Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three month period ended 31 March 2021. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210513005424/en/

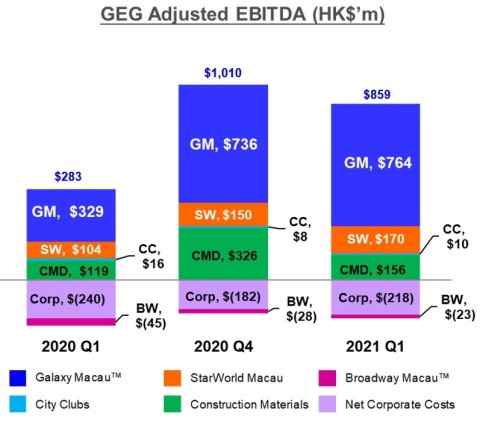

Chart of GEG Q1 2021 Adjusted EBITDA (Graphic: Business Wire)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I wish to take this opportunity to update you on the status of Macau and the performance of GEG in Q1 2021. COVID-19 has continued to impact the community and businesses globally including Macau and GEG. We are encouraged by Macau’s gradual recovery and remain cautiously optimistic that business conditions will continue to improve, while, at the same time, remain hypersensitive about any future outbreaks of the pandemic. From the later part of 2020 and continuing into 2021, we started to see some easing of restrictions relating to COVID-19. As a result, Macau has experienced a gradual increase in visitor arrivals which has translated into increased revenue.

Group’s Q1 Adjusted EBITDA of $859 million more than tripled year-on-year and was down 15% quarter-on-quarter. Please note that even though Adjusted EBITDA in Q1 2021 was less than Adjusted EBITDA in Q4 2020, we are pleased with the outcome given that Q4 2020 included a one-off $100 million COVID-19 insurance claim. In addition, Construction Materials Division is historically seasonal softer in the first quarter compared to the other three quarters. Construction Materials Division contributed $156 million in Q1 2021 compared to $326 million in Q4 2020. This is an annual seasonal occurrence and we expect an improvement in Q2 2021. Further, GEG’s performance was also supported by continued effective cost controls across the Group.

We again applaud the Macau Government for their proactive leadership during the challenging pandemic crisis. Their focus is not only to ensure the health and safety of the community, but also ensuring that Macau is well positioned to attract visitors, support economic recovery and maintain the social stability of Macau. We are pleased that the Macau Government through the Macau Government Tourism Office (MGTO) has been actively touring numerous Mainland cities and actively promoting Macau. This marketing is positioning Macau’s track record in combating COVID-19, promoting the various health and safety measures implemented in Macau and offering special tourism and accommodation packages to encourage visitation to Macau. We will continue to work with and support this important government lead initiative.

On 15 May 2021, Galaxy Macau™ will celebrate an exceptional 10-year presence in Macau. Since our launch in 2011, Galaxy Macau™ has delivered the highest level of entertainment and leisure options and provided exceptional experiences to our guests from all over the world. We are pleased to report that we continue to make good progress with our expansion plans through our development projects including Cotai Phases 3 & 4. In addition, we continue renovate, reconfigure and introduce new products to our resorts and we remain engaged in our international expansion plans including Japan, which is also being impacted by the pandemic.

We were pleased to announce in March 2021 the introduction of the legendary Raffles at Galaxy Macau. Raffles at Galaxy Macau will feature an approximate 450 all-suite tower and is targeted to open in the later part of 2021 or early 2022. The addition of Raffles further expands GEG’s portfolio of world-class accommodation offerings.

Our balance sheet continues to remain healthy with $42.4 billion in cash and liquid investments as at the end of Q1 and $33.6 billion of net cash. Total debt was $8.8 billion, including $8.3 billion associated with our treasury yield enhancement program and $0.5 billion of core debt. Our conservative financial management provides the Group with valuable flexibility in managing our ongoing operations and allows us to continue with our longer term development plans.

Going forward in the medium to longer term, we remain confident in the future of Macau. We have seen signs of early recovery post the reinstatement of the Individual Visit Scheme (“IVS”) in late September 2020 and it may take a few more quarters for business volumes to ramp up. However, we do acknowledge the ongoing difficulties associated with COVID-19 and potential future flare ups of COVID-19 could have a material adverse impact on our financial performance.

