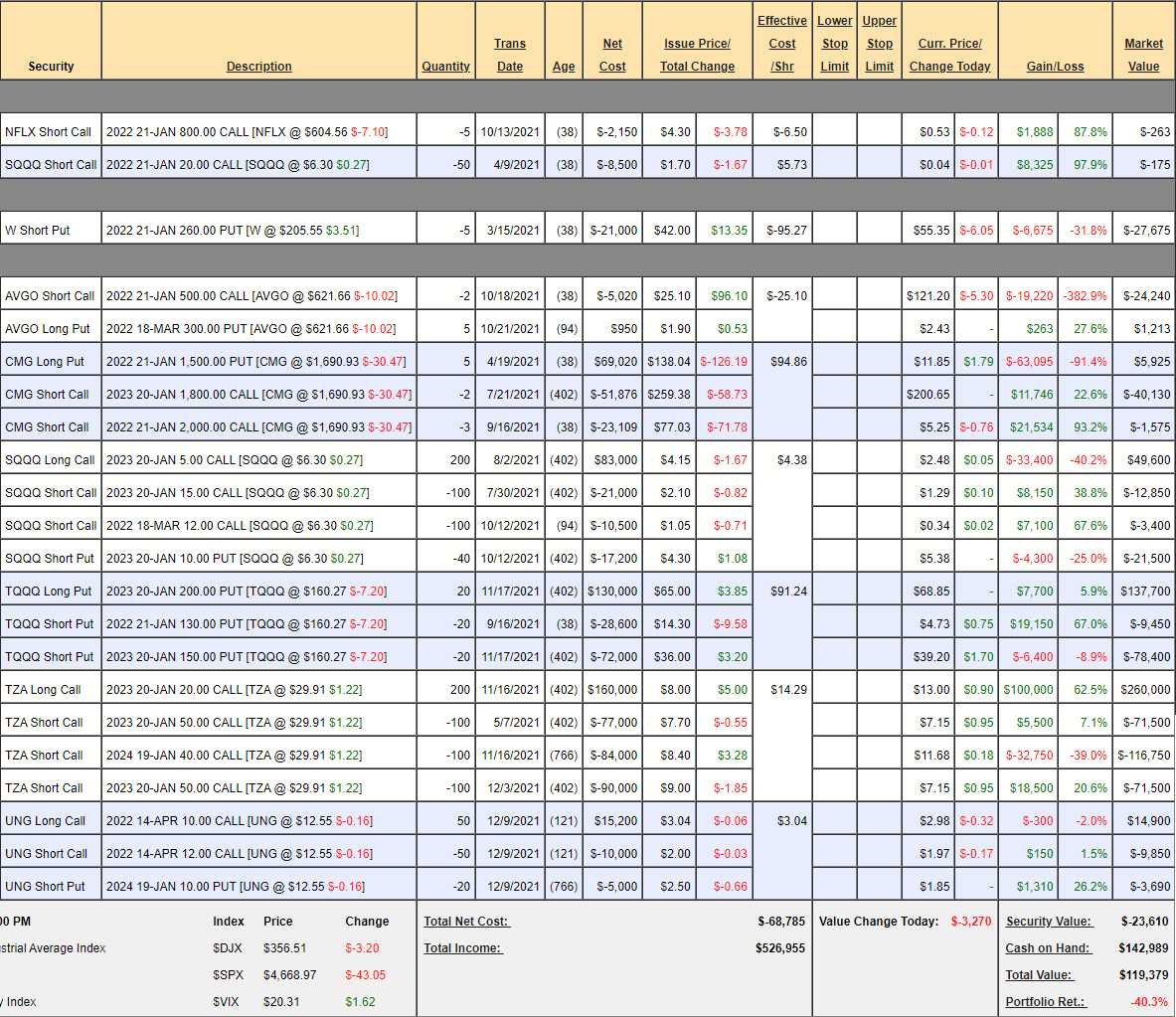

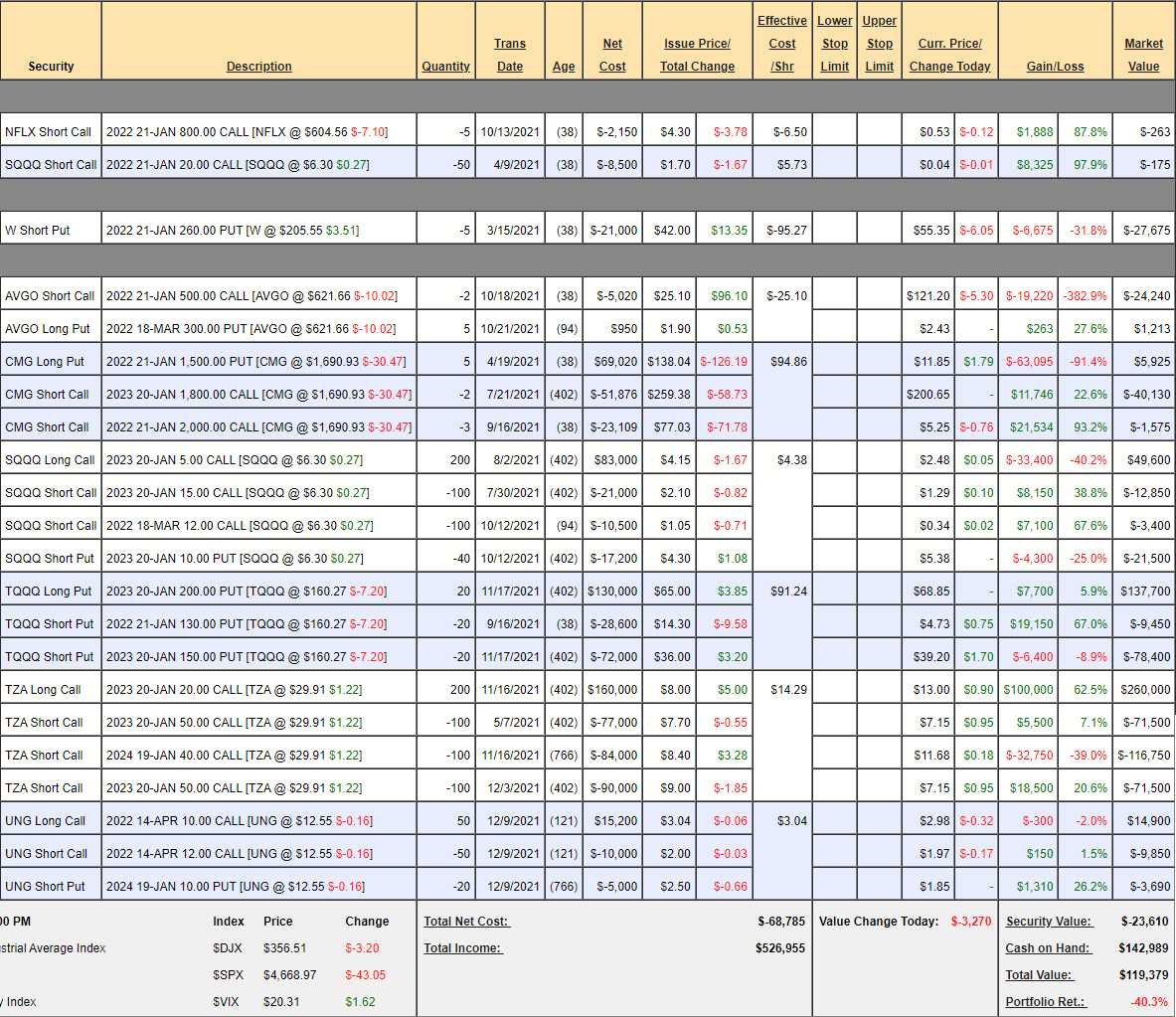

It's been a rough month for small caps . The Russell 2000 is down about 10% since our November 16th review but the other indexes are essentially flat. At the time, our Short-Term Portfolio (STP) was down 54.5%, at $91,022 at the top of the market and we made a few adjustments then and a few more adjustments on November 26th , getting more aggressively short as the new Covid strain came out and now our Short-Term Portfolio is down 40.3%, at $119,379 and up $28,357 for the month . It's a little disappointing as our Long-Term Portfolio (LTP) is down about $100,000 and the STP is there to protect the much larger (over $2M) LTP but the hedges don't really kick in on a small drop and the LTP holdings were way overbought at +336.6% last month – we knew that wasn't going to last.. Still, we have to make sure to check our math to make sure we are adequately protected for a larger drop. The goal of hedging is to MITIGATE (not erase) the damage of a drop so generally, we're happy to cover 50% of our losses on the way down and we're covering about 30% so we need to check to see if we are not adequately covered or if the missing $20,000 (out of $2.1M) is just a glitch that will work itself out. Looking at the positions, it's our side bets that hurt us this month: NFLX – These short calls will go worthless in January. SQQQ – Leftover short calls from an old spread, will also go worthless in January. W – This really hurt us as W dropped like a rock and we went from +$12,975 on 11/26 to -$6,675 – so there's a missing $19,650. It's not an excuse but we have to realize our primary hedges are working just fine and money is being drained elsewhere. Now we're in a funny position as we don't like W but we already cashed out the bearish side of the bets and we left this to expire – and it's not working. The best thing to do here is take advantage of the drop to sell more puts (while they are overpriced), …

It's been a rough month for small caps.

