VANCOUVER, BC / ACCESSWIRE / February 7, 2024 / Banyan Gold Corp. (the "Company" or "Banyan") (TSXV:BYN)(OTCQB:BYAGF) is pleased to announce an updated Mineral Resource Estimate (the "MRE" or the "Mineral Resource") prepared in accordance with National Instrument 43-101, Standards for Disclosure for Mineral Projects ("NI 43-101") for the AurMac Project, Yukon Territory.

The updated MRE comprises an Inferred Mineral Resource of 7.0 million ("M") ounces ("oz") of gold (as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43‑101).

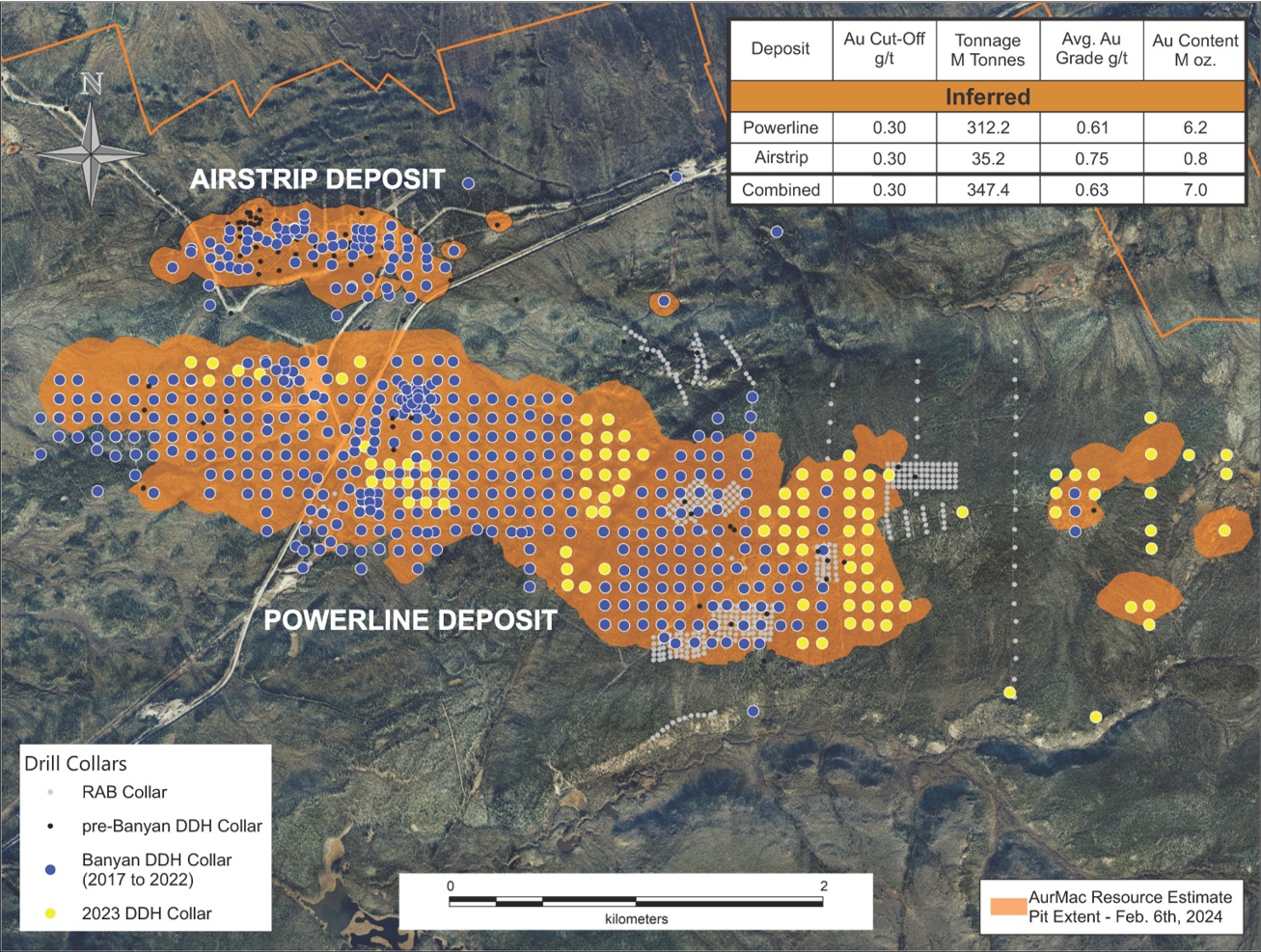

The pit constrained MRE is contained in two near/on-surface deposits: The Airstrip and Powerline1 deposits in the road accessible AurMac Project.

"With the AurMac Resource now at 7.0 Moz gold; 6.2 Moz in the Powerline Deposit alone, we can focus on delineating higher-grade zones, increase the confidence in the resource and further de-risk the project," stated Tara Christie, President and CEO. "Metallurgical studies to date have demonstrated that Powerline mineralization is amenable to conventional mining processes, including Carbon in Pulp ("CIP") and Carbon in Leach ("CIL"), flotation and heap leaching. Looking at the grade sensitivities, at a 0.60 g/t cut-off there are potentially 4 Moz at a grade of 1 g/t across AurMac, which highlights both the robust nature of the deposit as the cut-off grade is increased along with the potential for higher grade zones."

______________________________________________________________________

1 Includes Aurex Hill deposit (Aurex Hill was included as a standalone deposit in previous May 18, 2023 MRE). The 2023 drill program connected Powerline and Aurex Hill deposits into a single deposit, now defined as Powerline.

The updated MRE is summarized below in Table 1:

Table 1: Pit-Constrained Inferred Mineral Resources - AurMac Project(1)(2)(3)(4)(5)

Deposit |

Gold Cut-Off g/t |

Tonnage Tonnes |

Average Gold Grade g/t |

