In 2009, Tomer Shoval went on vacation with his family to Mexico, which unfortunately ended on a sour note — and one with which many travelers can empathize — they all got sick. Back in the U.S. several months later, Shoval and his wife started receiving a series of invoices and summaries of benefits, which seemed to add insult to injury. The bills were expensive, the invoices were complex, and what their insurance covered and what it didn’t was confusing.

Frustrated and beginning to get the sense that he wasn’t alone, Shoval quit his job eBay (where he was an executive) and co-founded Simplee with Roberto Rabinovich and Tom Tsarfati to help both patients and healthcare systems understand and manage healthcare expenses — from the comfort of their smartphones.

Fast forward to 2013, Simplee is tracking and managing more than $3 billion in patient medical expenses and now processes “tens of millions” in patient payments each year, Shoval tells us. Since launching in 2011, the startup has raised $7.8 million from investors like Greylock IL, The Social+Capital Partnership and Embarcadero Ventures, and today, with adoption continuing, Simplee is announcing that it has adding $10 million in Series B financing, led by Heritage Group. Existing investors, Social+Capital and Greylock IL, also contributed to the round, bringing the startup’s total investment to just under $18 million.

Shoval attributes the raise, and the startup’s growth over the last two years, in part, to the rise in consumer-driven healthcare in the U.S. People are increasingly choosing insurance coverage that comes with the pain of high deductibles, which means that patients have begun to pay of the cost of healthcare out of their own pockets. In fact, Shoval says that the average family in the U.S., on top of the cost of insurance, pays an additional $4,000 every year.

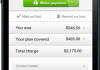

Increasingly, patients are confused what exactly they’re paying for and why, while, on the other side, hospitals, practices and care providers have to deal with collecting a growing share of costs directly from these confused patients — rather than insurance companies. To help consumers deal with the hassle of confusing healthcare payments, Simplee launched a platform that combined the financial management tools of Mint.com with a mobile wallet to make the process easier to manage, to track visits, monitor benefits and pay their bills online.

In addition to allowing users to track expenditures by each family member, the app also acts as a payment platform so that users can pay their bills direct, link their spending accounts and alert them to problems with billing — a huge value-add considering the changes that Obamacare will bring to this space. Today, the app offers coverage for 80 percent of insurance plans in the U.S., and Simplee continues to work to expand the list of insurance providers it supports, the co-founder says.

Another factor that has contributed to growth on the business side was the launch of SimpleePAY earlier this year — a B2B-style payment and loyalty platform that gives hospitals the ability to more easily distribute and collect bills, texting and emailing patients simple URLs instead of sending out printed versions. The goal was to enable hospitals to access the same kind of medical wallet it had made available to consumers, giving them a more robust set of features through which they could cut costs, increase revenues and deliver new features, along with a more modern billing experience.

The startup is already working with partners like El Camino Hospital in Mountain View to enable patient payments online, and today, it announced that Emergency Medicine Associates — the largest provider of emergency room services in Washington D.C. — will be deploying SimpleePAY as well.

In the coming months, Simplee hopes to continue expanding its roster of SimpleePAY customers, leveraging its new strategic investment from the Heritage Group — an organization that represents hundreds of hospitals across the U.S., investing in solutions that seek to “reduce cost, improve outcomes and increase the efficiency of healthcare delivery.”

With the new funding under its belt, Shoval says that Simplee will look to significantly expand its team of 30, and continue to invest in innovation and growing sales and marketing around SimpleePAY, which has become its chief source of revenue. But, in the end, he says, Simplee will look to stick to its core mission, which is helping both patients and healthcare providers to reduce the complexity of healthcare payments — even as Obamacare makes that job all the more difficult.

For more, find Simplee at home here.