Nokia Oyj (NYSE: NOK) is a worldwide provider of telecom equipment and network infrastructure solutions. The computer and technology sector giant is a major facilitator of 5G and 4G infrastructure deployment along with competitor Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC).

Nokia Offers Solutions for All Networks

Originally known as a dominant mobile phone manufacturer before the age of smartphones, Nokia migrated towards becoming an end-to-end network infrastructure solutions provider. They have expanded their services to cover a wide range of networks, including:

- Mobile Networks: Nokia provides hardware and software to outfit and manage 5G and earlier generation networks to telecom and wireless cellular providers like T-Mobile US Inc. (NASDAQ: TMUS). It was a pioneer in spearheading 5G rollouts and will be a key player in 6G, which is expected to expand the metaverse and extended reality (XR). The commercial rollout is expected to be commercially available by 2030.

- Cloud Networks: Nokia offers cloud infrastructure services, including software-defined networking (SDN) and network security solutions. They provide network management and optimization software and tools.

- Optical Networks: Nokia offers high-capacity optical transport solutions to enable data transmission over long distances, as well as internet protocol (IP) networking routers and switches that enable data transmission across networks.

Nokia’s Business Is Still Normalizing

Macroeconomic pressures on telecom operators have caused them to slow down their spending, which is having an impact on Nokia, especially with the tough YoY comps.

Nokia reported that in the second quarter of 2024, EPS was 7 cents, which managed to beat consensus estimates by a penny. Revenues fell 21.8% YoY to $4.87 billion due to tough comps and normalization from an exceptional 2023 year-ago quarter. This missed consensus expectations of $5.13 billion.

Revenue Decline By Segments

Nokia faced revenue declines in all its segments. Network Infrastructure sales fell 11% YoY. This caused management to lower their sales forecasts to negative 2% to 3%, down from up 2% to 8%. Operating margins are expected to be between 11.5% and 14.5%.

The Cloud and Network Services segment saw a 16% YoY sales drop, which also included the 3% headwind from divesting its device management and service platform. Sales guidance moving forward was lowered from negative 5% to flat, down from negative 2% to 3%. Operating margin estimates remain unchanged, around 6% to 9%.

The Mobile Networks segment saw the worst revenue decline of 24% YoY due to macroeconomic pressure and the normalization in India. This was due to experiencing the most 5G deployment in the same quarter last year in India. Management revised down the decline from negative 19% to negative 14% with operating margins in the 4% to 7% range.

While the decline in revenue by segments appears ugly, the reality is that India's 5G infrastructure spending actually peaked in 2023, resulting in outsized revenue spikes for Nokia last year. What goes up quickly will often take longer to normalize, and that's what is happening now. North America's revenues and most other major regions were positive. This is why the stock actually rallied from $3.60 after the Q2 2024 earnings release.

Optical Networks Segment Integration of Infinera

Nokia announced on June 27, 2024, that it would be acquiring optical network solutions provider Infinera Co. (NASDAQ: INFN) for $6.65 per share. This will bolster its largest segment, Optical Networks, adding over $1.5 billion in annual sales to its ledger. The deal is expected to close in the first half of 2025.

