Furniture company La-Z-Boy (NYSE:LZB) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 1.9% year on year to $521 million. Guidance for next quarter’s revenue was better than expected at $515 million at the midpoint, 0.5% above analysts’ estimates. Its non-GAAP profit of $0.71 per share was 10.4% above analysts’ consensus estimates.

Is now the time to buy La-Z-Boy? Find out by accessing our full research report, it’s free.

La-Z-Boy (LZB) Q3 CY2024 Highlights:

- Revenue: $521 million vs analyst estimates of $506 million (1.9% year-on-year growth, 3% beat)

- Adjusted EPS: $0.71 vs analyst estimates of $0.64 (10.4% beat)

- Revenue Guidance for Q4 CY2024 is $515 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 7.4%, in line with the same quarter last year

- Free Cash Flow was -$1.21 million, down from $17.92 million in the same quarter last year

- Market Capitalization: $1.79 billion

Melinda D. Whittington, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “Our second quarter results demonstrate the continued progress we are making against our strategic pillars and our strong execution throughout the enterprise. We were pleased to deliver a second consecutive quarter of sales growth across our business despite the continued challenging macroeconomic trends. The combination of our iconic brand, strong product portfolio particularly in reclining and motion furniture, and our talented team again produced steady results against persistently weak consumer demand. In our company-owned La-Z-Boy Furniture Galleries®, conversion rates, average ticket, and design sales all improved again year-over-year. We are consistently solving for the unique needs of our consumers and transforming houses into homes with our high quality, comfortable custom furniture solutions.”

Company Overview

The prized possession of every mancave, La-Z-Boy (NYSE:LZB) is a furniture company specializing in recliners, sofas, and seats.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

