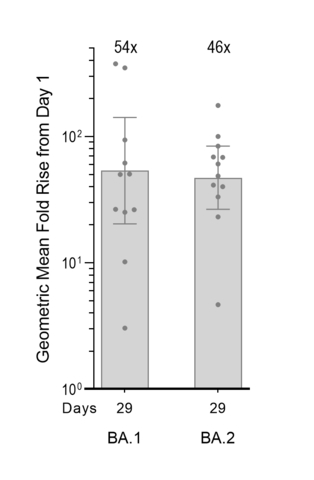

ARCT-154 booster data show 54- and 46-fold increases in neutralizing antibody response against Omicron BA.1 and BA.2

Investor conference call at 4:30 p.m. ET today

Arcturus Therapeutics Holdings Inc. (the “Company”, “Arcturus”, Nasdaq: ARCT), a global late-stage clinical messenger RNA medicines company focused on the development of infectious disease vaccines and significant opportunities within liver and respiratory rare diseases, today announced its financial results for the first quarter ended March 31, 2022, and provided corporate updates.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220509006091/en/

Pseudovirus MNT assay (exploratory assay; Moore Laboratory, National Institute for Communicable Diseases and University of the Witwatersrand, South Africa) showing GMFR levels of neutralizing antibody responses over Day 1 (baseline levels prior to boosting with ARCT-154) calculated using geometric mean concentrations (with 95% confidence intervals) obtained from participants measured at Days 1 and 29 (n = 12/12). (Graphic: Business Wire)

“The first quarter of this year has been commemorated by several key achievements for Arcturus. Our self-amplifying mRNA platform has been the first of its kind to demonstrate meaningful protection against COVID-19 disease in a pivotal primary vaccination trial,” said Joseph Payne, President and CEO of Arcturus Therapeutics. “In addition, ARCT-154 has shown promising booster data against all SARS-CoV-2 variants tested, including Omicron BA.1 and BA.2. We are expanding development activities of ARCT-154 into a global registrational booster trial and expect to begin dosing soon.”

Recent Corporate Highlights

- Arcturus today announced neutralizing antibody data from its ongoing Phase 1/2 study evaluating a single 5-mcg booster dose of ARCT-154 given at least five months following two primary doses of Comirnaty®. Pseudovirus microneutralization (MNT) assay on sera samples from twelve participants in the study demonstrate 54-fold and 46-fold geometric mean fold rises (GMFR) in neutralizing antibody titers against the original Omicron BA.1 and currently circulating Omicron BA.2 strains, respectively, on Day 29 post-boost compared to Day 1 pre-boost levels (see Figure).

- Arcturus recently announced three-month durability results from the booster study. Validated pseudovirus MNT assay results demonstrated high levels of neutralizing antibody response against the D614G SARS-CoV-2 strain. Neutralizing antibody responses on Day 15 and Day 29 were 28-fold and 40-fold, respectively, and persisted at 30-fold GMFR three months post-boosting. Validated pseudovirus MNT assay for the Beta strain also demonstrated notable durability of neutralizing antibody response at three months with 24-fold of GMFR. The GMFRs were 26-fold and 31-fold over baseline on Day 15 and Day 29, respectively.

- Surrogate virus neutralization (sVNT) assay results illustrated persistent and broad neutralizing antibody responses against several SARS-CoV-2 variants. Three months following booster dose administration of ARCT-154, sVNT responses remained 13 to 30-fold elevated over baseline pre-boost levels.

- The Company shared compelling vaccine efficacy data from an ongoing trial evaluating ARCT-154 as a primary vaccine in April. The primary efficacy endpoint was met, and the data also demonstrated remarkable vaccine efficacy of 95.3% (95% CI; 80.4% - 98.9%) in the prevention of severe and fatal COVID-19 disease. The vaccine efficacy was 55.0% (95% CI; 46.9% - 61.9%) for preventing overall COVID-19 disease, which is noteworthy against a backdrop of Delta and Omicron SARS-CoV-2 variant circulation in Vietnam*. These data from approximately 16,000 participants in the placebo-controlled efficacy study were shared with the Vietnam Ministry of Health by Arcturus’ partner and study sponsor Vinbiocare and added to the regulatory data package for EUA application presently under review.

