Study conducted by Morning Consult reveals providers believe 96% of payment is now value-based in some capacity, and 58% believe their EHR vendor won’t be able to support the data strategies required to thrive under value-based care

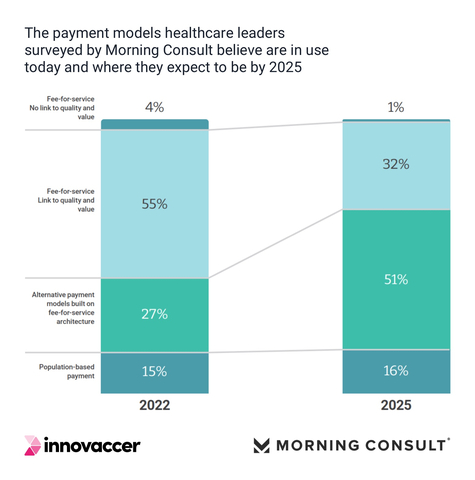

New research released today by Morning Consult and Innovaccer finds most providers believe value-based care has firmly displaced fee-for-service as the dominant payment and care delivery model. Only 4% of providers today report using pure FFS with no links to quality and value, and that plummets to 1% by 2025. Providers believe the payment model that’s historically dominated in healthcare has flamed out, and that 96% of healthcare payment today has connections to care quality, cost reductions and, in some cases, patient experience. That leaps to 99% by 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220913005652/en/

Fig. 1: The payment models healthcare leaders surveyed by Morning Consult believe are in use today and where they expect to be by 2025. (Graphic: Business Wire)

“At Innovaccer, we’re now talking about three key numbers: 5, 15, and 80,” said Amy Stevens, general manager of provider performance at Innovaccer. “This national ‘state of the union’ on payment models shows providers believe less than 5% of the dollars reimbursed today are in full traditional FFS. Only 15% of the dollars reimbursed are in full risk, according to the providers surveyed. These providers believe their remaining 80% sits in the middle as alternative payment models, with providers reporting they’re under increasing pressure to move these dollars to more performance-based, risk-heavy models.”

Moreover, while providers report they have moved 96% of their revenue into some form of performance risk, 80% of those programs operate on a FFS architecture, where claims submission (as opposed to population-based payment) remains the driving force for value-based analysis and payment. The FFS architecture is even present in Shared Savings models, according to respondents, where healthcare costs are compared with a goal, and providers and payers share in the savings or losses.

“This is a really interesting and somewhat troubling dynamic, where providers think they’re very far along on the journey to pure risk, but I can tell you that they’re not,” said Dr. Brian Silverstein, chief population health officer at Innovaccer. ”Payers report that pure FFS remains in the double digits within their provider networks. So, providers think the transition to value has substantially occurred, when in fact we're only at the very beginning. The amount of financial risk providers have is going to increase significantly in the next few years. It's clear they don’t have the tools, analytics, and processes to know how they're performing on risk-based contracts and see that a tsunami is coming.”

These insights and more are revealed in the State and Science of Value-Based Care, a newly published 37-page national research study conducted by Morning Consult and Innovaccer. The study uncovers key IT infrastructure issues healthcare leaders said are impeding or essential for progress towards accelerating their transformation to value-based care. Among other top highlights:

- 58% said they didn’t believe their EHR vendor could support their enterprise data strategy.

- 42% said their data is highly fragmented and siloed, a blind spot for insights, workflows, actions, and reporting essential for value-based care delivery.

- 48% said they’re not confident their organization has the infrastructure to capture and use the full range of patient data.

- 41% said their organization needs population health analytics to advance their enterprise data/information strategy, making it the #1 capability sought among ten priorities offered.

- 68% said their organization doesn’t have the AI capabilities to drive digital transformation essential for value-based care.

- 69% of healthcare leaders said they aren’t using technology to identify at-risk patients.

- Despite a 94% increase in the number of executives who expect consumer-generated data to have a high impact on SDoH by 2025, 72% of respondents aren’t integrating medical and social determinants data.

In addition to presenting key findings on providers’ outlook on value-based care, the State and Science of Value-Based Care report covers value-based care challenges and opportunities reported by respondents; addresses the people, process, and technology gaps respondents said must be bridged; and provides expert commentary and guidance to help providers to put their data to work to accelerate their transition to value.

“The research shows a strong relationship between an organization’s investment in modern digital infrastructure and their ability to succeed with value-based payment models,” Stevens said. “Digital investments will be the deciding factor for more mature risk-bearing organizations. The key to value-based care is the ability to integrate data from EHRs and other IT silos—clinical, claims, labs, pharmacy, telehealth, remote monitoring, social determinants, consumer generated, you name it—into a unified patient record that lets providers drive the analytics-driven workflows, care management, risk stratification, and patient engagement strategies to drive better outcomes at a lower cost.”

Download the State and Science of Value-Based Care here.

Research Methodology

The report was developed from healthcare leadership survey results compiled by Morning Consult and Innovaccer. The survey was designed to capture the opinions and experiences of healthcare executives around value-based care and related topics. The research was conducted in November and December 2021. Morning Consult compiled a national blue-ribbon panel of 75 U.S.-based C-suite, VP, and director-level executives at academic and non-academic health systems and facilities with up to 2,000 beds, and revenue from less than $1 billion to over $10 billion. All respondents had decision-making authority, share or influence final decisions with regards to technology investments for their organizations. Their views reflect a statistically accurate cross-section of healthcare leaderships’ opinions, views, pressures, and priorities heading into calendar year 2022. Innovaccer Research conducted an online survey with a sample comprising 160 healthcare executives, of which 37% were CXOs, 40% were providers, and 24% were nurses and other relevant clinicians. Health system size ranged from serving under 500,000 to over 2 million lives. Responses were segregated and sourcing documented in the report.

About Innovaccer

Innovaccer Inc., the Health Cloud company, is dedicated to accelerating innovation in healthcare. The Innovaccer® Health Cloud unifies patient data across systems and care settings, and empowers healthcare organizations to develop scalable, modern applications that improve clinical, financial, and operational outcomes. Innovaccer’s solutions have been deployed across more than 1,600 care settings in the U.S., enabling more than 96,000 providers to transform care delivery and work collaboratively with payers and life sciences companies. Innovaccer has helped its customers unify health records for more than 39 million people and generate over $1B in cumulative cost savings. Innovaccer is the #1 rated Data and Analytics Platform by KLAS, and the #1 rated population health technology platform by Black Book. For more information, please visit innovaccer.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220913005652/en/

Contacts

Sachin Saxena

Innovaccer Inc.

sachin_saxena@innovaccer.com

415-504-3851