(Please enjoy this updated version of my weekly commentary published September 27, 2021 from the POWR Growth newsletter).

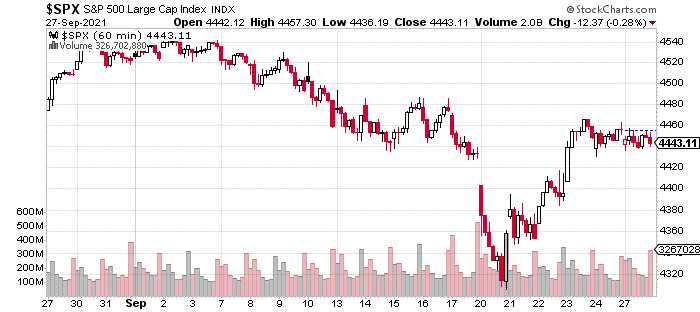

First, let’s do our regular look at what’s transpired in the S&P 500 for the last week:

Clearly, the bounce that began last Monday at 3pm has continued. Overall, the S&P 500 is up 3.2% from its recent low, and it’s off 2.2% from its all-time highs in early September. The Russell 2000’s performance is even better as it’s up 4.6% from Monday’s lows.

The strength in the Russell 2000 is not surprising as we are also seeing strength in long-term yields and reflation stocks as optimism about the economic outlook somewhat brightens.

This is mostly due to the coronavirus situation improving as the 7-day moving average of new cases for the country continued to drop over the last week from an average of 138,000 new cases/day to 109,000. And a stark improvement from 190,000 new cases/day in early September.

Thus, it’s not surprising that our reflationary stocks have performed so well.

Another reason for strength in reflation stocks and yields is that there has been positive chatter about the prospects of the reconciliation package and infrastructure bill which could come in smaller than expected to appease moderates.

However, it would still have a positive impact on the economy for sectors like consumer spending and industrials.

Now, let’s talk about how this impacts our strategy.

In today’s trade alert, I discussed the difference between secular growth and cyclical growth stocks. And why the latter seem more interesting at the moment given their combination of earnings growth and valuations into favorable year-end circumstances.

While, we continue to have secular growth stock exposure, I do expect them to underperform with the potent headwind of higher rates. We experienced this from early February to mid-March, when the 10Y yield sharply increased from 1.17% to 1.70% and many growth stocks and high-beta ones sold-off between 25% and 40%.

Many of the high-quality ones have recovered and gone on to make new highs, while lower-quality ones languish near their lows.

Given these developments, we are temporarily increasing our exposure to cyclical growth stocks.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $435.23 per share on Tuesday afternoon, down $7.41 (-1.67%). Year-to-date, SPY has gained 17.55%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Will Reflation Stocks Continue to Lead the Stock Market? appeared first on StockNews.com