While First Republic Bank NYSE: FRC) remains too risky for average investors, it is an interesting speculative play. Given the suitable catalysts, the company has value despite its risk and could rebound. Among the potential catalysts are the company’s Q1 earnings which will be released on April 14. The analysts aren’t expecting much from the results, a 33% decline in revenue and a 76% decline in earnings, but the new consensus targets are questionable.

Given the uncertainty surrounding the bank's business and health, there is a significant chance for over or underperformance. Ironically, the bank was being sized up as a long-term winner before the bank run, which caused the collapse.

The Analysts Haven’t Bailed On FRC Stock Yet

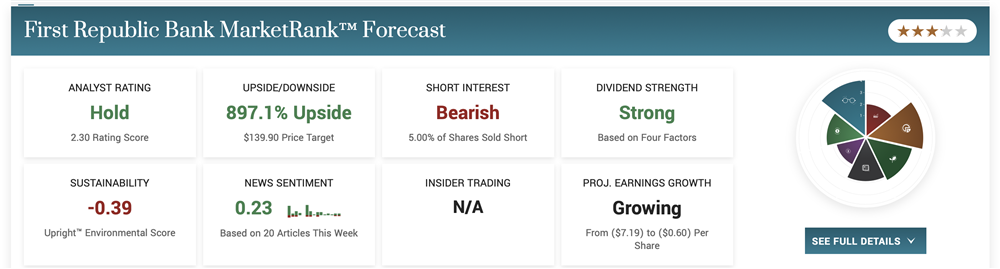

The trend in analysts' sentiment and the current consensus ratings are interesting. The 1st thing to note is that FRC sentiment and price target trended higher before the collapse. The sentiment had firmed to a Moderate Buy from Hold with a high price target well above $200. That was driven by an improving growth outlook and attractive valuation, but that has changed. The analysts have been lowering their ratings and price targets, price targets dramatically, but they are still holding on to the stock.

The new consensus is a firm Hold, and no sell ratings are showing up on Marketbeat.com’s tracking page this year or last, which is a sign of conviction. Some market participants think this stock is a sell, but no Wall Street analysts have joined the bear camp.

The price target is even more interesting for bullish speculators. It has come down more than 30% since the bank run but still assumes the stock is worth more than $100 and could advance nearly 1,000%. The consensus fell sharply following the collapse but has held steady since then.

Wells Fargo set the latest new target on April 5th, the new low at $25. This indicates the actual consensus is below $139 and even $100 (when filtering out pre-collapse targets), but even $25 implies nearly 70% of upside is possible.

Yet the short interest is another indication the market isn’t as bearish on this stock as it might be. The short interest surged 80% following the collapse but only about 5% of the shares. Since then, the shorts have covered, and there has been some rotation, but interest is steady near 5% as of the last report. That may change if more bad news is released, but it appears the bank has been stabilized.

Is First Republic A Takeover Target?

Regulators have urged the banking industry to consolidate, the larger, more stable bangs to buy out the smaller, toxic regional lenders, and First Republic is in the crosshairs. It has been estimated a takeover could happen before the following earnings report, but who might be a buyer? So far, the bank has accepted more than $30 billion in aid from a consortium of banks, including JPMorgan Chase & Co. (NYSE: JPM), Citigroup (NYSE: C) and Wells Fargo (NYSE: WFC). While a single buyer may present itself, it is more likely the bank will be split into segments and sold to whichever banks want them. The question is, what is the value of this company, and at what price will it sell?

The chart of FRC price action is ugly. Taken at face value, the downtrend appears to be gaining momentum and is set up for a much larger fall. The candles smack of a Bearish Flag Pattern that, if confirmed, could lead the stock down to $0 or close to it. The caveat is that this market is incredibly oversold and may have overextended to the point a rebound is inevitable. In that light, this market may move lower, and it may move higher depending on the next news that comes out. The only winner in that situation is volatility players.