Looking back on department store stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Nordstrom (NYSE:JWN) and its peers.

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

The 4 department store stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 0.5%.

While some department store stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.7% since the latest earnings results.

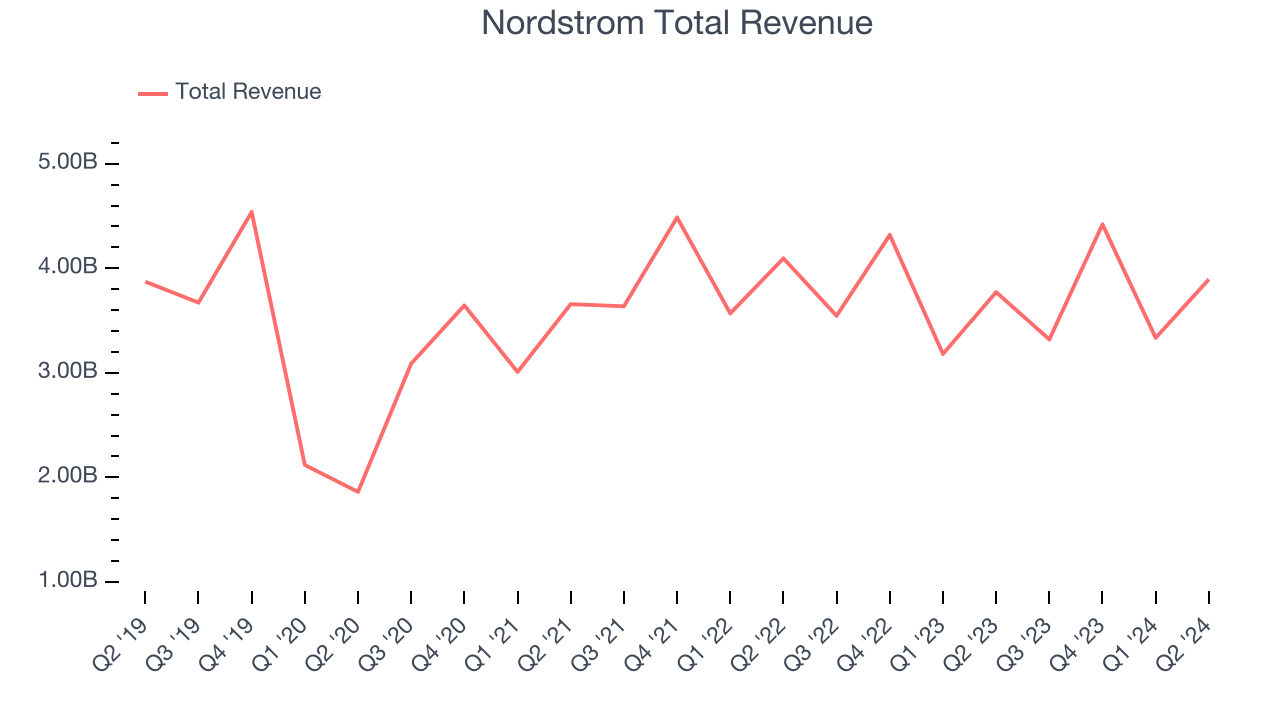

Nordstrom (NYSE:JWN)

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE:JWN) is a high-end department store chain.

Nordstrom reported revenues of $3.89 billion, up 3.2% year on year. This print was in line with analysts’ expectations, and overall, it was a stunning quarter for the company with an impressive beat of analysts’ earnings and gross margin estimates.

"Our second quarter results were solid, and we're encouraged by the continued topline strength in both banners and the progress we're making to expand gross margin and increase profitability," said Erik Nordstrom, chief executive officer of Nordstrom,

Nordstrom pulled off the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 10.5% since reporting and currently trades at $23.38.

Is now the time to buy Nordstrom? Access our full analysis of the earnings results here, it’s free.

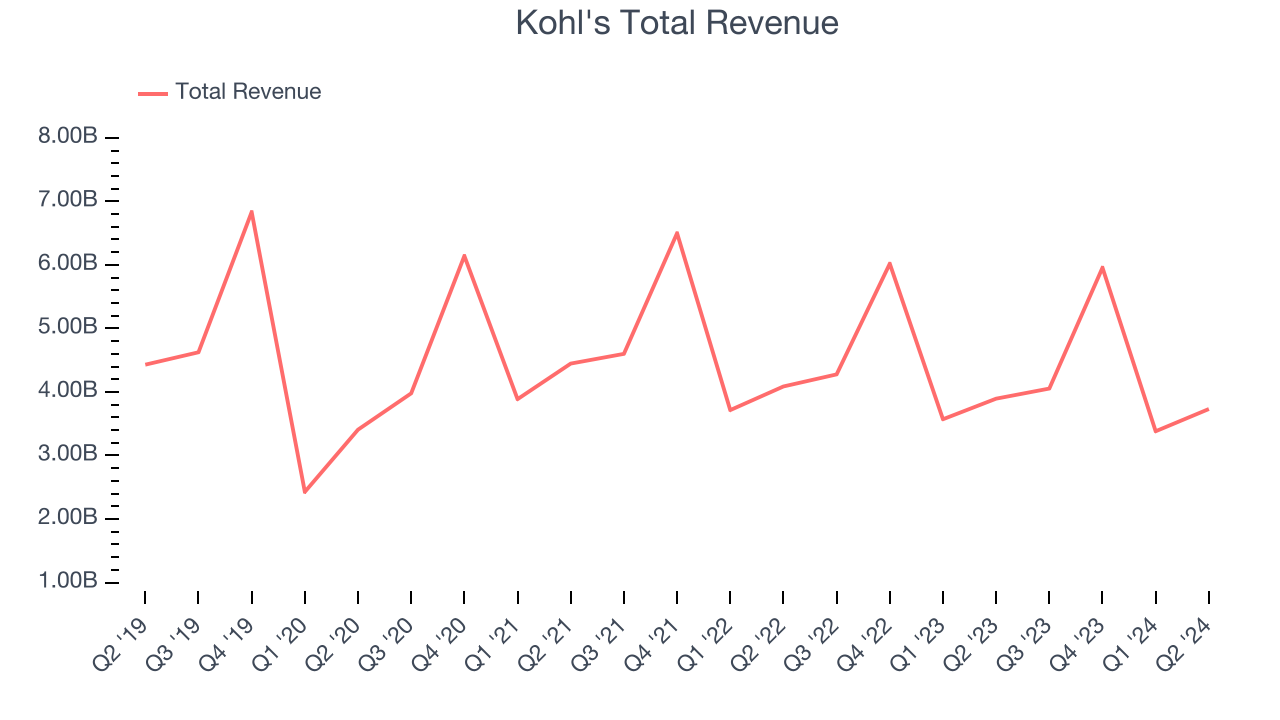

Best Q2: Kohl's (NYSE:KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $3.73 billion, down 4.2% year on year, outperforming analysts’ expectations by 2.1%. The business had a stunning quarter with an impressive beat of analysts’ earnings estimates.

Kohl's achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.5% since reporting. It currently trades at $18.72.

Is now the time to buy Kohl's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Dillard's (NYSE:DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $1.51 billion, down 5.2% year on year, falling short of analysts’ expectations by 1.1%. It was a softer quarter as it posted a miss of analysts’ EBITDA and earnings estimates.

Dillard's delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 3.6% since the results and currently trades at $376.

Read our full analysis of Dillard’s results here.

Macy's (NYSE:M)

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $5.10 billion, down 3.5% year on year. This number beat analysts’ expectations by 1%. It was a very strong quarter as it also logged an impressive beat of analysts’ earnings estimates.

The stock is down 13.2% since reporting and currently trades at $15.41.

Read our full, actionable report on Macy's here, it’s free.

Market Update

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.