Beer company Molson Coors (NYSE:TAP) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 7.8% year on year to $3.04 billion. Its non-GAAP profit of $1.80 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy Molson Coors? Find out by accessing our full research report, it’s free.

Molson Coors (TAP) Q3 CY2024 Highlights:

- Revenue: $3.04 billion vs analyst estimates of $3.13 billion (2.8% miss)

- Adjusted EPS: $1.80 vs analyst estimates of $1.67 (7.9% beat)

- Gross Margin (GAAP): 39.5%, down from 40.8% in the same quarter last year

- Operating Margin: 14.8%, down from 18% in the same quarter last year

- Free Cash Flow Margin: 11.5%, down from 16.8% in the same quarter last year

- Sales Volumes fell 12.3% year on year (3.2% in the same quarter last year)

- Market Capitalization: $11.72 billion

Company Overview

Sporting an impressive roster of iconic beer brands, Molson Coors (NYSE:TAP) is a global brewing giant with a rich history dating back more than two centuries.

Beverages, Alcohol and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Molson Coors is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when you've already penetrated the market.

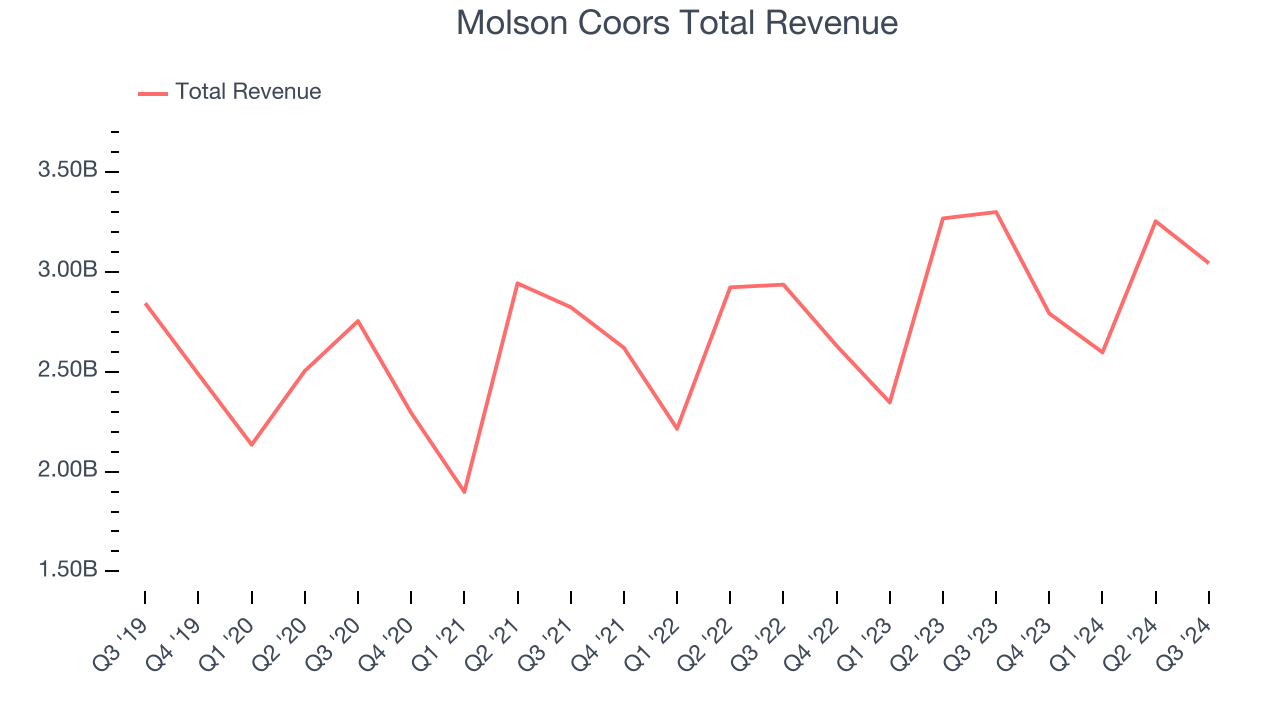

As you can see below, Molson Coors grew its sales at a tepid 5.5% compounded annual growth rate over the last three years as it failed to grow its volumes. We’ll explore what this means in the "Volume Growth" section.