Finally, I would again like to acknowledge and thank the Government of Macau and the health and emergency personnel who have worked so hard to ensure the safety of Macau. I would also like to thank our staff, management team and Board of Directors who voluntarily contributed to the various cost savings programs and for being so supportive of our Company during this period of time. Thank you!

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

Q1 2021 RESULTS HIGHLIGHTS GEG: Gradual Pandemic Recovery Continues Supported by Continued Effective Cost Control

Galaxy MacauTM: Gradual Pandemic Recovery Continues

StarWorld Macau: Gradual Pandemic Recovery Continues

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported by Macau SMEs

Balance Sheet: Healthy and Liquid Balance Sheet

Development Update: Making Progress on Cotai Phases 3 & 4

|

Macau Market Overview

In the first quarter of 2021, Macau continued to be impacted by COVID-19 and the associated travel restrictions. Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for Q1 2021 was $22.9 billion, down 22% year-on-year and up 8% quarter-on-quarter.

The IVS was progressively reinstated through the third quarter of 2020 but border entry restrictions for international tourists remained in place impacting customer arrivals. During the first part of 2021 including Chinese New Year, the Central Government encouraged limited travel to assist in combating the pandemic. In Q1 2021, visitor arrivals to Macau were 1.74 million, down 46% year-on-year and down 7% quarter-on-quarter. Mainland visitor arrivals were 1.57 million, down 32% year-on-year and down 10% quarter-on-quarter. Overnight visitors were 919,192, down 40% year-on-year.

Group Financial Results

In Q1 2021, the Group posted net revenue of $5.1 billion, up 1% year-on-year and flat quarter-on-quarter. Adjusted EBITDA was $859 million, up 204% year-on-year and down 15% quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $764 million, up 132% year-on-year and up 4% quarter-on-quarter. StarWorld Macau’s Adjusted EBITDA was $170 million, up 63% year-on-year and up 13% quarter-on-quarter. Broadway Macau™’s Adjusted EBITDA was $(23) million versus $(45) million in Q1 2020 and $(28) million in Q4 2020. Construction Materials Division Adjusted EBITDA grew 31% year on year to $156 million, but declined 52% sequentially due primarily to seasonality. Further, GEG’s performance was also supported by continued effective cost controls across the Group.

Latest twelve months Adjusted EBITDA was $(444) million, down 104% year-on-year and up 57% quarter-on-quarter.

In Q1 2021, the Group’s Normalized Adjusted EBITDA was $690 million after adjusting for good luck of $169 million, up 247% year-on-year and down 29% quarter-on-quarter. Please note that Q4 2020 Adjusted EBITDA benefited from the COVID-19 insurance claim of $100 million.

The Group’s total GGR on a management basis1 in Q1 2021 was $4.8 billion, down 13% year-on-year and up 3% quarter-on-quarter. Mass GGR was $2.8 billion, up 1% year-on-year and up 1% quarter-on-quarter. VIP GGR was $1.8 billion, down 27% year-on-year and up 10% quarter-on-quarter. Electronic GGR was $130 million, down 44% year-on-year and down 27% quarter-on-quarter.

| Group Key Financial Data | ||||||

(HK$'m) | Q1 2020 | Q4 2020 | Q1 2021 | |||

Revenues: | ||||||

Net Gaming | 4,046 | 3,651 | 3,857 | |||

Non-gaming | 549 | 646 | 598 | |||

Construction Materials | 475 | 806 | 641 | |||

Total Net Revenue | 5,070 | 5,103 | 5,096 | |||

Adjusted EBITDA | 283 | 1,010 | 859 | |||

Gaming Statistics2 | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Rolling Chip Volume3 | 68,169 | 43,910 | 47,235 | |||

