What a brutal six months it’s been for Monolithic Power Systems. The stock has dropped 25.9% and now trades at $563, rattling many shareholders. This might have investors contemplating their next move.

Following the drawdown, is now an opportune time to buy MPWR? Find out in our full research report, it’s free.

Why Is Monolithic Power Systems a Good Business?

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ:MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

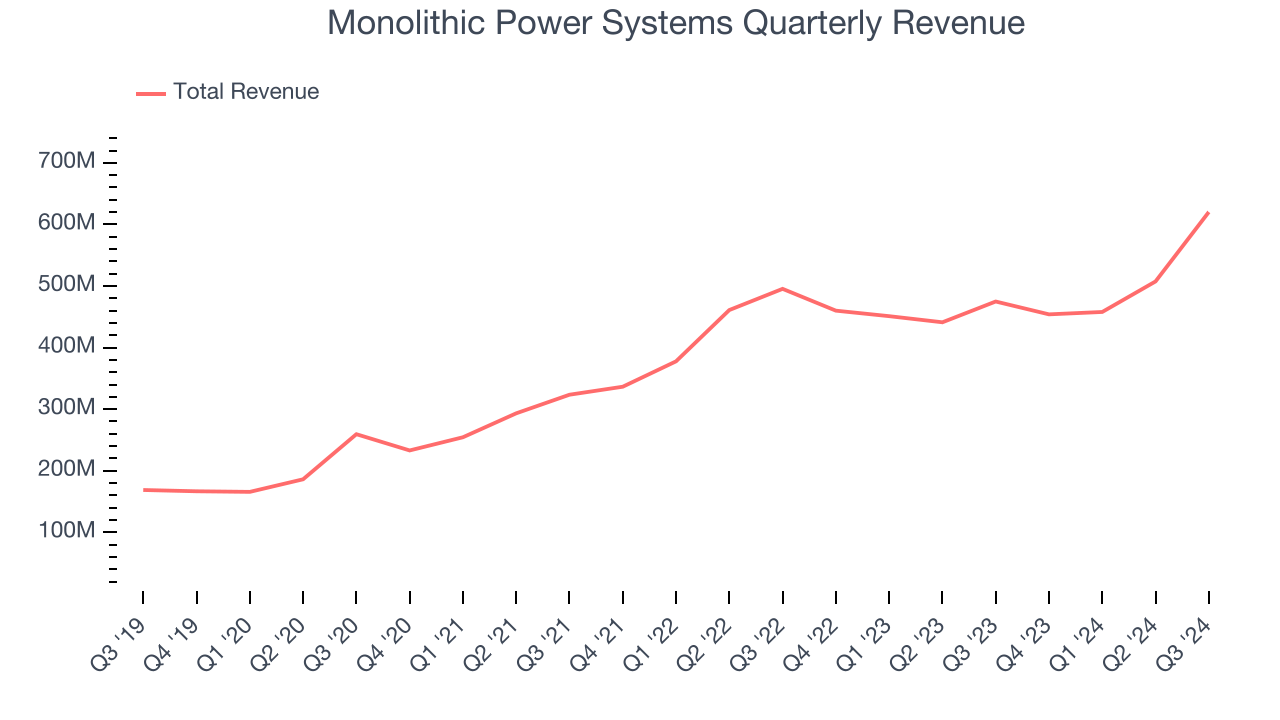

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Monolithic Power Systems grew its sales at an incredible 27.1% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses scale.

Sell-side analysts expect Monolithic Power Systems’s revenue to grow by 24% over the next 12 months, an improvement versus its 10.5% annualized growth rate for the last two years. This projection is admirable and implies its newer products and services will catalyze higher growth rates.

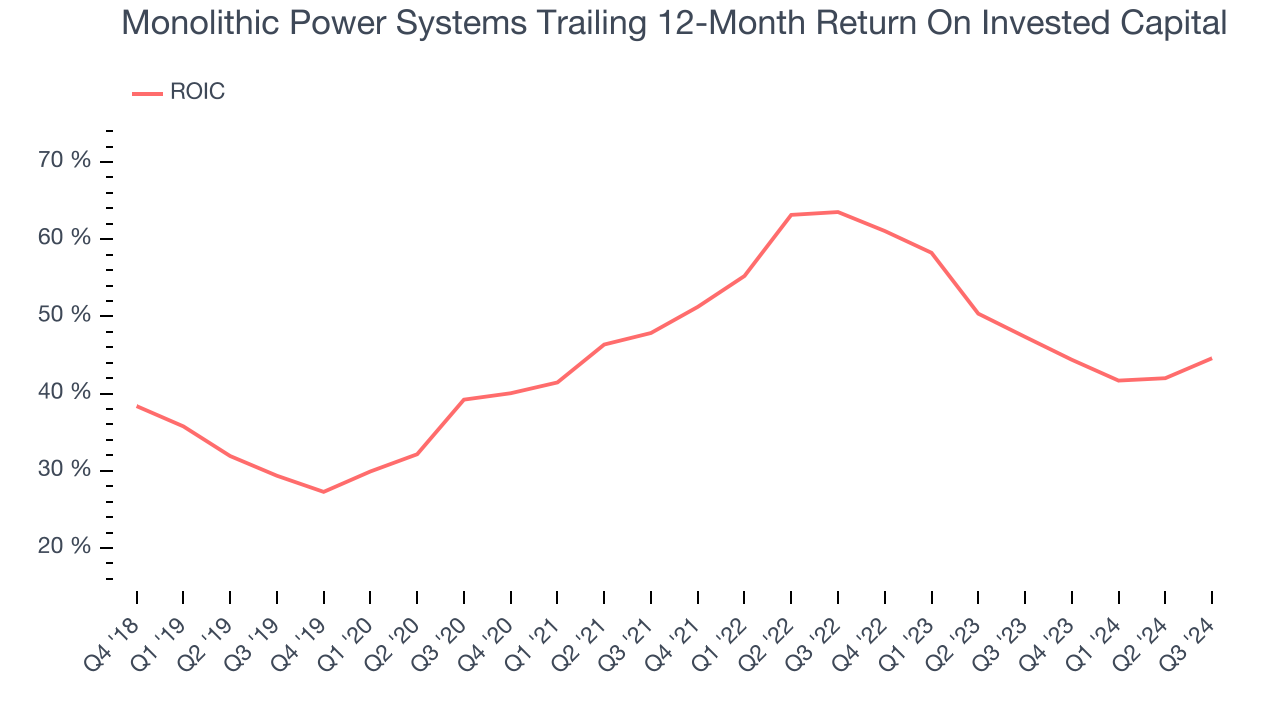

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Monolithic Power Systems’s five-year average ROIC was 48.5%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why Monolithic Power Systems ranks near the top of our list. After the recent drawdown, the stock trades at 33.6x forward price-to-earnings (or $563 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Monolithic Power Systems

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.