Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at SPX Technologies (NYSE:SPXC) and its peers.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 2.5%.

Luckily, gas and liquid handling stocks have performed well with share prices up 11.1% on average since the latest earnings results.

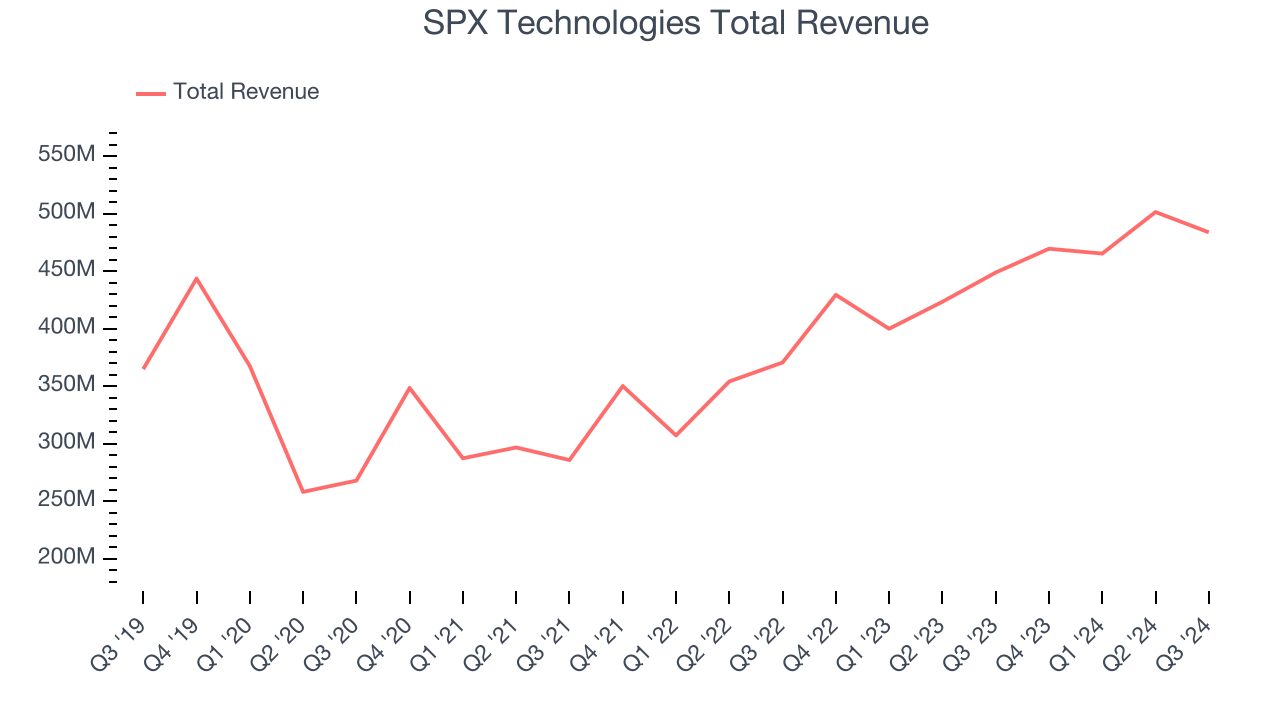

SPX Technologies (NYSE:SPXC)

SPX Technologies (NYSE:SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $483.7 million, up 7.8% year on year. This print fell short of analysts’ expectations by 3.2%. Overall, it was a slower quarter for the company with a miss of analysts’ organic revenue estimates and full-year revenue guidance missing analysts’ expectations.

The stock is up 3.8% since reporting and currently trades at $165.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free.