Win Rate % | 3.6 | % | 3.8 | % | 3.8 | % |

Win | 2,475 | 1,648 | 1,812 | |||

Mass Table Drop4 | 11,189 | 12,037 | 11,585 | |||

Win Rate % | 25.2 | % | 23.4 | % | 24.6 | % |

Win | 2,815 | 2,817 | 2,849 | |||

Electronic Gaming Volume | 7,119 | 4,322 | 4,195 | |||

Win Rate % | 3.2 | % | 4.1 | % | 3.1 | % |

Win | 231 | 178 | 130 | |||

Total GGR Win5 | 5,521 | 4,643 | 4,791 | |||

Balance Sheet

Due to our conservative financial management, our balance sheet continues to remain strong. At 31 March 2021, cash and liquid investments were $42.4 billion and net cash was $33.6 billion. Total debt was $8.8 billion, including $8.3 billion associated with our treasury yield enhancement program and $0.5 billion of core debt. Our healthy balance sheet provides us with valuable flexibility in managing our ongoing operations and allows us to continue investing in our longer term development plans.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In Q1 2021, Galaxy Macau™’s net revenue was $3.4 billion, down 3% year-on-year and up 3% quarter-on-quarter. Adjusted EBITDA was $764 million, up 132% year-on-year and up 4% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 22% (Q1 2020: 9%).

In Q1 2021, Galaxy Macau™’s Normalized Adjusted EBITDA was $637 million after adjusting for good luck of $127 million, up 149% year-on-year and down 9% quarter-on-quarter. Please note that Q4 2020 Adjusted EBITDA benefited from the COVID-19 insurance claim of $75 million.

The combined five hotels occupancy rate was 44% for Q1 2021.

Galaxy Macau™ Key Financial Data | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Revenues: | ||||||

Net Gaming | 3,060 | 2,731 | 2,875 | |||

Hotel / F&B / Others | 313 | 290 | 250 | |||

Mall | 151 | 297 | 292 | |||

Total Net Revenue | 3,524 | 3,318 | 3,417 | |||

Adjusted EBITDA | 329 | 736 | 764 | |||

Adjusted EBITDA Margin | 9 | % | 22 | % | 22 | % |

Gaming Statistics6 | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Rolling Chip Volume7 | 47,842 | 29,552 | 32,612 | |||

Win Rate % | 4.1 | % | 3.9 | % | 4.0 | % |

Win | 1,962 | 1,156 | 1,301 | |||

Mass Table Drop8 | 6,519 | 7,348 | 7,128 | |||

Win Rate % | 29.1 | % | 27.3 | % | 28.3 | % |

Win | 1,897 | 2,009 | 2,019 | |||

Electronic Gaming Volume | 4,482 | 3,064 | 3,167 | |||

Win Rate % | 4.0 | % | 5.0 | % | 3.2 | % |

Win | 178 | 153 | 102 | |||

Total GGR Win | 4,037 | 3,318 | 3,422 | |||

StarWorld Macau

In Q1 2021, StarWorld Macau’s net revenue was $1.0 billion, up 1% year-on-year and up 6% quarter-on-quarter. Adjusted EBITDA was $170 million, up 63% year-on-year and up 13% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 17% (Q1 2020: 10%).

In Q1 2021, StarWorld Macau’s Normalized Adjusted EBITDA was $128 million after adjusting for good luck of $42 million, up 39% year-on-year and down 10% quarter-on-quarter. Please note that Q4 2020 Adjusted EBITDA benefited from the COVID-19 insurance claim of $25 million.

Hotel occupancy was 62% for Q1 2021.

StarWorld Macau Key Financial Data | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Revenues: | ||||||

Net Gaming | 948 | 914 | 972 | |||

Hotel / F&B / Others | 49 | 35 | 34 | |||

Mall | 5 | 6 | 7 | |||

Total Net Revenue | 1,002 | 955 | 1,013 | |||

Adjusted EBITDA | 104 | 150 | 170 | |||

Adjusted EBITDA Margin | 10 | % | 16 | % | 17 | % |

Gaming Statistics9 | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Rolling Chip Volume10 | 18,509 | 13,280 | 13,683 | |||

Win Rate % | 2.4 | % | 3.6 | % | 3.4 | % |

Win | 451 | 481 | 470 | |||

Mass Table Drop11 | 3,584 | 3,957 | 3,790 | |||

Win Rate % | 20.2 | % | 16.9 | % | 19.2 | % |

Win | 725 | 668 | 727 | |||

Electronic Gaming Volume | 1,149 | 584 | 520 | |||

Win Rate % | 2.1 | % | 2.1 | % | 3.5 | % |

Win | 24 | 11 | 18 | |||

Total GGR Win | 1,200 | 1,160 | 1,215 | |||

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs, it does not have a VIP gaming component. In Q1 2021, Broadway Macau™’s net revenue was $15 million, down 72% year-on-year, down 6% quarter-on-quarter. Adjusted EBITDA was $(23) million, versus $(45) million in prior year and $(28) million in Q4 2020.

