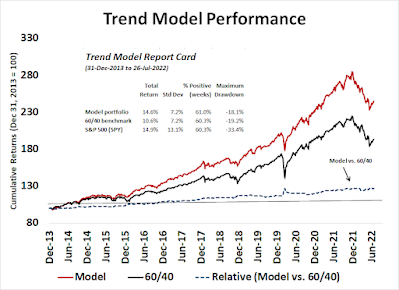

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

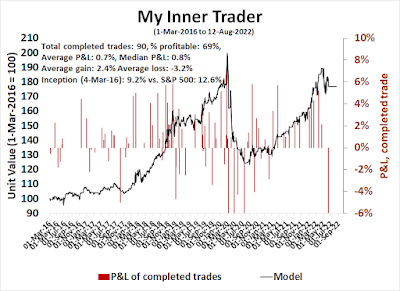

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Dovish pivot?The stock market has taken on a giddy tone in the wake of the tamer than expected inflation reports. The S&P 500 has staged an upside breakout through a key 50% Fibonacci retracement level, which according to some chartists, could be the signal for the all-clear and a resumption of the bull market.

Marketwatch reported that technical analyst Jonathan Krinsky interpreted the upside breakout with guarded optimism:“Since 1950 there has never been a bear market rally that exceeded the 50% retracement and then gone on to make new cycle lows,” said Jonathan Krinsky, chief market technician at BTIG, in a note earlier this month...

Krinsky, meanwhile, cautioned that previous 50% retracements in 1974, 2004, and 2009 all saw decent shakeouts shortly after clearing that threshold.

“Further, as the market has cheered ‘peak inflation’, we are now seeing a quiet resurgence in many commodities, and bonds continue to weaken,” he wrote Thursday.My review of market internals shows narrowing leadership which is a warning that the current rally is unsustainable.

The full post can be found here.