Medical expenses segment is likely to dominate the UK travel insurance as the global travelers are often exposed to foreign bacteria, unfamiliar foods and health concerns.

Dallas, United States - December 15, 2021 /MarketersMedia/ —

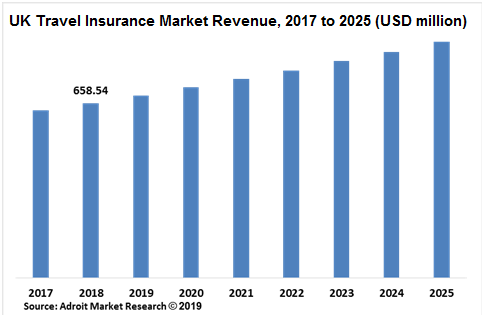

Travel insurance covers unforeseen losses incurred during inbound or outbound travel. Owing to benefits such as the cover of medical expenses, cancellation, personal possessions, travel documents and gadgets, personal accidents, legal advice, and activity cover, travel insurance is experiencing rapid adoption thus fostering progress in UK travel insurance market due to consumer preferences and adoption. The UK travel insurance market size is projected to reach USD 890.64 million by 2025.

Request Free sample pages of this report @

https://www.adroitmarketresearch.com/contacts/request-sample/836

However, lack of uniformity resulting from improper structure and reporting, changing regulatory norms, insurers failing to identify most common risk classification criteria, increasing Covid-19 restrictions for inbound as well as outbound travelers progression and severity of the new variant are hampering the UK travel insurance market.

Conversely, visitors spending more on travel during spring and more substantially in summer, except during the Covid surge is further ramping up opportunities for the UK travel insurance space. Furthermore, easing entry restrictions, harmonized safety, and hygiene protocols, increased traveler confidence amid rapid progress on vaccinations is anticipated to be growth opportunity to the UK travel insurance market.

The major players in UK travel insurance market are Post Office Money, LV= Premier, Columbus Direct Gold, Stay Sure, Admiral Platinum, InsureFor.com Premier, Saga Travel Insurance, The AA Gold, Sainsburys Platinum, Santander Travel Insurance, mAXA Gold, Co-Operative Insurance Platinum, Direct Travel Insurance Premier Plus, and JustTravelCover.com Arch Gold travel insurance company among others.

Read complete report @ https://www.adroitmarketresearch.com/industry-reports/uk-travel-insurance-market

These companies are highly rated in UK travel insurance market as they offer the best level of cover through their insurance product and ensure customer happiness, trust, transparency, and complaints handling. The companies dominate the UK travel insurance market providing comprehensive travel insurance services like the emergency medical cover, cover for personal possessions and baggage, cancellation cover, cover per trip, medical expenses and more.

The UK travel insurance market is classified into domestic travel insurance plan, international travel insurance, senior citizen travel insurance, and others based on travel insurance plan type. Among these, the international travel insurance plan held the maximum revenue in 2021 and is expected to grow substantially in the forecast years 2022-2028.

Report Scope

Study Period: 2018 - 2025

Base Year: 2020

Fastest Growing Market: UK

Market Value: USD 890.64 Million

The key factors such as increasing tourism, increasing tourism per trip, increased traveler confidence amid rapid progress on vaccinations, easing of entry restrictions in many destinations of UK, digital vaccination certificates facilitating international mobility continues to support the international travel insurance segment and overall UK travel insurance market.

The harmonized safety and hygiene protocols strengthened communication between countries to restore consumer confidence for international travel, easy travel, and affordable expenses, inbound visits related to business, family, friends, and exploring the UK are the key factors driving the UK travel insurance market.

We would encourage you to make a pre order inquiry before making a final purchase so that we can help you understand the above factors in detail. Make you’re a pre order inquiry @ https://www.adroitmarketresearch.com/contacts/enquiry-before-buying/836

FAQs:

What is the size of the UK Travel Insurance Market?

Which elements are helping the growth in UK?

Which market category has the most market share?

What factors are influencing the UK Travel Insurance Market?

Table of Content

Chapter 1 Executive Summary

Chapter 2 Research Approach & Methodology

Chapter 3 Market Outlook

Chapter 4 Travel Insurance Market Overview, By Type

Chapter 5 Travel Insurance Market Overview, By Application

Chapter 6 Travel Insurance Market Overview, By Type of Travel

Chapter 7 Travel Insurance Market Overview, By Distribution Channel

Chapter 8 Industry Structure

Chapter 9 Company Profiles

About Us

Adroit Market Research is an India-based business analytics and consulting company incorporated in 2018. Our target audience is a wide range of corporations, manufacturing companies, product/technology development institutions and industry associations that require understanding of a market's size, key trends, participants and future outlook of an industry. We intend to become our clients' knowledge partner and provide them with valuable market insights to help create opportunities that increase their revenues. We follow a code - Explore, Learn and Transform. At our core, we are curious people who love to identify and understand industry patterns, create an insightful study around our findings and churn out money-making roadmaps.

Contact Us:

Ryan Johnson

Account Manager Global

3131 McKinney Ave Ste 600, Dallas,

TX75204, U.S.A.

Phone No.: USA: +1 210-667-2421/ +91 9665341414

Contact Info:

Name: Ryan Johnson

Email: Send Email

Organization: Adroit Market Research

Website: https://www.adroitmarketresearch.com/industry-reports/uk-travel-insurance-market

Source: MarketersMedia

Release ID: 89056796