ARCT-154 Phase 3 COVID-19 booster trial achieved primary endpoint demonstrating strong immune response and favorable safety profile

Meiji Seika Pharma submitted ARCT-154 New Drug Application in Japan

New ARCT-154 booster clinical data demonstrate one-year durability across a panel of variants

Received FDA Fast Track Designation and Rare Pediatric Disease Designation for ARCT-810 for OTC deficiency

Received regulatory approval of ARCT-032 to proceed into a Phase 1b clinical study in CF patients

Investor conference call at 4:30 p.m. ET today

Arcturus Therapeutics Holdings Inc. (the “Company,” “Arcturus,” Nasdaq: ARCT), a global late-stage clinical messenger RNA medicines company focused on the development of infectious disease vaccines and opportunities within liver and respiratory rare diseases, today announced its financial results for the second quarter and six months ended June 30, 2023 and provided corporate updates.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230807532754/en/

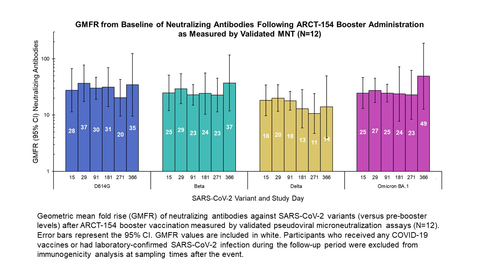

Geometric mean fold rise (GMFR) of neutralizing antibodies against SARS-CoV-2 variants (versus pre-booster levels) after ARCT-154 booster vaccination measured by validated pseudoviral microneutralization assays (N=12). Error bars represent the 95% CI. GMFR values are included in white. Participants who received any COVID-19 vaccines or had laboratory-confirmed SARS-CoV-2 infection during the follow-up period were excluded from immunogenicity analysis at sampling times after the event. (Graphic: Arcturus Therapeutics)

“Arcturus has continued to achieve significant operational progress alongside our exclusive global vaccines partner CSL Seqirus, highlighted by the NDA submission of ARCT-154, for the COVID-19 primary series vaccine and booster, in Japan by CSL Seqirus’ partner Meiji Seika Pharma,” said Joseph Payne, President & CEO of Arcturus Therapeutics. “As demonstrated by the recently published ARCT-154 Phase 3 head-to-head booster data versus Comirnaty®, we believe that our next generation STARR® mRNA platform is meaningfully differentiated. In addition to ARCT-154, we have also made significant progress with other clinical and pre-clinical mRNA therapeutic programs, and we look forward to sharing clinical data from our ARCT-810 and ARCT-032 programs later this year.”

Recent Corporate Highlights

-

The primary endpoint was achieved in the ARCT-154 Phase 3 booster vaccine study, demonstrating non-inferiority of immune response against SARS-CoV-2 ancestral strain compared to Comirnaty. Superiority of ARCT-154 in neutralizing antibody response against SARS-CoV-2 Omicron BA.4/5 variant was also demonstrated as a key secondary endpoint.

- The study compared immune responses between ARCT-154 and Comirnaty booster doses (original strain) in Japanese adults (N = 828 and randomized 1:1 to ARCT-154 and Comirnaty) that were previously immunized with two doses of mRNA COVID-19 vaccine then a third booster dose of Comirnaty at least 3 months prior to enrollment.

- ARCT-154, a self-amplifying mRNA vaccine, was administered at 5 mcg, a significantly lower dose relative to Comirnaty (30 mcg).

- Initial study results have been published in MedRxiv. The data suggests increased immunogenicity associated with ARCT-154 at Day 29 with 1.43-fold higher geometric mean titers of neutralizing antibodies against the vaccine strain versus Comirnaty.

- At the time of interim data cut, ARCT-154 was considered safe and tolerable with no safety concerns identified.

- Meiji Seika Pharma and the Japanese government provided funding for the ARCT-154 Phase 3 booster study.

- Meiji Seika Pharma is responsible for obtaining regulatory approval, distribution, sales and marketing of ARCT-154 in Japan.

- Meiji Seika Pharma announced a collaboration with ARCALIS Co., Ltd. to establish integrated cGMP mRNA vaccine manufacturing capabilities, from drug substance to drug product, in Japan. ARCALIS recently announced that construction has been completed for their state-of-the-art manufacturing facility in Japan.

- A Phase 1/2 clinical trial demonstrated one-year durability of immune response following ARCT-154 booster vaccine administration using validated microneutralization (MNT) assays. The geometric mean fold rise (GMFR) in neutralizing antibodies remained greater than 10-fold above baseline for one year across a panel of variants (ref: Figure), including Omicron BA.1.

- The LUNAR-FLU program continues to progress with funding and operational support from CSL Seqirus. LUNAR-FLU utilizes Arcturus’ validated next generation STARR® mRNA platform.