- Primary immunogenicity objective of Phase 1/2/3a portions of the study was met with 98.4% four-fold seroconversion for ancestral (Wuhan) strain.

- Solicited adverse events in the study have been generally mild or moderate in severity and transient (< 4 days duration) in ARCT-154 vaccinated participants. Unsolicited adverse events in the study have been comparable in the placebo and vaccinated arms. No unexpected safety concerns have been identified. Safety data collection remains ongoing.

- Technology transfer activities between Arcturus and Vinbiocare continue to mature toward completion of a manufacturing facility in Hanoi for self-amplifying mRNA vaccines.

- ARCT-810, the Company’s mRNA therapeutic candidate for ornithine transcarbamylase (OTC) deficiency will be evaluated in a randomized, double-blind, placebo-controlled, nested single and multiple ascending dose Phase 2 study in 24 adolescents and adults with OTC deficiency. The Company remains on track to initiate dosing of the first participants in the second quarter and obtain interim human proof-of-concept data in the second half of 2022.

- ARCT-032, the Company’s mRNA therapeutic candidate for cystic fibrosis, is on track for a Clinical Trial Application (CTA) filing in Q3 2022.

*References:

https://covariants.org/per-country;

https://covid19.who.int/region/wpro/country/vn;

https://ourworldindata.org (Vietnam Link)

Financial Results for the First Quarter Ended March 31, 2022

Revenues in conjunction with strategic alliances and collaborations: Arcturus’ primary sources of revenues were from consulting and related technology transfer fees, license fees and collaborative payments received from research and development arrangements with pharmaceutical and biotechnology partners. Total revenue for the three months ended March 31, 2022, was $5.2 million, compared with $2.1 million in the three months ended March 31, 2021, and $5.8 million for the three months ended December 31, 2021. The increase in revenue during the three months ended March 31, 2022, when compared with the three months ended March 31, 2021, is primarily due to the recognition of revenue from manufacturing technology transfer and clinical consulting services provided that are related to the Vinbiocare agreement.

Operating expenses: Total operating expenses for the three months ended March 31, 2022, were $55.6 million compared with $59.8 million for the three months ended March 31, 2021, and $43.4 million for the three months ended December 31, 2021. The increase in operating expenses of $12.2 million sequentially was primarily due to the increase in research and development expenses.

Research and development expenses: Research and development expenses for the three months ended March 31, 2022, were $44.9 million compared with $50.0 million for the three months ended March 31, 2021, and $32.6 million for the three months ended December 31, 2021. The increase in the three months ended March 31, 2022, when compared with the three months ended December 31, 2021, is primarily attributable manufacturing and quality runs for covid products and an increase in costs associated with the start-up activities toward initiation of the booster trial. In January 2022, the Company entered into an agreement with a pharmaceutical company, whereby the pharmaceutical company agreed to fund up to $25 million for a clinical trial for a LUNAR-COV19 vaccine candidate as a booster.

Net Loss: For the three months ended March 31, 2022, Arcturus reported a net loss of approximately $51.2 million, or ($1.94) per basic and diluted share, compared with a net loss of $56.3 million, or ($2.15) per basic and diluted share in the three months ended March 31, 2021, and a net loss of $38.7 million, or ($1.47) per basic and diluted share in the three months ended December 31, 2021.

Cash Position: Cash and cash equivalents were $319.7 million as of March 31, 2022, and $370.5 million at December 31, 2021. Based on the current pipeline, the Company’s cash position is expected to be sufficient to support operations into late 2023.

