(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

Market Commentary

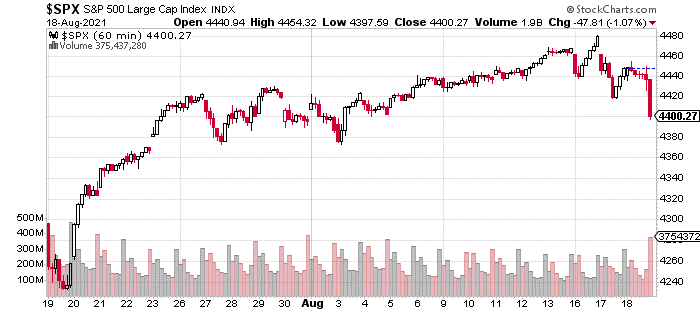

As usual, let’s start with the one-month, hourly chart. which shows that the market’s upwards drift was rudely interrupted and we have basically given back this week and last week’s gains in a couple of sessions.

Of course, that is how markets work – they ride the escalator up and take the stairs down.

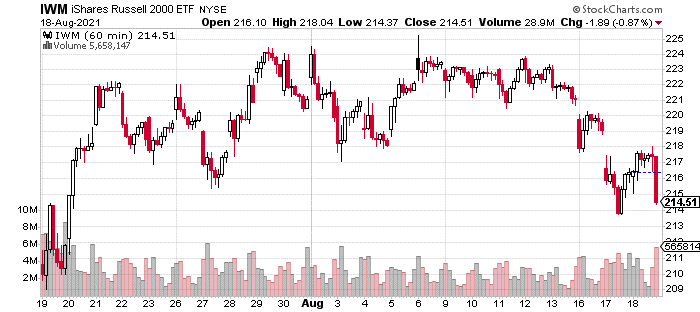

However as we’ve noted in the past, the S&P 500 is not the best proxy for the broader market and especially for growth stocks. A better illustration of the weakness under the surface can be found with the Russell 2000:

As the chart shows, the Russell 2000 has basically retraced the entire advance that started on July 19. Further, it never made new highs like the S&P 500. Even more interesting is that its decline took place while the 10Y yield was moving higher.

And, the 10Y yield starting to move higher from its oversold state made me more constructive on growth stocks linked to the economy.

However, it seems that in the tug of war between bullish and bearish forces… the bears have a temporary upper hand.

For much of this bull market, we’ve had rising growth expectations and a dovish Fed. Now, we have a slowing growth and a Fed that remains committed to tapering bond purchases. As long as this is the case, growth stocks probably won’t outperform for a significant chunk of time.

Recent Moves

Recently, the portfolio has gone through some turnover, and this is likely to continue if these trends persist. Let me explain my thought process:

I define four categories of growth (and of course, there is some overlap) – there is the slow and steady growth stocks, the speculative growth stocks, cyclical growth stocks, and small cap growth stocks.

While, there are some environments where all of these stocks tend to rally together (Nov 2020 – Feb 2021), currently, we are in a market where only one of these asset classes is trending higher – slow and steady growth.

Thus, we did boost our exposure to this group via some of the medical device and pharmaceutical stocks.

The latter 3 categories have basically trended lower or been range-bound since this portfolio’s inception in mid-April. Speculative growth stocks continue to digest the rapid gains from last year and many remain down 40-50% from their previous highs.

Cyclical growth stocks outperformed till about May but are now down anywhere from 10 to 25% off these recent highs. Finally, small cap growth stocks have been underperforming since the February high.

My logic was that the rebound in 10-year yields would lead to a rebound in cyclical growth and small-cap growth as these are most sensitive to growth expectations.

The market action this week shattered that notion, so we are once again back to the status quo – a market dominated by large caps where speculative/cyclical/small-cap growth strategies are likely to underperform but slow and steady growth will outperform.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $439.37 per share on Thursday afternoon, up $0.19 (+0.04%). Year-to-date, SPY has gained 18.29%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of POWR Growth newsletter. Learn more about Jaimini’s background, along with links to his most recent articles.

The post How Will Recent Volatility Impact the Stock Market? appeared first on StockNews.com