Nighthawk Gold Corp. (“Nighthawk” or the “Company”) (TSX: NHK; OTCQX: MIMZF) is pleased to report additional drill assay results from its 2022 Exploration Program, with encouraging results from the Grizzly Bear Deposit and 24 and 27 Deposits (collectively, the “24/27 Deposit”) within the Colomac Centre Area.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220901005119/en/

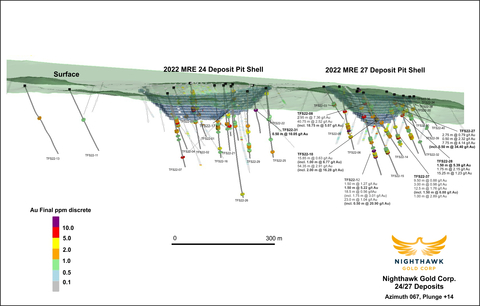

Figure 1 – 24/27 Deposits Isometric View Looking West (Graphic: Business Wire)

Table 1 – Highlight Drill Assay Results from the 24/27 and Grizzly Bear Deposits

Hole ID |

Deposit |

Highlight Assay Result |

||

TFS22-10 |

24/27 |

2.91 grams per tonne (“g/t Au”) over 54.35 metres (“m”) (including 16.28 g/t Au over 2.00 m) |

||

TFS22-08 |

24/27 |

2.52 g/t Au over 40.75 m (including 5.07 g/t Au over 18.75 m) |

||

TFS22-27 |

24/27 |

4.14 g/t Au over 7.75 m (including 34.40 g/t Au over 0.50 m) |

||

GB22-31 |

Grizzly Bear |

3.02 g/t Au over 20.25 m (including 22.69 g/t Au over 1.00 m) |

||

GB22-29 |

Grizzly Bear |

1.41 g/t Au over 21.50 m (2.50 g/t Au over 10.25 m) |

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

Nighthawk President & CEO Keyvan Salehi commented, “The latest drill results, combined with results released previously from Grizzly Bear1 and 24/272 Deposits, demonstrate the immense potential for mineral resource expansion within the Colomac Centre.”

24/27 Deposit

The Colomac Centre Area (please refer to Figure 3 for the Plan View Map) represents a group of five proximal deposits (Colomac Main, Grizzly Bear, Goldcrest, 24/27) in the heart of the Colomac Gold Project. The Company continued to intersect higher-grade intervals from the infill and step-out drilling at the 24/27 Deposit. Nighthawk has identified stacked zones of mineralization, increasing the width of the mineralized corridor, suggesting the potential expansion of the mineral resources in the area. Mineralization continues to remain open in all directions of 24/27 Deposit. Please refer to Figures 1, 4, and 5 for the 24/27 Deposit drilling Isometric, Plan, and Section views, respectively. Please refer to Tables 1 and 2 for the Highlight Drill Assay Results and Drill Assay Results Summary, respectively.

Grizzly Bear Deposit

The Grizzly Bear Deposit is located approximately 800 m southwest of the Colomac Main Deposit. Mineralization at the Grizzly Bear Deposit is hosted in smoky quartz veining in the felsic volcanic porphyry, along the lower contact to the mafic-intermediate volcanics. The current batch of drill results intersected downdip mineralized intervals along the boundary and outside of the pit-constrained Grizzly Bear Deposit 2022 Mineral Resource Estimate3, suggesting the potential expansion of the mineral resources in the area. Please refer to Figures 2, 6, 7, and 8 for the Isometric View, Plan View, Section View #1, and Section View #2 of the Grizzly Bear Deposit drilling, respectively.

Table 2 – Drill Assay Results Summary – Grizzly Bear and 24/27 Deposits

Hole ID |

Interval (m) |

Core Length |

Gold Grade |

|||||

From |

To |

(m) |

(g/t Au) |

|||||

Grizzly Bear Deposit |

||||||||

GB22-09 |

133.50 |

152.00 |

18.50 |

0.40 |

||||

including |

133.50 |

135.00 |

1.50 |

2.24 |

||||

GB22-12 |

226.00 |

227.50 |

1.50 |

5.42 |

||||

GB22-13 |

No Significant Intervals |

|||||||

GB22-17 |

43.75 |

44.50 |

0.75 |

2.05 |

||||

and |

83.00 |

105.25 |

22.25 |

1.02 |

||||

including |

103.75 |

104.75 |

1.00 |

11.65 |

||||

GB22-18 |

73.25 |

74.00 |

0.75 |

2.79 |

||||

and |

101.25 |

125.00 |

23.75 |

0.59 |

||||

including |

124.25 |

125.00 |

0.75 |

8.69 |

||||

GB22-19 |

72.00 |

73.00 |

1.00 |

1.61 |

||||

GB22-20 |

132.50 |

141.75 |

9.25 |

0.77 |

||||

including |

141.00 |

141.75 |

0.75 |

5.59 |

||||

GB22-21 |

138.00 |

149.00 |

11.00 |

0.97 |

||||

GB22-22 |

No Significant Intervals |

|||||||

GB22-23 |

109.00 |

126.00 |

17.00 |

1.44 |

||||

including |

114.75 |

115.50 |

0.75 |

12.65 |

||||

GB22-24 |

65.00 |

70.25 |

5.25 |

1.52 |

||||

and |

121.50 |

124.00 |

2.50 |

6.47 |

||||

GB22-25 |

No Significant Intervals |

|||||||

GB22-26 |

No Significant Intervals |

|||||||

GB22-27 |

147.40 |

150.50 |

3.10 |

2.05 |

||||

GB22-28 |

17.90 |

18.65 |

0.75 |

3.88 |

||||

and |

84.50 |

104.00 |

19.50 |

0.99 |

||||

including |

98.50 |

99.00 |

0.50 |

11.60 |

||||

GB22-29 |

104.50 |

126.00 |

21.50 |

1.41 |

||||

including |

115.75 |

126.00 |

10.25 |

2.50 |

||||

GB22-30 |

91.65 |

93.50 |

1.85 |

1.07 |

||||

and |

101.00 |

102.00 |

1.00 |

2.10 |

||||

GB22-31 |

129.50 |

149.75 |

20.25 |

3.02 |

||||

including |

129.50 |

130.50 |

1.00 |

22.69 |

||||

GB22-32 |

78.20 |

99.25 |

21.05 |

0.54 |

||||

including |

80.20 |

80.70 |

0.50 |

9.52 |

||||

GB22-33 |

68.50 |

70.00 |

1.50 |

2.36 |

||||

GB22-34 |

147.00 |

147.75 |

0.75 |

2.27 |

||||

24/27 Deposit |

||||||||

TFS22-08 |

7.25 |

10.20 |

2.95 |

7.36 |

||||

and |

44.00 |

84.75 |

40.75 |

2.52 |

||||

including |

66.00 |

84.75 |

18.75 |

5.07 |

||||

TFS22-10 |

49.15 |

65.00 |

15.85 |

0.63 |

||||

including |

64.00 |

65.00 |

1.00 |

6.77 |

||||

and |

101.00 |

155.35 |

54.35 |

2.91 |

||||

including |

101.50 |

103.50 |

2.00 |

16.28 |

||||

TFS22-12 |

57.00 |

58.50 |

1.50 |

1.27 |

||||

and |

88.00 |

89.50 |

1.50 |

5.22 |

||||

and |

163.50 |

182.00 |

18.50 |

0.56 |

||||

including |

170.75 |

172.50 |

1.75 |

3.01 |

||||

and |

211.00 |

234.00 |

23.00 |

1.04 |

||||

including |

211.00 |

211.50 |

0.50 |

20.90 |

||||

TFS22-18 |

113.00 |

114.50 |

1.50 |

2.31 |

||||

and |

159.65 |

160.65 |

1.00 |

4.95 |

||||

TFS22-19 |

Lost Hole |

|||||||

TFS22-23 |

33.50 |

35.00 |

1.50 |

2.81 |

||||

and |

70.00 |

71.00 |

1.00 |

1.08 |

||||

TFS22-24 |

150.50 |

152.00 |

1.50 |

2.04 |

||||

and |

158.75 |

160.00 |

1.25 |

1.46 |

||||

TFS22-27 |

53.65 |

56.40 |

2.75 |

0.79 |

||||

and |

82.00 |

82.50 |

0.50 |

2.32 |

||||

and |

104.60 |

112.35 |

7.75 |

4.14 |

||||

including |

111.85 |

112.35 |

0.50 |

34.40 |

||||

TFS22-28 |

77.50 |

79.00 |

1.50 |

5.39 |

||||

and |

123.25 |

125.00 |

1.75 |

2.15 |

||||

and |

151.00 |

166.25 |

15.25 |

1.23 |

||||

TFS22-29 |

139.00 |

140.50 |

1.50 |

1.13 |

||||

and |

163.50 |

164.50 |

1.00 |

3.19 |

||||

and |

220.00 |

228.50 |

8.50 |

0.67 |

||||

and |

239.75 |

243.00 |

3.25 |

1.27 |

||||

TFS22-30 |

68.75 |

71.00 |

2.25 |

1.43 |

||||

TFS22-31 |

104.00 |

104.50 |

0.50 |

10.05 |

||||

TFS22-32 |

81.30 |

86.30 |

5.00 |

0.57 |

||||

TFS22-33 |

78.00 |

79.00 |

1.00 |

2.21 |

||||

TFS22-23 |

33.50 |

35.00 |

1.50 |

2.81 |

||||

and |

70.00 |

71.00 |

1.00 |

1.08 |

||||

TFS22-24 |

150.50 |

152.00 |

1.50 |

2.04 |

||||

and |

158.75 |

160.00 |

1.25 |

1.46 |

||||

TFS22-27 |

53.65 |

56.40 |

2.75 |

0.79 |

||||

and |

82.00 |

82.50 |

0.50 |

2.32 |

||||

and |

104.60 |

112.35 |

7.75 |

4.14 |

||||

including |

111.85 |

112.35 |

0.50 |

34.40 |

||||

TFS22-28 |

77.50 |

79.00 |

1.50 |

5.39 |

||||

and |

123.25 |

125.00 |

1.75 |

2.15 |

||||

and |

151.00 |

166.25 |

15.25 |

1.23 |

||||

TFS22-29 |

139.00 |

140.50 |

1.50 |

1.13 |

||||

and |

163.50 |

164.50 |

1.00 |

3.19 |

||||

and |

220.00 |

228.50 |

8.50 |

0.67 |

||||

and |

239.75 |

243.00 |

3.25 |

1.27 |

||||

TFS22-30 |

68.75 |

71.00 |

2.25 |

1.43 |

||||

TFS22-31 |

104.00 |

104.50 |

0.50 |

10.05 |

||||

TFS22-32 |

81.30 |

86.30 |

5.00 |

0.57 |

||||

TFS22-33 |

78.00 |

79.00 |

1.00 |

2.21 |

||||

TFS22-34 |

No Significant Intervals |

|||||||

TFS22-35 |

228.00 |

229.00 |

1.00 |

4.11 |

||||

TFS22-36 |

Lost Hole |

|||||||

TFS22-37 |

65.00 |

74.50 |

9.50 |

0.88 |

||||

and |

122.75 |

125.75 |

3.00 |

0.98 |

||||

and |

151.50 |

164.00 |

12.50 |

1.76 |

||||

including |

160.50 |

162.00 |

1.50 |

6.88 |

||||

and |

184.00 |

185.00 |

1.00 |

2.89 |

||||

TFS22-38 |

No Significant Intervals |

|||||||

TFS22-39 |

No Significant Intervals |

|||||||

TFS22-40 |

No Significant Intervals |

|||||||

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

Deposit |

BHID |

Easting |

Northing |

Elevation |

Length |

Azimuth |

Dip |

|||||||

Grizzly Bear |

GB22-09 |

590681 |

7140318 |

344 |

180 |

300 |

-45 |

|||||||

Grizzly Bear |

GB22-12 |

590699 |

7140277 |

353 |

252 |

300 |

-60 |

|||||||

Grizzly Bear |

GB22-13 |

590663 |

7140254 |

354 |

225 |

300 |

-50 |

|||||||

Grizzly Bear |

GB22-17 |

590445 |

7140018 |

344 |

201 |

330 |

-45 |

|||||||

Grizzly Bear |

GB22-18 |

590445 |

7140018 |

344 |

252 |

330 |

-60 |

|||||||

Grizzly Bear |

GB22-19 |

590419 |

7139974 |

341 |

252 |

330 |

-55 |

|||||||

Grizzly Bear |

GB22-20 |

590335 |

7139900 |

334 |

201 |

