Trading stock options takes timing, especially when based on chart patterns. One of the key frustrations with directional options trades happens when the expected move takes place after an upcoming options expiration. Traders should have the ability to reassess their premises for taking and staying in a trade and make necessary and timely adjustments. This is a given when trading stocks in any stock sector, and it can be when trading options.

You’ve likely experienced looking in the rearview mirror and seeing your stock make the intended move just after your expiration hit. If only you could have held to the next expiration. If that's ever happened to you, then consider rolling your options.

Time and Price Adjustments

Time can often remedy your options trades by giving the trade more time to play out. Rolling options enable you to make time adjustments to your trade as needed by extending the expiration dates. Your price targets may need to be adjusted. Rolling options enable you to do this as well. Rolling options enable you to adjust your expiration date and strike price.

Whether you are in a position of profits or losses, rolling options enable you to adjust as needed as long as you stick to a plan. Rolling options can be used on directional trades, debit spreads or covered calls.

What are Rolling Options?

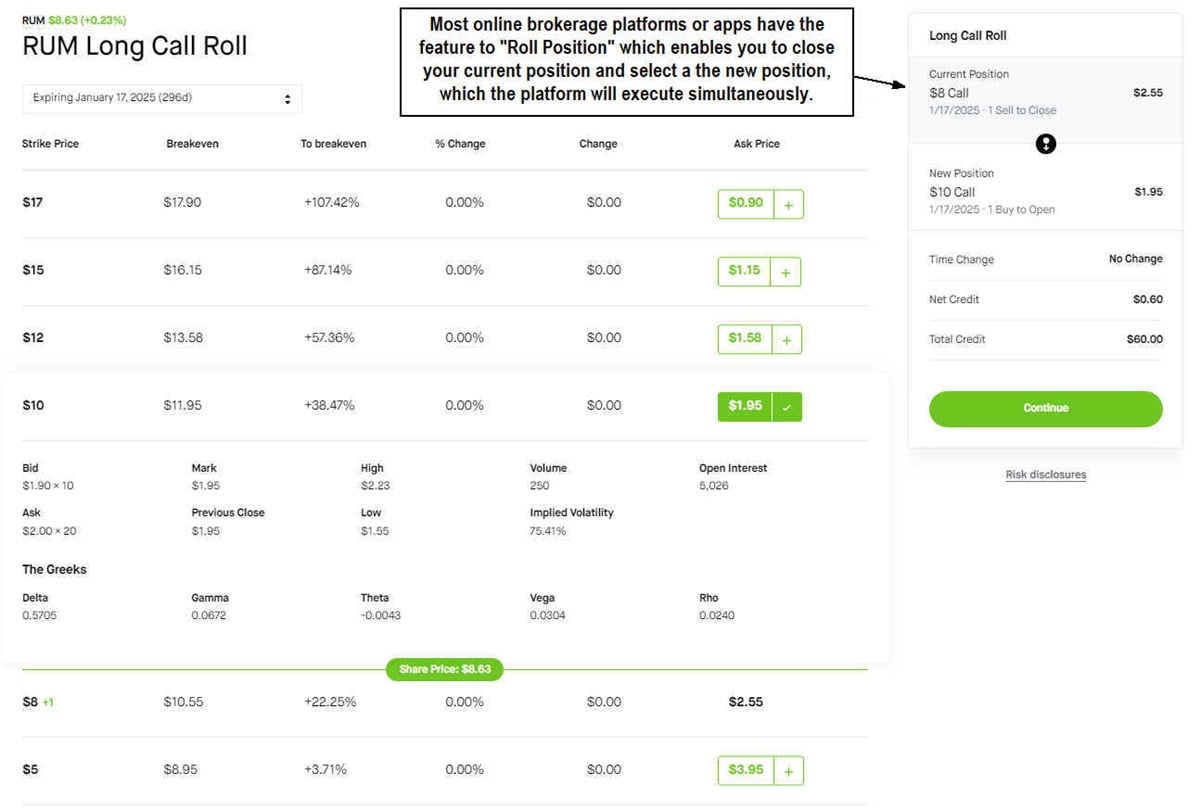

Rolling options involves closing out your existing options position while simultaneously opening a new options position for the same underlying stock. Most brokers that enable this feature allow you to place the order, and the platform will simultaneously attempt to execute both orders. You can manually close out and open a new position without the feature, but it may not be simultaneous or quick.

