Technology real estate company Opendoor (NASDAQ:OPEN) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 40.5% year on year to $1.38 billion. On the other hand, next quarter’s revenue guidance of $950 million was less impressive, coming in 21.1% below analysts’ estimates. Its GAAP loss of $0.11 per share was also 39.7% above analysts’ consensus estimates.

Is now the time to buy Opendoor? Find out by accessing our full research report, it’s free.

Opendoor (OPEN) Q3 CY2024 Highlights:

- Revenue: $1.38 billion vs analyst estimates of $1.27 billion (8.3% beat)

- EPS: -$0.11 vs analyst estimates of -$0.18 (39.7% beat)

- EBITDA: -$38 million vs analyst estimates of -$63.02 million (39.7% beat)

- Revenue Guidance for Q4 CY2024 is $950 million at the midpoint, below analyst estimates of $1.20 billion

- Gross Margin (GAAP): 7.6%, down from 9.8% in the same quarter last year

- Operating Margin: -4.9%, up from -8.1% in the same quarter last year

- EBITDA Margin: -2.8%, up from -5% in the same quarter last year

- Free Cash Flow was $56 million, up from -$227 million in the same quarter last year

- Homes Sold: 3,615, up 928 year on year

- Market Capitalization: $1.25 billion

“Opendoor’s third quarter acquisition volumes, revenue, Contribution Profit, and Adjusted EBITDA all exceeded our guidance, notwithstanding persistent housing market headwinds. In August, many anticipated that interest rate cuts would bring buyers and sellers back to the market. However, mortgage rates remain stubbornly high and the housing market continues to be challenged by high delistings, low clearance, and strained affordability,” said Carrie Wheeler, CEO of Opendoor.

