As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the air freight and logistics industry, including GXO Logistics (NYSE:GXO) and its peers.

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 7 air freight and logistics stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 19.3% below.

In light of this news, share prices of the companies have held steady as they are up 1.5% on average since the latest earnings results.

GXO Logistics (NYSE:GXO)

With notable customers such as Nike and Apple, GXO (NYSE:GXO) manages outsourced supply chains and warehousing for various companies.

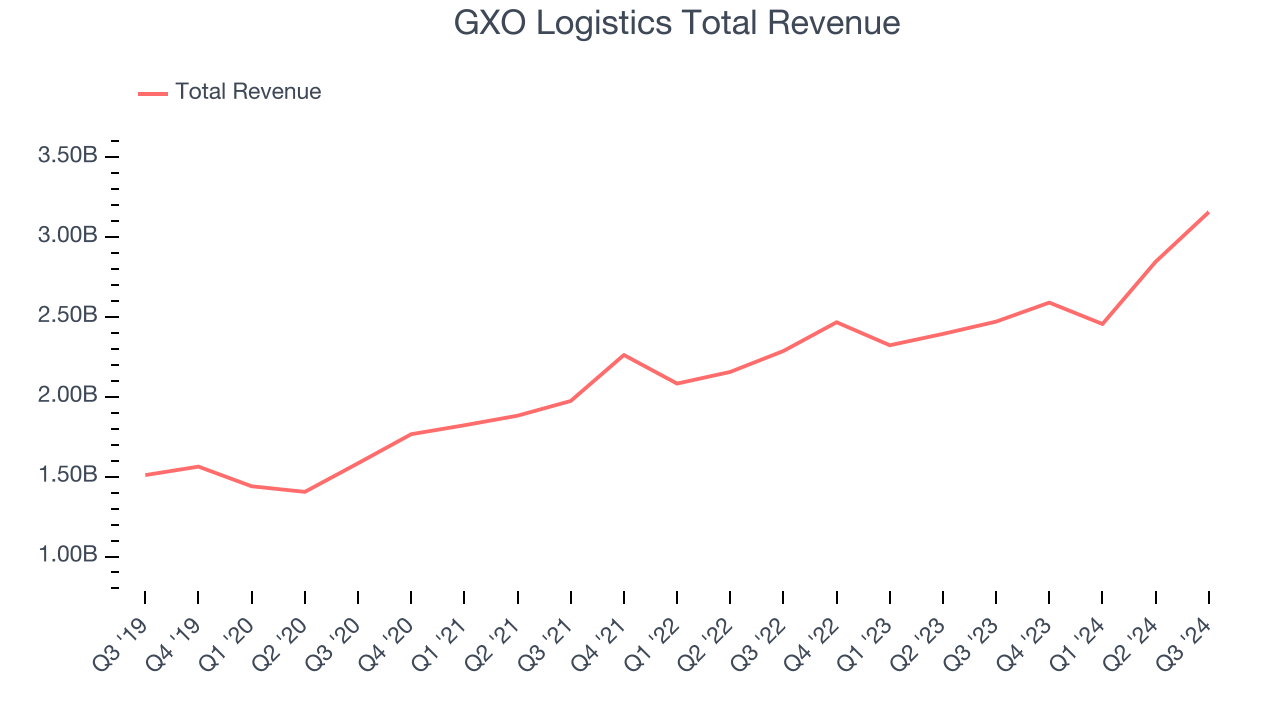

GXO Logistics reported revenues of $3.16 billion, up 27.8% year on year. This print exceeded analysts’ expectations by 5.3%. Despite the top-line beat, it was still a slower quarter for the company with revenue guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ organic revenue estimates.

Malcolm Wilson, chief executive officer of GXO, said, “We have increasing momentum in our business. In the third quarter, we delivered our highest-ever quarterly revenue of $3.2 billion, reflecting growth of 28% year over year, along with sequential improvement in organic revenue growth and strong free cash flow.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $58.50.

Read our full report on GXO Logistics here, it’s free.

