Enviva Inc. (NYSE: EVA) (“Enviva,” “we,” “us,” or “our”) today provided a business update in advance of planned investor meetings that included the reaffirmation of full-year 2022 financial guidance, preliminary expectations for second-quarter 2022 adjusted EBITDA, and the announcement of a new European contract.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220621006100/en/

(Graphic: Business Wire)

Highlights:

- Reaffirming full-year 2022 financial guidance, including net income (loss) of $30 million net loss to $10 million net income, and adjusted EBITDA of $230 million to $270 million. Full-year 2022 adjusted EBITDA is forecasted to increase by approximately 10% as compared to 2021, using the midpoint of the guidance range. Full-year 2022 dividend expectations of $3.62 per share remain unchanged, representing a 10% increase as compared to 2021

- Expecting second-quarter 2022 sales volumes to increase approximately 20% over first-quarter 2022 actuals, as short-term supply chain issues continue to resolve

- Announcing the signing of a 60,000 metric ton per year (“MTPY”), 12-year, take-or-pay off-take contract with an existing customer, a large European utility, for industrial heat generation, with deliveries expected to commence during 2026

- Announcing the start of construction of Enviva’s fully contracted wood pellet production plant in Epes, Alabama; when fully ramped, the plant is expected to generate approximately $65 million in annual adjusted EBITDA, resulting in an expected investment multiple of approximately 5 times; exploring debt financing options for the Epes plant, including tax-exempt bond programs

“Given the operational and supply chain improvements we have achieved thus far in the second quarter of 2022, we expect to deliver full-year 2022 annual adjusted EBITDA in line with our previously announced guidance of $230 million to $270 million, and are forecasting approximately $35 million to $40 million in adjusted EBITDA for the second quarter of 2022, consistent with the preview we provided during our last earnings call,” said John Keppler, Chairman and Chief Executive Officer. “We continue to expect the second half of 2022 to drive two-thirds of full-year 2022 adjusted EBITDA, as the third and fourth quarters of this year are expected to significantly benefit from both the continued production ramp at our Lucedale, Mississippi plant, and the higher production throughput we traditionally experience in our seasonally stronger back half.”

“Continued global commitments to the energy transition combined with the current geopolitical backdrop are creating a highly constructive pricing environment for near-term deliveries and long-term contracts at favorable headline pricing levels not previously seen. Our sales and marketing teams in Europe, Japan, and the United States are making great progress toward executing new long-term agreements and converting previously announced memorandums of understanding to binding take-or-pay off-take contracts. Given the continuing structural shortage in wood pellet supply that remains in our industry, where long-term demand continues to outstrip supply capacity, there has never been a better time to be in this business and we are excited to be positioned for highly accretive, durable growth.”

Financial Update

As described in Enviva’s most recent earnings release, Enviva continues to expect reported financial results with respect to the second quarter of 2022 to be similar to reported results for the first quarter of 2022, as the company exited its seasonally soft period and is capitalizing on the substantially increased plant availability driven by the reduction of COVID-related absenteeism and improving performance by our logistics providers. Additionally, the production ramp for Enviva’s newest wood pellet production plant in Lucedale, Mississippi continues to increase in line with expectations, and we have begun shipping from Enviva’s new deep-water marine terminal in Pascagoula, Mississippi. Although diesel costs remain elevated across the southeastern United States, we have mitigated the impact by reducing our procurement radius and thus the freight costs associated with transporting the fiber we source from the forests to our plant locations.

Finally, we have been able to help address dislocations in our customers’ and other producers’ supply chains, rescheduling certain contracted deliveries into future periods, enabling prompt deliveries to other customers requiring incremental deliveries at elevated spot pricing. Recent biomass spot market prices, as well as the forward curve pricing of certain European indices, have exceeded $300 per metric ton (“MT”), representing a substantial premium to the current long-term contracted pricing of roughly $200 to $220 per MT across Enviva’s weighted average portfolio, and we have been able to capture some of that differential during the second quarter of 2022.

As a result, adjusted gross margin per metric ton (“AGM/MT”) for the second quarter of 2022 is projected to be in line with reported results for the first quarter of 2022, as the full benefit of (i) cost improvements, (ii) improved pricing, and (iii) increased sales volumes (currently estimated to be approximately 20% better than the first quarter) will be offset somewhat by the higher-cost inventory carried from first-quarter 2022.

2022 Guidance Outlook

Given financial projections for the second quarter of 2022 and the favorable trends and expectations for the balance of the year, Enviva reaffirmed full-year 2022 financial guidance.

$ millions, unless noted |

2022 Guidance |

2021 Reported1 |

|

Net Income (Loss) |

(30.0) - 10.0 |

(145.3) |

|

Adjusted EBITDA |

230.0 - 270.0 |

226.1 |

|

Distributable Cash Flow (“DCF”) |

165.0 - 205.0 |

167.8 |

|

Dividend per Common Share |

$3.62/share |

$3.30/share |

|

Total Capital Expenditures |

255.0 - 275.0 |

NM2 |

1 2021 results are presented on a recast basis for net loss, and a non-recast basis for adjusted EBITDA and DCF

2 Not meaningful

For full-year 2022, adjusted EBITDA is projected to increase by approximately 10% as compared to 2021 (using the midpoint of the 2022 guidance range), and dividend expectations of $3.62 per share also represent an increase of approximately 10% over 2021.

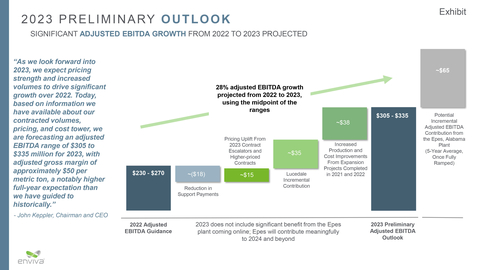

Looking forward into 2023, we expect pricing strength and increased sales volumes to drive significant growth over 2022. Based on information available today regarding contracted volumes, pricing, and our cost tower, adjusted EBITDA for 2023 is projected to range from $305 million to $335 million, representing approximately a 28% increase over expectations for 2022, based on the midpoints of the guidance ranges. Additionally, AGM/MT is projected to be approximately $50 per MT for 2023, a notable increase from the $47.21 AGM/MT achieved in 2021. Please refer to the exhibit at the end of this press release for further information.

Total capital expenditures for 2022 continue to be estimated in the range of $255 million to $275 million, but given the current strong contracting momentum driven by global decarbonization and energy security needs, the timing of construction of our next greenfield plant in Bond, Mississippi could be accelerated, which would lead to incremental growth capital expenditures during fiscal 2022.

Enviva expects to commence construction of its fully contracted wood pellet production plant in Epes, Alabama in early July 2022. As part of the debt financing options we are pursuing, the Industrial Development Authority of Sumter County, the county in which our Epes plant will be constructed, recently posted a notice proposing the issuance of tax-exempt bonds to fund construction of the Epes plant. If successful, the Industrial Development Authority of Sumter County would issue tax-exempt bonds on behalf of Enviva and lend the proceeds to Enviva to construct the plant. Enviva also expects to finalize an approximately $42 million new markets tax credit loan this week.

“Enviva remains focused on optimizing its capital structure under conservative financial policies and the alternatives under consideration, like the tax-exempt bond financing through the Industrial Development Authority of Sumter County, reflect a positive step forward in our efforts to reduce our cost of capital and better match credit tenor with the nature of our long-term contracted assets,” said Shai Even, Chief Financial Officer. “We believe the attractive financing terms and tenor that may be available in the tax-exempt market represent a creative, low-cost, and replicable alternative for Enviva.”

From an equity capital markets perspective, at the end of June 2022, Enviva will have traded as a corporation for six months. A key part of the strategic and financial rationale of converting to a corporation was to expand Enviva’s investor base, including passive ownership. During the first quarter of 2022, Enviva was included in several indices, and on June 24, 2022, Enviva will be included in the Russell 3000 Index, and is expected to be added to the Russell 1000 Index as well. Once included, Enviva’s passive ownership is expected to approach 10% of the company’s publicly traded share float, notable progress from less than 1% at the beginning of 2022.

Contracting and Market Update

Today, Enviva announced the signing of a new 12-year, take-or-pay off-take contract with an existing European customer to provide wood pellets to be used for industrial heat generation. Deliveries are expected to commence in 2026, with Enviva supplying 60,000 MTPY, subject to certain conditions precedent.

In addition, we are progressing site selection alternatives and binding supply contracts with our U.S.-based sustainable aviation fuel (“SAF”) partner, and we expect to be in a position to announce the contract’s first phase of development by the fourth quarter of this year.

