VANCOUVER, BC / ACCESSWIRE / January 24, 2024 / Mawson Gold Limited ("Mawson" or the "Company") (TSXV:MAW)(Frankfurt:MXR)(OTC PINK:MWSNF) announces Southern Cross Gold Ltd. ("Southern Cross Gold" or "SXG") has published its maiden gold and antimony Exploration Target at its flagship 100%-owned Sunday Creek Project in Victoria, Australia (Figures 3 and 4). The Exploration Target has been developed to demonstrate the scale and high-grade gold-antimony potential of the Sunday Creek Project that has been drilled over the last year and is the first step in the pathway to a resource.

Highlights:

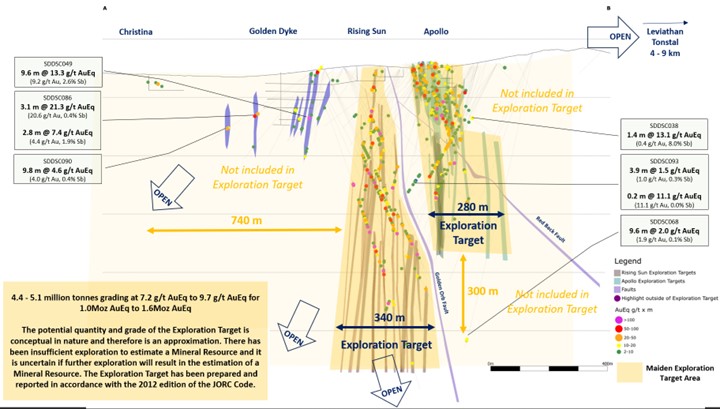

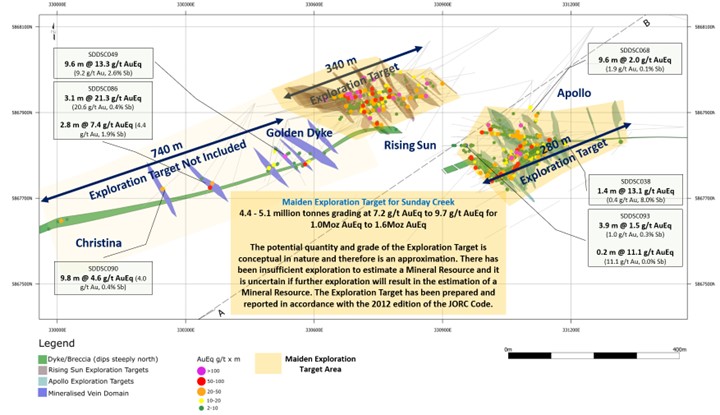

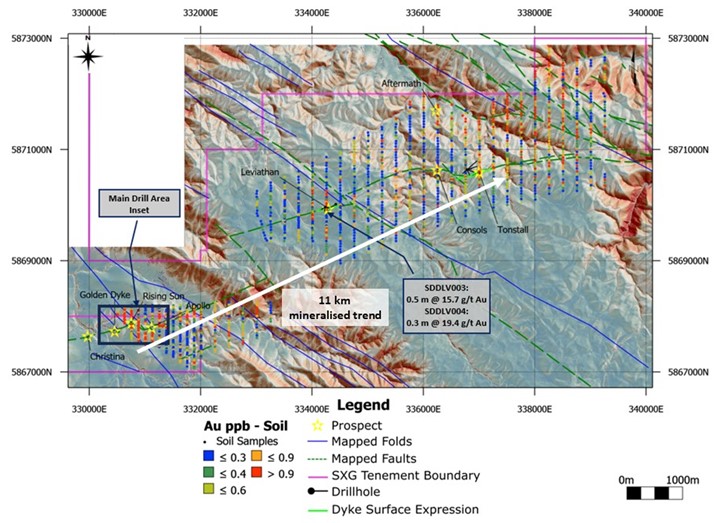

- The Exploration Target for the Sunday Creek project covers only 620 m or about 50% of the known strike of the main drill area and encompasses the Rising Sun and Apollo areas (see Figures 1, 2 and 3). This Target area represents <10% of the 11 km strike of the dyke host across the project.

- The estimated range of potential mineralization for the Exploration Target is (also see Table 1):

4.4 - 5.1 million tonnes grading at 7.2 g/t AuEq to 9.7 g/t AuEq for 1.0Moz AuEq to 1.6Moz AuEq

This is based on 45,971 m of orientated diamond drilling by SXG and preciously Mawson and 64 aircore, reverse circulation and unoriented diamond drill holes for 5,599 m. The potential quantity and grade of the Exploration Target is conceptual in nature and therefore is an approximation. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. The Exploration Target has been prepared and reported in accordance with NI43-101.