Best Q3: Expeditors (NYSE:EXPD)

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

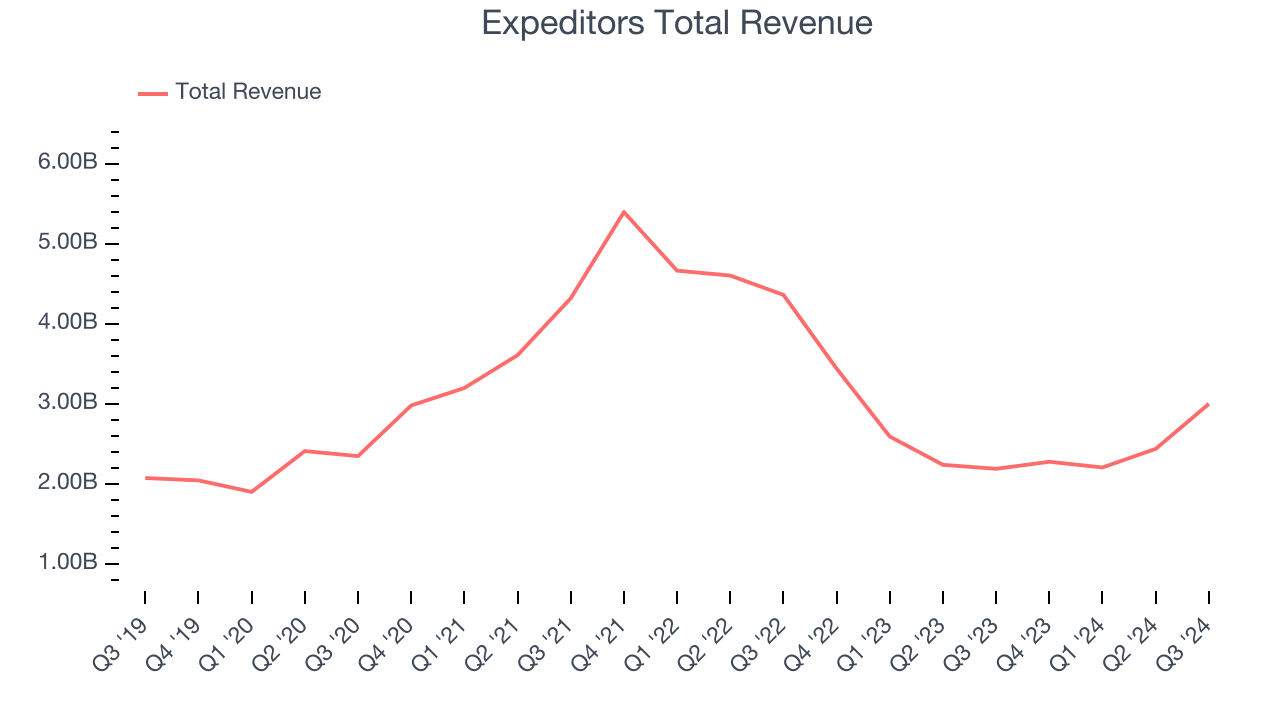

Expeditors reported revenues of $3 billion, up 37% year on year, outperforming analysts’ expectations by 21.3%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA estimates.

Expeditors achieved the biggest analyst estimates beat and fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $120.67.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: FedEx (NYSE:FDX)

Sporting one of the largest air cargo fleets in the world, FedEx (NYSE:FDX) is a global provider of parcel and cargo delivery services.

FedEx reported revenues of $21.58 billion, flat year on year, falling short of analysts’ expectations by 1.5%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 4.2% since the results and currently trades at $288.

Read our full analysis of FedEx’s results here.

Air Transport Services (NASDAQ:ATSG)

Founded in 1980, Air Transport Services Group (NASDAQ:ATSG) provides air cargo transportation and logistics solutions.

Air Transport Services reported revenues of $471.3 million, down 9.9% year on year. This number lagged analysts' expectations by 7.1%. It was a disappointing quarter as it also logged a significant miss of analysts’ adjusted operating income and EPS estimates.

Air Transport Services had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $21.96.

Read our full, actionable report on Air Transport Services here, it’s free.

United Parcel Service (NYSE:UPS)

Trademarking its recognizable UPS Brown color, UPS (NYSE:UPS) offers package delivery, supply chain management, and freight forwarding services.

United Parcel Service reported revenues of $22.25 billion, up 5.6% year on year. This result topped analysts’ expectations by 0.5%. It was a strong quarter as it also produced a solid beat of analysts’ EBITDA estimates.

United Parcel Service achieved the highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $132.

Read our full, actionable report on United Parcel Service here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.