(Please enjoy this updated version of my weekly commentary published August 25, 2021 from the POWR Growth newsletter).

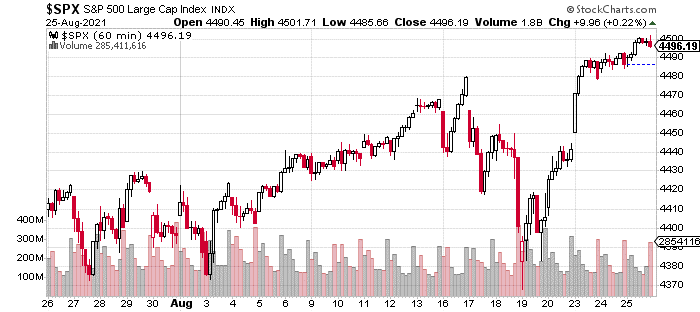

The one-month, hourly chart shows that the S&P 500 is up 3% over the last week and now at new, all-time highs.

Unlike previous rallies, we are even seeing increased participation from small-cap stocks:

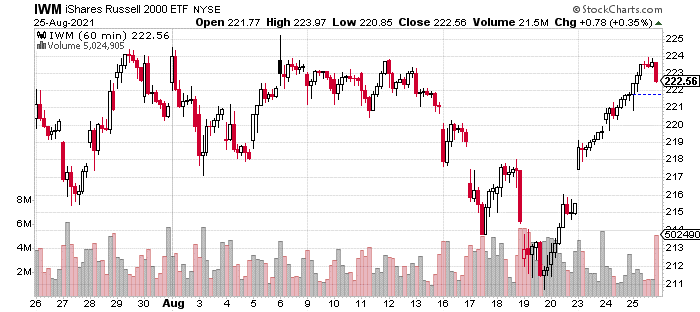

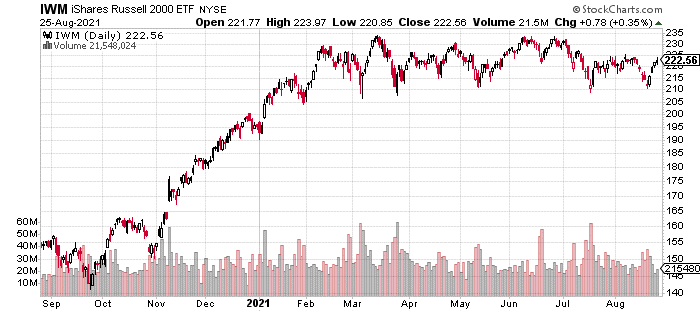

From Thursday’s low, the Russell 2000 is up 5%. However, this index is not at new highs and remains well below these levels as indicated by its six-month, daily chart:

In fact, it’s essentially been in a sideways range since February trading between 210 and 230.

And throughout this range - overbought readings have been met with selling, while oversold readings are met with furious buying.

This divergent state of affairs encapsulates the current market environment – the S&P 500 is in a grinding rally higher, while small and mid-cap stocks are locked into this excruciating range.

It’s quite remarkable that nothing has really changed this circumstance despite the plethora of news and events over the past six months such as the spike in coronavirus cases due to the Delta variant, the Fed inching towards a taper, 2 consecutive quarters of strong earnings results, and the likely passage of a $1+ trillion infrastructure bill and $3.5 trillion budget.

We’ve adapted to this situation by being a bit nimbler and more active in trading our small and mid-cap stocks while also retaining exposure to large cap stocks that will benefit from the drop in interest rates.

Speaking of Rates….

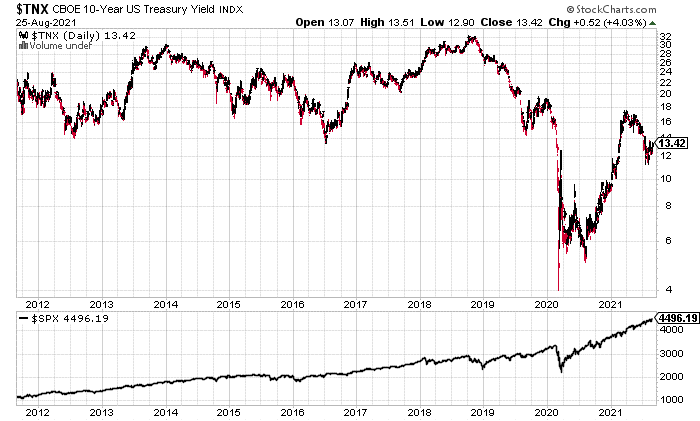

Let’s take a look at the 10-year, monthly chart of the 10-year yield:

As we can see, the S&P 500 can keep chugging higher regardless of what rates are doing. However, the trend in rates certainly do impact the type and composition of the rally.

For example, the 10-year dropped from above 3% to below 2% in 2019. During this time, cyclical stocks were in a bear market despite the S&P 500 gaining more than 20%.

Currently, the 10Y yield has dropped from 1.75% to 1.34%. This drop has correlated with underperformance in more economically sensitive parts of the market like housing, energy, and materials. This has created pessimism around the recovery and even led to increased chatter about the possibility that growth will drastically decelerate in the coming months.

We actually have a useful analogue in terms of what we went through from 2016 to 2018 which was the last bull market in rates.

In the early part of 2016, the market and rates dropped amid fears of a double-dip recession. While the market bottomed in February, rates made a lower low and bottomed soon following the Brexit vote which caught markets offsides.

From there, markets blasted higher with cyclicals leading for the rest of 2016. Then, there was profit-taking for much of 2017 until rates bottomed and once again started moving higher. During this time, small-caps and cyclicals underperformed, while the S&P 500 grinded higher. We had the same circumstance of earnings growth and low rates as we do today.

I believe that time period is quite similar to today in terms of earnings growth, low rates, and a powerful economic recovery. We are currently in the digestion phase which requires some patience, but we know that eventually it will resolve higher, and the big gains will be found in preparing for this outcome.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $446.36 per share on Thursday afternoon, down $2.55 (-0.57%). Year-to-date, SPY has gained 20.17%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of POWR Growth newsletter. Learn more about Jaimini’s background, along with links to his most recent articles.

The post How Will the Upcoming Fed Meeting Impact the Stock Market? appeared first on StockNews.com