Amazon.com Inc. (NASDAQ: AMZN) announced its buyout of iRobot Co. (NASDAQ: IRBT) for $1.7 billion in an all-cash transaction for $61 per share in August 2022. The deal between the two consumer discretionary sector companies has been awaiting regulatory clearance since then. In the meantime, iRobot's financial performance has declined, causing Amazon to reduce its buyout price to $51.75 per share in July 2023.

The European Commission (EC) has expressed strong concerns about the merger but has until February 15, 2024, to make a final ruling. Shares plunged 27% on the rumor that the EC informed Amazon executives they intend to block the deal. The U.S. Federal Trade Commission (FTC) has also drafted a lawsuit blocking the deal. The FTC has yet to vote on the agreement or even meet with Amazon to discuss the transaction. It has scheduled a "closed-door" meeting on January 24.

Get AI-powered insights on MarketBeat.

Concerns regarding an Amazon and iRobot merger

The main concerns regarding the anti-competitive nature of the merger circle around the market dominance and leverage the combination would make. Amazon's significant market share in the online retail segment of household appliances makes it too easy to favor its products and harm competitors unfairly.

Amazon's acquisition of crucial technology and data about robot navigation and mapping gives them an unfair advantage in marketing competing products, thereby stifling consumer innovation and options. Amazon gaining access to iRobot's data and algorithms can further strengthen Amazon's position in the smart home products segment. The merger could lead to less competition, higher prices and reduced options for consumers in the robot vacuum market. Check out the sector heatmap on MarketBeat.

Has Amazon lost interest in the deal?

Amazon skipped the January 10, 2024, deadline to offer concessions to the EC. There's a rumor that Amazon skipped a settlement offer from the EC in January 2024, further fueling the belief that Amazon is losing interest in the deal. iRobot's business has declined as competitors continue taking market share, which makes the EC arguments fall by the wayside.

Will Amazon make a concerted effort to see this deal through? Amazon intended to add iRobot products to its line of smart home products, including Alexa-enabled devices like Echo Dot and Echo Show, smart thermostats and Ring doorbells, acquired in 2018 for $839 million.

A troubling indication that Amazon may be losing interest is the EC's simple concession for Amazon not to give iRobot products preference in the search results. Amazon ignored the concession request.

iRobot’s collapsing business

In its Q3 2023 earnings report, iRobot lost $2.82 per share, missing analyst estimates by $1.67. Revenues tanked 33.1% to $186.18 million, falling way short of the $245 million single analyst estimate. Revenues have tanked to 2016 levels. The pending Amazon acquisition has also prompted iRobot to skip earnings conference calls while suspending forward guidance and leaving investors in the dark.

Upcoming catalysts

The upcoming catalysts impacting iRobot or its deal include the February 14 deadline for the EC to file a ruling. iRobot earnings are expected in early February 2024.

The U.S. FTC has not made a ruling but has scheduled a closed-door meeting on January 24. There is a two-year deadline for the deal to conclude, which marks August 2024 as the final deadline to close the deal.

iRobot analyst ratings and price targets are at MarketBeat. You can find iRobot peers and competitor stocks with the MarketBeat stock screener. IRBT has a 10.5% short interest.

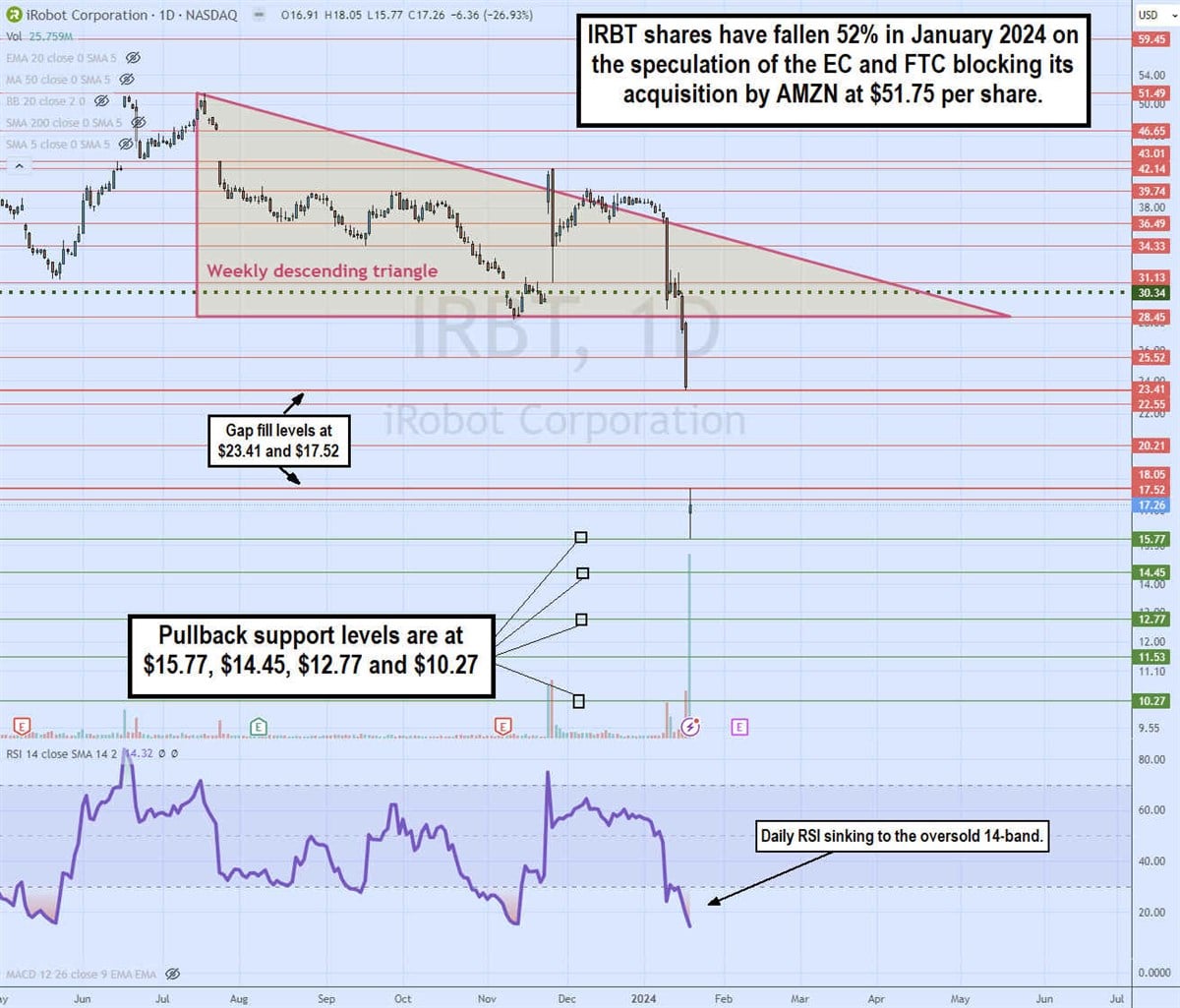

Weekly descending triangle breakdown

The daily candlestick chart on IRBT illustrates a weekly descending triangle breakdown pattern. IRBT shares have been bean down by 53% in January 2024. IRBT formed a gap between $23.41 and $17.52 on its latest sell-off on the speculation that the EC will block its acquisition by AMZN, with further speculation that the FTC is preparing a lawsuit also to block the transaction.

The daily relative strength index (RSI) has sunk to the extremely oversold 14-band. IRBT sales have fallen to 2016 levels, but share prices are at levels not seen since 2012. Pullback support levels are at $31.23, $30.14, $27.25 and $25.16.