This is not a good trend: The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review ) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED! We're actually quite bearish – our hedges don't really start kicking in until there's a 10% correction but losing just $4,000 on a 5% market pullback is wonderful so we're very pleased with where we stand at the moment – especially heading into the Q3 earnings reports. We just had the final read on Thursday of our Q3 GDP and that came in strong at 6.7% so it's not the earnings we'll be watching, but the Q4 guidance. Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and w e're up at levels we haven't seen since the late 80s . This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either). Currently, 80% of the Items in the Consumer Price Index are rising. In the 70s and 80s, it was 100% but part of that is due to changes in measurments since that time as now, if you paid $1,200 for an IPhone with 256G of memory and now you pay $1,400 for an IPhone with 521G of memory, the Fed considers that to be a CHEAPER phone, since you got twice the memory for your money.(and processing power, etc) – so no inflation there – DEflation, in fact! There's also a substitution model …

This is not a good trend:

The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED!

The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED!

We're actually quite bearish – our hedges don't really start kicking in until there's a 10% correction but losing just $4,000 on a 5% market pullback is wonderful so we're very pleased with where we stand at the moment – especially heading into the Q3 earnings reports. We just had the final read on Thursday of our Q3 GDP and that came in strong at 6.7% so it's not the earnings we'll be watching, but the Q4 guidance.

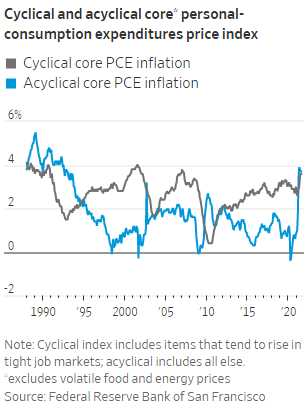

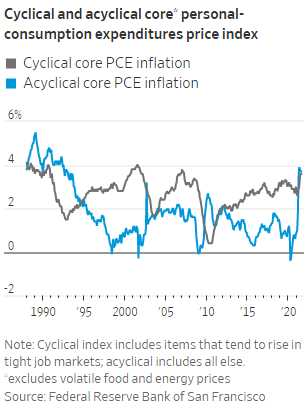

Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and we're up at levels we haven't seen since the late 80s. This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either).

Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and we're up at levels we haven't seen since the late 80s. This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either).

Currently, 80% of the Items in the Consumer Price Index are rising. In the 70s and 80s, it was 100% but part of that is due to changes in measurments since that time as now, if you paid $1,200 for an IPhone with 256G of memory and now you pay $1,400 for an IPhone with 521G of memory, the Fed considers that to be a CHEAPER phone, since you got twice the memory for your money.(and processing power, etc) – so no inflation there – DEflation, in fact!

There's also a substitution model…

The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED!

The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED! Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and we're up at levels we haven't seen since the late 80s. This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either).

Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and we're up at levels we haven't seen since the late 80s. This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either).