Down we go again! It's important to have some perspective when contemplating the future so here is the Nasdaq's chart for the 21st Century, so far. I'm sure it's not how you remember it because of something called a recency bias and it's hard to imagine, after going up from 2,500 to 16,500 (560%) in the past 10 years, that the Nasdaq has done anything else in the past 20 years but, other than another silly 400% run we had from 1997 to 2000, we were essentially flat for the first 10 years . To some extent, " this time is different " – but that's what they said last time as well but now, as it was in 1999, what we can say for sure is there is no evidence in Corporate Profits that shows us that 15,000, let alone 16,500, is justified for the components of the Nasdaq. In fact, earnings in Q1 have been a bit of a disappointment and, more Nasdaq companies benefit from Covid (stay at home, work remotely, cure infections, deliver stuff) than suffer from it (supply chain issues, less retail shopping). This is their time to shine!

Down we go again!

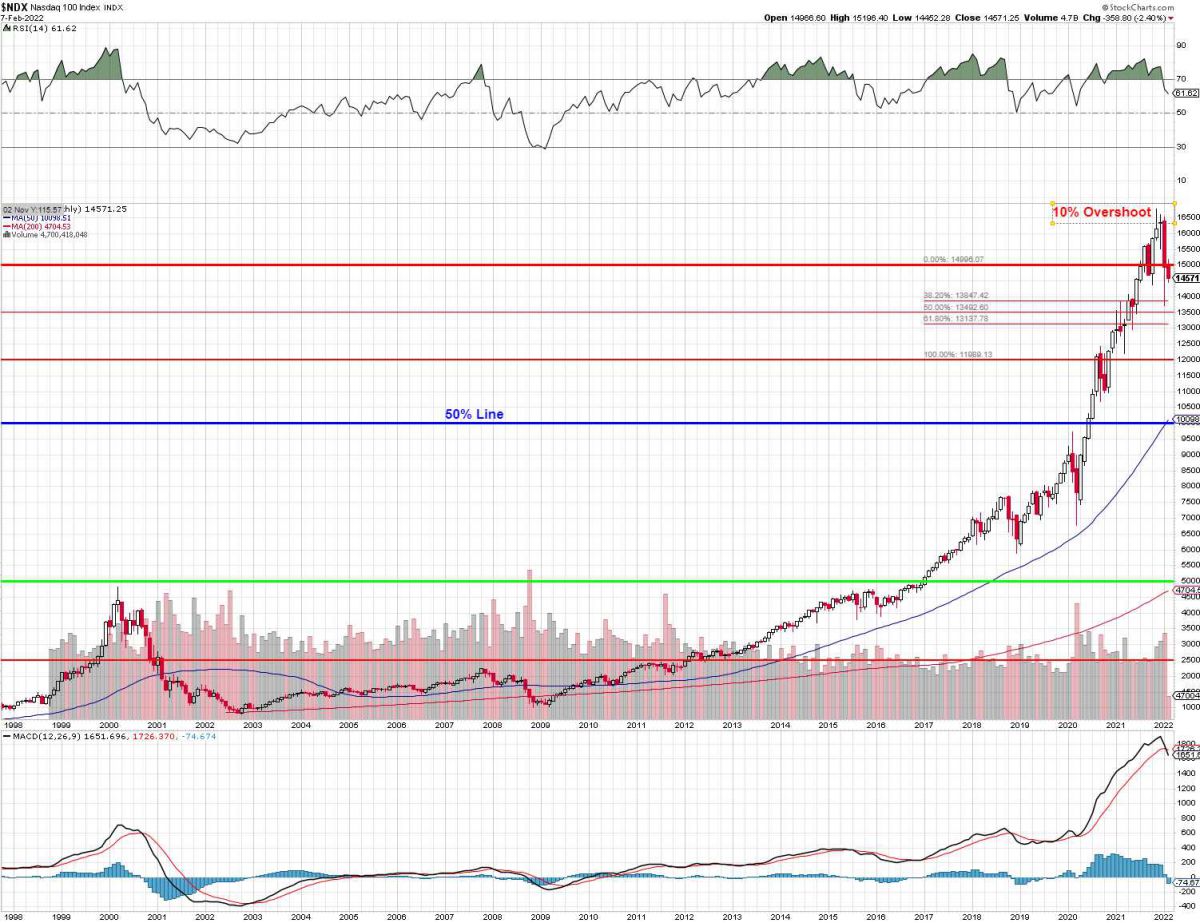