Earnings Call Monday, May 9 @ 4:30 p.m. ET |

||

Domestic: |

888-256-1007 |

|

International: |

323-994-2093 |

|

Conference ID: |

6122841 |

|

Webcast: |

||

About Arcturus Therapeutics

Founded in 2013 and based in San Diego, California, Arcturus Therapeutics Holdings Inc. (Nasdaq: ARCT) is a global late-stage clinical mRNA medicines and vaccines company with enabling technologies: (i) LUNAR® lipid-mediated delivery, (ii) STARR™ mRNA Technology and (iii) mRNA drug substance along with drug product manufacturing expertise. Arcturus’ diverse pipeline of RNA therapeutic and vaccine candidates includes mRNA vaccine programs for SARS-CoV-2 (COVID-19) and influenza, and other programs to potentially treat ornithine transcarbamylase (OTC) deficiency, and cystic fibrosis along with partnered programs including glycogen storage disease type III (GSD III), hepatitis B virus (HBV), and non-alcoholic steatohepatitis (NASH). Arcturus’ versatile RNA therapeutics platforms can be applied toward multiple types of nucleic acid medicines including messenger RNA, self-amplifying mRNA, small interfering RNA, circular RNA, antisense RNA, microRNA, DNA, and gene editing therapeutics. Arcturus’ technologies are covered by its extensive patent portfolio (with patents and patent applications issued in the U.S., Europe, Japan, China and other countries). Arcturus’ commitment to the development of novel RNA therapeutics has led to collaborations with Janssen Pharmaceuticals, Inc., part of the Janssen Pharmaceutical Companies of Johnson & Johnson, Ultragenyx Pharmaceutical, Inc., Takeda Pharmaceutical Company Limited, CureVac AG, Duke-NUS Medical School, and the Cystic Fibrosis Foundation. For more information visit www.ArcturusRx.com. In addition, please connect with us on Twitter and LinkedIn.

Forward Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact included in this press release, are forward-looking statements, including those regarding strategy, future operations, the expectations for or likelihood of success of any collaborations, the promise of the company’s platform technologies for multiple types of nucleic acid medicines, the likelihood of success (including safety and efficacy) of the Company’s pipeline (including ARCT-154, ARCT-810, ARCT-032 and a STARR mRNA candidate for influenza), the likelihood that any independent verification by Arcturus, or any regulatory body’s assessment of, of data will be consistent with the information shared by Vinbiocare from the ARCT-154 study in Vietnam, the likelihood that the clinical results of ARCT-154 studies (including the efficacy, booster durability or other antibody responses), or any other non-clinical or clinical data, will be predictive of future clinical results or efficacy, predictive of results against existing or future COVID variants, or sufficient for any regulatory approval, the likelihood of regulatory clearance to proceed with, and the planned timing, design (including number of participants), screening, enrollment, initiation or completion of, and data readouts of, a booster study of ARCT-154, a Phase 2 study for ARCT-810, or any other clinical trials, the timing of interim data from the ARCT-810 study or any other data, the likelihood or timing of an EUA or regulatory approval in Vietnam for ARCT-154 or for any regulatory approval, the likelihood, and timing for, a filing to proceed with a clinical study of ARCT-032, the likelihood that a patent will issue from any patent application, its financial projections, current cash position and expected cash burn and the impact of general business and economic conditions. Arcturus may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in any forward-looking statements such as the foregoing and you should not place undue reliance on such forward-looking statements. These statements are only current predictions or expectations, and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements, including those discussed under the heading "Risk Factors" in Arcturus’ most recent Annual Report on Form 10-K, and in subsequent filings with, or submissions to, the SEC, which are available on the SEC’s website at www.sec.gov. Except as otherwise required by law, Arcturus disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or otherwise.

Trademark Acknowledgements

The Arcturus logo and other trademarks of Arcturus appearing in this announcement, including LUNAR® and STARR™, are the property of Arcturus. All other trademarks, services marks, and trade names in this announcement are the property of their respective owners.

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except par value information) |

||||||||

|

|

March 31,

|

|

December 31,

|

||||

|

|

(unaudited) |

|

|

||||

Assets |

|

|

|

|

||||

Current assets: |

|

|

|

|

||||

Cash and cash equivalents |

|

$ |

319,678 |

|

|

$ |

370,492 |

|

Accounts receivable |

|

|

3,691 |

|

|

|

3,367 |

|

Prepaid expenses and other current assets |

|

|

3,636 |

|

|

|

5,102 |

|

Total current assets |

|

|

327,005 |

|

|

|

378,961 |

|

Property and equipment, net |

|

|

7,530 |

|

|

|

5,643 |

|

Operating lease right-of-use asset, net |

|

|

5,245 |

|

|

|

5,618 |

|

Equity-method investment |

|

|

131 |

|

|

|

515 |

|

Non-current restricted cash |

|

|

2,077 |

|

|

|

2,077 |

|

Total assets |

|

$ |

341,988 |

|

|

$ |

392,814 |

|

Liabilities and stockholders’ equity |

|

|

|

|

||||

Current liabilities: |

|

|

|

|

||||

Accounts payable |

|

$ |

10,014 |

|

|

$ |

10,058 |

|

Accrued liabilities |

|

|

19,970 |

|

|

|

23,523 |

|

Current portion of long-term debt |

|

|

24,260 |

|

|

|

22,474 |

|

Deferred revenue |

|

|

53,062 |

|

|

|

43,482 |

|

Total current liabilities |

|

|

107,306 |

|

|

|

99,537 |

|

Deferred revenue, net of current portion |

|

|

6,641 |

|

|

|

19,931 |

|

Long-term debt, net of current portion |

|

|

39,235 |

|

|

|

40,633 |

|

Operating lease liability, net of current portion |

|

|

4,057 |

|

|

|

4,502 |

|

Total liabilities |

|

$ |

157,239 |

|

|

$ |

164,603 |

|

Stockholders’ equity |

|

|

|

|

||||

Common stock: $0.001 par value; 60,000 shares authorized; 26,407 issued and outstanding at March 31, 2022 and 26,372 issued and outstanding at December 31, 2021 |

|

|

26 |

|

|

|

26 |

|

Additional paid-in capital |

|

|

583,382 |

|

|

|

575,675 |

|

Accumulated deficit |

|

|

(398,659 |

) |

|

|

(347,490 |

) |

Total stockholders’ equity |

|

|

184,749 |

|

|

|

228,211 |

|

Total liabilities and stockholders’ equity |

|

$ |

341,988 |

|

|

$ |

392,814 |

|

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (unaudited) (in thousands except per share data) |

||||||||||||

|

|

Three Months Ended |

||||||||||

|

|

March 31, |

|

December 31, |

||||||||

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|||

Collaboration revenue |

|

$ |

5,244 |

|

|

$ |

2,127 |

|

|

$ |

5,794 |

|

Operating expenses: |

|

|

|

|

|

|

||||||

Research and development, net |

|

|

44,893 |

|

|

|

50,050 |

|

|

|

32,633 |

|

General and administrative |

|

|

10,730 |

|

|

|

9,743 |

|

|

|

10,806 |

|

Total operating expenses |

|

|

55,623 |

|

|

|

59,793 |

|

|

|

43,439 |

|

Loss from operations |

|

|

(50,379 |

) |

|

|

(57,666 |

) |

|

|

(37,645 |

) |

Gain (loss) from equity-method investment |

|

|

(384 |

) |

|

|

1,248 |

|

|

|

(155 |

) |

Gain from foreign currency |

|

|

158 |

|

|

|

430 |

|

|

|

(339 |

) |

Finance expense, net |

|

|

(564 |

) |

|

|

(358 |

) |

|

|

(525 |

) |

Net loss |

|

$ |

(51,169 |

) |

|

$ |

(56,346 |

) |

|

$ |

(38,664 |

) |

Net loss per share, basic and diluted |

|

$ |

(1.94 |

) |

|

$ |

(2.15 |

) |

|

$ |

(1.47 |

) |

Weighted-average shares outstanding, basic and diluted |

|

|

26,376 |

|

|

|

26,243 |

|

|

|

26,359 |

|

Comprehensive loss: |

|

|

|

|

|

|

||||||

Net loss |

|

$ |

(51,169 |

) |

|

$ |

(56,346 |

) |

|

$ |

(38,664 |

) |

Comprehensive loss |

|

$ |

(51,169 |

) |

|

$ |

(56,346 |

) |

|

$ |

(38,664 |

) |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220509006091/en/

Contacts

IR and Media Contacts

Arcturus Therapeutics

Deepankar Roy, Ph.D.

(858) 900-2682

IR@ArcturusRx.com

Kendall Investor Relations

Carlo Tanzi, Ph.D.

(617) 914-0008

ctanzi@kendallir.com