- Drilling with 4 rigs within, along strike and down dip from Rising Sun and Apollo continues.

- Mawson owns 93,750,000 shares of SXG (51%), valuing its stake at A$87.7 million (C$77.9 million) based on SXG's closing price on January 23, 2024 AEST.

EXPLORATION TARGET

The approximate Exploration Target ranges are listed in Table 1 and locations shown in Figure 1.

Table 1. Sunday Creek Exploration Target for Apollo and Rising Sun at the Sunday Creek Project

Range |

Tonnes (Mt) |

AuEq g/t* |

Au g/t |

Sb % |

Au Eq (Moz) |

Au (Moz) |

Sb (kt) |

Lower Case |

4.4 |

7.2 |

5.3 |

1.2 |

1.0 |

0.74 |

53.5 |

Upper Case |

5.1 |

9.7 |

7.8 |

1.2 |

1.6 |

1.28 |

62.8 |

Michael Hudson, Mawson Interim CEO and Executive Chairman, states: "Sunday Creek is a rare high-grade discovery. This Exploration Target is the first early opportunity to demonstrate the scale and high-grade potential as suggested by the last year of successful drilling. Notably, the Exploration Target is constrained to the current drill footprint at Apollo and Rising Sun as they contain sufficient drilling to determine continuity and infer grade ranges. This represents approximately half the strike of the main drill area and significant potential exists to increase the size of the exploration target with high grade drill results drilled for up to 450 m beyond the Exploration Target area. These are early days and we expect further drilling will continue to expand the multi-million-ounce potential and high-grade tenor of Sunday Creek."

BASIS FOR EXPLORATION TARGET

The tonnage and grade are estimates based on continuity of mineralization defined by exploration diamond drilling results (previously reported including relevant sections and plans) within proximity to the intrusive "main structure" zone and bleached sediments. Strike extents in the lower-case model are minimized to half drill spacing (~14m) or to locally restrictive geology (i.e. bounds of bleached sediment or dyke) whichever was smaller. The upper-case model strike extents were extended to the average vein strike (typically around ~40m) or to geological constraints, whichever was smaller.

The Exploration Target was limited to a vertical depth of 1,003 m below surface (-710m RL), limited by the deepest mineralization defined to date within the "main structure" dyke/dyke breccia and bleached sediments within Rising Sun. Drilling indicates Rising Sun could contain higher gold and antimony grades than Apollo and Apollo Deeps.

A series of sub-vertical lodes within a 620 m-wide corridor has been outlined at Rising Sun and Apollo with mineralization remaining open to the east, west and also to depth.

Only the Rising Sun and Apollo areas were considered for the Exploration Target as they contain sufficient drilling to suggest continuity and infer grade ranges. The Exploration Target is based on the interpretation of the following geology and mineralization data that has been collated as of the date of this announcement:

- 116 structurally oriented drillholes for 45,971 m at the main Sunday Creek area that have been drilled by Mawson/SXG;

- 64 aircore, reverse circulation and unoriented diamond drill holes for 5,599 m that were drilled historically on the project;

- 26,513 drill hole assay results;

- 353 density measurements on mineralized diamond drill core, an SG of 2.75 g/cm3 was applied to the Exploration Target.

- surface geological mapping, costean data and diamond core geological logging;

- detailed LiDAR imagery;

- geophysical datasets including detailed ground magnetic and 3D induced polarization;

- wireframing and modelling of the Apollo and Rising Sun mineralized body.

A total of 49 mineralized vein set shapes were created for the Exploration Target of which 42 were vein sets and 7 high-grade internal shapes (at Apollo, but not Rising Sun due to the lack of drill data) were defined. A total of 32 of the vein set shapes had grades estimated from composited assay data, while 17 vein set shapes used the average calculated grade of either Rising Sun (lower case 5.3 g/t Au and 1.4 % Sb and upper case 8.9 g/t Au and 1.5% Sb) or Apollo (lower and upper case 4.0 g/t Au, 0.6% Sb) and this was applied to the exploration target. Drilling indicates Rising Sun could contain higher gold and antimony grades than Apollo and Apollo Deep.

Mineralization across all vein sets was limited by the deepest mineralization defined to date, within the "main structure" dyke/dyke breccia and bleached sediments within Rising Sun approximately 1,000 m below surface. While at Apollo the Exploration Target extended from surface to where drill density decreases 650 m below surface.