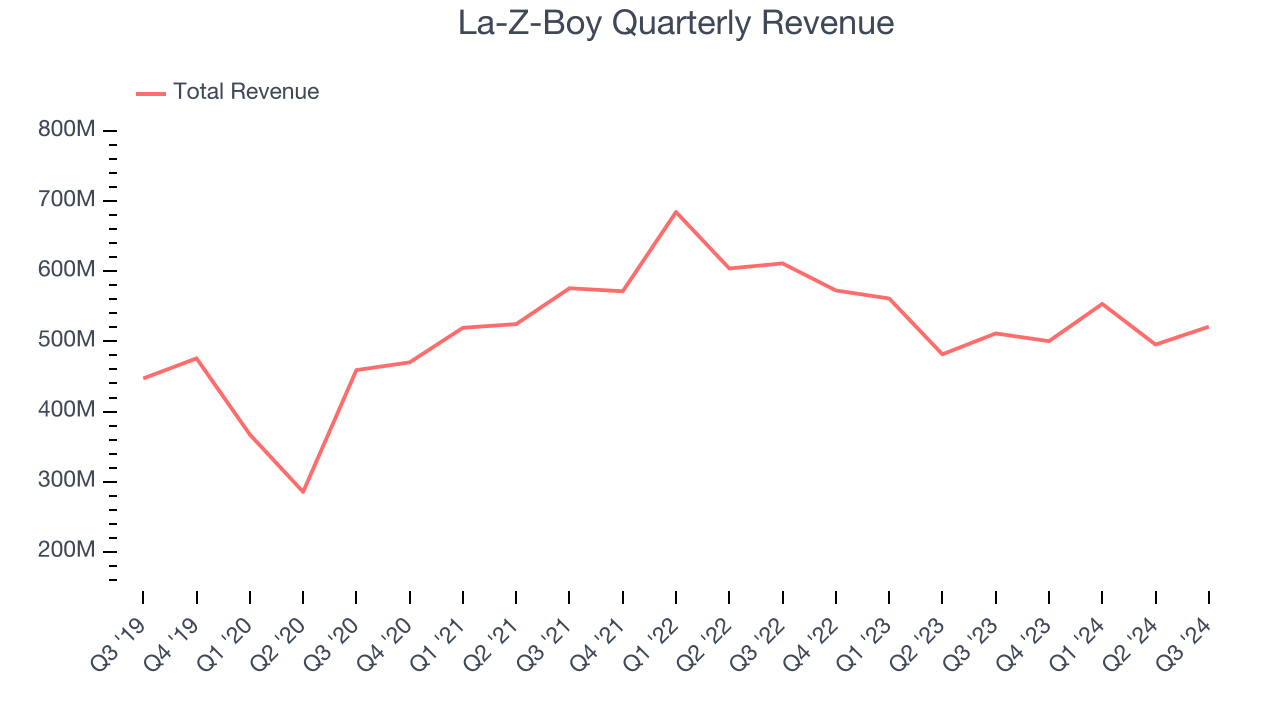

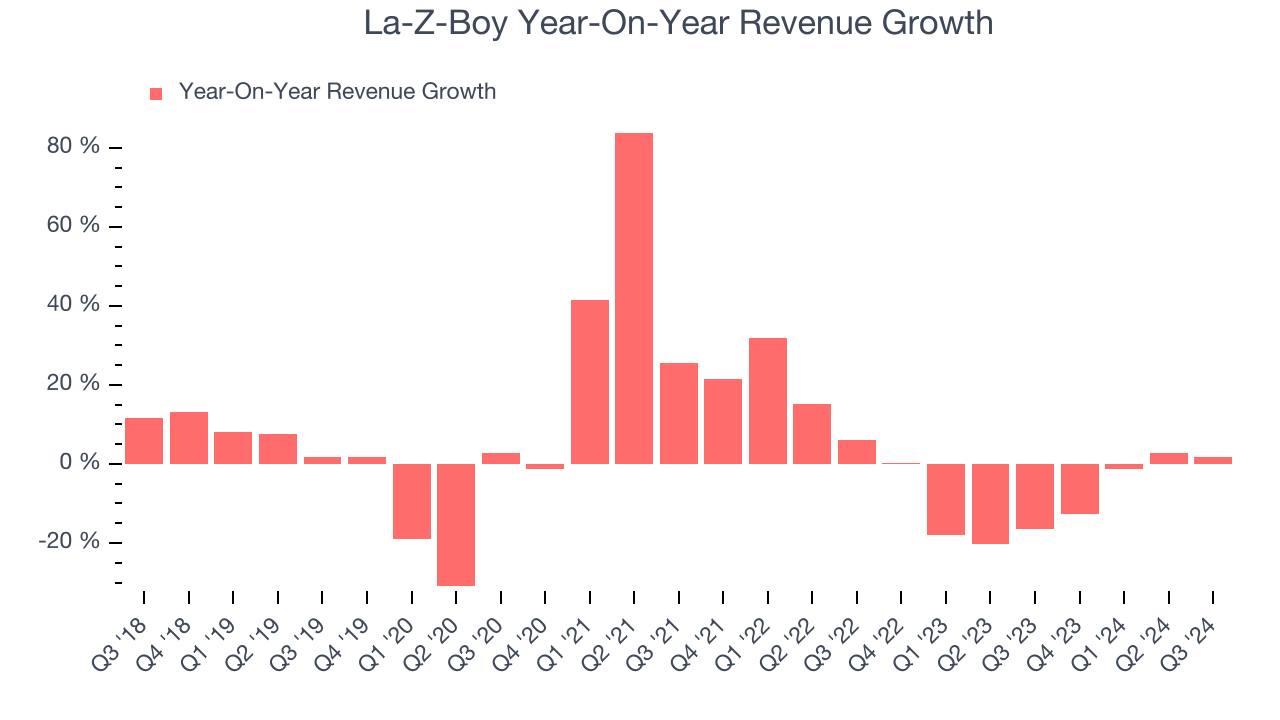

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, La-Z-Boy’s sales grew at a sluggish 3% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. La-Z-Boy’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8.5% annually.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 62.2% and 37.8% of core revenues. Over the last two years, La-Z-Boy’s Wholesale revenue (sales to retailers) averaged 9.7% year-on-year declines while its Retail revenue (direct sales to consumers) averaged 2.4% declines.