-

In June, the Company announced that the U.S. Food and Drug Administration (FDA) had granted Fast Track Designation to ARCT-810, the Company’s mRNA therapeutic candidate for ornithine transcarbamylase (OTC) deficiency. The Company has also recently received Rare Pediatric Disease Designation from the FDA for ARCT-810, which is designed to recognize serious or life-threatening manifestations primarily affecting patients under 18 years of age. Due to such designation, if ARCT-810 achieves approval for a pediatric indication in the original rare pediatric disease product application, Arcturus will receive a voucher for priority review of a subsequent marketing application for a different product.

- ARCT-810 Phase 1b single ascending dose study in the U.S. has completed enrollment and dosing of all cohorts (N = 16 patients).

- ARCT-810 Phase 2 study in UK and Europe will enroll up to 24 adolescents and adults with OTC deficiency. The ongoing study is evaluating two dose levels and includes up to six (6) bi-weekly administrations for each participant. The Company expects to share interim data on biological activity from a subset of patients in the coming months.

- ARCT-032, the Company’s inhaled mRNA therapeutic for cystic fibrosis, has completed dosing in a Phase 1 study in New Zealand, including 32 subjects across four (4) ascending single-dose cohorts. The Company received regulatory approval of a protocol amendment to allow the transition to a Phase 1b clinical study of ARCT-032 in up to 8 adult cystic fibrosis patients.

Financial Results for the Three and Six Months Ended June 30, 2023

Revenues in conjunction with strategic alliances and collaborations:

Arcturus’ primary sources of revenues were from license fees, consulting and related technology transfer fees, reservation fees and collaborative payments received from research and development arrangements with pharmaceutical and biotechnology partners. For the three months ended June 30, 2023, we reported revenue of $10.5 million compared with $27.1 million for the three months ended June 30, 2022. Revenue decreased by $16.6 million during the three months ended June 30, 2023 as compared to the prior year period. The decrease was primarily attributable to a decrease in revenue of $12.7 million related to the termination of the agreement with Vinbiocare and a decrease in revenue of $12.5 million related to the agreement with the Israeli Ministry of Health. The decrease was primarily offset by an increase in revenue of $8.6 million related to the collaboration agreement with CSL Seqirus and the grant agreement with BARDA which were both executed in the second half of 2022. Revenue increased by $58.5 million during the six months ended June 30, 2023 as compared to the six months ended June 30, 2022. The increase was attributable to an increase in revenue of $87.6 million primarily related to the collaboration agreement with CSL Seqirus and the grant agreement with BARDA which were both executed in the second half of 2022.

Operating expenses:

Total operating expenses for the three months ended June 30, 2023 were $65.9 million compared with $49.2 million for the three months ended June 30, 2022. Total operating expenses for the six months ended June 30, 2023 were $131.4 million compared with $104.8 million for the six months ended June 30, 2022.

Research and development expenses:

Our research and development expenses consist primarily of external manufacturing costs, in-vivo research studies and clinical trials performed by contract research organizations, clinical and regulatory consultants, personnel related expenses, facility related expenses and laboratory supplies related to conducting research and development activities. Research and development expenses were $52.7 million for the three months ended June 30, 2023, compared with $38.2 million in the comparable period last year, primarily reflecting increased clinical research and manufacturing costs of $11.4 million and an increase of $2.9 million in personnel related costs. Research and development expenses were $104.4 million for the six months ended June 30, 2023, compared with $83.1 million in the comparable period last year, primarily reflecting increased manufacturing costs of $11.1 million, an increase of $5.9 million in personnel related costs, an increase in consulting expenses of $1.8 million, an increase of $1.3 million in facilities expense and a decrease of contra research and development expenses recognized of $2.7 million. The increase was primarily offset by a decrease of clinical-related expenses of $1.2 million.

General and Administrative Expenses:

General and administrative expenses primarily consist of salaries and related benefits for our executive, administrative, legal and accounting functions and professional service fees for legal and accounting services as well as other general and administrative expenses. General and administrative expenses were $13.2 million and $27.0 million for the three and six months ended June 30, 2023, respectively, compared with $11.0 million and $21.7 million in the comparable periods last year. The increases resulted primarily from personnel expenses due to increased headcount and salaries, increased travel and consulting expenses as well as increased rent expense associated with the new facility.

Net Loss:

For the three months ended June 30, 2023, Arcturus reported a net loss of approximately $52.6 million, or ($1.98) per diluted share, compared with a net loss of $21.6 million, or ($0.82) per diluted share in the three months ended June 30, 2022. For the six months ended June 30, 2023, Arcturus reported a net loss of approximately $1.8 million, or ($0.07) per diluted share, compared with a net loss of $72.7 million, or ($2.75) per diluted share in the six months ended June 30, 2022.

Cash Position and Balance Sheet:

Cash, cash equivalents and restricted cash were $380.6 million as of June 30, 2023 and $394.0 million on December 31, 2022. We have collected approximately $300.0 million in upfront payments and milestones from CSL Seqirus as of June 30, 2023. Additionally, we received $23.6 million under the manufacturing and supply of ARCT-154 from CSL Seqirus during the quarter ended June 30, 2023. We expect to continue to receive future milestone payments from CSL Seqirus that will support the ongoing development of the covid and flu programs. The cash runway remains extended through the beginning of 2026 based on the current pipeline and programs.

Earnings Call: Monday, August 7, 2023 @ 4:30 pm ET

- Domestic: 1-877-407-0784

- International: 1-201-689-8560

- Conference ID: 13738872

- Webcast: Link

About Arcturus Therapeutics

Founded in 2013 and based in San Diego, California, Arcturus Therapeutics Holdings Inc. (Nasdaq: ARCT) is a global late-stage clinical mRNA medicines and vaccines company with enabling technologies: (i) LUNAR® lipid-mediated delivery, (ii) STARR® mRNA Technology (samRNA) and (iii) mRNA drug substance along with drug product manufacturing expertise. Arcturus’ pipeline includes RNA therapeutic candidates to potentially treat ornithine transcarbamylase deficiency and cystic fibrosis, along with its partnered mRNA vaccine programs for SARS-CoV-2 (COVID-19) and influenza. Arcturus’ versatile RNA therapeutics platforms can be applied toward multiple types of nucleic acid medicines including messenger RNA, small interfering RNA, circular RNA, antisense RNA, self-amplifying mRNA, DNA, and gene editing therapeutics. Arcturus’ technologies are covered by its extensive patent portfolio (patents and patent applications issued in the U.S., Europe, Japan, China, and other countries). For more information, visit www.ArcturusRx.com. In addition, please connect with us on Twitter and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact included in this press release, are forward-looking statements, including those regarding strategy, future operations, the likelihood of success of the Company’s pipeline (including ARCT-032 and ARCT-810) and partnered programs (including the COVID-19 and flu programs partnered with CSL Seqirus), the potential of the Company’s platform technology to be meaningfully differentiated from other technologies, the anticipated timing and sharing of clinical data including from the Company’s ARCT-810 and ARCT-032 programs, the continued progress of the LUNAR-FLU program, the likelihood and timing of regulatory approvals of any products including ARCT-154 in Japan or anywhere else, the anticipated conduct of the ARCT-032 study in New Zealand, the likelihood that preclinical or clinical data will be predictive of future clinical results, the likelihood that the interim study results of the ARCT-154 Phase 3 booster vaccine study will be predictive of, or consistent with, the complete study results, the likelihood that a patent will issue from any patent application, the likelihood or timing of collection of accounts receivables including expected payments from CSL Seqirus, its current cash position and expected cash burn and runway, and the impact of general business and economic conditions. Arcturus may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in any forward-looking statements such as the foregoing and you should not place undue reliance on such forward-looking statements. These statements are only current predictions or expectations, and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements, including those discussed under the heading "Risk Factors" in Arcturus’ most recent Annual Report on Form 10-K, and in subsequent filings with, or submissions to, the SEC, which are available on the SEC’s website at www.sec.gov. Except as otherwise required by law, Arcturus disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or otherwise.

Trademark Acknowledgements

The Arcturus logo and other trademarks of Arcturus appearing in this announcement, including LUNAR® and STARR®, are the property of Arcturus. All other trademarks, services marks, and trade names in this announcement are the property of their respective owners.