Negotiations on our recently announced memorandums of understanding (“MOU”) in Europe are also continuing to progress smoothly. Over the next three to six months, we expect to convert several of these MOUs into more than 2 million MTPY of new, binding, long-term take-or-pay off-take contracts principally supplying industrial sectors (e.g., sugar, lime, and SAF) and heat markets around the globe. Many of these contracts are being prepared for final execution and are expected to start deliveries as early as 2023, ramping to peak delivered volumes by late 2025 or early 2026. On average, these contracts are expected to have durations between 10 and more than 15 years and contemplate deliveries to jurisdictions including the Netherlands and Germany.

Regulatory Update

The current geopolitical crisis, high and volatile fossil fuel prices, and the continued urgency to deliver on climate mitigation all underscore the importance of addressing each attribute of the energy trilemma – decarbonization, affordability, and security of supply. European Union policymakers have long recognized that sustainable biomass is a renewable, competitively priced, baseload dispatchable heat and power source, and offers such an effective solution to each of these challenges, that bioenergy now accounts for more than 60% of renewable energy in Europe. As European Commission President Ursula von der Leyen recently stated, “…every single kilowatt-hour we get from solar, wind, biomass – you name it – hydrogen, is a kilowatt-hour with which we will be reducing our dependency on Russian fossil fuels.”

Under the Green Deal, the EU has committed to further increase and accelerate climate targets and is updating over 15 climate and energy laws, including reviewing its criteria for sustainable biomass. The broader lawmaking process continues as the EU is still in its promulgation and implementation phases of the increased biomass utilization targets and criteria passed in Renewable Energy Directive II (“RED II”) and has now begun to take up the process for Renewable Energy Directive III.

Like all EU policymaking, this is a lengthy and contentious process involving the three main institutions (the EU Parliament, the EU Commission, and the EU Council). Leading academic, scientific, and policymaking support continues to reinforce the EU’s long-standing conclusions about the positive climate benefits of greater biomass utilization, including in the UN IPCC’s recent Sixth Assessment Report where Dr. Gert-Jan Nabuurs, Coordinating Lead Author of the report, notes, “The fact that the use of woody biomass under the right conditions leads to less net CO2 emissions than combustion of coal or gas is virtually undisputed within science…” As a result, the EU Council is expected to agree on its position soon (where almost a dozen EU member states have made a public declaration that no change to RED II would be acceptable) and the EU Parliament is expected to vote in the fall, after which, negotiations will begin to reach a common position that then becomes law, in a process that is anticipated to conclude in the first half of 2023. Given the ranges of currently proposed legislation, a compromise update to biomass sustainability criteria is expected to remain consistent with current policy in order to reach the EU’s stated objectives of net zero by 2050. As Frans Timmermans, the EU Commission’s Executive Vice President for the Green Deal, succinctly stated recently, “without biomass, we’re not going to make it.”

Executive Leadership Update

The company recently announced the promotion of Enviva co-founder and Chief Commercial Officer, Thomas Meth, to President, recognizing the increased role and responsibility for the day-to-day management of the company Mr. Meth has assumed over the last several years, in addition to the tremendous commercial success, market development, and long-term contracted growth he has engineered for the company.

“As a visionary and seasoned executive, Thomas has earned the deep respect of our employees, partners, and other stakeholders around the globe,” said Keppler. “When Thomas and I co-founded Enviva almost two decades ago, we each had the same combination of strategic vision for profitably solving climate change and a laser focus on execution. It continues to be a privilege to lead Enviva with Thomas and I am very excited to formalize his increased responsibilities in leading the high-performing company we are today, as we work to create and unlock enormous shareholder value by executing the business plan outlined in connection with our recent Simplification and Corporate Conversion Transactions.”

