Aftermarket auto parts retailer Advanced Auto Parts Inc. (NYSE: AAP) has dramatically underperformed its Auto/Tires/Trucks sector peers. Its shares are trading down 66.8% year-to-date (YTD) compared to O'Reilly Automotive Inc. (NASDAQ: ORLY) shares trading up 15.2% and AutoZone Inc. (NYSE: AZO) trading up 8.1% YTD. Thank you for reaching out.

The company also operates Carquest, its Canadian retail business, and Worldpac, a wholesale distributor catering to professional and commercial auto shops, dealers and OEMs for over 6,000 stores across the United States, Canada, Puerto Rico, Mexico and the U.S. Virgin Islands. Its recent earnings report gave investors little confidence regarding a turnaround, but the new CEO appointed on September 11, 2023, suggested possibly divesting Worldpac and Carquest subsidiaries.

New CEO spearheads the turnaround story

Shane O'Kelly was appointed the new CEO of Advanced Auto Parts on September 11, 2023. O'Kelly comes from The Home Depot Inc. (NYSE: HD), where he was CEO of its wholly-owned subsidiary HD Supply. Before that, he was the CEO of PetroChoice, the largest distributor of lubricants and solutions. O'Kelly was a West Point graduate with a Harvard MBA. In his first earnings report, he outlined the implementation of several measures to drive the turnaround and return to profitable growth. Check out the sector heatmap on MarketBeat.

Strategic review lifts sentiment

Two critical pieces of O'Kelly's plans are a cost reduction program estimated at growing cost savings of up to $150 million and a strategic review to enhance shareholder value. The company has initiated the sale process for potentially divesting Worldpac and Carquest, and engaged Centerview Partners to facilitate the sales process. No further details regarding the timing or price until the processes are concluded or it deems further disclosure is required.

10-Q delay is a gut punch

Unfortunately, the company also announced the discovery of accounting errors that will impact the cost of sales and G&A expenses in full-year 2022, leading to the delay of its 10-Q filing. This news hit shares like a gut punch, causing shares to sink 5.78% after recovering from the earnings gap of the prior day.

Dumpster fire paves the way for a clean start

Advanced Auto Parts Q3 2023 release took some non-recurring charges relating to inventory to gain a fresh start, embarking on a turnaround led by its new CEO. On November 15, 2023, Advanced Auto Parts reported a loss of 82 cents per share versus a consensus analyst profit of $1.44, down significantly from the $1.92 EPS in the year-ago period.

However, this includes a $119 million charge relating to an estimated change in the value of inventory reserves. Despite that, operating results were still weak due to higher product and supply chain costs and weaker demand. Operating losses were $43.7 million. Revenues rose 2.9% YoY to $2.72 billion, beating $2.68 billion analyst estimates.

Setting the bar way low

Advanced Auto Parts set the bar low, really low. For full-year 2023, the company expects EPS of $1.40 to $1.80, down from $4.50 to $5.10 previous estimates, versus $4.64 consensus analyst estimates. Full-year 2023 revenues are expected between $11.25 billion to $11.30 billion, down from $11.25 to $11.35 billion, versus $11.26 billion consensus analyst estimates.

CEO Insights

CEO O'Kelly stated they are planning to invest $50 million of the $150 million in cost savings from its new cost reduction plan in its employees to improve frontline team member retention. They have also initiated the sales process for Worldpac and Carquest to focus on its blended box business model. He commented, "We are committed to stabilizing the company and returning Advance to profitable growth, and our frontline team's passion and extensive knowledge are integral to how we succeed."

He continued, "Seeing our frontline team members in action delivering for customers, coupled with robust industry fundamentals and strong vendor relationships, has reaffirmed my optimism that by making rigorous strategic and operational decisions now, Advance will be well positioned to capitalize on the opportunities ahead and deliver value for shareholders."

Advanced Auto Parts analyst ratings and price targets are at MarketBeat. Advanced Auto Parts peers and competitor stocks can be found with the MarketBeat stock screener.

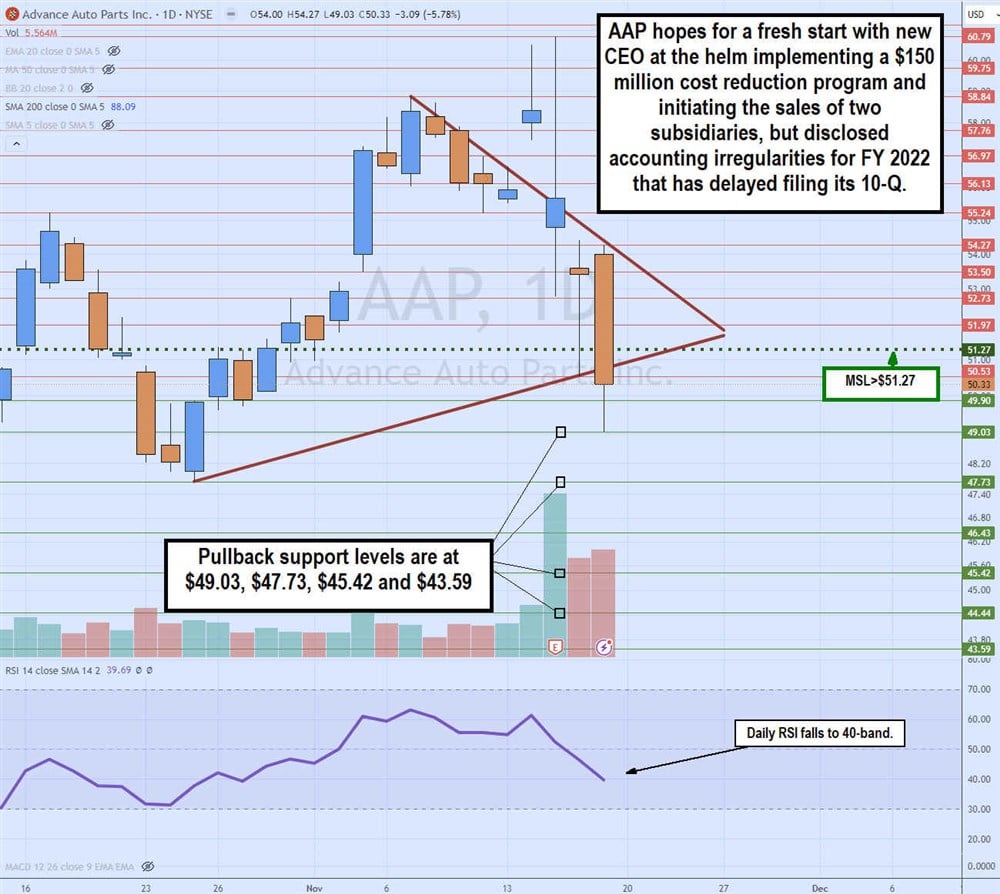

Daily symmetrical triangle breakdown

The daily candlestick chart on AAP illustrates a symmetrical triangle pattern on the verge of breaking down. The descending trendline commenced on November 7, 2023, after peaking at $58.84. The ascending lower trendline commenced on October 25, 2023, after bottoming at $47.73. AAP attempted to breakout through the upper trendline on November 14, 2023, but was pulled back into the triangle after its Q3 2023 earnings release. Share fell under the daily market structure low (MSL) trigger at $51.27 and the ascending lower trendline after announcing the delay of its 10-Q report, which completely vaporized any rally momentum. The daily relative strength index (RSI) has steadily fallen to the 40-band. Pullback support levels are $49.03, $47.73, $45.42 and $43.59.