Increases Pace of Growth While Improving Loss Ratio

Kin Insurance (“Kin” or the “Company”), a leading direct-to-consumer homeowners insurance technology company that has entered into a definitive business combination agreement with Omnichannel Acquisition Corp. (NYSE: OCA) (“Omnichannel”), today announced select preliminary operating results for the second quarter ended June 30, 2021:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210910005115/en/

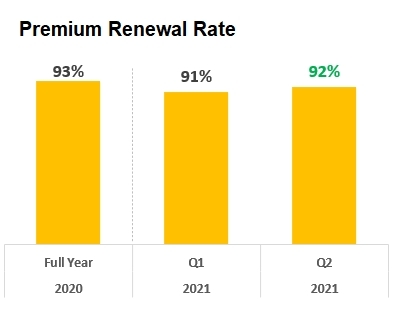

*Premium Renewal Rate for Kin Carrier (Photo: Business Wire)

- Total Written Premium increased to $24.7 million for the second quarter of 2021, nearly four times the $6.4 million of Total Written Premium in the prior-year comparative period. Growth was entirely organic and directly written without the use of independent agents.

- $22.9 million (93%) of second quarter 2021 Total Written Premium was written through the Kin Interinsurance Network (the “Carrier”), a reciprocal exchange managed by Kin Insurance, Inc.

- Premium Renewal Rate on the Carrier remained strong at 92% in the second quarter of 2021.

- Gross Profit from Kin’s Management Operations grew 354% to $6.8 million, compared to $1.5 million in the prior-year comparative period.

- Operating Loss of ($6.9M) was unchanged compared to the first quarter of 2021.

- Adjusted Loss Ratio1 on the Carrier for the first half of 2021 was 67%, a 29 point improvement compared to 96% in the prior-year period.

| Summary Financials | |||||||||||||

| Results are for Shareholder Interest (Kin Insurance Inc.) | |||||||||||||

2020 |

2021 |

||||||||||||

| ($mm) | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |||||||

| Total Written Premium | 4.8 |

|

6.4 |

|

5.4 |

|

8.5 |

|

16.4 |

|

24.7 |

|

|

| % growth (YoY) | 39 |

% |

27 |

% |

126 |

% |

278 |

% |

244 |

% |

287 |

% |

|

| Revenue | 1.1 |

|

1.5 |

|

1.4 |

|

2.2 |

|

4.4 |

|

6.8 |

|

|

| % growth (YoY) | 170 |

% |

172 |

% |

279 |

% |

357 |

% |

317 |

% |

354 |

% |

|

| % of written premium | 22 |

% |

24 |

% |

25 |

% |

26 |

% |

27 |

% |

28 |

% |

|

| Gross Profit | 1.1 |

|

1.5 |

|

1.4 |

|

2.2 |

|

4.4 |

|

6.8 |

|

|

| % growth | 170 |

% |

172 |

% |

279 |

% |

357 |

% |

317 |

% |

354 |

% |

|

| Operating Expenses | 4.1 |

|

4.8 |

|

5.4 |

|

9.1 |

|

11.3 |

|

13.7 |

|

|

| Operating Income | -3.1 |

|

-3.3 |

|

-4.1 |

|

-6.9 |

|

-6.9 |

|

-6.9 |

|

|

“We performed well in the second quarter, increasing our pace of growth year over year while maintaining our peer-leading unit economics. We also grew Total Written Premium by 50% on a sequential basis, while only growing expenses by 21%,” said Sean Harper, Chief Executive Officer of Kin. “Customers continue to choose Kin because of our efficient pricing, tech-forward product and exceptional customer service.”

The Kin Interinsurance Network, the customer-owned reciprocal exchange managed by Kin, had a first half 2021 adjusted loss ratio of 67%, a significant improvement from 96% in the prior-year period. Because the Kin Interinsurance Network is a reciprocal exchange that collects surplus contributions from policyholders, adjusted loss ratio includes the pro-rated portion of the surplus contributions to appropriately compare Kin’s loss ratio to industry peers that do not have this unique feature.

“Kin’s technology and direct-to-consumer business model enable us to better execute on sound insurance pricing, underwriting and claims principles,” said Angel Conlin, Chief Insurance Officer of Kin. “We believe our data advantage enables our team of expert actuaries and data scientists to apply our pricing and underwriting more accurately than legacy insurance companies that are more reliant on user and agent input data. This is exciting validation of our continued commitment to actuarially sound pricing, while delighting customers, evidenced in our stable renewal rate.”

Business Combination Transaction

On July 19, 2021, Kin entered into a business combination agreement with Omnichannel Acquisition Corp. (NYSE: OCA). The business combination is expected to close in the fourth quarter of 2021. Upon closing, the combined public company will be named Kin Insurance Inc., and is expected to be listed on the NYSE under the new ticker symbol “KI”. Additionally, Kin's closing on the acquisition of an inactive insurance carrier with licenses in more than 40 states is still expected in the fourth quarter of 2021.

About Kin

Kin is the home insurance company for every new normal. By leveraging proprietary technology, Kin delivers fully digital homeowners insurance with an elegant user experience, accurate pricing, and fast, high-quality claims service. Kin offers homeowners, landlord, condo, and mobile home insurance through the Kin Interinsurance Network (KIN), a reciprocal exchange owned by its customers who share in the underwriting profit. Because of its efficient technology and direct-to-consumer model, Kin provides affordable pricing without compromising coverage. To learn more, visit https://www.kin.com.

About Omnichannel Acquisition Corp.

Omnichannel Acquisition Corp. (NYSE: OCA) is a blank check company whose business purpose is to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. For more information, please visit www.omnichannelcorp.com.

Important Information for Investors and Stockholders

This communication relates to a proposed business combination (the “Business Combination”) between Omnichannel Acquisition Corp. (“Omnichannel”) and Kin Insurance, Inc. (“Kin”). In connection with the proposed Business Combination, Omnichannel has filed with the SEC a registration statement on Form S-4 that includes a preliminary proxy statement of Omnichannel in connection with Omnichannel’s solicitation of proxies for the vote by Omnichannel’s stockholders with respect to the proposed Business Combination and a preliminary prospectus of Omnichannel. The final proxy statement/prospectus will be sent to all Omnichannel stockholders, and Omnichannel will also file other documents regarding the proposed Business Combination with the SEC. This communication does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Before making any voting or investment decision, investors and security holders are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed Business Combination as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Omnichannel through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Omnichannel may be obtained free of charge by written request to: Christine Pantoya, Chief Financial Officer, Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, New Jersey 07901.

Forward-Looking Statements

This communication includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the business of Kin or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement and the proposed Business Combination contemplated thereby; (2) the inability to complete the transactions contemplated by the transaction agreement due to the failure to obtain approval of the stockholders of Omnichannel or other conditions to closing in the transaction agreement; (3) the ability to meet the NYSE’s listing standards following the consummation of the transactions contemplated by the transaction agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Kin as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed Business Combination; (7) changes in applicable laws or regulations; and (8) the possibility that Kin may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Omnichannel’s Annual Report on Form 10-K, and other documents filed by Omnichannel from time to time with the SEC and the registration statement on Form S-4 and proxy statement/prospectus discussed above. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Omnichannel and Kin assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved.

Any financial and capitalization information or projections in this communication are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Omnichannel’s and Kin’s control. While such information and projections are necessarily speculative, Omnichannel and Kin believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of financial information or projections in this communication should not be regarded as an indication that Omnichannel or Kin, or their respective representatives and advisors, considered or consider the information or projections to be a reliable prediction of future events.

Participants in the Solicitation

Omnichannel, Kin and their respective directors and executive officers may be deemed participants in the solicitation of proxies of Omnichannel stockholders with respect to the proposed Business Combination. Omnichannel stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and executive officers of Omnichannel Acquisition Corp. and their ownership of Omnichannel’s securities in Omnichannel’s final prospectus relating to its initial public offering, which was filed with the SEC on November 23, 2020 and is available free of charge at the SEC’s website at www.sec.gov, or by written request to: Christine Pantoya, Chief Financial Officer, Omnichannel Acquisition Corp., 485 Springfield Avenue #8, Summit, New Jersey 07901.

Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement / prospectus that Omnichannel intends to file with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act, or an exemption therefrom.

1Adjusted Loss ratio, a non-GAAP financial measure, is the ratio of gross losses and allocated loss adjustment expenses of the Carrier, to the gross earned premium of the Carrier and the pro-rated earned surplus contribution made by policyholders.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210910005115/en/

Contacts

Kin

Investor Relations

investors@kin.com

Media Relations

press@kin.com

Omnichannel

Investor Relations

oacir@icrinc.com

Media Relations

oacpr@icrinc.com