In today's digital age, securing sensitive information and digital assets is a top priority for businesses globally. With technology's constant evolution and the rapid shift to digital operations, cybersecurity has become pivotal in fortifying against potential threats.

As businesses increasingly embrace digital infrastructures, the need for robust cybersecurity measures cannot be overstated. The aftermath of cyber intrusions, including data breaches, financial losses, and damage to reputation, has compelled organizations to make cybersecurity an integral part of their operational strategies.

Delving into the cybersecurity realm without acknowledging CrowdStrike would be remiss. Its recent performance has established its position as a prominent leader in the industry. With an exceptional surge of nearly 200% in the past year and an almost 10% uptick since the start of the year, CRWD has firmly cemented its place among the top performers in the tech large-cap sphere.

This company's demonstrated excellence in the cybersecurity industry makes it an attractive option for investors seeking exposure to this critical space. But with the stock up almost 200% over the past year, is it now too late to buy it?

Getting to know CrowdStrike (NASDAQ: CRWD)

CrowdStrike (NASDAQ: CRWD) is a US-based cybersecurity company known for its cloud-based and endpoint security solutions, threat intelligence, and cyber-attack response services. The company's flagship product is Falcon, which has a diverse client base across various industries.

The company has played a critical role in identifying and responding to high-profile cyberattacks, such as the Sony Pictures hack and the DNC hack, and assisting in investigations involving Chinese espionage against the US.

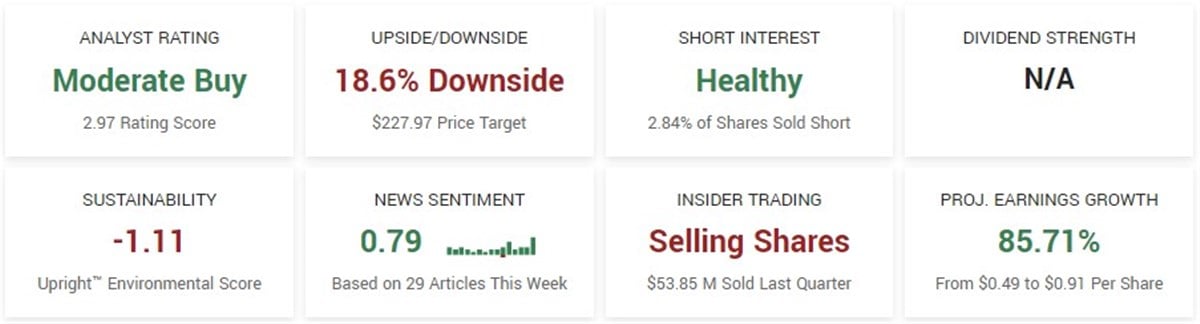

With the growing industry and demand for its services, CrowdStrike's revenue has consistently grown yearly. The company last reported earnings on November 28, surpassing analysts' expectations. They posted an EPS of 82 cents, beating the consensus estimate of 74 cents by eight cents. The company's quarterly revenue hit $786.01 million, marking a 35.3% increase from the same quarter last year and exceeding the consensus estimate of $777.30 million. Notably, forecasts predict an 85.71% growth in earnings for the upcoming year, with estimates rising from 49 cents to 91 cents per share.

Analysts pound the table on CrowdStrike

As one might expect, given the industry trends and CRWD's dominant performance, analysts are bullish on the stock, earning itself a spot on the Top-Rated Stocks list and the Most-Upgraded Stocks list.

CRWD has an analyst consensus rating of Moderate Buy, based on thirty-six analyst ratings. That rating is in line with other large-cap computer and tech companies and above the consensus rating for S&P 500 stocks, currently at Hold.

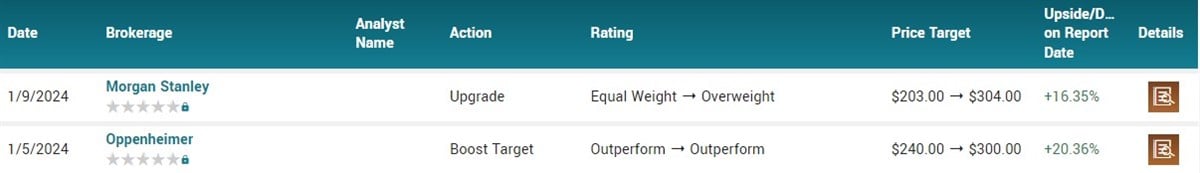

Since the start of the year, two analysts have pounded the table on CRWD stock, boosting their targets significantly. On January 5, Oppenheimer increased its target from $240 - $300, forecasting an upside of over 20% on the report date. Then, on January 9, Morgan Stanley upgraded its rating from Equal Weight to Overweight and boosted its target from $203 to $304.

Steady institutional inflows vs. insider selling

Over the previous twelve months, the stock has experienced sustained institutional inflows. While that is a favorable sign for those looking to invest, it's also worth noting that insiders have been consistently selling the stock during the same period.

Over the past twelve months, total net institutional inflows of $5.5 billion have occurred. This brings the current institutional ownership in CRWD to 63.53%.

On the flip side, a statistic that might be worrying for investors emphasizing positive insider activity is that there have been steady insider outflows. During the previous twelve months, eight insiders have sold stock totaling $134.51 million. No insiders purchased stock during that period. In fact, over the last twelve quarters, only three quarters comprised insider buying.

The stock is overbought in the short-term

Based on the stock's Relative Strength Index (RSI), it has entered the overbought zone. The RSI, which gauges recent price action's strength in a stock, currently stands at 78.92. This firmly suggests that CRWD is overbought, especially in the short term. Therefore, both traders and investors might be best suited to await a stock pullback and price stabilization rather than chasing what seems to be inflated prices in the short term.