Gold Content oz. |

Inferred | ||||

Airstrip |

0.30 |

35,243,000 |

0.75 |

845,000 |

Powerline1 |

0.30 |

312,243,000 |

0.61 |

6,158,000 |

Combined Inferred |

0.30 |

347,486,000 |

0.63 |

7,003,000 |

Notes to Table 1:

- The effective date for the MRE is February 6, 2024.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.30 g/t gold for all deposits, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,800/ounce, US$2.50/t mining cost, US$5.50/t processing cost, US$2.00/t G+A, 80% gold recoveries, and 45° pit slopes.

- The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

A NI 43-101 Technical Report supporting the updated Mineral Resource will be filed on SEDAR at www.sedar.com within 45 days of this release. The pit outlines used to constrain the MRE are shown in Figure 1. Detailed images of the Mineral Resource model, including an interactive 3D model and additional information can be found at: https://www.banyangold.com/projects/aurmac/

Figure 1: Plan Map Showing the Mineral Resource Estimate Extents and Drill Collar Locations.

Powerline Deposit

The drill data for the Powerline deposit is comprised of 954 drill holes, representing an increase of 107 holes from the May 18, 2023 MRE.

There are several geologic controls on gold mineralization as per the current geologic understanding of the Powerline deposit. The mineralization model is comprised of eight (8) parallel and undulating mineralized zones. These zones trend east-west with a plunge of 5° to the west and dip of 10° to the north. The bulk of the gold resources within the updated MRE are hosted within quartz veins that dip 13° to 17° toward an azimuth of 329° to 335°.

The most common sampling length of the Powerline deposit is 1.5 metres ("m"), accounting for more than 50% of the sample data and is the composite length. Capping of high-grade outliers was carried out for each mineralized zone and ranged from 4.0 g/t gold to 11.0 g/t gold.

The estimation of gold grades into a block model was carried out with the Ordinary Kriging ("OK") technique on capped composites with the resultant block model comprised of a parent block size of 10m (easting) x 10m (northing) x 5m (elevation) and a sub-block size of 1m (easting) x 1m (northing) x 1m (elevation).

At a 0.30 g/t gold cut-off, the pit-constrained, Inferred Mineral Resources for Powerline are 312.2 million tonnes at an average gold grade of 0.61 g/t for a total of 6,158,000 ounces of gold. Cut-off grade sensitivities for the Powerline deposit are presented in Table 2.

Table 2. Pit-Constrained Inferred Mineral Resources - Powerline Deposit

|

Gold Cut-Off g/t |

Tonnage Tonnes |

Average Gold Grade g/t |

Gold Content oz. |

0.10 |

697,390,410 |

0.381 |

8,550,238 |

0.15 |

590,039,114 |

0.427 |

8,106,672 |

0.20 |

482,047,991 |

0.484 |

7,499,203 |

0.25 |

387,686,859 |

0.548 |

6,830,502 |

0.30 |

312,242,588 |

0.613 |

6,157,698 |

0.35 |

253,024,490 |

0.681 |

5,541,148 |

0.40 |

206,559,332 |

0.750 |

4,983,854 |

0.45 |

171,814,695 |

0.816 |

4,509,840 |

0.50 |

143,516,573 |

0.884 |

4,078,027 |

0.55 |

120,189,338 |

0.954 |

3,688,163 |

0.60 |

102,287,802 |

1.020 |

3,355,684 |

0.65 |

87,233,209 |

1.089 |

3,053,511 |

0.70 |

75,257,684 |

1.155 |

2,795,056 |

0.75 |

64,397,989 |

1.228 |

2,542,221 |

0.80 |

55,379,482 |

1.301 |

2,317,272 |

0.85 |

47,696,039 |

1.379 |

2,114,224 |

0.90 |

42,408,870 |

1.441 |

1,964,417 |

0.95 |

36,941,699 |

1.518 |

1,802,350 |

1.00 |

32,682,794 |

1.589 |

1,669,694 |

Notes to Table 2:

- The effective date for the MRE is February 6, 2024.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM Definition Standards were followed for the classification of Inferred Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.30 g/t gold, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,800/ounce, US$2.50/t mining cost, US$5.50/t processing cost, US$2.00/t G+A, 80% recoveries, and 45° pit slope

Airstrip Deposit

The Airstrip deposit is delineated by 139 drill holes, representing no increase of drill holes from the May 18, 2023 MRE. Topographic control was from a detailed LIDAR survey dataset.

There are several geologic controls on gold mineralization as per the current geologic understanding of the Airstrip deposit. The Airstrip lithological model is comprised of eight (8) east-west oriented units, with six (6) of the units dipping at approximately 40° to the south. The bulk of the gold identified within the updated MRE are hosted within a calcareous package; a roughly 90-metre-thick east-west striking zone dipping approximately 40° to the south.

The most common sampling length of the Airstrip deposit is 1.5 m accounting for approximately 45% of the sample data; all composites were constructed at this interval. Capping of high-grade outliers was based on lithological domains and varied from 3.0 g/t gold to 9.0 g/t gold.

The estimation of gold grades into a block model was carried out with the OK technique on capped composites and the resultant block model comprised of a block size of 10m (easting) x 10m (northing) x 5m (elevation) and sub-block size of 1m (easting) x 1m (northing) x 1m (elevation). Density was calculated from a total of 418 measurements from the drill core. The average density per lithology type was assigned to the corresponding blocks.

At a 0.30 g/t gold cut-off, the pit-constrained, Inferred Mineral Resources for the Airstrip deposit are 35.2 million tonnes at an average gold grade of 0.75 g/t for a total of 845,000 ounces of gold. Cut-off grade sensitivities for the Airstrip deposit are presented in Table 3.