310 |

-45 |

|||||||

Grizzly Bear |

GB22-21 |

590335 |

7139900 |

334 |

222 |

310 |

-60 |

|||||||

Grizzly Bear |

GB22-22 |

590274 |

7139895 |

330 |

150 |

310 |

-45 |

|||||||

Grizzly Bear |

GB22-23 |

590274 |

7139895 |

330 |

177 |

310 |

-60 |

|||||||

Grizzly Bear |

GB22-24 |

590184 |

7139817 |

324 |

150 |

335 |

-60 |

|||||||

Grizzly Bear |

GB22-25 |

590187 |

7139745 |

325 |

225 |

330 |

-50 |

|||||||

Grizzly Bear |

GB22-26 |

590187 |

7139745 |

325 |

234 |

330 |

-60 |

|||||||

Grizzly Bear |

GB22-27 |

590158 |

7139744 |

325 |

201 |

315 |

-56 |

|||||||

Grizzly Bear |

GB22-28 |

590117 |

7139717 |

327 |

156 |

315 |

-45 |

|||||||

Grizzly Bear |

GB22-29 |

590117 |

7139717 |

327 |

177 |

315 |

-55 |

|||||||

Grizzly Bear |

GB22-30 |

590085 |

7139676 |

329 |

168 |

315 |

-48 |

|||||||

Grizzly Bear |

GB22-31 |

590085 |

7139676 |

329 |

204 |

315 |

-62 |

|||||||

Grizzly Bear |

GB22-32 |

590024 |

7139667 |

328 |

128.2 |

315 |

-60 |

|||||||

Grizzly Bear |

GB22-33 |

589943 |

7139607 |

329 |

115.7 |

315 |

-56 |

|||||||

Grizzly Bear |

GB22-34 |

590020 |

7139635 |

329 |

225 |

315 |

-72 |

|||||||

24/27 |

TFS22-08 |

595509 |

7144839 |

372 |

150 |

95 |

-50 |

|||||||

24/27 |

TFS22-10 |

595446 |

7144810 |

382 |

225 |

95 |

-45 |

|||||||

24/27 |

TFS22-12 |

595446 |

7144810 |

382 |

300 |

95 |

-65 |

|||||||

24/27 |

TFS22-18 |

595398 |

7145197 |

361 |

201 |

70 |

-60 |

|||||||

24/27 |

TFS22-19 |

595503 |

7144746 |

378 |

12 |

95 |

-45 |

|||||||

24/27 |

TFS22-23 |

595440 |

7145192 |

354 |

126 |

70 |

-50 |

|||||||

24/27 |

TFS22-24 |

595407 |

7145180 |

358.725 |

225 |

70 |

-60 |

|||||||

24/27 |

TFS22-27 |

595496 |

7144720 |

374 |

150 |

95 |

-45 |

|||||||

24/27 |

TFS22-28 |

595496 |

7144720 |

374 |

225 |

95 |

-60 |

|||||||

24/27 |

TFS22-29 |

595389 |

7145117 |

356 |

276 |

65 |

-58 |

|||||||

24/27 |

TFS22-30 |

595500 |

7144695 |

373 |

150 |

95 |

-45 |

|||||||

24/27 |

TFS22-31 |

595455 |

7145139 |

354 |

210 |

65 |

-58 |

|||||||

24/27 |

TFS22-32 |

595500 |

7144695 |

373 |

225 |

95 |

-60 |

|||||||

24/27 |

TFS22-33 |

595420 |

7143221 |

380 |

348 |

100 |

-50 |

|||||||

24/27 |

TFS22-34 |

595502 |

7144672 |

373 |

45 |

95 |

-45 |

|||||||

24/27 |

TFS22-35 |

595366 |

7143093 |

383 |

351 |

100 |

-50 |

|||||||

24/27 |

TFS22-36 |

595503 |

7144746 |

378 |

21 |

95 |

-60 |

|||||||

24/27 |

TFS22-37 |

595503 |

7144746 |

378 |

195 |

95 |

-65 |

|||||||

24/27 |

TFS22-38 |

595501 |

7144672 |

373 |

21 |

95 |

-45 |

|||||||

24/27 |

TFS22-39 |

595501 |

7144672 |

373 |

177 |

95 |

-53 |

|||||||

24/27 |

TFS22-40 |

595493 |

7144656 |

378 |

162 |

95 |

-45 |

Technical Information

The pit shell outlines in Figures 1 to 8 are from the 2022 MRE3 and were completed by InnovExplo Inc. and are defined by a US$1,600/oz gold price assumption.