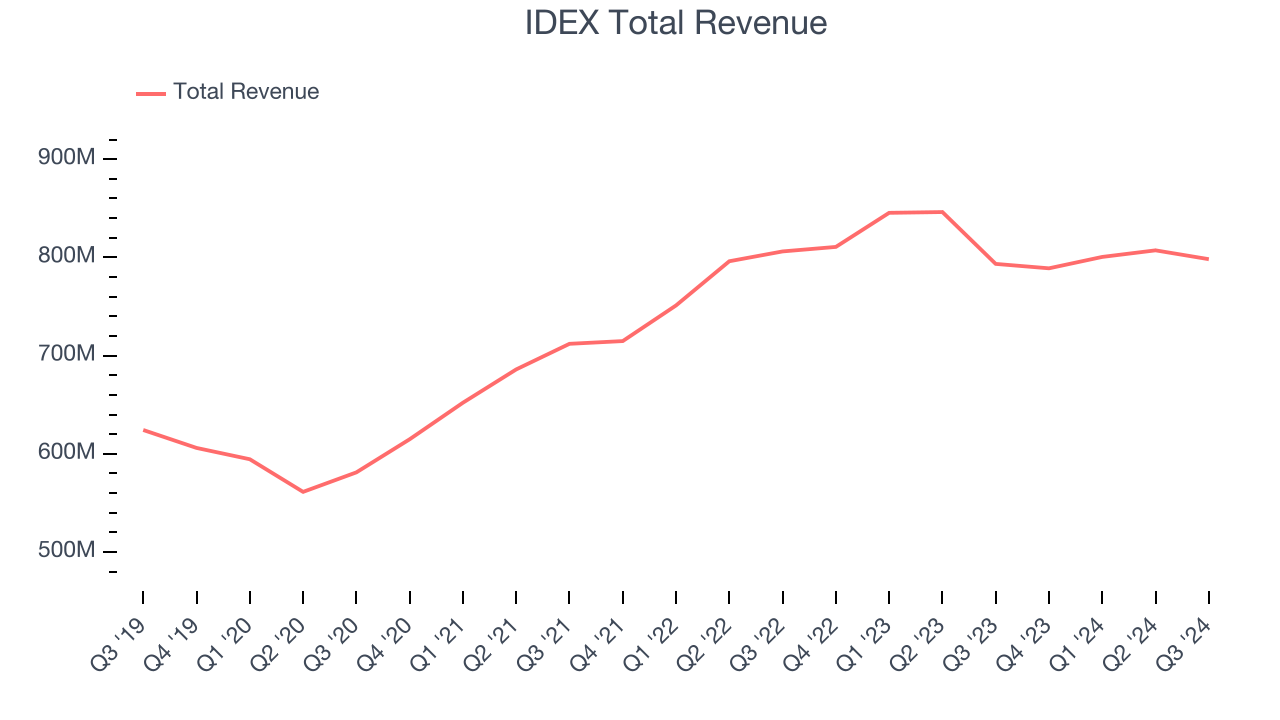

Best Q3: IDEX (NYSE:IEX)

Founded in 1988, IDEX (NYSE:IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

IDEX reported revenues of $798.2 million, flat year on year, in line with analysts’ expectations. The business had a satisfactory quarter with an impressive beat of analysts’ operating margin estimates but a miss of analysts’ organic revenue estimates.

The market seems happy with the results as the stock is up 12.1% since reporting. It currently trades at $228.50.

Is now the time to buy IDEX? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Graco (NYSE:GGG)

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $519.2 million, down 3.8% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted a miss of analysts’ operating margin estimates.

Interestingly, the stock is up 7% since the results and currently trades at $88.71.

Read our full analysis of Graco’s results here.

Parker-Hannifin (NYSE:PH)

Founded in 1917, Parker Hannifin (NYSE:PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Parker-Hannifin reported revenues of $4.90 billion, up 1.2% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a slower quarter as it recorded a miss of analysts’ EBITDA estimates.

The stock is up 11.9% since reporting and currently trades at $699.32.

Read our full, actionable report on Parker-Hannifin here, it’s free.

Ingersoll Rand (NYSE:IR)

Started with the invention of the steam drill, Ingersoll Rand (NYSE:IR) provides mission-critical air, gas, liquid, and solid flow creation solutions.

Ingersoll Rand reported revenues of $1.86 billion, up 7% year on year. This result met analysts’ expectations. More broadly, it was a mixed quarter as it also logged an impressive beat of analysts’ operating margin estimates but a miss of analysts’ organic revenue estimates.

The stock is up 9% since reporting and currently trades at $104.64.

Read our full, actionable report on Ingersoll Rand here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.