Table 3: Pit-Constrained Inferred Mineral Resources - Airstrip Deposit

|

Gold Cut-Off g/t |

Tonnage Tonnes |

Average Gold Grade g/t |

Gold Content oz. |

0.10 |

65,037,243 |

0.490 |

1,024,588 |

0.15 |

54,825,160 |

0.558 |

983,570 |

0.20 |

47,624,079 |

0.616 |

943,188 |

0.25 |

41,155,729 |

0.678 |

897,121 |

0.30 |

35,242,684 |

0.746 |

845,276 |

0.35 |

29,839,553 |

0.822 |

788,597 |

0.40 |

25,644,811 |

0.895 |

737,927 |

0.45 |

22,123,269 |

0.970 |

689,941 |

0.50 |

19,053,218 |

1.050 |

643,204 |

0.55 |

16,860,792 |

1.118 |

606,053 |

0.60 |

14,811,367 |

1.193 |

568,102 |

0.65 |

13,355,548 |

1.256 |

539,315 |

0.70 |

11,951,253 |

1.324 |

508,736 |

0.75 |

10,921,475 |

1.380 |

484,564 |

0.80 |

10,019,660 |

1.435 |

462,270 |

0.85 |

9,044,269 |

1.500 |

436,170 |

0.90 |

8,336,922 |

1.553 |

416,263 |

0.95 |

7,744,357 |

1.602 |

398,877 |

1.00 |

7,100,662 |

1.658 |

378,507 |

Notes to Table 3:

- The effective date for the MRE is February 6, 2024.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM Definition Standards were followed for the classification of Inferred Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.30 g/t gold, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,800/ounce, US$2.50/t mining cost, US$5.50/t processing cost, US$2.00/t G+A, 80% gold recovery, and 45° pit slope.

Quality Assurance, Quality Control Measures and Data Verification

The reported work was completed using industry standard procedures, including a quality assurance/quality control ("QA/QC") program consisting of the insertion of certified standards, duplicates and blanks into the sample stream and utilizing certified independent analytical laboratories for all assays. Additionally, historic QA/QC data and methodology on the AurMac Project were reviewed and will be summarized in the NI 43-101 Technical Report. The qualified persons detected no significant QA/QC issues during review of the data.

A robust system of standards, ¼ core duplicates and analytical blanks, was implemented in all Banyan drilling programs and was monitored as chemical assay data became available. All control samples were within accuracy and precision thresholds required to meet data quality standards. These control samples amounted to approximately 10% of all samples submitted to analytical laboratories.

All geological data in the MRE was verified by Ginto Consulting Inc. ("Ginto") as being accurate to the extent possible and to the extent possible all geological information was reviewed and confirmed. Ginto made site visits to the AurMac Project on September 15th, 2018, November 27th, 2019, August 30th to 31st, 2021 and November 5th, 2022, and observed Banyan's drilling and sampling techniques, as well as viewed AurMac drill core. Ginto confirms that the assay sampling and QA/QC sampling of core by Banyan provides adequate and good verification of the data and believes the work to have been done within the guidelines of NI 43-101.

NI 43-101 Technical Report

Additional discussion and disclosure on the updated MRE, AurMac Mineral Resource Model Data Verification, as well as on property earn-in status, underlying royalties and recently completed metallurgical test work will be included in the forthcoming NI 43-101 Technical Report to be filed on SEDAR within 45 days of this release.

Qualified Persons

The updated Mineral Resource Estimate for the AurMac Project was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent "Qualified Person" as required by NI 43-101, who has reviewed and approved the contents of this release and has verified the data disclosed as it relates to the MRE. The data was verified by Mr. Jutras using data validation and quality assurance procedures under industry standards.

Paul D. Gray, P.Geo., is a "Qualified Person" as defined under NI 43-101, and has reviewed and approved the content of this news release in respect of all disclosure other than the MRE. Mr. Gray is Banyan Gold's geological consultant and has verified the data disclosed in this news release in respect of disclosure other than the MRE, including the sampling, analytical and test data underlying the information. Mr. Gray has made numerous site visits annually since the Company first optioned the Project.

Analytical Method

Drill core from 34 drill holes from the 2023 drill program were analyzed at Bureau Veritas Minerals of Vancouver, B.C. utilizing the aqua regia digestion ICP-MS 36-element AQ200 analytical package with FA450 50-gram Fire Assay with AAS finish for gold on all samples. Drill core from 73 drill holes from the 2023 drilling campaign were analyzed at MSA Canada in Langley, B.C. utilizing the aqua regia digestion ISP-MS 39-element IMS-116 analytical package with FAS-121 50-gram Fire Assay with AAS finish for gold on all samples.

All core samples were split on-site at Banyan's core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples were sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to either the Bureau Veritas, Whitehorse preparatory laboratory where samples were prepared and then shipped to Bureau Veritas's Analytical laboratory in Vancouver, BC for pulverization and final chemical analysis or MSALABS, on-site preparatory laboratory where samples were prepared and then shipped to MSALABS in Langley, BC for final chemical analysis. A robust system of standards, ½ core duplicates and blanks was implemented in the 2023 exploration drilling program. A more robust description of historic analytical procedures will be included in the forthcoming AurMac NI 43-101 report to be filed on SEDAR.

Risk Factors

Banyan is unaware of any legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Resource estimates described in this news release.

Upcoming Events

- CEM Whistler Capital Event, February 9 - 11, 2024

- Adelaide Capital Webinar - February 15, 2024 - 11 AM PST / 2 PM EST

- BMO 33rd Global Metals, Mining & Critical Minerals Conference, February 25 - 28, 2024

- Tombstone Gold Rush Breakfast - Fireside Chat - Toronto, March 5, 2024

- 7AM to 9 AM EST

- Red Cloud Pre-PDAC Mining Showcase, Toronto, March 1

- PDAC, March 3 - 6, 2023

- Exhibitor Booth No. 2213, March 3 - 4

- PDAC 2024 One on One Meeting Program, March 4 - 5

- Core Shack Exhibitor Booth No. 3106, March 5 - 6

About Banyan

The 173 square kilometres ("sq km") AurMac Project lies 30 km from Victoria Gold's Eagle Project and adjacent to Hecla Mining's high grade Keno Hill Silver mine. The AurMac Project is transected by the main Yukon highway and access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Project benefits from a 3-phase powerline, existing power station and cell phone coverage. Banyan has the right to earn up to a 100% interest, in both the Aurex and McQuesten Properties respectively, subject to certain royalties.

In addition to the AurMac Project, the Company holds the Hyland Gold Project, located 70 km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt (the "Hyland Project"). The Hyland Project represents a sediment hosted, structurally controlled, intrusion related gold deposit, within a large land package (over 125 sq km), accessible by a network of existing gravel access roads.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN" and is quoted on the OTCQB Venture Market under the symbol "BYAGF". For more information, please visit the corporate website at www.BanyanGold.com or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD LOOKING INFORMATION: This news release contains forward-looking information, which is not comprised of historical facts and is based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs. Such information can generally be identified by the use of forwarding-looking wording such as "may", "will", "expect", "estimate", "anticipate", "intend(s)", "believe", "potential" and "continue" or the negative thereof or similar variations. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's plans for exploration; and statements regarding exploration expectations, prospectivity of the Company's property interests, potential mining processes, pricing assumptions and costs ease and confidence in increasing ounces, exploration or development plans and timelines; mineral resource estimates; mineral recoveries and anticipated mining costs. Factors that could cause actual results to differ materially from such forward-looking information include uncertainties inherent in resource estimates, continuity and extent of mineralization, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the estimation of mineral resources and the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan's public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

View the original press release on accesswire.com