR Ratings demonstrate that OPTT has steady momentum and stability but provides low overall quality.

How Does Ocean Power Technologies Inc. (OPTT) Stack Up Against its Peers?

Other stocks in the Water sector that may be worth considering are Consolidated Water Co. Ltd. (CWCO), Global Water Resources Inc. (GWRS), and The York Water Company (YORW) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

OPTT shares were trading at $0.50 per share on Wednesday morning, down $0.00 (+0.26%). Year-to-date, OPTT has gained 11.09%, versus a 6.90% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Investor Beware: This Is the Worst Water Stock You Could Possibly Own appeared first on StockNews.com