There's no reason not to hit 4,000 this week – yet . Pre-holiday weeks are usually low-volume affairs and the market tends to drift higher. There's not much in the way of earnings that are likely to derail us at the moment though Nike (NKE) this evening is a big one that could be problematic if it doesn't go well. NKE was an upside surprise last quarter so it would be a huge disappointment if they miss now. The stock has dropped 20% with the market since then – so it won't take much to get them to pop . Of course, China went back on lockdown so they could have had additional supply-chain issues and lower sales in China and Consumer Spending in the US also pulled back recently – so it depends how things were going through the end of May, which is what this report will capture. NKE is the kind of stock we like to buy at PSW when they are cheap but $113 is not cheap as it's $178Bn in market cap and, even if all goes great, NKE is only going to make $6Bn this year – about 5% more than they made last year. That means they are trading at close to 30x current earnings and it means only that $180 was RIDICULOUS and $113 is simply getting better – but still not a price we'd pay for a retail manufacturer. That's the dark side of upcoming earnings – there's still a lot of companies out there trading at unrealistic prices. I can get the same return on a 10-year note (3.4%) as I can on NKE stock. Speaking of notes, Russia is finally about to default on theirs – although they don't see it that way. They were expected to pay $100M by last night and they did not – which is the usual definition of default – 30 days after their May 27th deadline. Russia claims to have made payments in Rubles but Rubles are not acceptable under the contracts but it's up to the investors (private) to declare Russia in default (and hire food testers from now on) – so we'll see what happens. On the Economic Calendar, Powell is scheduled to speak after Wednesday's GDP Report …

There's no reason not to hit 4,000 this week – yet.

There's no reason not to hit 4,000 this week – yet.