Rolling Options is Not a Failsafe

Be aware that when you close out your position, gains or losses are booked. Rolling over options doesn't protect you from losses. It actually cuts your losses. Therefore, you must have a game plan and firm premises intact whenever you roll over a losing position. Be aware of the options Greeks if you are taking directional trades because Theta is not on your side.

Do Rolling Options Trigger a Wash Sale?

The wash rule prevents you from claiming loss deductions if you sell a stock or security at a loss and repurchase it or a substantially identical security within 30 days of the sale. Rolling over options closes out the position, but it doesn't trigger the wash rule. Despite making a simultaneous trade with the same underlying security, you are utilizing either different strikes, expirations calls or puts.

The differing factors of the new opening options position prevent it from being qualified as identical securities and avoid the wash rule. If you sell a stock and buy an identical option, then it falls under the wash rule. If you close an option positive and repurchase it with the same strike and expiration, it can fall under the wash rule. The wash rule aims to prevent investors from taking a tax deduction for securities they still own.

When to Roll Options

There are many reasons why you would roll your options. You may not want to hold the position into expiration and seek to expand the expiration date. You may want to adjust your position. You may want to protect profits, cut losses, and reverse a losing position. When rolling your options to a higher strike price, usually protects profits when you are

. When rolling options to extend the expiration date, buying more time on an out-of-the-money (ITM) losing position is usually used.

Three Ways to Roll Options

There are three directions to roll options. The first two involve adjusting the strike prices, and the last involves extending the expiration date.

You can roll them up when your position is profitable and you expect the price to rise higher. For example, your ABC 55 calls are in the money, but the chart looks stronger for a higher move, so you roll them to the 60 calls.

You can roll options down to a lower strike price and keep the same expiration. This adjustment improves the potential to get ITM without having to pay an extra time premium. It involves closing the position and opening a new one at a lower strike price but keeping the same expiration date.

You can roll options out by extending the expiration date. If your ABC calls are out-of-the-money (OTM) with a week left until expiration, you may opt to roll it out to the next month's expiration. This extends the life of the trade, giving it more time to play out.

You can also decide to adjust both the strike and expiration date as well if your strategy calls for it.

How to Roll Options

Most brokerage platforms and apps provide a feature that enables you to roll a position or roll an option. By selecting this feature for the option position you are holding, you can pick which strike price and expiration date to roll over to. Check with your brokerage for specific instructions. Doing it through the in-platform or in-app feature is more seamless as it gets done nearly simultaneously.

If you don't have that feature, then you would manually close out the existing position and open the new position. This will take more time and can involve more slippage.

Placing the Trade

Let's use an example the video-sharing platform Rumble Inc. (NASDAQ: RUM).

The weekly candlestick chart on RUM illustrates a bull flag breakout. The weekly relative strength index (RSI) is rising again towards the 70-band. Since this is a wider time frame chart, the price range is also much wider as trend moves can form and continue to move for extended periods.

Since the position is ITM, we expect it to continue higher for the coming weeks to months. We decide to roll up the option position from the $8 strike price to the $10 strike price. Since we own 1 RUM $8 call expiring on Jan. 17, 2025, we can select the roll position feature and pick the new position, which will be the RUM $10 call with the same expiration.

The result of this roll-up will be a 60-cent credit, which is a profit that we booked while extending the upside potential on the trade.

Rolling Provides Agility

Rolling options enable you to adjust your strike price or expiration with the changes in your strategy. They can be used to book profits on ITM positions and buy time in OTM positions. The most important aspect is the agility it provides you when in an options position so that you don't have to be "stuck" in a position. Be sure to plan out your strategy ahead of time and stay nimble.