Below drilling intercepts to the lower estimation limit, the low tonnage range used a minimum width of 1.5 m (75% of average estimated true width of domains) while the high tonnage range applied a minimum width of 2 m (average true width of domains). Strike extents in the low tonnage range model were minimized to half drill spacing (~14 m) or to locally restrictive geology (i.e. bounds of altered sediment (ASED) or dyke) whichever was smaller. The high tonnage range model applied strike extents that were extended to the average vein strike (typically around ~40m) or to geological constraints, whichever was smaller.

Wireframes have been created in Leapfrog Geo using a threshold of 1 g/t Au over 2m. The economic composite tool was used to allow for the inclusion of thin, high-grade intercepts. Grade ranges have been informed by a preliminary grade estimate conducted on top-cut, composited data using Leapfrog Edge. The high- and low-grade ranges are primarily driven by differences in top cuts applied to the Rising Sun estimate. The low-end grade range used a top cut of 24 g/t Au while the upper grade range used a top cut of 67 g/t Au. The change in top cuts reflects the exclusion or inclusion respectively of a higher-grade population present across multiple veins that may be sub-domained and estimated separately as additional drilling is conducted.

For the high-range domains Rising Sun (versus Apollo) contributes 64% of the tonnes and 80% of the contained ounces. Significant upside also remains within the tenor potential of Rising Sun when further high-grade domains can be recognized and separated to maintain the high-grade nature of the veins ie no top cuts need be applied.

Notably the Exploration Target is constrained to the two main areas along the strike of the dyke breccia host on the project: Rising Sun (over 340 m strike) and Apollo (over 280 m strike) for a total 620 m of strike. This strike represents about 50% strike of the 1.2 km main drill footprint to date at Sunday Creek.

EXPLORATION TARGET UPSIDE

The Exploration Target covers 50% of the strike of the core drill area. The other half of the area has not been drilled to the intensity required to include in this Exploration Target, highlighting the potential to further increase the overall gold-antimony endowment of the Sunday Creek Gold-Antimony Project. Drilled prospect areas not yet included in the Exploration Target include:

-

Apollo East: up to 260 m above and east of the exploration target, with drill results including:

- SDDSC063: 1.5 m @ 6.6 g/t AuEq (5.0 g/t Au, 1.0% Sb) from 25.2 m

- SDDSC038: 1.4 m @ 13.1 g/t AuEq (0.4 g/t Au, 8.0% Sb) from 305.5 m

-

Apollo West: 70 m west of the Apollo exploration target area, with drill results including:

- SDDSC093: 3.9 m @ 1.5 g/t AuEq (1.0 g/t Au, 0.3% Sb) from 503.0 m

- SDDSC093: 0.1 m @ 10.5 g/t AuEq (8.7 g/t Au, 1.2% Sb) from 524.8 m

- SDDSC093: 0.2 m @ 11.1 g/t AuEq (11.1 g/t Au, 0.0% Sb) from 528.7 m

-

Apollo Deep: 300 m down dip extension below the exploration target area, with drill results including:

- SDDSC068: 9.6 m @ 2.0 g/t AuEq (1.9 g/t Au, 0.1% Sb) from 1,010.4 m

-

Golden Dyke: 175 m west of the exploration target area, with drill results including:

- SDDSC049: 9.6 m @ 13.3 g/t AuEq (9.2 g/t Au, 2.6% Sb) from 204.4 m

- MDDSC018: 1.8 m @ 9.5 g/t AuEq (8.2 g/t Au, 0.9% Sb) from 202.3 m

- VCRD004: 3.0 m @ 5.5 g/t AuEq (5.2 g/t Au, 0.2% Sb) from 160.0 m

-

Christina: drilling up to 470 m (and historic workings up to 750 m) west of the exploration target area, with drill results including:

- SDDSC086: 2.8 m @ 7.4 g/t AuEq (4.4 g/t Au, 1.9% Sb) from 252.7 m

- SDDSC086: 3.1 m @ 21.3 g/t AuEq (20.6 g/t Au, 0.4% Sb) from 266.5 m.

- SDDSC090: 9.8 m @ 4.6 g/t AuEq (4.0 g/t Au, 0.4% Sb) from 346.9 m

-

Drilled regional targets (including Leviathan): located 3 km east from Apollo, with drill results including:

- SDDLV003: 0.5 m @ 15.7 g/t Au from 87.0 m

- SDDLV004: 0.3 m @ 5.6 g/t Au from 73.4 m and 0.3 m @ 19.4 g/t Au from 100.7 m

- Undrilled regional areas: Exploration at Sunday Creek has district-scale potential. There is an 11 km strike of multiple dyke-breccia-altered sediment mineralized trends extending beyond the initial target drill area, defined by historic workings and soil sampling.

TOWARDS A MINERAL RESOURCE ESTIMATE

The proposed exploration activities designed to test the validity of the Exploration Target and to move from an Exploration Target to a Mineral Resource Estimate will comprise the following activities.

Native Title Heritage Surveys

Heritage surveys required to gain access to the Exploration Target area have been completed in conjunction with the Taungurung Land and Waters Council who represent the Native Title holders the Taungurung People.

Cultural Heritage Clearances

Heritage walk overs required to gain access to the Exploration Target area have been completed in conjunction with the Taungurung Land and Waters Council who represent the Native Title holders the Taungurung People.

Approvals

The majority of the Exploration Target is contained within a small crown land allotment. Southern Cross Gold owns 132.64 hectares that fully encloses the crown land. Approvals required for exploration drilling to test the Exploration Target, have all been obtained on all the crown land and on the freehold land, except within 200 m of the Sunday Creek near the Christina area. Drill access to these areas is now required to test at depth to the west of Golden Dyke and approvals to access these areas are expected in Q1 2024.

Exploration Licences

The vast majority of the Exploration Target is located within granted Retention Licence RL6040 and surrounded by granted EL6163. No further Exploration Licences are required to be granted to test the Exploration Target.

Exploration Program

Expansion and resource definition drilling is continuing at the project with four diamond rigs operating to continue to extend mineralization drill-out within the Exploration Target and to upgrade the mineralization to Mineral Resource status. It is expected that these activities will be completed during the second half of 2024.

Metallurgical test work

Southern Cross Gold has completed initial metallurgical test work on two drill holes from the Exploration Target area which were reported on 10 January 2024. Mineralogical investigations demonstrated a high proportion of non-refractory native gold (82% - 84%). Additionally, gravity and bulk flotation resulted in 93.3% - 97.6% recovery of gold. Flotation gave 88.9% - 95.0% recovery of gold across two products:

1. An antimony concentrate, grading 32% - 52% Sb (87.1% - 93.8% recovery), 81.4 g/t - 313.6 g/t Au (40% of feed gold) with low to moderate arsenic contents (0.4% and 2.58%). It was estimated that 96% - 98% of the contained gold was native gold and;

2. A sulphide concentrate containing 65.7 g/t - 159.0 g/t Au (49% - 55% of feed gold) with higher arsenic contents (5.7% and 12.1%). Critically 79% - 82% of the contained gold was native gold indicating the opportunity for ease of gold separation.

Mineral Resource Estimate

SRK Consulting (Australasia) Pty Ltd ("SRK") have been engaged for ongoing modelling assistance and the eventual preparation of a Mineral Resource Estimate.

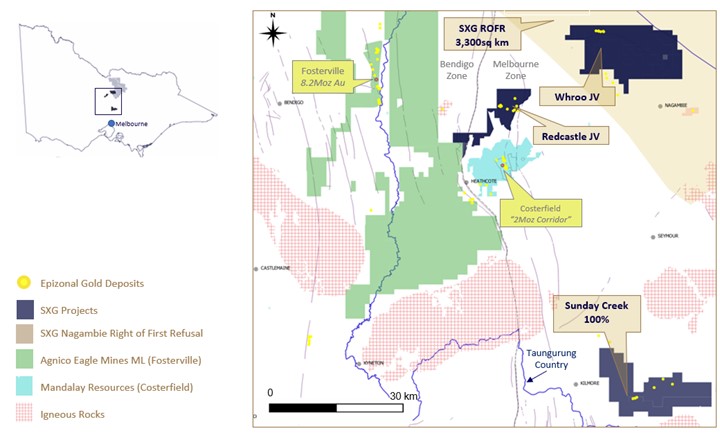

About Sunday Creek

The Sunday Creek epizonal-style gold project is located 60 km north of Melbourne within 19,365 hectares of granted exploration tenements.

History

The Sunday Creek deposit is a high level orogenic (or epizonal) deposit. Small scale mining has been undertaken in the project area since the 1880s continuing through to the early 1900s. Historical production occurred with multiple small shafts and alluvial workings across the existing permits. Past production at the Sunday Creek prospect is reported as 41,000 oz gold at a grade of 33 g/t gold. Larger historic workings along the trend from west to east include Christina, Golden Dyke, Rising Sun and Apollo.