About Enviva

Enviva Inc. (NYSE: EVA) is the world’s largest producer of industrial wood pellets, a renewable and sustainable energy source produced by aggregating a natural resource, wood fiber, and processing it into a transportable form, wood pellets. Enviva owns and operates ten plants with a combined production capacity of approximately 6.2 million MTPY in Virginia, North Carolina, South Carolina, Georgia, Florida, and Mississippi, and is starting construction on its eleventh plant, which will be located in Epes, Alabama. The Epes plant is projected to add 1.1 million MTPY, approximately an 18% increase, to Enviva’s production capacity, and is expected to be the world’s largest wood pellet production plant once constructed. Enviva sells most of its wood pellets through long-term, take-or-pay off-take contracts with creditworthy customers in the United Kingdom, the European Union, and Japan, helping to accelerate the energy transition and to decarbonize hard-to-abate sectors like steel, cement, lime, chemicals, and aviation fuels. Enviva exports its wood pellets to global markets through its deep-water marine terminals at the Port of Chesapeake, Virginia, the Port of Wilmington, North Carolina, and the Port of Pascagoula, Mississippi, and from third-party deep-water marine terminals in Savannah, Georgia, Mobile, Alabama, and Panama City, Florida.

To learn more about Enviva, please visit our website at www.envivabiomass.com. Follow Enviva on social media @Enviva.

Non-GAAP Financial Measures

In addition to presenting our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), we use adjusted gross margin, adjusted gross margin per metric ton, adjusted EBITDA, and distributable cash flow to measure our financial performance. In addition, as a result of our Simplification Transaction, we were required to recast our historical financial results in accordance with GAAP. Accordingly, any results presented on a non-recast basis constitute a Non-GAAP measure.

Our adjusted EBITDA preliminary outlook range for 2023 is based on internal financial analyses. Such estimates are based on numerous assumptions and are inherently uncertain and subject to significant business, economic, financial, regulatory, and competitive risks that could cause actual results and amounts to differ materially from such estimates. A reconciliation of the estimated adjusted EBITDA range for 2023 to the closest GAAP financial measure, net income (loss), is not provided because net income (loss) expected to be generated is not available without unreasonable effort, in part because the amount of estimated incremental interest expense related to financing and depreciation is not available at this time.

The estimated incremental adjusted EBITDA that can be expected from Enviva’s development of new wood pellet plant capacity is based on an internal financial analysis of the anticipated benefit from the incremental production capacity and cost savings we expect to realize. Such estimates are based on numerous assumptions and are inherently uncertain and subject to significant business, economic, financial, regulatory, and competitive risks that could cause actual results and amounts to differ materially from such estimates. A reconciliation of the estimated incremental adjusted EBITDA expected to be generated by a new wood pellet production plant constructed by Enviva to the closest GAAP financial measure, net income (loss), is not provided because net income (loss) expected to be generated is not available without unreasonable effort, in part because the amount of estimated incremental interest expense related to the financing of such a plant and depreciation is not available at this time.

Our estimated AGM/MT for the second quarter of 2022 and full-year 2023 is based on internal financial analyses. Such estimates are based on numerous assumptions and are inherently uncertain and subject to significant business, economic, financial, regulatory, and competitive risks that could cause actual results and amounts to differ materially from such estimates. A reconciliation of the estimated AGM/MT for the second quarter of 2022 and full-year 2023 to the closest GAAP financial measure, gross margin, is not provided because gross margin expected to be generated is not available without unreasonable effort, in part because monthly financial data for June 2022 is not available at this time.

The preliminary adjusted EBITDA range and estimated AGM/MT for the second quarter of 2022 represents the most current information available to management and reflects estimates and assumptions. Enviva’s actual results may differ materially from these preliminary estimates due to the completion of Enviva’s financial closing procedures, final adjustments, and other developments that may arise between the date of this press release and the time that financial results for the second quarter of 2022 are finalized. The foregoing preliminary financial results have not been compiled or examined by Enviva’s independent registered public accounting firm, nor has Enviva’s independent registered public accounting firm performed any procedures with respect to this information or expressed any opinion or any form of assurance of such information. A reconciliation of the estimated adjusted EBITDA range for the second quarter of 2022 to the closest GAAP financial measure, net income (loss), is not provided because net income (loss) expected to be generated is not available without unreasonable effort, in part because the amount of estimated incremental interest expense related to financing and depreciation is not available at this time.

Adjusted Gross Margin and Adjusted Gross Margin per Metric Ton

We define adjusted gross margin as gross margin excluding loss on disposal of assets, equity-based compensation and other expense, depreciation and amortization, changes in unrealized derivative instruments related to hedged items, acquisition and integration costs and other, Support Payments, and effects of COVID-19 and the war in Ukraine. We define adjusted gross margin per metric ton as adjusted gross margin per metric ton of wood pellets sold. We believe adjusted gross margin and adjusted gross margin per metric ton are meaningful measures because they compare our revenue-generating activities to our cost of goods sold for a view of profitability and performance on a total-dollar and a per-metric ton basis. Adjusted gross margin and adjusted gross margin per metric ton primarily will be affected by our ability to meet targeted production volumes and to control direct and indirect costs associated with procurement and delivery of wood fiber to our wood pellet production plants and our production and distribution of wood pellets.

Adjusted EBITDA

We define adjusted EBITDA as net income (loss) excluding depreciation and amortization, interest expense, income tax expense (benefit), early retirement of debt obligation, equity-based compensation and other expense, loss on disposal of assets, changes in unrealized derivative instruments related to hedged items, acquisition and integration costs and other, effects of COVID-19 and the war in Ukraine, and MSA Fee Waivers, and Support Payments. Adjusted EBITDA is a supplemental measure used by our management and other users of our financial statements, such as investors, commercial banks, and research analysts, to assess the financial performance of our assets without regard to financing methods or capital structure.

Distributable Cash Flow

We define distributable cash flow as adjusted EBITDA less cash income tax expenses, interest expense net of amortization of debt issuance costs, debt premium, and original issue discounts, and maintenance capital expenditures. We use distributable cash flow as a performance metric to compare our cash-generating performance from period to period and to compare the cash-generating performance for specific periods to the cash dividends (if any) that are expected to be paid to our shareholders. We do not rely on distributable cash flow as a liquidity measure.

Limitations of Non-GAAP Financial Measures

Adjusted net income (loss), adjusted gross margin, adjusted gross margin per metric ton, adjusted EBITDA, and distributable cash flow, as well as our Non-Recast Presentation are not financial measures presented in accordance with GAAP. We believe that the presentation of these non-GAAP financial measures provides useful information to investors in assessing our financial condition and results of operations. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Each of these non-GAAP financial measures has important limitations as an analytical tool because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider adjusted net income (loss), adjusted gross margin, adjusted gross margin per metric ton, adjusted EBITDA, or distributable cash flow, or our Non-Recast Presentation, in isolation or as substitutes for analysis of our results as reported under GAAP.

Our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

The following table presents a reconciliation of net loss to adjusted EBITDA and distributable cash flow for the year ended December 31, 2021, on a recast basis and non-recast basis (in millions):

|

Year Ended December 31, 2021 |

||||||||||

|

Recast

|

|

Adjustments |

|

Non-Recast

|

||||||

|

(in millions) |

||||||||||

Net loss |

$ |

(145.3 |

) |

|

$ |

112.1 |

|

|

$ |

(33.2 |

) |

Add: |

|

|

|

|

|

||||||

Depreciation and amortization |

|

92.0 |

|

|

|

(2.8 |

) |

|

|

89.2 |

|

Interest expense |

|

56.5 |

|

|

|

(11.2 |

) |

|

|

45.3 |

|

Income tax (benefit) expense |

|

(17.0 |

) |

|

|

17.1 |

|

|

|

0.1 |

|

Early retirement of debt obligation |

|

9.4 |

|

|

|

(9.4 |

) |

|

|

— |

|

Non-cash equity-based compensation and other expense |

|

55.9 |

|

|

|

(32.4 |

) |

|

|

23.5 |

|

Loss on disposal of assets |

|

10.2 |

|

|

|

(0.1 |

) |

|

|

10.1 |

|

Changes in unrealized derivative instruments |

|

(2.7 |

) |

|

|

— |

|

|

|

(2.7 |

) |

Acquisition and integration costs and other |

|

32.6 |

|

|

|

— |

|

|

|

32.6 |

|

MSA Fee Waivers and Support Payments |

|

25.1 |

|

|

|

36.1 |

|

|

|

61.2 |

|

Adjusted EBITDA |

$ |

116.7 |

|

|

$ |

109.4 |

|

|

$ |

226.1 |

|

Less: |

|

|

|

|

|

||||||

Interest expense, net of amortization of debt issuance costs, debt premium, and original issue discount |

|

52.6 |

|

|

|

(8.3 |

) |

|

|

44.3 |

|

Maintenance capital expenditures |

|

14.0 |

|

|

|

— |

|

|

|

14.0 |

|

Distributable cash flow |

$ |

50.1 |

|

|

$ |

117.7 |

|

|

$ |

167.8 |

|

The following table provides a reconciliation of the estimated range of adjusted EBITDA and DCF to the estimated range of net income for Enviva for the twelve months ending December 31, 2022 (in millions):

|

Twelve Months Ending

|

Estimated net income |

$ (30.0) - 10.0 |

Add: |

|

Depreciation and amortization |

100.0 |

Interest expense |

55.0 |

Income tax expense |

— |

Non-cash share-based compensation expense |

42.0 |

Loss on disposal of assets |

4.0 |

Changes in unrealized derivative instruments |

— |

Acquisition and integration costs |

15.0 |

Effects of COVID-19 |

16.0 |

Effects of the war in Ukraine |

4.0 |

Support Payments |

24.0 |

Estimated adjusted EBITDA |

$ 230.0 - 270.0 |

Less: |

|

Interest expense net of amortization of debt issuance costs, debt premium, and original issue discount |

50.0 |

Cash income tax expense |

— |

Maintenance capital expenditures |

15.0 |

Estimated distributable cash flow |

$ 165.0 - 205.0 |

Cautionary Note Concerning Forward-Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, regarding Enviva’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, and objectives of management are forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms, and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Enviva disclaims any duty to revise or update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Enviva cautions you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Enviva. These risks include, but are not limited to: (i) the volume and quality of products that we are able to produce or source and sell, which could be adversely affected by, among other things, operating or technical difficulties at our wood pellet production plants or deep-water marine terminals; (ii) the prices at which we are able to sell our products; (iii) our ability to successfully negotiate, complete, and integrate acquisitions, including the associated contracts, or to realize the anticipated benefits of such acquisitions; (iv) failure of our customers, vendors, and shipping partners to pay or perform their contractual obligations to us; (v) our inability to successfully execute our project development, capacity, expansion, and new facility construction activities on time and within budget; (vi) the creditworthiness of our contract counterparties; (vii) the amount of low-cost wood fiber that we are able to procure and process, which could be adversely affected by, among other things, disruptions in supply or operating or financial difficulties suffered by our suppliers; (viii) changes in the price and availability of natural gas, coal, or other sources of energy; (ix) changes in prevailing economic and market conditions; (x) inclement or hazardous environmental conditions, including extreme precipitation, temperatures, and flooding; (xi) fires, explosions, or other accidents; (xii) changes in domestic and foreign laws and regulations (or the interpretation thereof) related to renewable or low-carbon energy, the forestry products industry, the international shipping industry, or power, heat, or combined heat and power generators; (xiii) changes in domestic and foreign tax laws and regulations affecting the taxation of our business and investors; (xiv) changes in the regulatory treatment of biomass in core and emerging markets; (xv) our inability to acquire or maintain necessary permits or rights for our production, transportation, or terminaling operations; (xvi) changes in the price and availability of transportation; (xvii) changes in foreign currency exchange or interest rates, and the failure of our hedging arrangements to effectively reduce our exposure to related risks; (xviii) risks related to our indebtedness, including the levels and maturity date of such indebtedness; (xix) our failure to maintain effective quality control systems at our wood pellet production plants and deep-water marine terminals, which could lead to the rejection of our products by our customers; (xx) changes in the quality specifications for our products that are required by our customers; (xxi) labor disputes, unionization, or similar collective actions; (xxii) our inability to hire, train, or retain qualified personnel to manage and operate our business and newly acquired assets; (xxiii) the possibility of cyber and malware attacks; (xxiv) our inability to borrow funds and access capital markets; (xxv) viral contagions or pandemic diseases, such as COVID-19; (xxvi) overall domestic and global political and economic conditions, including the imposition of tariffs or trade or other economic sanctions, political instability, or armed conflict, including the ongoing conflict in Ukraine; (xxvii) the proposed tax-exempt financings and use of proceeds thereof; and (xxviii) the development and construction of the Epes plant and the expected production capacity thereof.

Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Enviva’s expectations and projections can be found in Enviva’s periodic filings with the SEC. Enviva’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

No Offer or Solicitation

This press release is neither an offer to sell nor a solicitation of an offer to buy any securities, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220621006100/en/

Contacts

Kate Walsh

Vice President, Investor Relations

+1 240-482-3856

investor.relations@envivabiomass.com