There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q1 2021.

Hotel occupancy was 9% for Q1 2021.

Broadway Macau™ Key Financial Data | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Revenues: | ||||||

Net Gaming | 22 | 0 | 0 | |||

Hotel / F&B / Others | 25 | 10 | 9 | |||

Mall | 6 | 6 | 6 | |||

Total Net Revenue | 53 | 16 | 15 | |||

Adjusted EBITDA | (45 | ) | (28 | ) | (23 | ) |

Adjusted EBITDA Margin | NEG12 | NEG13 | NEG14 | |||

Gaming Statistics15 | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Mass Table Drop16 | 114 | NIL | NIL | |||

Win Rate % | 17.9 | % | NIL | NIL | ||

Win | 20 | NIL | NIL | |||

Electronic Gaming Volume | 220 | 7 | 13 | |||

Win Rate % | 2.0 | % | 1.5 | % | 3.5 | % |

Win | 5 | 0 | 0 | |||

Total GGR Win | 25 | 0 | 0 | |||

NIL represents tables closed during the period.

City Clubs

City Clubs contributed $10 million of Adjusted EBITDA in Q1 2021, down 38% year-on-year and up 25% quarter-on-quarter.

City Clubs Key Financial Data | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Adjusted EBITDA | 16 | 8 | 10 | |||

Gaming Statistics17 | ||||||

(HK$'m) | ||||||

Q1 2020 | Q4 2020 | Q1 2021 | ||||

Rolling Chip Volume18 | 1,818 | 1,078 | 940 | |||

Win Rate % | 3.4 | % | 1.1 | % | 4.4 | % |

Win | 62 | 11 | 41 | |||

Mass Table Drop19 | 972 | 732 | 667 | |||

Win Rate % | 17.8 | % | 19.2 | % | 15.4 | % |

Win | 173 | 140 | 103 | |||

Electronic Gaming Volume | 1,268 | 667 | 495 | |||

Win Rate % | 1.9 | % | 1.9 | % | 2.0 | % |

Win | 24 | 14 | 10 | |||

Total GGR Win | 259 | 165 | 154 | |||

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $156 million in Q1 2021, up 31% year-on-year and down 52% quarter-on-quarter. Note that Q1 is historically a seasonally softer quarter compare to the other three quarters. This is an annual seasonal occurrence and we expect an improvement in Q2 2021.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. We are proceeding with the development of Phases 3 & 4 and continue to review and refine plans to ensure a world-class optimal development. We see the premium market evolving with this segment preferring higher quality and more spacious rooms. Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We will try to maintain our development targets, however due to COVID-19, development timelines may be impacted. At this point we cannot quantify the impact but we will endeavor to maintain our schedule.

The Group was pleased to announce in March 2021 the signing of a collaboration agreement with Accor for Raffles, the legendary brand that has set the standard in luxury hospitality for more than 130 years. We will welcome the iconic brand with the addition and target opening of an exclusive all-suite tower, Raffles at Galaxy Macau in the later part of 2021 or early 2022. Raffles at Galaxy Macau, will feature an approximate 450 all-suite tower and is the latest chapter in the storied history of the legendary Raffles brand and will soon introduce a new level of sophistication and refinement to Macau.

Greater Bay Area / Hengqin

We understand the strategic master plan might have been revised with more emphasis on strengthening ties with Macau’s plan for the future and the Macau community. It was reported that more information will be available shortly and we are eagerly awaiting the details. In addition, we are expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area.

International

Our Japan based team continues with our Japan development efforts even as they deal with the COVID-19 crisis. We view Japan as a long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, remain interested in bringing our brand of World Class IRs to Japan.