This quarter, La-Z-Boy reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 3%. Company management is currently guiding for a 2.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, an improvement versus the last two years. While this projection implies its newer products and services will fuel better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

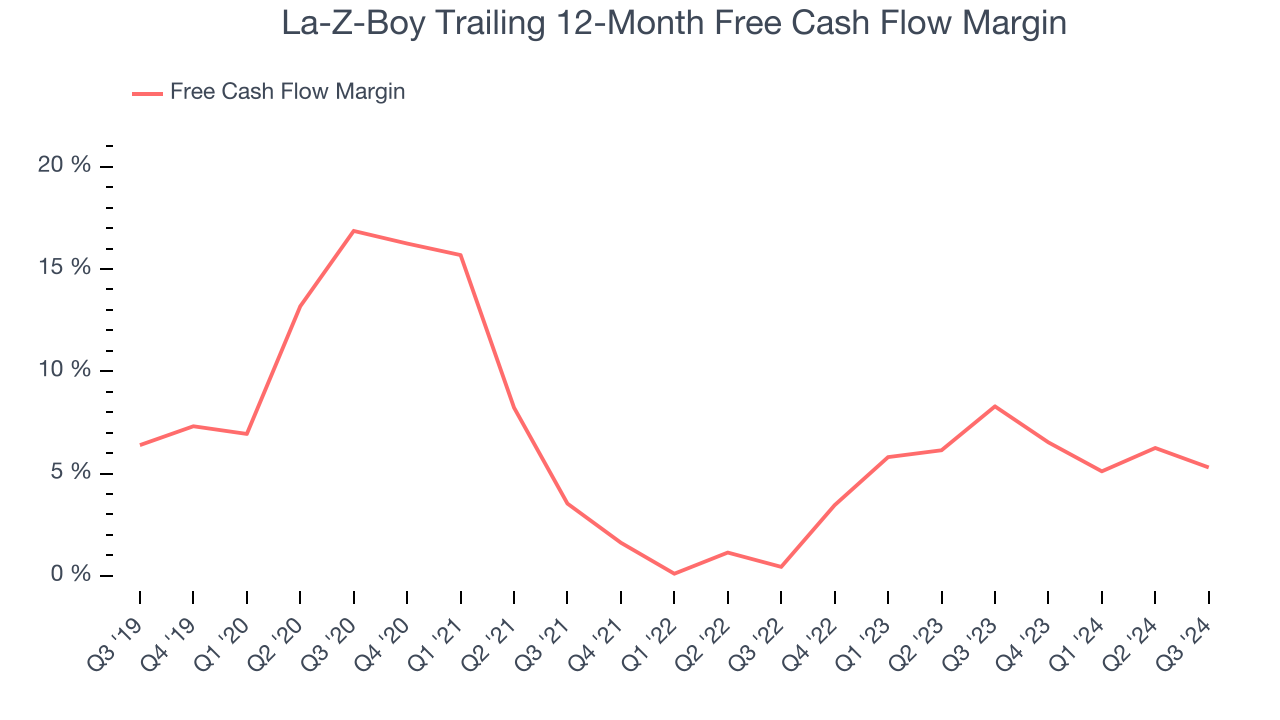

La-Z-Boy has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.8%, subpar for a consumer discretionary business.

La-Z-Boy broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 3.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting La-Z-Boy’s free cash flow margin of 5.3% for the last 12 months to remain the same.

Key Takeaways from La-Z-Boy’s Q3 Results

It was encouraging to see La-Z-Boy beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 2.2% to $43.20 immediately after reporting.

La-Z-Boy had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.