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||

|

|

June 30,

|

|

December 31,

|

||||

(in thousands, except par value information) |

|

(unaudited) |

|

|

||||

Assets |

|

|

|

|

||||

Current assets: |

|

|

|

|

||||

Cash and cash equivalents |

|

$ |

323,471 |

|

|

$ |

391,883 |

|

Restricted cash |

|

|

55,000 |

|

|

|

— |

|

Accounts receivable |

|

|

2,799 |

|

|

|

2,764 |

|

Prepaid expenses and other current assets |

|

|

3,974 |

|

|

|

8,686 |

|

Total current assets |

|

|

385,244 |

|

|

|

403,333 |

|

Property and equipment, net |

|

|

12,722 |

|

|

|

12,415 |

|

Operating lease right-of-use asset, net |

|

|

30,553 |

|

|

|

32,545 |

|

Non-current restricted cash |

|

|

2,127 |

|

|

|

2,094 |

|

Total assets |

|

$ |

430,646 |

|

|

$ |

450,387 |

|

Liabilities and stockholders’ equity |

|

|

|

|

||||

Current liabilities: |

|

|

|

|

||||

Accounts payable |

|

$ |

13,619 |

|

|

$ |

7,449 |

|

Accrued liabilities |

|

|

28,763 |

|

|

|

30,232 |

|

Current portion of long-term debt |

|

|

— |

|

|

|

60,655 |

|

Deferred revenue |

|

|

47,963 |

|

|

|

28,648 |

|

Total current liabilities |

|

|

90,345 |

|

|

|

126,984 |

|

Deferred revenue, net of current portion |

|

|

25,725 |

|

|

|

20,071 |

|

Operating lease liability, net of current portion |

|

|

28,111 |

|

|

|

30,216 |

|

Other non-current liabilities |

|

|

1,290 |

|

|

|

2,804 |

|

Total liabilities |

|

|

145,471 |

|

|

|

180,075 |

|

Stockholders’ equity |

|

|

|

|

||||

Common stock, $0.001 par value; 60,000 shares authorized; issued and outstanding shares were 26,574 at June 30, 2023 and 26,555 at December 31, 2022 |

|

|

27 |

|

|

|

27 |

|

Additional paid-in capital |

|

|

625,085 |

|

|

|

608,426 |

|

Accumulated deficit |

|

|

(339,937 |

) |

|

|

(338,141 |

) |

Total stockholders’ equity |

|

|

285,175 |

|

|

|

270,312 |

|

Total liabilities and stockholders’ equity |

|

$ |

430,646 |

|

|

$ |

450,387 |

|

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (unaudited) |

||||||||||||||||

|

|

Three Months Ended |

|

Six Months Ended |

||||||||||||

|

|

June 30, |

|

June 30, |

||||||||||||

(in thousands, except per share data) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

Revenue: |

|

|

|

|

|

|

|

|

||||||||

Collaboration revenue |

|

$ |

9,565 |

|

|

$ |

27,093 |

|

|

$ |

89,294 |

|

|

$ |

32,337 |

|

Grant revenue |

|

|

954 |

|

|

|

— |

|

|

|

1,510 |

|

|

|

— |

|

Total revenue |

|

|

10,519 |

|

|

|

27,093 |

|

|

|

90,804 |

|

|

|

32,337 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

||||||||

Research and development, net |

|

|

52,668 |

|

|

|

38,189 |

|

|

|

104,436 |

|

|

|

83,082 |

|

General and administrative |

|

|

13,225 |

|

|

|

10,993 |

|

|

|

26,987 |

|

|

|

21,723 |

|

Total operating expenses |

|

|

65,893 |

|

|

|

49,182 |

|

|

|

131,423 |

|

|

|

104,805 |

|

Loss from operations |

|

|

(55,374 |

) |

|

|

(22,089 |

) |

|

|

(40,619 |

) |

|

|

(72,468 |

) |

Loss from equity-method investment |

|

|

— |

|

|

|

(131 |

) |

|

|

— |

|

|

|

(515 |

) |

Gain (loss) from foreign currency |

|

|

149 |

|

|

|

1,217 |

|

|

|

(179 |

) |

|

|

1,375 |

|

Gain on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

33,953 |

|

|

|

— |

|

Finance income (expense), net |

|

|

3,252 |

|

|

|

(560 |

) |

|

|

5,729 |

|

|

|

(1,124 |

) |

Net loss before income taxes |

|

|

(51,973 |

) |

|

|

(21,563 |

) |

|

|

(1,116 |

) |

|

|

(72,732 |

) |

Provision for income taxes |

|

|

577 |

|

|

|

- |

|

|

|

680 |

|

|

|

||

Net loss |

|

$ |

(52,550 |

) |

|

$ |

(21,563 |

) |

|

$ |

(1,796 |

) |

|

$ |

(72,732 |

) |

Net loss per share, basic and diluted |

|

$ |

(1.98 |

) |

|

$ |

(0.82 |

) |

|

$ |

(0.07 |

) |

|

$ |

(2.75 |

) |

Weighted-average shares outstanding, basic and diluted |

|

|

26,563 |

|

|

|

26,425 |

|

|

|

26,557 |

|

|

|

26,401 |

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

||||||||

Net loss |

|

$ |

(52,550 |

) |

|

$ |

(21,563 |

) |

|

$ |

(1,796 |

) |

|

$ |

(72,732 |

) |

Comprehensive loss |

|

$ |

(52,550 |

) |

|

$ |

(21,563 |

) |

|

$ |

(1,796 |

) |

|

$ |

(72,732 |

) |

View source version on businesswire.com: https://www.businesswire.com/news/home/20230807532754/en/

Contacts

IR and Media Contacts

Arcturus Therapeutics

Neda Safarzadeh

VP, Head of IR/PR/Marketing

(858) 900-2682

IR@ArcturusRx.com

Kendall Investor Relations

Carlo Tanzi, Ph.D.

(617) 914-0008

ctanzi@kendallir.com