This quarter, Molson Coors missed Wall Street’s estimates and reported a rather uninspiring 7.8% year-on-year revenue decline, generating $3.04 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and illustrates the market believes its products will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Volume Growth

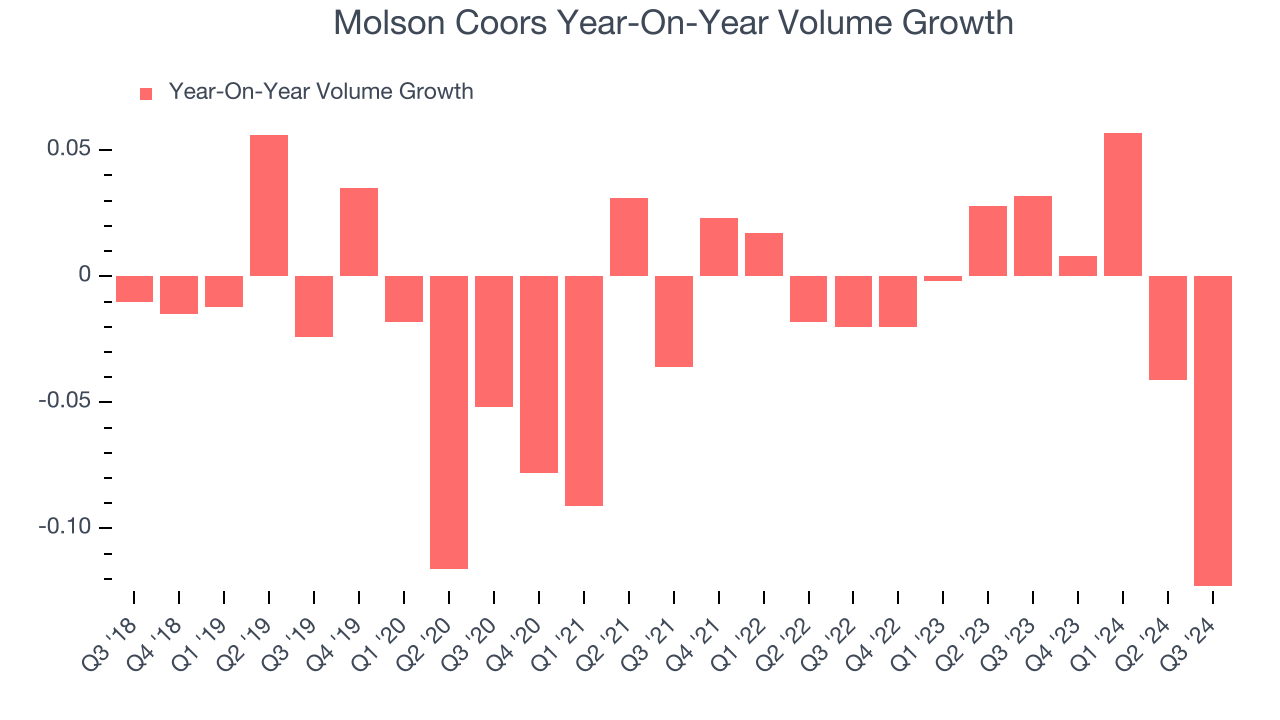

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Molson Coors’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

In Molson Coors’s Q3 2024, sales volumes dropped 12.3% year on year. This result was a reversal from the 3.2% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn’t deter you from investing in a business. We’ll be monitoring the company to see how things progress.

Key Takeaways from Molson Coors’s Q3 Results

It was encouraging to see Molson Coors slightly top analysts’ EPS expectations this quarter. On the other hand, its revenue missed Wall Street’s estimates on weak volume growth. Overall, this was a weaker quarter. The stock remained flat at $56.53 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.