September is historically the worst month of the year for the stock market. And this September held true to form with a -9.4% shellacking for the S&P 500 (SPY).

Now the bear market stands at -25.6% down from the all time highs. For as bad as that sounds, don’t forget that the average bear market decline is 34%.

Perhaps the greatest oddity of this past week’s drop to new lows is that it happened even as fairly positive economic news was released. This is a bit of a head scratcher to some...but actually makes a lot of sense in the grand scheme of things.

I will explain that riddle and more in the updated market outlook and trading plan that follows...

Market Commentary

The S&P 500 (SPY) had a strong +2% session on Wednesday. Yet all that joy was quickly wiped off the board on Thursday. And by Friday, we were exploring new depths of this bear market at 3,585.

The reasons why will seem antithetical at first. But by the end of this article you will understand how good news, is actually bad news for investors at this time.

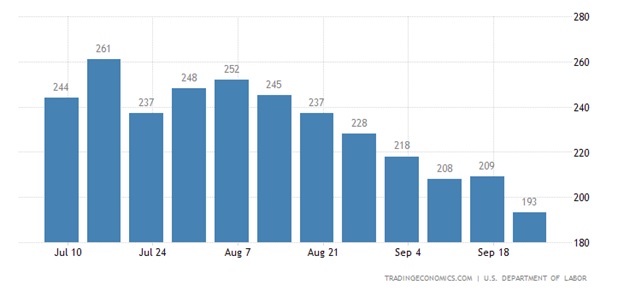

Let’s start with Thursday’s Jobless Claims report which fell back under 200,000. This is proof positive that the employment market remains very strong.

So why did stocks nose dive -2.11% Thursday on this very seemingly news?

Because it gives the Fed a green light to raise rates more robustly to reign in inflation with the belief that they would cause less pain to the economy.

But what many investors know is that employment is a momentum based concept. And that once it starts going bad...even if by a little...it keeps rolling in that negative direction for a long time.

This is another way to say that most investors, do not fully trust the Fed to manage a soft landing. That is certainly true with history as their guide that it is very hard to accomplish especially if you are late to the part to try and contain inflation. (Which is absolutely the case here).

So if you are late then you have to move fast with bigger rate hikes each time. This very much flies in the face of having a measured approach which is more likely to create a soft landing.

Another good news is bad news situation happened on Friday when the strength of the Personal Income & Outlays report showing extremely robust spending in the economy. So good that it single handedly moved the GDP Now model from the Atlanta Fed up from an estimate of only +0.3% growth for Q3 all the way up to +2.4%.

Sounds great...right?

Wrong!

Let me explain the negative pattern that normally flows from periods of high inflation. When people become afraid of how much prices will be in the future they are compelled to rush out and spend more money now.

That increased demand in the present becomes decreased demand in the future which is what begets a recession.

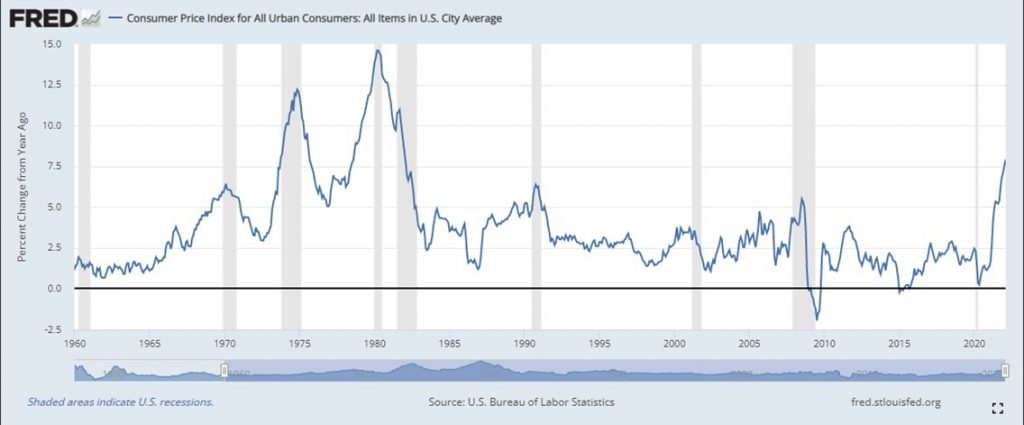

In fact, you could almost say that with inflation the economy almost looks its most robust just before it falls off a cliff. This image of raging inflation followed by recession and bear markets tells that story quite clearly. (blue line = inflation rate and gray bear signals recessions that coincided with bear markets).

With all that negativity being said...I would not be surprised with a relief rally next week just because the recent bear run has likely exhausted itself. Perhaps a 3-5% bounce can be expected forming in early October. But don’t count on another INSANE 18% bounce like we saw in July and August.

The above is what makes sense from a short term price action stand point. However, this train is still be run by the economics of the situation. That being how high inflation leads to recession and bear market.

Therefore, there will be a lot of attention to the parade of economic data that kicks off every month. Here is the current slate.

10/3 = ISM Manufacturing (the very weak Chicago PMI today foreshadows increased weakness in this vital monthly report)

10/5 = ISM Services that likely will show a lift as we saw from increased spending in the Personal Income & Outlays report today. But as stated...that is not necessarily a positive thing. Also, we get ADP Employment which is usually more accurate than the Government Report in spotting changes in trend.

10/7 = Government Employment Situation for September. Oddly this report could be a negative no matter what happens. If too strong, then just like Jobless Claims this past Thursday, it could spook investors that the Fed will be overly aggressive with rate hikes. On the other hand, if it starts to show weakness then it increases the odds of recession and with that further bear market downside.

Bear markets are a process that typically takes 13 months to make its way to a lasting bottom before the next bull market emerges. This one seems pretty well on track with that average time span as many expect the recession to hit in Q1 of 2023.

That will likely spark a sell off to the bottom. Then value oriented investors will start bottom fishing for the eventual return of the economy. This is what begets the next bull market. And this is why we often say “it is darkest before the dawn” in that investors start buying stocks when the economy is at its ugliest.

Long story short, we are still in a bear market. And likely have not found bottom yet. So trade accordingly.

What To Do Next?

Discover my special portfolio with 9 simple trades to help you generate gains as the market descends further into bear market territory.

This plan has been working wonders since it went into place mid August generating a +4.65% gain as the S&P 500 (SPY) tanked over 15%.

If you have been successfully navigating the investment waters in 2022, then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next...then do consider getting my “Bear Market Game Plan” that includes specifics on the 9 unique positions in my timely and profitable portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares rose $0.70 (+0.20%) in after-hours trading Friday. Year-to-date, SPY has declined -23.93%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Terrible September for Stocks…How About October? appeared first on StockNews.com