Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Estée Lauder (NYSE:EL) and the best and worst performers in the consumer staples industry.

The consumer staples industry comprises companies engaged in the manufacturing, distribution, and sale of essential, everyday products. These products, also known as "staples," are fundamental to daily living and include packaged food, beverages and alcohol, personal care, and household products. Consumer staples stocks are considered defensive investments because consumers often purchase them regardless of economic conditions. To stand out, companies must have some combination of brand recognition, product quality, and price competitiveness.

The 33 consumer staples stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 10.1% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

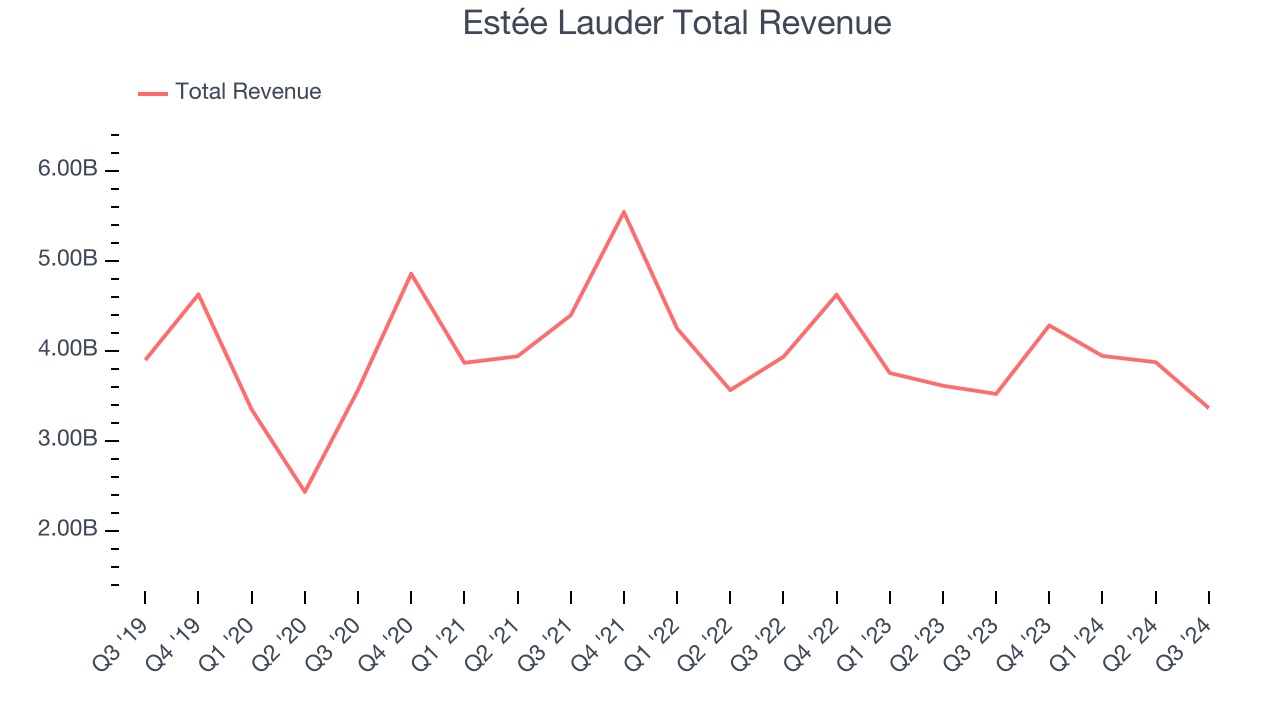

Estée Lauder (NYSE:EL)

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

Estée Lauder reported revenues of $3.36 billion, down 4.5% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ earnings estimates but revenue guidance for next quarter missing analysts’ expectations.

Fabrizio Freda, President and Chief Executive Officer said, “Our first quarter results are largely aligned with our outlook on an adjusted basis, despite the fact that the expected headwinds in China and Asia travel retail were greater than anticipated. Our Profit Recovery and Growth Plan drove gross margin expansion, which was partially offset by operating deleverage. Other pillars of our strategic reset also delivered promising initial results.

Unsurprisingly, the stock is down 23.3% since reporting and currently trades at $66.84.

Is now the time to buy Estée Lauder? Access our full analysis of the earnings results here, it’s free.

