SecondMarket, which has served as a hub for transactions of pre-IPO Facebook stock for a few years, will have to find some new venture-backed companies to pique investor interest this year. While Facebook is a big loss, there are plenty of other startups that have become hot prospects.

The New York-based company, which arranges secondary sales of stock in venture-backed or privately-held companies, said Pinterest, Warby Parker and Stripe are the companies that have attracted the most new interest in the last quarter. If we haven’t written enough about Pinterest already, it’s the fastest growing standalone site ever, reaching 10 million unique visitors per month more quickly than any other site. Warby Parker and Stripe both have working revenue models(!) in selling glasses and facilitating payments. Informally, Stripe has been tipped the next Y Combinator that might be valued at more than $1 billion, following Dropbox and Airbnb.

Once Facebook leaves SecondMarket, it will be Twitter leading the pack. Then Dropbox and Foursquare follow after that in total investor interest. No surprise there, but it’s worth noting that Dropbox and Foursquare have actually switched places. Local commerce is, indeed, difficult to monetize, as evidenced by Groupon and Yelp’s continuing quarterly losses. Square jumped three places, the most SecondMarket has ever seen any company move on the Top 10 list. Yelp’s IPO also made room for Kayak to join the list.

If you want to keep track of the Sand Hill venture firms that are leading in terms of backing the most companies on the 100 most-watched list, Kleiner Perkins is at the top. For a few years, the word was that they had missed the boat on consumer Internet after focusing too intensely on cleantech. But some aggressive late-stage deal-making to get into companies like Twitter has helped. They’re also in Square and Spotify.

Behind them are Sequoia Capital, Accel Partners, Greylock Partners and Benchmark Capital. No surprises there! After those four is Union Square Ventures, the New York-based firm that has called it early on companies like Twitter and Tumblr, and DFJ. Andreessen Horowitz, the “startup” venture capital firm, comes in at eighth. It’s followed by Ron Conway’s SV Angel and then New Enterprise Associates.

In terms of totally new companies that joined SecondMarket, GoPro, Nest and Factual lead the list. GoPro is an activity image capture company that produces gear-mountable cameras and accessories and Nest is the highly-buzzed about smart thermostat company from Apple alums.

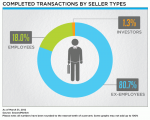

If we look at the actual dynamics of the market itself, employees and former employees of companies continue to be the leading sellers of stock. Former employees make up the biggest chunk of sellers, as they’re responsible for 80.7 percent of transactions. That’s not surprising as many venture-backed companies like Facebook have forbidden current employees from selling their stock. Employees have to leave the company in order to liquidate their holdings.

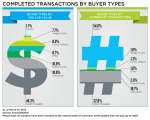

In terms of buyer types, issuers (or the startups themselves), make up the lion’s share of transactions. But those transactions are apparently tiny, as they only make up 1.7 percent of dollar value. Most of SecondMarket’s buyers happen to be asset managers, individuals and mutual funds.

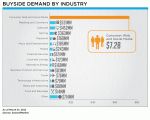

In terms of buyer interest, most buyers wanted “consumer web and social media” companies. Keep in mind that this data might look very different from the rest of the year, as Facebook stopped trading on SecondMarket in April. Investors put in “Indications of Interest,” or said they were willing to buy $7.2 billion in shares of “consumer web and social media” companies. Retailing and commerce, software and gaming followed.

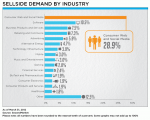

Sellside demand also mostly mirrored buyside demand, with “consumer web and social media” stock sales representing 28.9 percent of sellside interest. That was followed by software, business products and services, and then retailing and commerce.

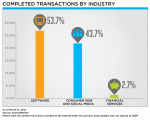

SecondMarket also showed completed transactions. “Software” transactions beat out “consumer web and social media” for the first time.