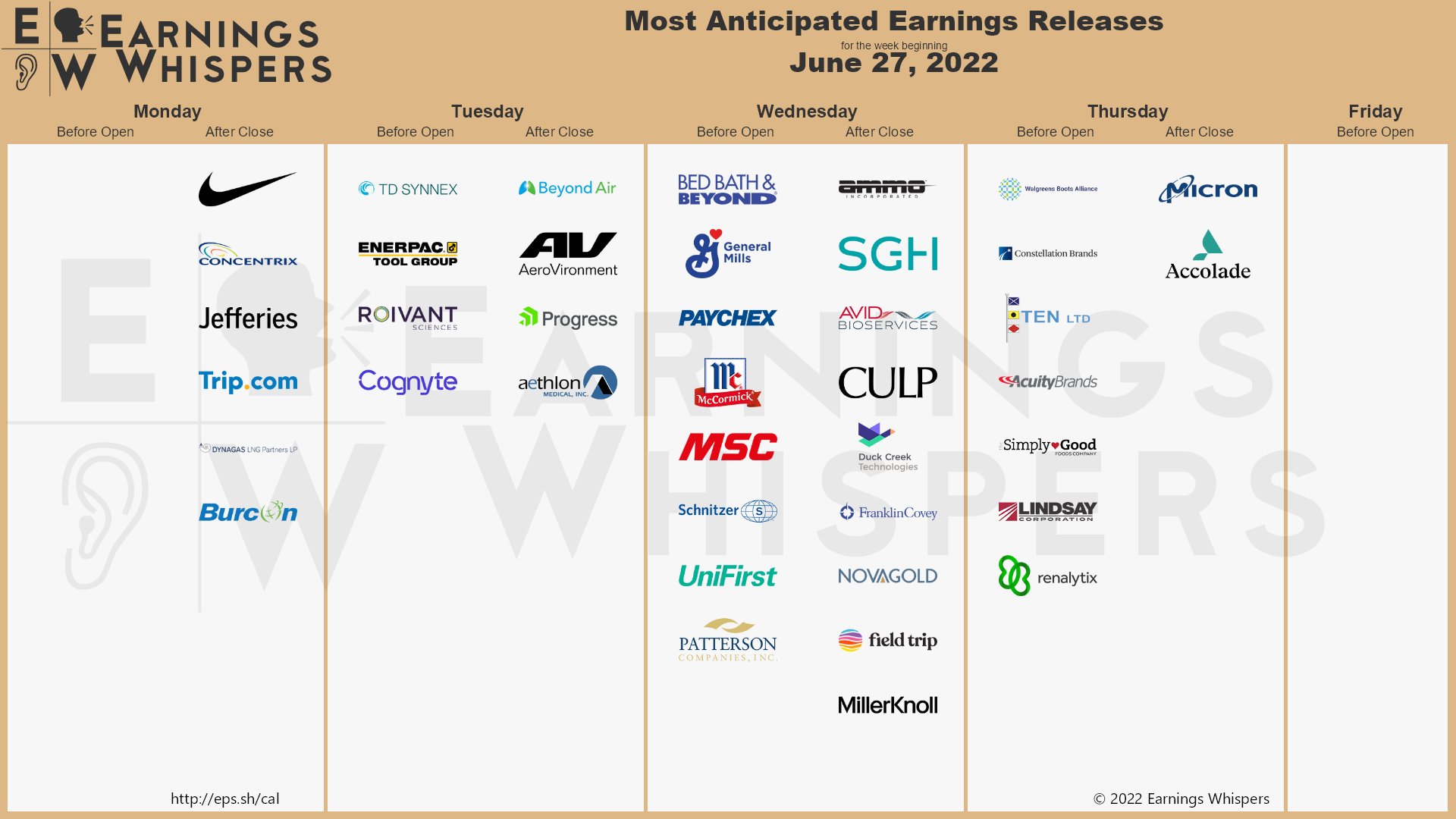

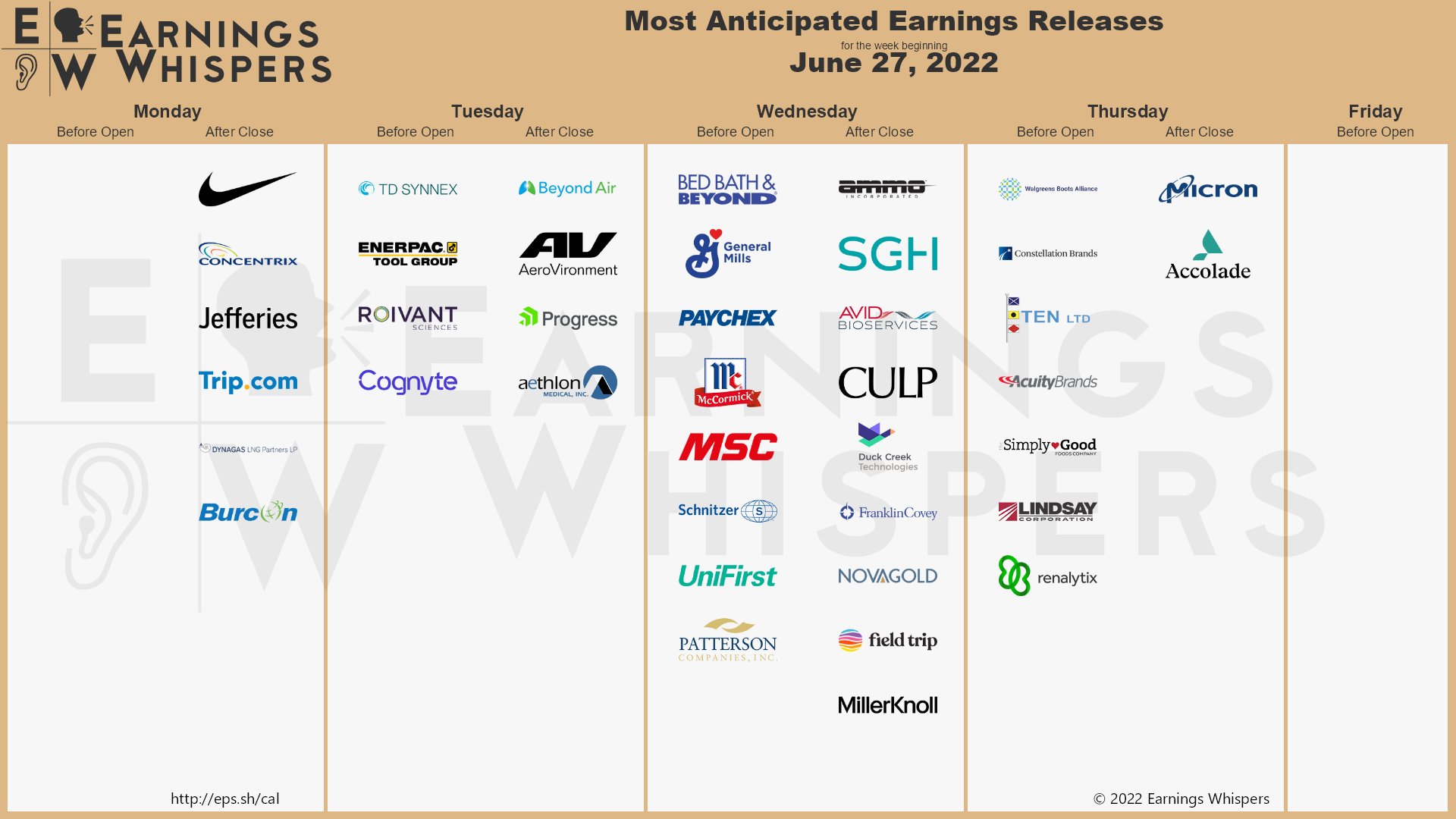

Pre-holiday weeks are usually low-volume affairs and the market tends to drift higher. There's not much in the way of earnings that are likely to derail us at the moment though Nike (NKE) this evening is a big one that could be problematic if it doesn't go well. NKE was an upside surprise last quarter so it would be a huge disappointment if they miss now. The stock has dropped 20% with the market since then – so it won't take much to get them to pop.

Of course, China went back on lockdown so they could have had additional supply-chain issues and lower sales in China and Consumer Spending in the US also pulled back recently – so it depends how things were going through the end of May, which is what this report will capture.

NKE is the kind of stock we like to buy at PSW when they are cheap but $113 is not cheap as it's $178Bn in market cap and, even if all goes great, NKE is only going to make $6Bn this year – about 5% more than they made last year. That means they are trading at close to 30x current earnings and it means only that $180 was RIDICULOUS and $113 is simply getting better – but still not a price we'd pay for a retail manufacturer.

That's the dark side of upcoming earnings – there's still a lot of companies out there trading at unrealistic prices. I can get the same return on a 10-year note (3.4%) as I can on NKE stock. Speaking of notes, Russia is finally about to default on theirs – although they don't see it that way. They were expected to pay $100M by last night and they did not – which is the usual definition of default – 30 days after their May 27th deadline. Russia claims to have made payments in Rubles but Rubles are not acceptable under the contracts but it's up to the investors (private) to declare Russia in default (and hire food testers from now on) – so we'll see what happens.

On the Economic Calendar, Powell is scheduled to speak after Wednesday's GDP Report…

On the Economic Calendar, Powell is scheduled to speak after Wednesday's GDP Report…

On the Economic Calendar, Powell is scheduled to speak after Wednesday's GDP Report…

On the Economic Calendar, Powell is scheduled to speak after Wednesday's GDP Report…