Nighthawk has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. Drill core samples were transported in security-sealed bags for analyses at ALS Global Assay Laboratory in Vancouver, BC (“ALS Global”). ALS Global is an ISO/IEC 17025 accredited laboratory. Halved drill core is stored on site and pulps are returned and stored for record.

As part of its QA/QC program, Nighthawk inserts external gold standards (low to high-grade), blanks and duplicates every 20 samples in addition to the standards, blanks, and pulp duplicates inserted by ALS Global.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for Nighthawk, who is the “Qualified Person” as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About Nighthawk

Nighthawk is a Canadian-based gold exploration company with 100% ownership of more than 930 km2 of district-scale land position within the Indin Lake Greenstone Gold Belt, located approximately 200 km north of Yellowknife, Northwest Territories, Canada. The Company is advancing several highly prospective exploration targets. The Colomac Centre and Satellite deposits currently has a Mineral Resource Estimate3 of 58.2 million tonnes grading 1.44 g/t Au for 2.69 million ounces in the Indicated category and 19.7 million tonnes grading 2.10 g/t Au for 1.33 million ounces in the Inferred category. Nighthawk’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards demonstrating the economic viability of its assets and rapidly advancing its projects towards a development decision.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to the Company’s mineral resource estimates, potential expansion of pit-constrained mineralization, potential expansion of mineral resource estimates, the potential for higher-grade assay results, continued exploration and drilling initiatives and having the necessary funding required to complete these initiatives, the prospectivity of exploration targets, the potential economic viability of the assets, and the advancement of projects towards a development decision. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “add” or “additional”, “advancing”, “anticipates” or “does not anticipate”, “appears”, “believes”, “can be”, “continue”, “demonstrating”, “estimates”, “encouraging”, “expand” or “expanding” or “expansion”, “expect” or “expectations”, “forecasts”, “forward”, “goal”, “increase”, “intends”, “justification”, “support”, “plans”, “potential” or “potentially”, “prospective”, “prioritize”, “reflects”, “scheduled”, “suggesting”, “updating”, “will be” or “will consider”, “work towards”, ,or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or "will be taken", "occur", or "be achieved".

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nighthawk to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, impact of inflation, impact of the war in Ukraine, risks associated with the COVID-19 pandemic, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Nighthawk’s annual information form for the year ended December 31, 2021, available on www.sedar.com. Although Nighthawk has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Nighthawk does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

1 Please refer to the Nighthawk July 19, 2022 news release, which is available on the Company’s website at www.nighthawkgold.com and in the Company’s profile in www.sedar.com.

2 Please refer to the Nighthawk July 27, 2022 news release, which is available on the Company’s website at www.nighthawkgold.com and in the Company’s profile in www.sedar.com.

3For more information on the Mineral Resource Estimate (“2022 MRE”) please refer to the March 8, 2022 news release and in the Company’s NI 43-101 technical report entitled “NI 43-101 Technical Report and Update of the Mineral Resource Estimate for the Indin Lake Gold Property, Northwest Territories, Canada” and dated March 31, 2022 (“Technical Report”), which is available on SEDAR www.sedar.com and on the Company’s website at www.nighthawkgold.com. John McBride, Vice President of Exploration of Nighthawk, who is the “Qualified Person” as defined by NI 43-101, has reviewed, and approved of the scientific and technical disclosure contained in this news release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220901005119/en/

The latest drill results, combined with results released previously from Grizzly Bear and 24/27 Deposits, demonstrate the immense potential for mineral resource expansion within the Colomac Centre.

Contacts

NIGHTHAWK GOLD CORP.

Tel: 1-416-880-7090; Email: info@nighthawkgold.com

Website: www.nighthawkgold.com

Keyvan Salehi

President & CEO

Michael Leskovec

CFO

Allan Candelario

VP, Investor Relations & Corporate Development