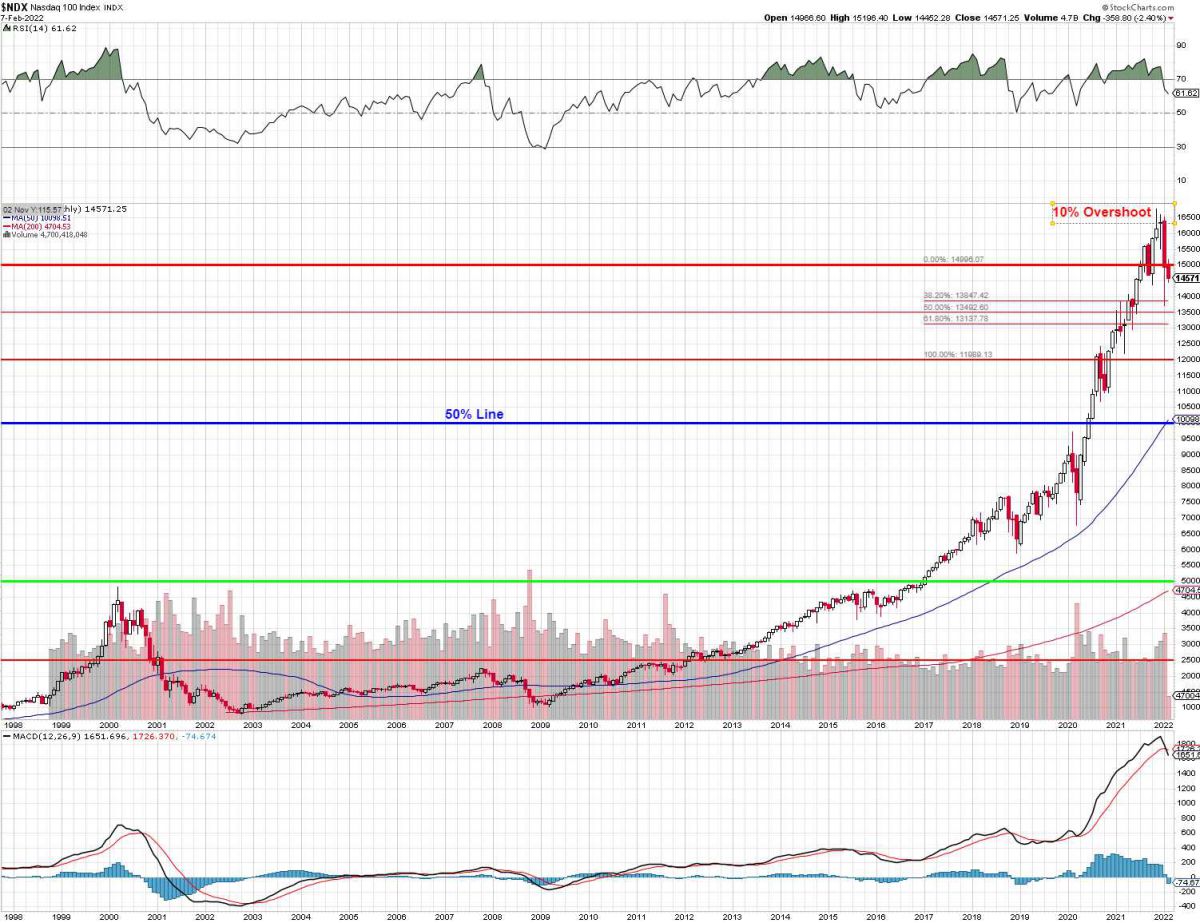

It's important to have some perspective when contemplating the future so here is the Nasdaq's chart for the 21st Century, so far. I'm sure it's not how you remember it because of something called a recency bias and it's hard to imagine, after going up from 2,500 to 16,500 (560%) in the past 10 years, that the Nasdaq has done anything else in the past 20 years but, other than another silly 400% run we had from 1997 to 2000, we were essentially flat for the first 10 years.

To some extent, "this time is different" – but that's what they said last time as well but now, as it was in 1999, what we can say for sure is there is no evidence in Corporate Profits that shows us that 15,000, let alone 16,500, is justified for the components of the Nasdaq. In fact, earnings in Q1 have been a bit of a disappointment and, more Nasdaq companies benefit from Covid (stay at home, work remotely, cure infections, deliver stuff) than suffer from it (supply chain issues, less retail shopping). This is their time to shine!