( click to enlarge )

( click to enlarge )We finally got the breakout in Netflix, Inc. (NASDAQ:NFLX). Shares rallied past resistance of $96.55 (declining 200-day EMA) and hit my trigger to open positions. I'll be watching the stock on Friday, looking for a follow through move. I'm using the rising 50-day EMA as stop.

( click to enlarge )

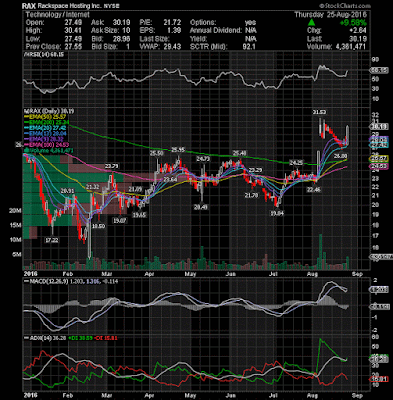

( click to enlarge )Rackspace Hosting, Inc. (NYSE:RAX) After a healthy pullback in the last two weeks we got a big bullish impulse today that could signal the beginning of another move higher. Immediate resistance is at 30.41 (today’s high). A break above that area could trigger further upside recovery testing $31.5 area. Watch the stock on Friday.

( click to enlarge )

( click to enlarge )General Dynamics Corporation (NYSE:GD) watch for a possible breakout out of current consolidation.

( click to enlarge )

( click to enlarge )Amedica Corporation (NASDAQ:AMDA) successfully tested the support and closed above the 50EMA for the fourth time in a row. If shares can hold that $1 level then we could see a nice bounce in prices back towards the key 1.40 level. From a technical standpoint daily technical indicators are looking bullish. The MACD is above its signal line and is moving up in positive territory. RSI still above its 50% level.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) has witnessed a healthy pullback to its 20-day EMA, which has acted as a nice support for stock. Plus, the stock has experienced a golden cross this week, which is a bullish technical signal that occurs when the 50-day moving average crosses above the 200-day moving average as both moving averages are rising. The main trend is up, the bulls are in control.

( click to enlarge )

( click to enlarge )KapStone Paper and Packaging Corp. (NYSE:KS) finally broke through its 200-day EMA. The volume confirmed the breakout as it was greater than average. Look for the stock to test the prior highs of June.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC