What is wrong with people?

What is wrong with people?

The market dropped 2.5% after yesterday's Fed Minutes were released and all they said was what they announced at the Dec 15th meeting, which is they are going to start tightening in 2022, probably with 3-4 0.25% hikes. You would think they announced the end of the World the way the market started selling off and the day's volume only hit 104M on SPY – not even a major volume day.

Still, as I had noted in our Live Trading Webinar BEFORE it happened, we simply don't have enough buyers to support any kind of selling so, as soon as there's any bad news and people try to sell – the bottom can fall out very quickly. Having a 2.5% drop means we look for a 0.5% (weak) or 1% (strong) bounce and, if we don't get those – then it's likely we're in for another downturn.

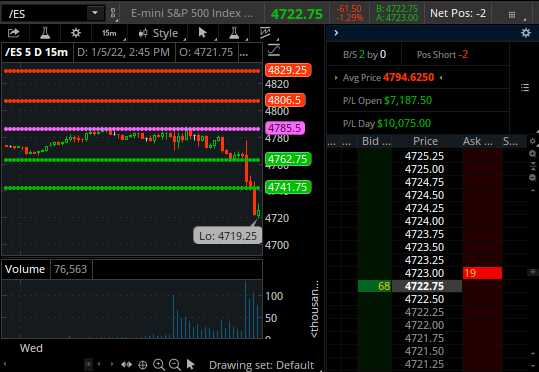

That would be fine with us as we cashed out of our S&P (/ES) 500 shorts yesterday with a $10,000 gain (you're welcome) at 4,720 (we initiated those in last Wednesday's Morning Report and again on Thursday) and now we have switched to shorting the Dow (/YM) Futures at 36,400 but with tight stops above that line – it's what we call a "fresh horse" trade.

That would be fine with us as we cashed out of our S&P (/ES) 500 shorts yesterday with a $10,000 gain (you're welcome) at 4,720 (we initiated those in last Wednesday's Morning Report and again on Thursday) and now we have switched to shorting the Dow (/YM) Futures at 36,400 but with tight stops above that line – it's what we call a "fresh horse" trade.

We're also excited to short more Oil (/CL) at $79.50 as that is just silly. OPEC released a not yesterday that they are expecting the current round of Covid not to affect anything – even as thousands of airlines and cruise ships are being cancelled every day and schools are shutting down and companies are delaying return to work dates. Even Spider Man was empty at the IMAX yesterday (I was waiting for it to get less crowded but wow!).

Just because the indexes have done silly things it doesn't mean we have to pay attention to them and low volume BS for the past few weeks means we have no reason to change our original bounce chart from December's dip – as those zones are still in play. …