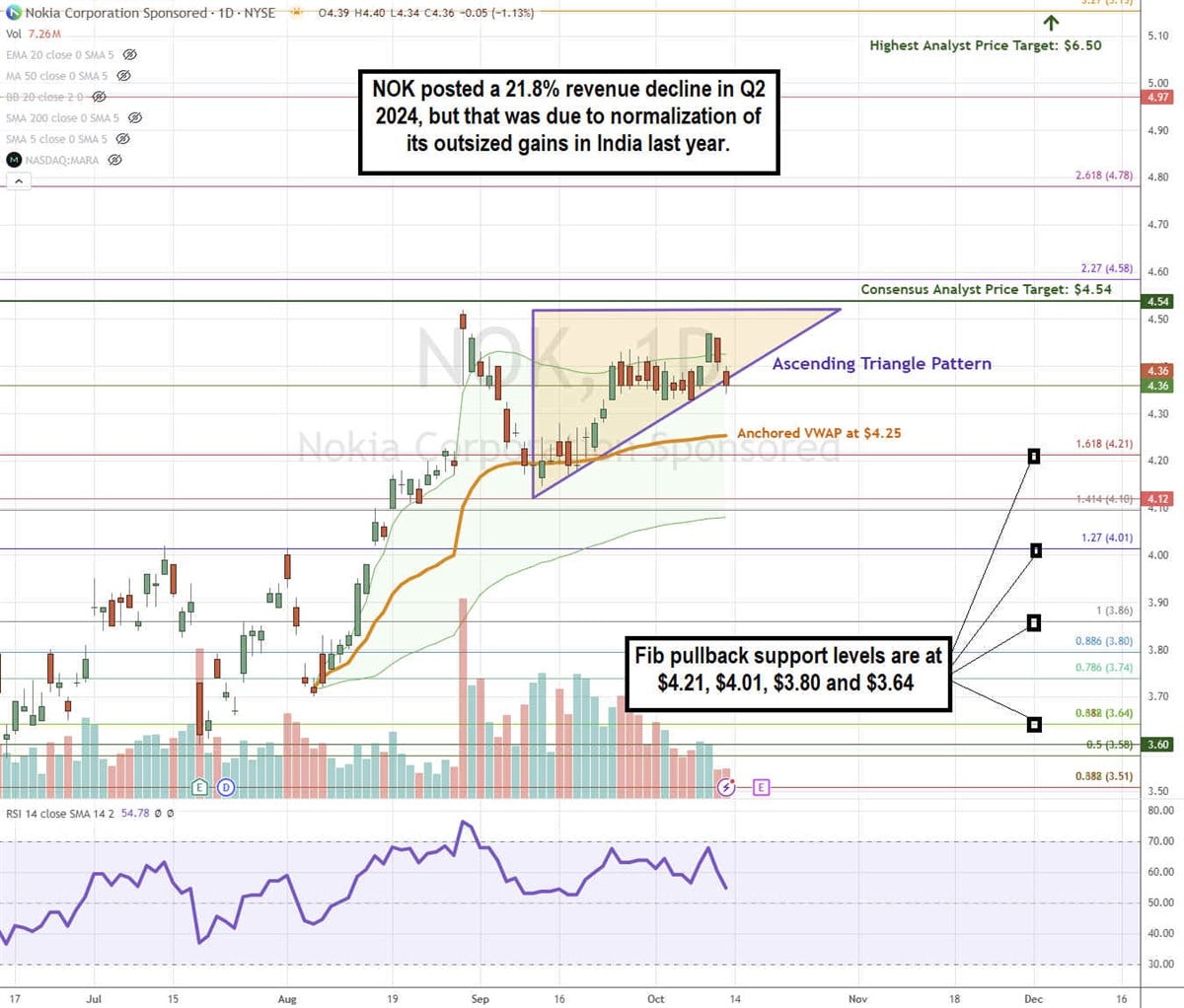

NOK Stock Forms an Ascending Triangle Pattern

An ascending price channel is comprised of ascending or rising upper trendline resistance and ascending lower trendline support. A breakout forms when the stock surges through the upper trendline, and a breakdown occurs when the stock falls below the lower trendline support.

NOK stock has been uptrending since its Q2 2024 earnings report. The daily candlestick chart illustrates an ascending triangle pattern with a flat-top upper trendline resistance near $4.54, which also happens to be the consensus analyst target. The rising lower trendline has held pullbacks at higher levels as the stock nears the apex point, where it will either break out or break down, falling through the lower trendline. The daily RSI fell to the 54-band. Fibonacci (Fib) pullback support levels are at $4.21, $4.01, $3.80 and $3.64.

Nokia’s average consensus price target is $4.54, and its highest analyst price target sits at $6.50. It has two Buy, four Hold, and two Sell ratings from analysts. The stock trades at 12.11x forward earnings.

Actionable Options Strategies: Bullish investors can consider using cash-secured puts to buy NOK at the Fib pullback support levels for entry and write covered calls to execute a wheel strategy for income in addition to the 1.83% annual dividend yield.