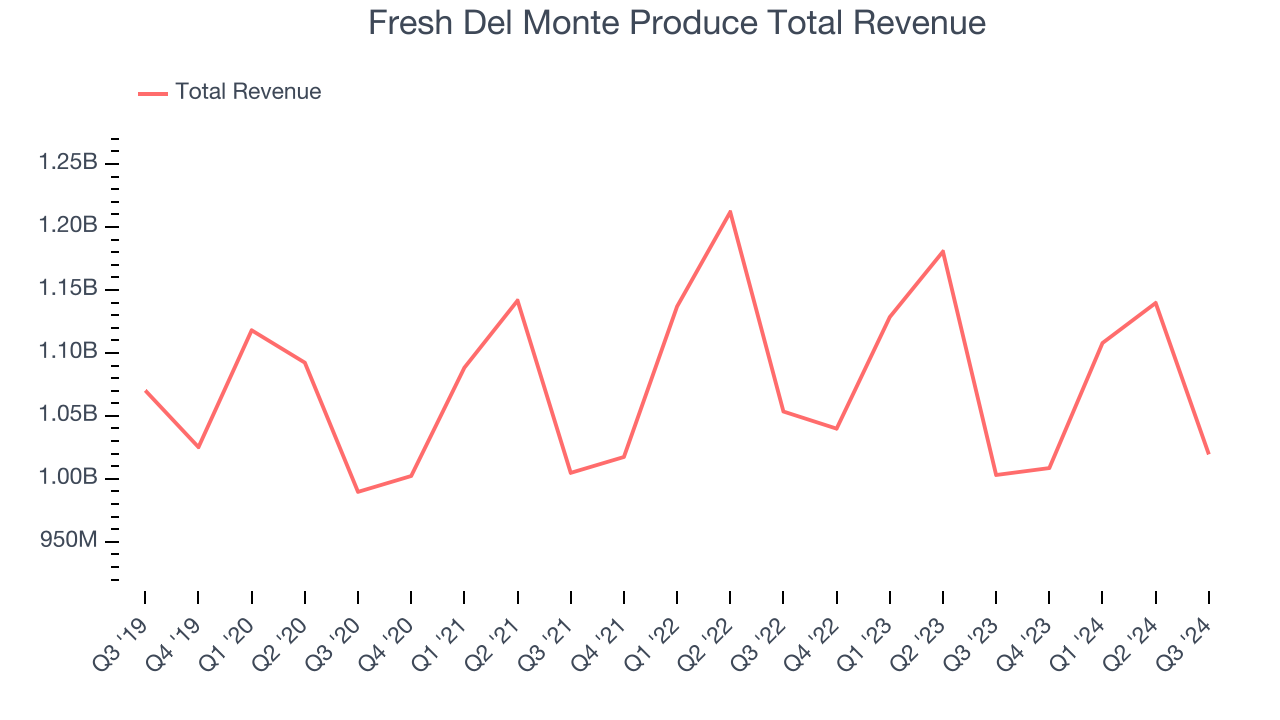

Best Q3: Fresh Del Monte Produce (NYSE:FDP)

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Fresh Del Monte Produce reported revenues of $1.02 billion, up 1.6% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with an impressive beat of analysts’ earnings and gross margin estimates.

The market seems happy with the results as the stock is up 10.5% since reporting. It currently trades at $32.11.

Is now the time to buy Fresh Del Monte Produce? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Conagra (NYSE:CAG)

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today (NYSE:CAG) boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.79 billion, down 3.8% year on year, falling short of analysts’ expectations by 1.6%. It was a softer quarter as it posted a miss of analysts’ organic revenue growth and EBITDA estimates.

As expected, the stock is down 11.5% since the results and currently trades at $28.95.

Read our full analysis of Conagra’s results here.

MGP Ingredients (NASDAQ:MGPI)

Headquartered in Atchison, Kansas, MGP Ingredients (NASDAQ:MGPI) is a leading supplier of high-quality ingredients to the food and beverage industry

MGP Ingredients reported revenues of $161.5 million, down 23.7% year on year. This print met analysts’ expectations. Zooming out, it was a mixed quarter as it also logged a decent beat of analysts’ EBITDA estimates but a miss of analysts’ gross margin estimates.

MGP Ingredients had the slowest revenue growth among its peers. The stock is down 18.8% since reporting and currently trades at $45.68.

Read our full, actionable report on MGP Ingredients here, it’s free.

Kellanova (NYSE:K)

With Corn Flakes as its first and most iconic product, Kellanova (NYSE:K) is a packaged foods company that is dominant in the cereal and snack categories.

Kellanova reported revenues of $3.23 billion, flat year on year. This number surpassed analysts’ expectations by 2.5%. It was a strong quarter as it also recorded an impressive beat of analysts’ organic revenue growth estimates and a decent beat of analysts’ earnings estimates.

The stock is flat since reporting and currently trades at $80.61.

Read our full, actionable report on Kellanova here, it’s free.

Market Update

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.