Selected Major Awards in Q1 2021

Award | Presenter |

Galaxy MacauTM | |

Michelin One-star - 8½ Otto e Mezzo BOMBANA - Lai Heen Michelin Plate - Terrazza Italian Restaurant - The Ritz-Carlton Café - Yamazato 2021 Particularly Pleasant Luxury Hotel - Banyan Tree Macau - The Ritz-Carlton, Macau | Michelin Guide Hong Kong and Macau 2021 |

2021 Forbes Travel Guide Five-star Hotel - Banyan Tree Macau - The Ritz-Carlton, Macau 2021 Forbes Travel Guide Five-star Spa - Banyan Tree Spa Macau - The Ritz-Carlton Spa, Macau 2021 Forbes Travel Guide Five-star Restaurant - Belon - Lai Heen | Forbes Travel Guide |

SCMP 100 Top Tables 2021 - 8½ Otto e Mezzo BOMBANA - Lai Heen - Yamazato | South China Morning Post |

Hotel Group B (Excellence Award) Energy Saving Concept Award (Hotel Group) | Macau Energy Saving Activity 2020 |

StarWorld Macau | |

Top Class Comfort Hotel Michelin Two-star - Feng Wei Ju | Michelin Guide Hong Kong and Macau 2021 |

SCMP 100 Top Tables 2021 - Feng Wei Ju | South China Morning Post |

Broadway MacauTM | |

Michelin Plate - Wong Kun Sio Kung | Michelin Guide Hong Kong and Macau 2021 |

Hotel Group B (Excellence Award) | Macau Energy Saving Activity 2020 |

Construction Materials Division | |

The 19th Hong Kong Occupational Safety & Health Award – Safety

| Occupational Safety and Health Council |

The 19th Hong Kong Occupational Safety & Health Award – Safety

| |

The 19th Hong Kong Occupational Safety & Health Award - Safety

| |

Outlook

We are pleased with the progressive reinstatement of the IVS visas in Mainland through Q3 2020 and we have seen a steady recovery post Chinese New Year. The Macau Government is working closely with the Mainland authorities toward resuming approval of the online IVS visa application process and the reintroduction of package tours.

The Macau Government has an outstanding track record on handling the challenging pandemic crisis. Their focus is not only to ensure the health and safety of the community, but also ensuring that Macau is well positioned as a quality destination to attract visitors, support economic recovery and maintain the social stability of Macau. We believe that when Mainland and international tourists make future travel plans, health and safety will be foremost in their minds.

We look forward to the launching of the public consultation on the proposed amendments to Macau’s gaming law in the second half of this year. Additionally, the Macau SAR Legislative Assembly election will take place on 12 September 2021.

Recently, the Central Government announced that it was exploring a Digital Currency Electronic Payment (DCEP) project and a further discussion of using RMB digital currency. We are encouraged by this concept and support this government initiative, and we look forward to learning more about their plans.

From 1 March 2021, a new criminal law was introduced in Mainland China. We expect the new law to have significant impact on the VIP business and junket players. GEG is fully compliant with the laws and regulations of the locations where it has commercial activities. The Central Government has stressed that it wants the gaming industry of Macau to have a healthy development and diversify. GEG supports a more transparent and regulated operational environment that will benefit the development of the industry in the longer term.

GEG is ready to capture future growth with our substantial development pipeline. These include the ongoing development of Cotai Phases 3 & 4 which are specifically designed to capture a larger share of the Mass business. We continue to renovate our existing properties, reconfigure and introduce new products into our resorts to ensure they remain highly competitive and appealing to our valuable guests.

These projects will support Macau’s economy in both the near and longer term. We remain engaged in our international expansion plans including Japan. We understand that due to the impact of COVID-19, Japan has revised their timeline of Integrated Resorts licenses and we remain interested in introducing our brands to Japan. We have great confidence in Macau and we will continue with our development program. Whilst we remain confident, we are conscious that potential future flare ups of COVID-19 could impact the rate of Macau’s recovery. GEG remains committed to support the Government’s vision to develop Macau into a World Center of Tourism and Leisure.

- END -

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also progressing plans for its Hengqin project and we are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Etrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the Group level the gaming statistics include Company owned resorts plus City Clubs.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 Gaming statistics are presented before deducting commission and incentives.

7 Reflects junket rolling chip volume only.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Gaming statistics are presented before deducting commission and incentives.

10 Reflects junket rolling chip volume only.

11 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

12 NEG represents negative margin.

13 NEG represents negative margin.

14 NEG represents negative margin.

15 Gaming statistics are presented before deducting commission and incentives.

16 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

17 Gaming statistics are presented before deducting commission and incentives.

18 Reflects junket rolling chip volume only.

19 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210513005424/en/

Contacts: