Luminus Management LLC (together with certain of its affiliates, “Luminus” or “we”), the investment advisor to funds and accounts that beneficially own 4.5% of the outstanding ordinary shares of EnscoRowan plc (“EnscoRowan” or the “Company”) (NYSE: ESV), sent a letter to EnscoRowan’s Board of Directors (the “Board”) expressing its urgent recommendations for the Company.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190612005528/en/

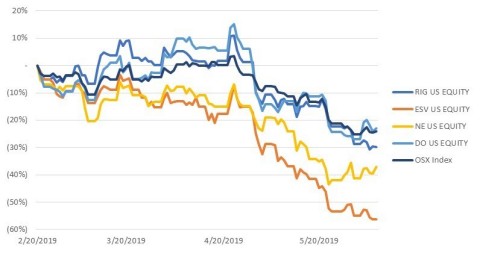

Relative Prices from 2/20/2019 close: Source: Luminus Management, LLC; Bloomberg; numbers through 6/7/2019

The key points from Luminus’ letter are as follows:

- Luminus has been extremely disappointed by the absolute and relative trading performance of EnscoRowan both before, and since, consummation of the Ensco-Rowan merger. We cannot imagine that other long-term shareholders feel differently.

- Luminus proposes that EnscoRowan launch a priority guaranteed bond offering to immediately fund a special dividend of $2.5 billion to shareholders.

- Luminus believes that a dividend in excess of the current $1.6 billion market capitalization will demonstrate that the Board and Management are willing to share a portion of the Company’s financial flexibility to deliver value for shareholders.

- This commitment should precipitate an immediate re-rating of EnscoRowan’s stock. We estimate that, after paying this special dividend, the Company will retain its significant financial flexibility to harvest the benefits of the emerging market recovery and Management’s post-merger value-creation strategy.

- EnscoRowan will also be able to utilize its extensive remaining financial flexibility to effect liability management

The full letter and accompanying presentation are available at www.enscovaluecreation.com, and an unformatted version of the letter can be read below:

| June 12, 2019 |

Via Email and FedEx |

| The Board of Directors |

| EnscoRowan plc |

| 6 Chesterfield Gardens |

| London, England W1J 5BQ |

| United Kingdom |

| 5847 San Felipe |

| Suite 3300 |

| Houston, TX 77057 |

Re: Balance Sheet Optimization and Shareholder Value Creation

Members of the Board:

Luminus Management LLC (together with certain of its affiliates, “Luminus” or “We”) is the investment advisor to funds and accounts that beneficially own 4.5% of the outstanding ordinary shares of EnscoRowan plc (“EnscoRowan” or the “Company”) (NYSE: ESV).

Luminus has been actively involved in the offshore drilling sector, and we have continuously owned at least one of EnscoRowan’s predecessor companies since 2013. We are an investment management firm founded in 2002 focused on the core sectors of power and energy, energy infrastructure, and related industrials. We are long-term, value-oriented investors, and our strategy employs a rigorous, fundamental, bottom-up, sector-focused approach.

As one of the Company’s largest shareholders, Luminus has been extremely disappointed by the absolute and relative trading performance of EnscoRowan both before, and since, consummation of the Ensco-Rowan merger. We propose that EnscoRowan launch a priority guaranteed bond offering to immediately fund a special dividend of $2.5 billion to shareholders. We believe that a dividend in excess of the current $1.6 billion market capitalization will demonstrate that the Board and Management are willing to utilize a portion of the Company’s significant value and financial flexibility to deliver value for shareholders. We believe this commitment will highlight value and extensive balance sheet flexibility, and precipitate a re-rating of EnscoRowan’s stock. In fact, we estimate that, after paying this special dividend, the Company will retain ample financial flexibility to harvest the benefits of the emerging market recovery and Management’s post-merger value creation strategy. EnscoRowan can also utilize its significant remaining financial flexibility to execute liability management.

A key component of the merger rationale was to create value for shareholders through both synergies and balance sheet flexibility. The current market’s disregard of the future prospects of EnscoRowan has created an enormous opportunity to reward shareholders with the synergies and extensive balance sheet flexibility gained through the merger.

In the pages that follow we will further detail our analysis, recommendations, and rationale.

Executive Summary:

EnscoRowan has meaningfully underperformed the market since approval of the Ensco-Rowan merger. From February 20, 2019 through June 7, 2019, EnscoRowan’s stock price declined by approximately 56%, underperforming peers and the broader oilfield services market by approximately 26% and 32%, respectively.

Investors seem to refuse to give EnscoRowan credit for many of its positive attributes and factors, including:

- High-quality assets

- Tightening jackup market

- ARO joint venture

- $165 million per year in projected transaction synergies

- Emerging tangible floater recovery

- Extensive balance sheet flexibility

In recent months, we have seen the consummation of the merger, inflection in floater and jackup dayrates, the advancement of the ARO joint venture, and increased synergy projections. Yet, the stock price has dramatically underperformed. Simply put, in our view the investment community has failed to understand EnscoRowan’s true value, and sees no path for the market to reassess the stock’s valuation.

Where does this leave us?

We believe that the Company must now consider a broader range of options than Company Management has previously communicated. The Company’s largest remaining unutilized asset that can be unlocked and shared with equity is its extensive balance sheet flexibility.

EnscoRowan—and particularly its shareholders—have paid for this flexibility:

When other drillers utilized their flexibility earlier in the cycle to increase leverage and add layers of debt, EnscoRowan sold equity and convertible bonds. In fact, EnscoRowan is the only tier-one driller that has issued equity and equity-linked debt since 2011 outside of a corporate transaction or bankruptcy. In total, EnscoRowan has issued ~$1.5 billion in equity and convertible bonds and ~$1.4 billion in equity consideration in the Rowan merger.

Additionally, EnscoRowan prioritized creditors following the Rowan acquisition by providing corporate guarantees on assumed debt rather than allowing a lower-priority layer of debt to exist within its capital structure. In our opinion, the lower priority would have weighed on bond prices and opened more lucrative opportunities for “equity-accretive” liability management.

These actions – while consistent with EnscoRowan’s long-term aspiration to return to investment-grade – have prioritized creditors at a cost to equity. Given our view that the benefits of investment-grade status are at a minimum five years away, we believe these actions to improve the Company’s credit rating to enhance shareholder value on a “present value” basis actually hurt shareholders. Furthermore, we believe that a special dividend does not stop EnscoRowan from becoming investment-grade; it only delays attaining that status by a few years. We strongly believe now is the time to further consider the interests of shareholders in corporate priorities.

Do shareholders have a seat at the table?

Management has made it clear to debt and equity holders that liability management will be a near-term component of their capital allocation strategy. Investors are expecting EnscoRowan to announce a liability-management bond tender in the near term. Assuming EnscoRowan funds this tender with new bonds, those bonds are likely to contain covenants and restrictions that will constrain the Company for many years to come.

In light of the disproportionate underperformance of the equity versus the bonds, the relative cost of capital between equity and senior unsecured debt has shifted dramatically. Following this significant repricing of EnscoRowan’s securities, we believe that the Company must reconsider the broader available range of options, and shifting the capital structure away from extremely high cost equity and towards lower cost debt has become essential.

Recommendation:

EnscoRowan’s stock value has decoupled from the fundamental strength of the business, and the stock is trading at a significant discount to its fundamental value. As a result, it is our opinion that the Board should:

- Raise $2.5 billion of priority guaranteed debt, and safeguard the Company’s ability to issue additional structurally senior debt

- Safeguard future financial flexibility (on both a junior and senior priority guaranteed basis)

- Fund a $2.5 billion special dividend

- Better incentivize Management to continue to pursue this value creation plan, and at the very least, re-value employee equity and option grants

EnscoRowan’s market capitalization currently stands at $1.6 billion. We believe that announcing a special dividend that is 56% larger than today’s market capitalization will crystallize many of the merger benefits for EnscoRowan’s shareholders. Our proposal is the best way to maximize shareholder value in a fiscally responsible way AND ensure that shareholders still benefit from the ultimate industry recovery. The cost of paying the dividend is limited; ultimately the Company’s long-term target of achieving investment-grade status would be deferred, but its ability to achieve all the rest of its objectives would be retained.

EnscoRowan’s stock is trading like an out-of-the-money call option on asset value:

The Ensco-Rowan merger was approved on February 21, 2019. From that time through June 7, 2019, EnscoRowan’s stock price has declined by approximately 56%, underperforming peers and the broader oilfield services market by approximately 26% and 32%, respectively.

In our opinion, the market has clearly shown it will treat EnscoRowan’s stock like an option rather than as equity of a viable long-term company. This was clearly demonstrated on Friday, May 17, 2019, after the Company announced an unexpected $180 million arbitration award from Samsung Heavy Industries. Despite the disclosure of a highly probable cash inflow equal to almost 10% of the Company’s market capitalization, the equity failed to respond. An announcement of that magnitude in a traditional equity would have seen a more commensurate improvement of its stock price. In our opinion, the only way this award could have been broadly ignored by the market is if investors believed the money would not accrue to equity’s benefit, and that the “ESV-equity-option” would not benefit from the award.

EnscoRowan’s balance sheet is misunderstood:

We believe that investors mistakenly view EnscoRowan’s balance sheet as a source of weakness:

Barclays, 3/5/2019: “ESV/RDC needs the floater market to recover quickly, however, as debt maturities from now until 2024 year-end are daunting… ESV/RDC generated a combined FCF loss of ~$800mm last year and will likely be FCF-negative again in 2019, leaving the company with just 3-4 years to generate over $1.2bn of FCF to meet its obligations by 2024.”

Barclays, 5/3/2019: “In our view there is now a clear distinction between DO/RIG and ESV/NE. The former have better balance sheets giving them a longer runway for the recovery to take hold ... ESV and NE, on the other hand, have less time before things get better with looming debt maturities in ’24-’26.”

BTIG, 5/30/2019: “We believe ESV’s steeper discount on an implied value per rig is a function of balance sheet concerns.”

However, EnscoRowan has extensive flexibility and optionality around its balance sheet that is likely not being appreciated by the market and is not available to many of the Company’s peers. EnscoRowan has maintained this flexibility through the cycle by conservatively capitalizing with equity, by issuing equity and convertible bonds totaling ~$1.5 billion since 2011, and by issuing ~$1.4 billion in equity consideration in the Rowan merger.

- Incremental Debt Capacity:

EnscoRowan’s bond indentures provide the Company with very significant flexibility to raise additional debt, fund operations, manage liabilities, and pay dividends. Revolver aside, all of EnscoRowan’s outstanding bonds have light, investment-grade style covenant packages, which include no limitation on dividends and allow for significant amounts of structurally senior debt to be issued. Therefore, for the purposes of this analysis we conservatively assume that EnscoRowan will terminate its revolver. In its place, we assume that EnscoRowan will utilize its significant capacity for first-money-out paper similar to Transocean Ltd.’s “priority guaranteed” and Noble Corp’s “senior guaranteed” bonds (hereafter referred to as “priority guaranteed debt”).

EnscoRowan has not tapped into any of these various capacities or utilized these levers, unlike the vast majority of its peers. Transocean Ltd. (NYSE: RIG), Noble Corporation plc (NYSE: NE), Pacific Drilling S.A. (NYSE: PACD), Seadrill Ltd (NYSE: SDRL), Odfjell Drilling (ODL NO), Maersk Drilling (CPH: DRLCO), Borr Drilling Ltd (OB: BDRILL), Vantage Drilling International (OTCMKTS: VTG), and Shelf Drilling Ltd (OSE: SHLF) have all either availed themselves of secured debt markets or layered their unsecured debt with guaranteed bonds. The capital markets are giving the Company very little or no “credit” for its flexibility; EnscoRowan should acknowledge that its strategy of maintaining excess flexibility (pursued at the meaningful cost of equity dilution) is not being valued, and this path should be comprehensively reconsidered.

- Senior Debt:

EnscoRowan’s high-quality asset base can backstop over $4.4 billion in incremental priority guaranteed debt. EnscoRowan owns three primary types of assets: drillships, semisubmersibles, and jackups. EnscoRowan also owns 50% of the ARO Drilling joint venture with Saudi Aramco. We have estimated EnscoRowan’s debt capacity using the following metrics:

Drillships: Pacific Drilling raised just over $1 billion in secured debt in September 2018 against 7 drillships, at an implied debt/rig of ~$150 million and an average cash cost (at issuance) just over 9%. These bonds currently trade near par, implying that these terms are currently “on-market.” Also noteworthy is the fact that PACD had very limited contract coverage on its assets at the time of issuance, highlighting that this debt capacity is based on asset values and not cash flow. EnscoRowan’s drillships cost on average $687 million per rig to construct (per IHS), and recent transactions imply drillship value in the $300-350 million range. EnscoRowan has 16 drillships (of better quality on average than Pacific Drilling, in our opinion)—or 14 net of two already-encumbered newbuilds in the shipyard—for an implied debt capacity of $2.1 billion.

Semisubmersibles: EnscoRowan has two 6th-Generation semisubmersible rigs, seven 8500-series rigs delivered in 2008 and later (three are working; four are cold-stacked), and three older semisubmersibles. EnscoRowan’s 6th-Generation rigs cost on average $688 million per rig to construct, and the three active 8500-series rigs cost $492 million per rig to construct (per IHS). A conservative approach would be to assume $100 million of debt on each of the 6th-Generation rigs and $50 million on each of the three working 8500-series rigs. This would represent an additional $350 million in debt capacity.

Jackups: Borr Drilling in March 2019 obtained a $160 million bank facility secured by mortgages over four jackup rigs, and a separate $120 million bank facility secured by mortgages over two jackups rigs. These transactions imply $40-60 million in debt per modern jackup, which is likely a conservative debt capacity benchmark as the bank market is typically more conservative with respect to loan-to-values than bond markets. EnscoRowan’s 36 jackups delivered in 2000 or later (including 15 harsh-environment-capable rigs) cost on average $211 million per rig to construct (per IHS), and modern jackup transactions are now over $85 million per rig, having troughed at around $65 million. Assuming no debt capacity exists against the Company’s older jackups and $45 million per rig of debt capacity against the newer jackups, this fleet represents an additional $1.62 billion in debt capacity.

ARO Drilling Joint Venture: EnscoRowan is a 50/50 partner with Saudi Aramco, the world’s largest jackup customer, which also has an A+/A1 credit rating. ARO currently owns a fleet of seven jackup rigs (five of which were delivered in 2004 or later), leases another nine jackup rigs from EnscoRowan (included in the 36 jackups mentioned above) and has plans to order up to 20 newbuild jackup rigs over the next 10 years with 8-year contractual commitments at 6-year EBITDA payback rates. Additionally, the entity currently has over $200 million in contract backlog from Saudi Aramco. We will not attempt to value the joint venture here, but EnscoRowan owns a $455 million shareholder loan against ARO drilling, and Saudi Aramco is also ARO’s only customer. We assume this loan could be monetized for an additional $375 million.

All these components would bring EnscoRowan’s total debt capacity to $4.45 billion on current asset-backed-financing comparables. The Company could raise this entire amount incrementally to current outstanding debt, as this debt could be issued closer to the assets with “priority guaranteed” status, priming existing bonds. Using precedent transactions at Pacific Drilling and Borr Drilling, and using the greater than 300 basis points spread between Noble Corp’s senior guaranteed and senior unsecured bonds, we triangulate to a 9% cost of debt.

- Discounted Debt Repurchases:

Our analysis conservatively assumes that EnscoRowan does not repurchase debt at a discount, and that full interest expense and principal balance are paid up to maturity of the current outstanding debt. Based on current trading prices, we believe EnscoRowan could save over $1.0 billion in principal payments if near- and medium-debt were repurchased today; including long-term debt brings this number to almost $2.0 billion. Note, this is based on an unaffected number before management proceeds with any of the shareholder value-creation measures we have outlined.

- Liability Management to Extend Maturities:

Our analysis does not give credit for EnscoRowan’s ability to utilize “junior priority guaranteed” debt – debt that is senior to currently existing unsecured bonds, but junior to the pro forma priority guaranteed debt. EnscoRowan has ~$3.4 billion of debt due in 2024 and 2025 that we assume will be repaid in cash. In practice, EnscoRowan should be able to tender for bonds at a discount with the consideration consisting of longer-dated junior priority guaranteed debt instead of cash. Creditors accepting this tender would immediately become senior to all currently outstanding unsecured debt. This tool enables the Company to further extend maturities without consuming cash.

- Asset Sales:

Our analysis does not assume any benefit from asset sales. Although the analysis assigns debt capacity of $150 million per drillship and $45 million per premium jackup, recent comparable asset sales have placed drillship values at or above $300 million and premium jackup values in the $85 million or greater range. Thus, any asset sales would further buttress the Company’s balance sheet (in excess of the aforementioned debt capacity). Covenants on current outstanding debt provide significant flexibility with respect to asset sales and use of proceeds.

We believe EnscoRowan’s balance sheet can easily support funding a $2.5 billion special dividend, leaving it extensively capitalized to execute on its business strategy and benefit from the industry recovery:

Assumptions

- $1.5 billion in pro forma cash and short-term investments as of March 31, 2019

- No discounted debt repurchases

- No liability management to extend maturities

- No asset sales

- Incremental funded debt at 9% (with almost no tax shield) at a priority guaranteed level. Debt used to fund a $2.5 billion special dividend and for general corporate purposes as Management executes on its strategy

- Wall Street “Bear” Case

a. EBITDA

i. Bloomberg consensus EBITDA through 2021

ii. 2022 EBITDA a linear interpolation of 2021 and 2023 estimates

iii. For 2023 and beyond, constant dayrate estimates that are at or below the bottom quartile of distributed analyst estimates—these dayrate estimates align with sell-rated analyst projections

b. Capital Expenditures: Bloomberg consensus through 2021; held constant thereafter

In connection with the Ensco-Rowan merger, Rowan’s financial advisors and management team—many of whom constitute the current EnscoRowan management team—developed financial forecasts for the pro forma business through 2024. Using Management’s own publicly disclosed numbers, we believe EnscoRowan remains extensively capitalized and retains significant equity value after a $2.5 billion special dividend:

| Cash Flow | Q2 '19 | Q3 '19 | Q4 '19 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Attributable EBITDA | 83 | 83 | 83 | 293 | 598 | 1,209 | 1,850 | 2,419 | 2,692 | 2,692 |

| Less: Transaction Costs | (34) | (34) | (34) | (102) | (37) | (15) | - | - | - | - |

| Less: Net Cash Interest on Existing Debt | (110) | (108) | (107) | (399) | (426) | (421) | (406) | (384) | (319) | (232) |

| Less: Priority Guaranteed Interest | (28) | (57) | (57) | (142) | (227) | (229) | (227) | (227) | (227) | (227) |

| Less: Taxes | (34) | (10) | (10) | (86) | (40) | (40) | (118) | (201) | (248) | (260) |

| Plus: Tax Savings from Incremental Interest | 1 | 3 | 3 | 7 | 11 | 11 | 11 | 11 | 11 | 11 |

| Less: Change in NWC | - | - | - | 41 | - | - | - | - | - | - |

| CFO | (121) | (123) | (121) | (387) | (121) | 515 | 1,110 | 1,618 | 1,909 | 1,984 |

| Less: Capex | (114) | (114) | (114) | (371) | (457) | (315) | (356) | (350) | (376) | (376) |

| Less: Dividends | - | - | - | (5) | - | - | - | - | - | - |

| Plus: Other | 929 | - | - | 926 | - | - | - | - | - | - |

| Cash Flow Before Debt Service | 693 | (237) | (235) | 163 | (578) | 200 | 754 | 1,268 | 1,533 | 1,608 |

| Less: Maturities / Borrowings | - | (201) | 96 | (106) | 64 | (114) | (621) | - | (2,203) | (1,169) |

| Plus: Net Priority Guaranteed Proceeds | 2,500 | - | - | 2,500 | - | - | - | - | - | - |

| Less: Special Dividend | (2,500) | - | - | (2,500) | - | - | - | - | - | - |

| Plus: Incremental Priority Guranteed Borrowings | - | - | - | - | 6 | (6) | - | - | - | - |

| Change in Cash | 693 | (438) | (140) | 58 | (509) | 81 | 133 | 1,268 | (670) | 438 |

| Ending Cash Balance | 1,237 | 799 | 659 | 659 | 150 | 231 | 364 | 1,632 | 962 | 1,400 |

| Current Debt Outstanding* | 7,681 | 7,480 | 7,575 | 7,575 | 7,639 | 7,526 | 6,905 | 6,905 | 4,702 | 3,533 |

| Priority Guaranteed Bonds | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 |

| Additional Cumulative Financing Required | - | - | - | - | 6 | - | - | - | - | - |

| Total Debt Balance | 10,181 | 9,980 | 10,075 | 10,075 | 10,145 | 10,026 | 9,405 | 9,405 | 7,202 | 6,033 |

| Net Debt Reduction / (Addition) | NA | (237) | (235) | NA | (578) | 200 | 754 | 1,268 | 1,533 | 1,608 |

| Net Debt / EBITDA | 32.1x | 16.7x | 8.1x | 4.9x | 3.2x | 2.3x | 1.7x |

Note: EBITDA and capex forecast carried over from 2024 to 2025 |

Source: Luminus Management, LLC; Bloomberg |

Even under a below-consensus Wall Street “Bear” Case, our models indicate EnscoRowan remains sufficiently capitalized and retains substantial equity value after a $2.5 billion special dividend—even without liability management, discounted debt repurchases, or asset sales:

| Rigs | Count | Dayrate (Sk/d) | ||||||||

| Drillships | 18 | 329 | ||||||||

| 6G Semis | 2 | 275 | ||||||||

| 8500 semis | 3 | 150 | ||||||||

| 2000+ Jackups | 36 | 112 | ||||||||

| 2004+ ARO Jackups | 2.5 | 112 | ||||||||

| Run-Rate Attributable EBITDA | 1,700 |

| Cash Flow | Q2 '19 | Q3 '19 | Q4 '19 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Attributable EBITDA | 41 | 79 | 75 | 239 | 507 | 975 | 1,338 | 1,700 | 1,700 | 1,700 |

| Less: Transaction Costs | (34) | (34) | (34) | (102) | (37) | (15) | - | - | - | - |

| Less: Net Cash Interest on Existing Debt | (110) | (108) | (107) | (399) | (426) | (421) | (406) | (384) | (319) | (232) |

| Less: Priority Guaranteed Interest | (28) | (57) | (57) | (142) | (227) | (241) | (259) | (252) | (302) | (399) |

| Less: Taxes | (34) | (10) | (10) | (86) | (40) | (40) | (46) | (100) | (109) | (122) |

| Plus: Tax Savings from Incremental Interest | 1 | 3 | 3 | 7 | 11 | 12 | 13 | 13 | 15 | 20 |

| Less: Change in NWC | - | - | - | 41 | - | - | - | - | - | - |

| CFO | (164) | (127) | (130) | (442) | (213) | 270 | 639 | 976 | 985 | 967 |

| Less: Capex | (65) | (100) | (126) | (320) | (400) | (325) | (325) | (325) | (325) | (325) |

| Less: Dividends | - | - | - | (5) | - | - | - | - | - | - |

| Plus: Other | 929 | - | - | 926 | - | - | - | - | - | - |

| Cash Flow Before Debt Service | 700 | (227) | (256) | 160 | (613) | (55) | 314 | 651 | 660 | 642 |

| Less: Maturities / Borrowings | - | (201) | 96 | (106) | 64 | (114) | (621) | - | (2,203) | (1,169) |

| Plus: Net Priority Guaranteed Proceeds | 2,500 | - | - | 2,500 | - | - | - | - | - | - |

| Less: Special Dividend | (2,500) | - | - | (2,500) | - | - | - | - | - | - |

| Plus: Incremental Priority Guranteed Borrowings | - | - | - | - | 44 | 168 | 307 | (519) | 1,411 | 527 |

| Change in Cash | 700 | (429) | (160) | 54 | (505) | - | - | 132 | (132) | - |

| Ending Cash Balance | 1,244 | 815 | 655 | 655 | 150 | 150 | 150 | 282 | 150 | 150 |

| Current Debt Outstanding* | 7,681 | 7,480 | 7,575 | 7,575 | 7,639 | 7,526 | 6,905 | 6,905 | 4,702 | 3,533 |

| Priority Guaranteed Bonds | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 |

| Additional Cumulative Financing Required | - | - | - | - | 44 | 212 | 519 | - | 1,411 | 1,938 |

| Total Debt Balance | 10,181 | 9,980 | 10,075 | 10,075 | 10,183 | 10,237 | 9,924 | 9,405 | 8,613 | 7,971 |

| Net Debt Reduction / (Addition) | NA | (227) | (256) | NA | (613) | (55) | 314 | 651 | 660 | 642 |

| Net Debt / EBITDA | 39.5x | 19.8x | 10.3x | 7.3x | 5.4x | 5.0x | 4.6x |

| *Assumes no revolver draw and assumes shipyard financing elected & extended through period end |

Source: Luminus Management, LLC; Bloomberg |

According to Moody’s 2018 and 2019 ratings notes, we believe EnscoRowan would be under consideration for a multi-notch upgrade should Debt / EBITDA be sustained below 6.0x—which we see even in the out years of the Wall Street “Bear” Case pro forma for the special dividend.

The industry is in the early stages of a recovery:

The industry appears to be solidly on the path to recovery, despite a decline in oil prices in the middle of last year’s budgeting season.

Evercore ISI, 3/26/2019: “Floating rig… utilization crossed 65% this month to its highest level in more than three years. More importantly, the marketed utilization (i.e. excluding cold stacked units) is approaching 80% or the highest level since November 2015. This is well ahead of our forecasts...”

Wells Fargo, 5/5/2019: “The more notable takeaway… was the commentary and data points suggesting a significant step up in UDW and moored floater dayrates from 2019 to 2020… Other conversations this week also suggest a solid step up in spot UDW rates well above $200k from the $150-180k range… The most notable change the last few weeks/months has been a tightening in the spot market, which we believe is being supported by the recent build in backlog among the largest publicly traded offshore drillers.”

Arctic Securities, 4/9/2019: “Latest data points with some duration indicate a dayrate hike in the range of ~USD50-100k vs. 2017/18… We also see indications that dayrates for extensions have increased somewhat.”

BTIG, 5/30/2019: “The on-contracted floater count stands at ~133 rigs, the highest level since July 2018 and up ~17% from the bottom in early January. Equally encouraging the contracted rig count (includes rigs yet to start working) is at ~158 (the highest level since the summer of 2017). The on-contracted Jackup count averaged ~320 rigs over the last 4-weeks, the highest level since 2Q16. And the contracted Jackup count has averaged ~358 rigs over the last 4-weeks, its highest level since 4Q15. Things are better.”

DNB Markets, 5/29/2019: “We see very little debate among offshore drilling stakeholders that the trough is behind us for dayrates and utilisation; to us this also appears acknowledged by investors with a bearish view on the sector. In particular, the jack-up market has performed well in all regions recently in terms of utilisation and rates.”

Conclusion:

Despite the Company’s high-quality assets, tangible improvements in the market, a one-of-a-kind joint venture with Saudi Aramco, synergy benefits from a just-closed transaction valued at $1+ billion (or almost two thirds of the Company’s market capitalization), and very significant financial flexibility, EnscoRowan’s stock is trading at its lows since 1993. It appears that equity markets have not rewarded the Company for its “best-in-class” balance sheet strategy. This strategy is becoming increasingly expensive to maintain. Reducing EnscoRowan’s reliance on high-cost equity in exchange for lower-cost senior and junior priority guaranteed debt has become essential, in our view.

The Board and Management should initiate plans to declare a $2.5 billion special dividend. This approach would use a portion of EnscoRowan’s balance sheet flexibility to appropriately capitalize the Company, and would be highly accretive for shareholders, helping to crystallize EnscoRowan’s underappreciated fundamental value while allowing the Company to retain extensive financial flexibility for Management to execute on its strategy, and for stakeholders to benefit from the offshore drilling recovery that is currently underway. Approving this transaction would reward long-term shareholders who have supported and financed EnscoRowan through the downturn.

Based on the substantial value-creation alone, Luminus is confident that shareholders will support this idea, and we encourage the Board to initiate plans to raise Priority Guaranteed debt and fund a special dividend.

Luminus would appreciate the opportunity to present this plan to the full EnscoRowan Board of Directors, and to address any questions or concerns.

| Sincerely, |

| Jonathan Barrett |

| Adam Weitzman |

| Ethan Keller |

About Luminus

Luminus Management, LLC (“Luminus”) is an investment adviser founded in 2002. Luminus employs a low net, relative-value oriented strategy that seeks to generate alpha via deep fundamental analysis and opportunistic investments across the capital structure of companies within the broader energy ecosystem. Luminus's fund strategy has a general focus on opportunities within North America, and its coverage universe includes power, utilities, MLPs, E&P, drillers, refiners, engineering and construction, and coal/steel.

Disclaimer

The materials in this document (“Materials”) are for informational purposes only and may not be relied on by any person for any purpose and are not, and should not be construed as investment, financial, legal, tax or other advice. The Materials represent the opinions of Luminus Management, LLC and their respective affiliates (together, “Luminus”) and have been compiled based on publicly available information. The Materials do not purport to be complete or comprehensive; or constitute an agreement, offer, a solicitation of an offer, or any advice to enter into or conclude any transaction or take or refrain from taking any other course of action (whether on the terms shown therein or otherwise).

The Materials contain “forward-looking statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe Luminus’s objectives, plans or goals are forward-looking. Any forward-looking statements are based on Luminus’s current intent, belief, expectations, estimates and projections. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. All financial data and estimates as of close of business June 7, 2019.

Any representation, statement or opinion expressed or implied in any of the Materials is provided in good faith but only on the basis that no reliance will be placed on any of the contents therein. You should obtain your own professional advice and conduct your own independent evaluation with respect to the subject matter therein. Luminus expressly disclaims any responsibility or liability for any loss howsoever arising from any use of or reliance on any of the Materials or any of their contents as a whole or in part by any person, or otherwise howsoever arising in connection with the same. There is no assurance or guarantee with respect to the prices at which any securities of the Issuer will trade, and such securities may not trade at prices that may be implied herein. Luminus is not under any obligation to provide any updated or additional information or to correct any inaccuracies in the Materials. Funds managed by Luminus currently beneficially own, and/or have an economic interest in, securities of EnscoRowan plc. (the “Issuer”). These funds are in the business of trading, buying and selling securities. It is possible that there will be developments in the future (including changes in price of the Issuer’s securities) that cause one or more of such funds or accounts from time to time to sell all or a portion of their holdings of the Issuer in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities. To the extent that Luminus discloses information about its position or economic interest in the securities of the Issuer in the Materials, it is subject to change and Luminus expressly disclaims any obligation to update such information. The Materials shall not constitute an offer to sell or the solicitation of an offer to buy any interests in any fund managed by Luminus. All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190612005528/en/

Contacts:

Luminus Management

212-424-2823

investors@enscovaluecreation.com