( click to enlarge )

( click to enlarge )What a week my readers/twitter followers had with some amazing gains on multiple stocks from my watchlist. Some of you may remember my Tuesday's post about this monster stock alert. Kura Oncology Inc (NASDAQ:KURA) closed the week with a gain of 79.58% over the previous week. The stock showed great momentum and had great trading volume. If you're still in KURA make sure you have your downside protected. Congratulations to all of you that took advantage of this pick and think of me when you spend some of your well-earned gains. I will wait for a pullback to enter long again.

( click to enlarge )

( click to enlarge )Calithera Biosciences Inc (NASDAQ:CALA) is one for the bottom pickers. The stock has had a rough time over the past weeks but the selling pressure seems to have dried up. The selling that brought the stock to $3.24 has slowed, and since last week the accumulation has been building. Strong volumes and sharp volatility indicate investor uncertainty which often precedes a trend change. In my view, the stock has formed a bottom and I expect a move past 3.66 to take the stock towards the target of 4.20 with stop-loss at 3.20. From a technical standpoint, there are some signs of an imminent bounce due to the positive divergences (MACD Hist, RSI & CMF), which often leads to short covering. Plus, the Parabolic SAR triggered a Buy signal for the first time since May. Fundamentally, the stock seems to be undervalued at current levels with a good balance sheet and zero debt. The percentage of shares held by institutional and mutual fund owners is 75%. A big bounce could be brewing.

( click to enlarge )

( click to enlarge )Relypsa Inc (NASDAQ:RLYP) Earlier this month, the stock broke the downtrend line and cleared the declining 200-day EMA on expanding volume. Price pulled back last week on low volume and successfully tested the 200-day EMA (new support / prior resistance). Following a short-lived pullback, the stock resumed the upside Friday with a big bullish candlestick on solid volume. This could lead to a test of the 21.98 high within the coming days, which is why RLYP has been added once again to my watchlist for next week. From a technical perspective, the key EMAs I monitor (9-day EMA, 13-day EMA, 20-day EMA, 50-day EMA and 100-day MA) are confirming the recent strength in the stock. On the daily technical chart above, notice the 20-day EMA (light blue line) crossed above the 100-day EMA (Pink line) late in June. Also, the 50-day EMA is now above the 100-day EMA and trending higher. Plus, the MACD is rising above its signal line in positive territory and the RSI has moved above its 50% level. A move above $21.98 next week opens the door to $25. I continue to support the idea of a significant rally, probably even above the April highs. The bulls remain in control as long as it continues consolidating its recent move.

( click to enlarge )

( click to enlarge )Chimerix Inc (NASDAQ:CMRX) Rallied over 5.5% Friday on decent volume. The stock is trading near the high end of its one-month range. A break of this key resistance level (4.07/4.10) would send it to 4.56. All major indicators are displaying bullish signals.

( click to enlarge )

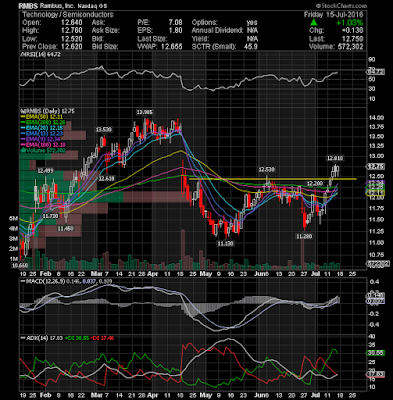

( click to enlarge )Rambus Inc. (NASDAQ:RMBS) finally closed the week above the $12.50 mark, gaining 64 cents or 5.28% since last week’s closing, to settle at $12.75. A break over Thursday's high could push it to test $13.25. All short-term EMAs are rising and the stock is trading above them. The bulls are back in control.

( click to enlarge )

( click to enlarge )Apple Inc. (NASDAQ:AAPL) has been in an upwards trend the past few days and looks ready to continue this move. To confirm the reversal, price needs to close above the declining 100-day EMA with heavy volume. The short-term trend is bullish as the stock is above all key short-term exponential moving averages. Additionally, MACD lines are going up and RSI still climbing. I suspect the stock may continue to appreciate over the coming days. Stop should be placed around 96 (rising 20-day EMA). Keep this one under radar.

( click to enlarge )

( click to enlarge )Westport Fuel Systems Inc (NASDAQ:WPRT) In a Potential double bottom formation. The immediate resistance is around 1.57/1.6 which the stock will likely to test next week. A close above this key resistance area is a pre-requisite for the reversal of the bearish trend.

( click to enlarge )

( click to enlarge )I continue to watch Zagg Inc (NASDAQ:ZAGG) because the volume is still large, so the stock could potentially break out again at any moment. Keep an eye for a possible breakout over $6.51 The technical daily chart still showing a bullish bias.

Guys, if you've been using Stockal and think that it's an interesting tool - do try to leave a review for it on the app store. If you think it needs to improve in certain aspects since it's just getting started, do let me know and I will have your feedback directed to the Stockal guys. In case you haven't Stockal yet - download and try it now! It's on iOS and Android . The app puts investing indicators together with curated data, collaboration and trading in one place for you! You can link your brokerage account with the app and buy/sell stocks directly on Stockal using the intelligence it gives. Cool right! Have you tried the Chat feature yet? You can actually see stock summaries within chat if you mention stocks like <$AAPL> while chatting with a friend. And you can also buy/sell right from within chat. These guys are also working on Group Chat and Expert Chat channels where you can invite groups of peers to chat with or you can follow some expert chat channels to get info and ideas all the time and without waiting!

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC