Semiconductor design software provider Cadence Design Systems (NASDAQ:CDNS) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 18.8% year on year to $1.22 billion. The company expects the full year’s revenue to be around $4.63 billion, close to analysts’ estimates. Its non-GAAP profit of $1.64 per share was also 13.7% above analysts’ consensus estimates.

Is now the time to buy Cadence? Find out by accessing our full research report, it’s free.

Cadence (CDNS) Q3 CY2024 Highlights:

- Revenue: $1.22 billion vs analyst estimates of $1.18 billion (2.9% beat)

- Adjusted EPS: $1.64 vs analyst estimates of $1.44 (13.7% beat)

- The company reconfirmed its revenue guidance for the full year of $4.63 billion at the midpoint

- Management slightly raised its full-year Adjusted EPS guidance to $5.90 at the midpoint

- Gross Margin (GAAP): 86.6%, down from 89.3% in the same quarter last year

- Operating Margin: 28.8%, in line with the same quarter last year

- Free Cash Flow Margin: 31.5%, up from 12% in the previous quarter

- Billings: $1.24 billion at quarter end, up 23.3% year on year

- Market Capitalization: $70.45 billion

“Cadence delivered exceptional results for the third quarter of 2024, driven by broad-based strength across our portfolio, especially in IP, SD&A, and hardware systems,” said Anirudh Devgan, president and chief executive officer.

Company Overview

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

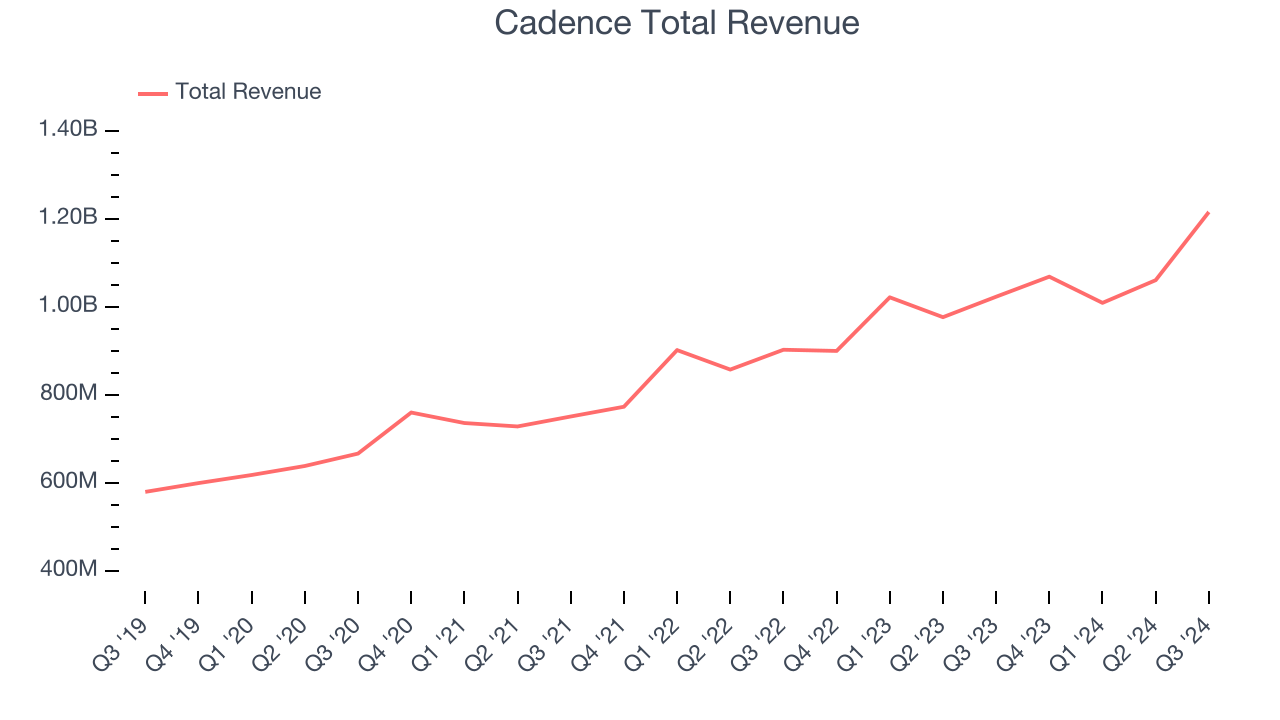

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Cadence’s sales grew at a sluggish 13.5% compounded annual growth rate over the last three years. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Cadence reported year-on-year revenue growth of 18.8%, and its $1.22 billion of revenue exceeded Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 20.5% over the next 12 months, an acceleration versus the last three years. This projection is admirable and shows the market thinks its newer products and services will spur faster growth.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

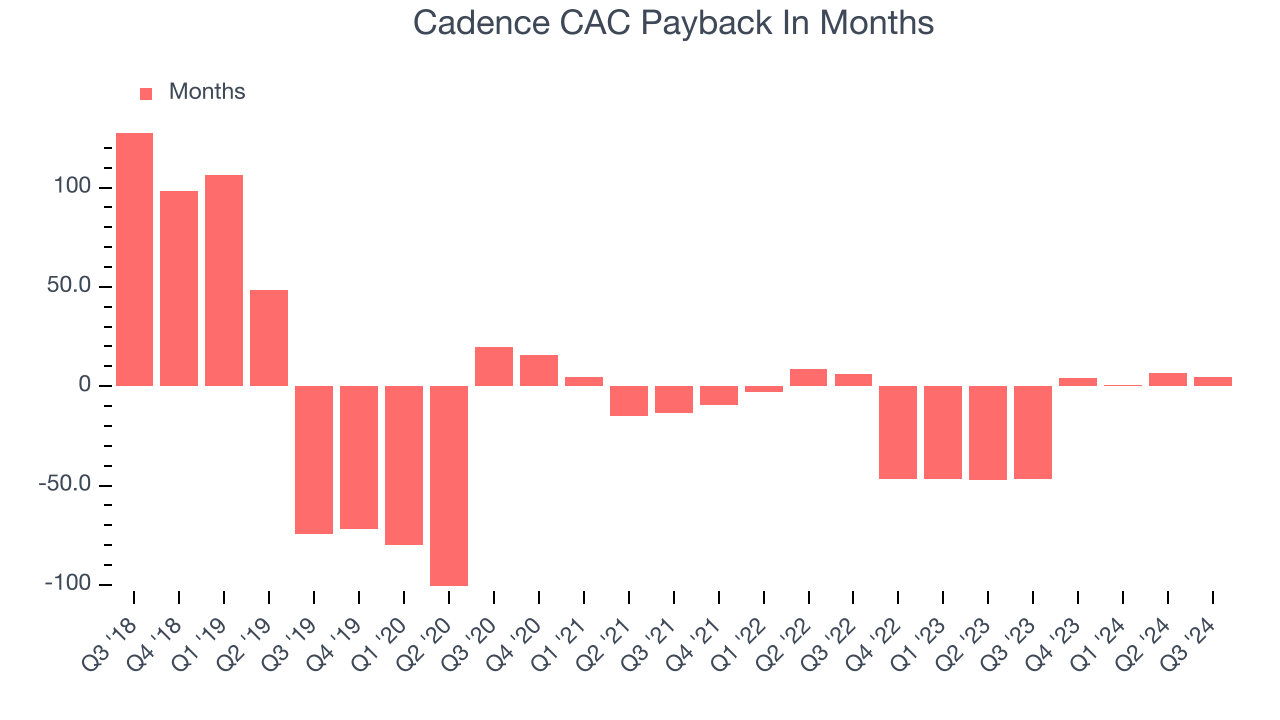

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Cadence is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.7 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Cadence’s Q3 Results

We were impressed by how strongly Cadence blew past analysts’ billings expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.2% to $268.51 immediately after reporting.

Cadence put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.