It's been a rough month for small caps.

The Russell 2000 is down about 10% since our November 16th review but the other indexes are essentially flat. At the time, our Short-Term Portfolio (STP) was down 54.5%, at $91,022 at the top of the market and we made a few adjustments then and a few more adjustments on November 26th, getting more aggressively short as the new Covid strain came out and now our Short-Term Portfolio is down 40.3%, at $119,379 and up $28,357 for the month.

It's a little disappointing as our Long-Term Portfolio (LTP) is down about $100,000 and the STP is there to protect the much larger (over $2M) LTP but the hedges don't really kick in on a small drop and the LTP holdings were way overbought at +336.6% last month – we knew that wasn't going to last.. Still, we have to make sure to check our math to make sure we are adequately protected for a larger drop.

The goal of hedging is to MITIGATE (not erase) the damage of a drop so generally, we're happy to cover 50% of our losses on the way down and we're covering about 30% so we need to check to see if we are not adequately covered or if the missing $20,000 (out of $2.1M) is just a glitch that will work itself out. Looking at the positions, it's our side bets that hurt us this month:

- NFLX – These short calls will go worthless in January.

- SQQQ – Leftover short calls from an old spread, will also go worthless in January.

- W – This really hurt us as W dropped like a rock and we went from +$12,975 on 11/26 to -$6,675 – so there's a missing $19,650. It's not an excuse but we have to realize our primary hedges are working just fine and money is being drained elsewhere. Now we're in a funny position as we don't like W but we already cashed out the bearish side of the bets and we left this to expire – and it's not working. The best thing to do here is take advantage of the drop to sell more puts (while they are overpriced),

…

It's been a rough month for small caps.

It's been a rough month for small caps.