Company Overview

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

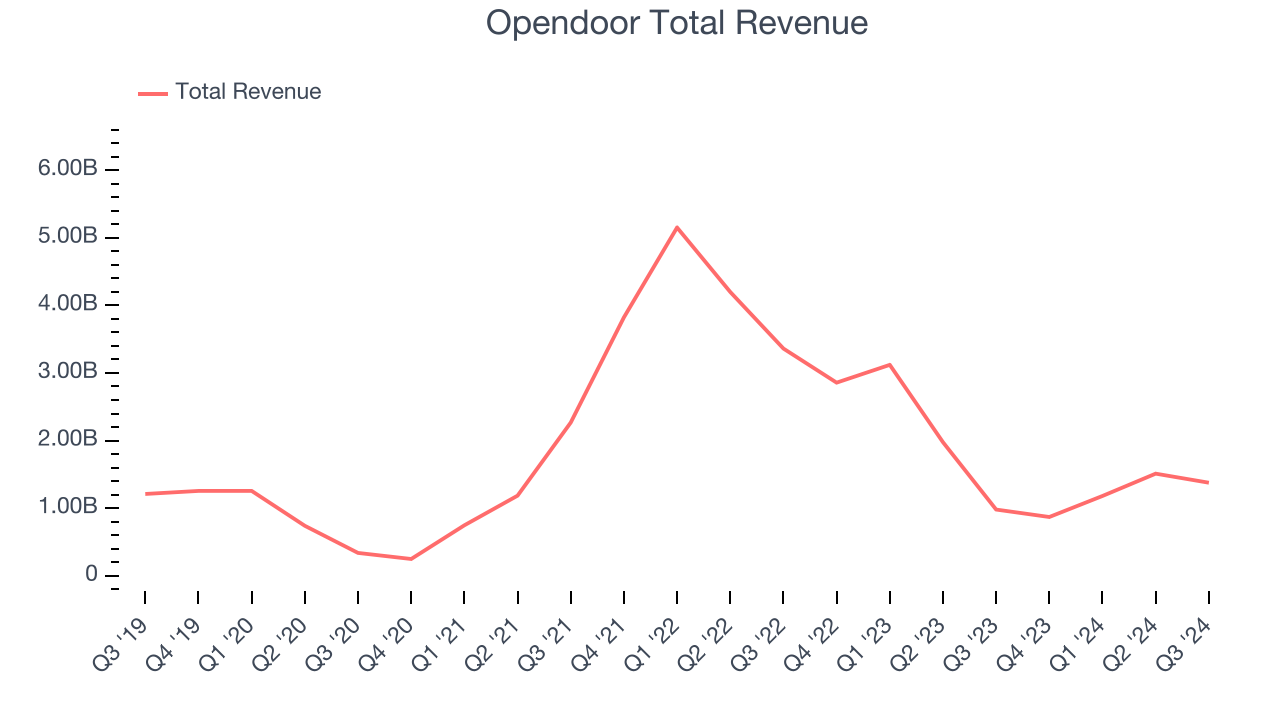

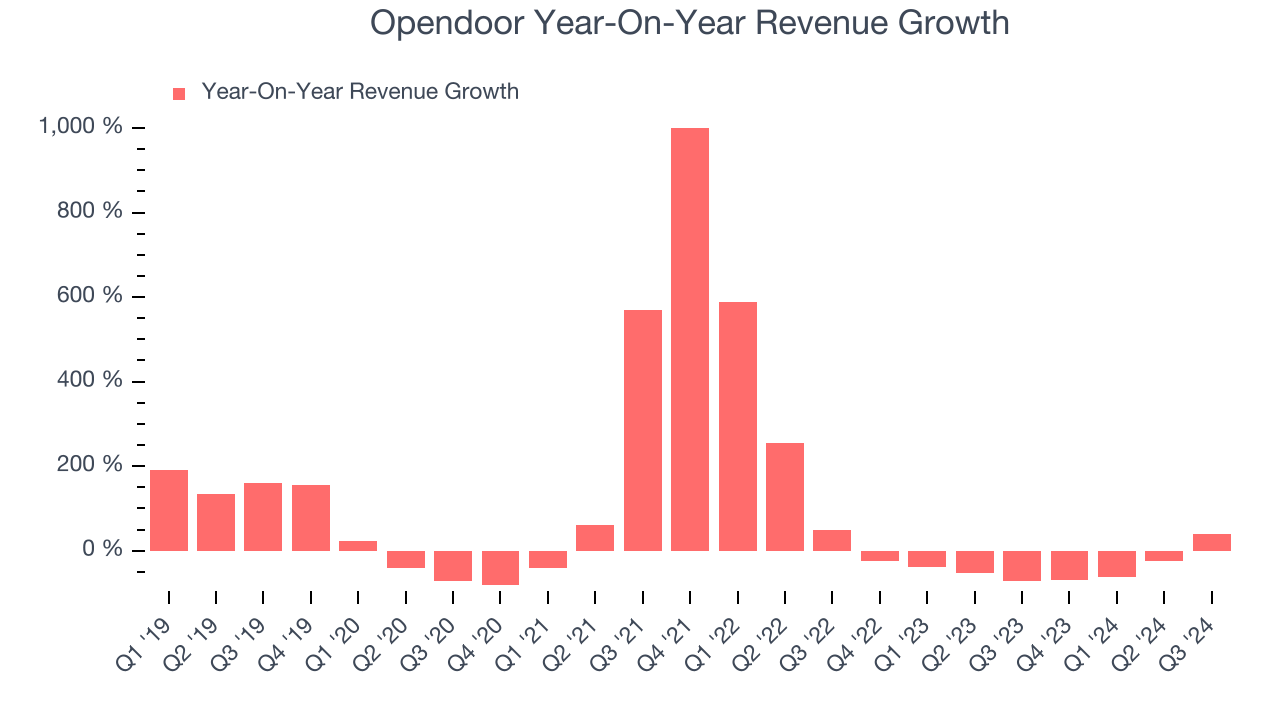

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Opendoor grew its sales at a sluggish 4.4% compounded annual growth rate. This shows it couldn’t expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Opendoor’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 45.3% annually.

