U.S. solar panel imports fell during the first quarter, according to analysis from S&P Local Market Intelligence. The drop reportedly came as the industry braced for an investigation by the U.S. Commerce Department over allegations that China-based manufacturers are dumping solar modules by setting up operations in other Asian nations in a bid to circumvent U.S. tariffs.

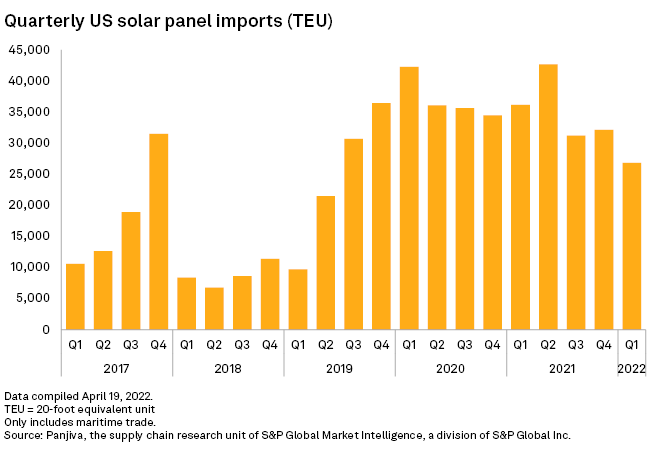

The number of shipping containers delivering solar panels to American ports during the first three months of the year was down 17% from the prior quarter and 26% from a year earlier, according to research firm Panjiva, which was quoted by S&P.

S&P also said that American solar companies have reported “widespread delays or cancellations” of panel shipments since the start of the investigation, which could result in tariffs being applied retroactively to past imports. Recent congestion at Chinese ports due to a resurgence of Covid-19 restrictions has also further disrupted global trade.

In early April, the Solar Energy Industries Association (SEIA) claimed that three-quarters of solar companies responding to a survey reportedly said that panel deliveries have been cancelled or delayed in the days since the Commerce Department opened a circumvention case against imports of solar goods from Cambodia, Malaysia, Thailand and Vietnam.

SEIA said in a press release that more than 90% of the 200 companies that responded to its survey said that the Commerce Department’s actions are having a “severe or devastating impact” on their bottom line.

The industry trade group said that all market segments — residential, commercial, community solar, and utility-scale solar — “overwhelmingly reported” devastating or severe impacts from the investigation. Survey respondents included SEIA members and non-members.

“Projects are getting delayed, force majeure is being called,” Adam Hahn, a managing director at GreenFront Energy Partners LLC, said in an interview with S&P, referring to contract provisions that can excuse companies from obligations in extraordinary circumstances. “For the most part, what we’ve heard is that countries have just stopped shipping panels here.”

But lawyers for Auxin Solar, which instigated the Commerce Department investigation, said in March that solar cells and module imports surged ahead of the Commerce Department decision. Attorney alleged in a filing that “an enormous volume” of imported solar cells and modules was “surging into the United States.”

They cited a recent Commodity Status Report from U.S. Customs and Border Protection that showed imports totaled 1.8 GW of capacity, including 1.6 GW imported in a single week. The filing said that imports didn’t reach similar levels in 2021 until 38 weeks into the year.

Even so, on April 8, Northern States Power Co., a utility owned by Xcel Energy Inc., asked the Minnesota Public Utilities Commission to suspend proceedings for the company’s planned Sherco Solar Project so that it can reevaluate pricing and “discuss alternatives with our potential suppliers” in light of the Commerce Department investigation.

S&P said the investigation adds to cost pressures that have been hitting the solar industry from supply chain disruptions and inflation. As a result of those headwinds, U.S. solar installations are expected to fall by 7% in 2022.

An Xcel Energy spokesperson said several solar projects in Colorado that the company has signed contracts to buy power from and which are due online by mid-2023 are in “various stages of risk at this time, and negotiations on potential solutions are ongoing.”