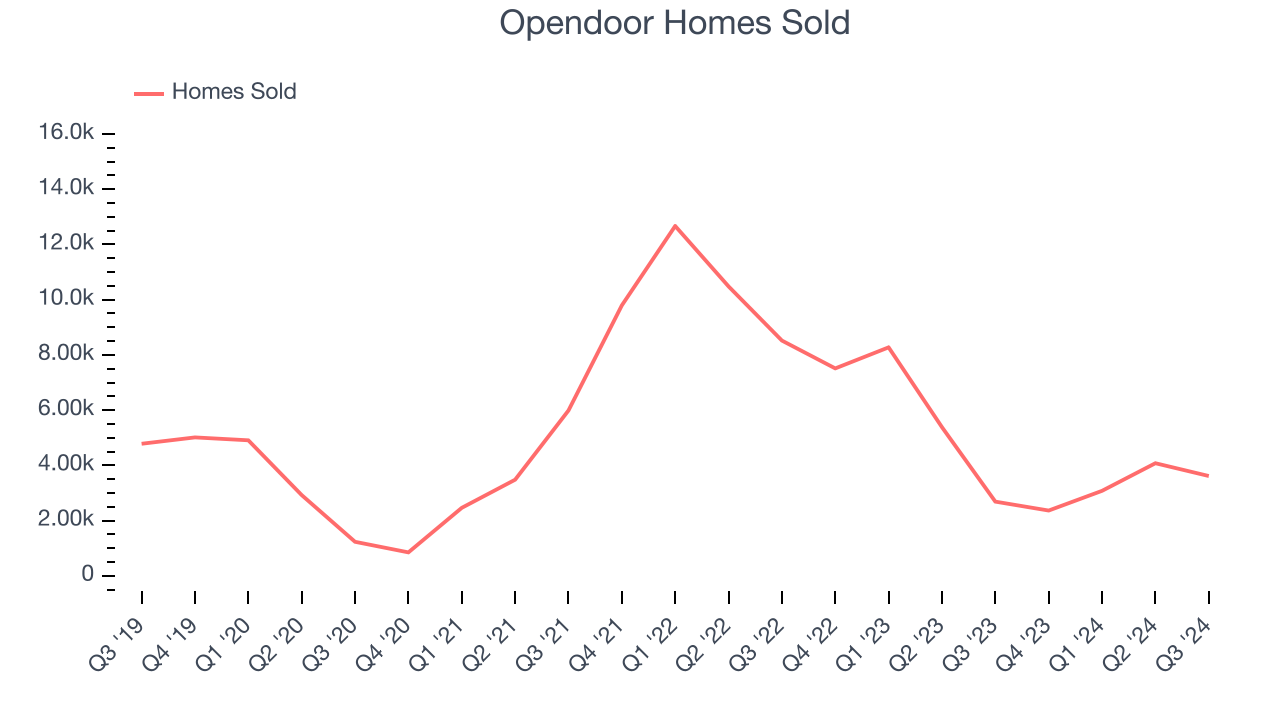

We can dig further into the company’s revenue dynamics by analyzing its number of homes sold, which reached 3,615 in the latest quarter. Over the last two years, Opendoor’s homes sold averaged 37% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Opendoor reported magnificent year-on-year revenue growth of 40.5%, and its $1.38 billion of revenue beat Wall Street’s estimates by 8.3%. Company management is currently guiding for a 9.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 37.9% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will catalyze higher growth rates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

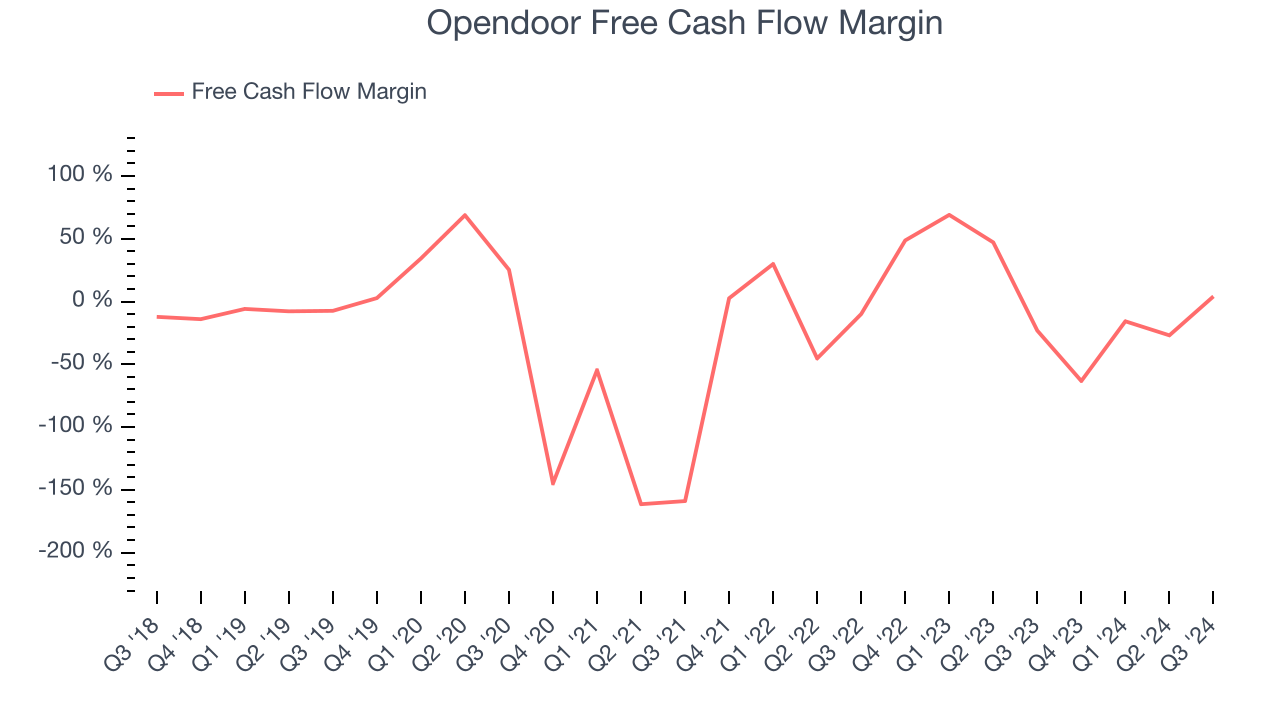

Opendoor has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 22.8% over the last two years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Opendoor’s free cash flow clocked in at $56 million in Q3, equivalent to a 4.1% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Opendoor will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 22% for the last 12 months will increase to negative 4%.

Key Takeaways from Opendoor’s Q3 Results

We were impressed by how significantly Opendoor blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.2% to $1.94 immediately following the results.

Sure, Opendoor had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.