Regional Geology

Sunday Creek occurs with the Melbourne Zone of the Lachlan Geosyncline, in sequences folded and thrust-faulted by the Late Devonian Tabberabberan Orogeny. The regional host to the Sunday Creek mineralization is an interbedded turbidite sequence of siltstones, mudstones, and minor sandstones, metamorphosed to sub-greenschist facies and folded into a set of open north-west trending synclines and anticlines.

Structural Setting and Local Geology

Intruded into the sedimentary sequence is a series of intermediate monzodiorite - diorite dykes and breccias on an east-west trend. The Sunday Creek dykes have highly variable textures and compositions with the earliest emplaced aphanitic varieties emplaced along thin fracture sets. These fine-grained dykes locally grade into porphyritic to massive varieties as the thickness of the dykes increases and brecciate in areas of complexity or in proximity to fold hinges.

Large scale thrusts sub-parallel to the NW trending structural grain, dislocate the dyke system and an array of sub-vertical extension veins form subparallel to the bedding trend and orthogonal to the intruded dyke sequence. Veining is focused within areas of high competency contrast, such as the intruded dyke and surrounding alteration, fold hinges and areas of structural complexity.

Alteration

Distally a regional chlorite alteration weakly pervades the sediments, with a change in mica composition from phengitic to muscovitic mica approaching mineralization, an increase in carbonate spotting and cementation and proximal to the dyke a very intense texturally destructive alteration of sericite-carbonate-silica "bleaching" of the sediments.

Mineralization & Structural Setting

Geological controls on mineralization (structural, chemical, stratigraphic) exist on every ore deposit and Sunday Creek is no different. Mineralization is structurally controlled, with increased mineralization associated within the "bleaching" around the intrusive sequence. Early alteration and sulphide (pyrite) mineralization has exploited the vesicular/amygdaloidal nature of the pervasively altered/mineralized dyke and the brecciated areas, or forms east-west trending pyrite veinlets.

Gold-antimony mineralization is dominantly hosted within zones of sub-vertical, brittle-ductile NW striking shear veins and associated veins, containing visible gold, quartz, stibnite, occasional fibrous sulphosalts and minor ferroan carbonates infill. The veins have an associated selvedge of disseminated sulphides in the form of arsenian pyrite, pyrite and arsenopyrite. The mineralized zones crosscut the bleached sediments and altered dyke (the "host") on a north-westerly orientation and the zones are typically between 5-30m wide, 20-100m in strike and currently defined vertically down to 1km depth. Each of these zones repeats every 10-20m within the Apollo and Rising Sun areas with 42 vein sets currently defined to date.

When observed from above, the host resembles the side rails of a ladder, where the sub-vertical mineralized vein sets are the rungs, many of which extend from surface to depth.

Further Information

Further discussion and analysis of the Sunday Creek project is available through the interactive Vrify 3D animations, presentations and videos all available on the SXG website. These data, along with an interview on these results with Managing Director Michael Hudson can be viewed at www.southerncrossgold.com.au.

Gold Equivalent Calculation

SXG considers that both gold and antimony that are included in the gold equivalent calculation ("AuEq") have reasonable potential to be recovered at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Mandalay Resources Ltd contains two million ounces of equivalent gold (Mandalay Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

SXG considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its Mandalay Technical Report, 2022 dated 25 March 2022. The gold equivalence formula used by Mandalay Resources was calculated using recoveries achieved at the Costerfield Property Brunswick Processing Plant during 2020, using a gold price of US$1,700 per ounce, an antimony price of US$8,500 per tonne and 2021 total year metal recoveries of 93% for gold and 95% for antimony, and is as follows:

𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%).

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXG considers that a 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services ("On Site") which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

MAW considers that both gold and antimony that are included in the gold equivalent calculation ("AuEq") have reasonable potential to be recovered at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Mandalay Resources Ltd contains two million ounces of equivalent gold (Mandalay Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

SXG considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its Mandalay Technical Report, 2022 dated 25 March 2022. The gold equivalence formula used by Mandalay Resources was calculated using recoveries achieved at the Costerfield Property Brunswick Processing Plant during 2020, using a gold price of US$1,700 per ounce, an antimony price of US$8,500 per tonne and 2021 total year metal recoveries of 93% for gold and 95% for antimony, and is as follows: 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%).

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXG considers that a 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.

Certain information in this announcement also relates to prior drill hole exploration results, are extracted from the following announcements, which are available to view on www.southerncrossgold.com.au:

About Mawson Gold Limited (TSXV:MAW),(FRANKFURT:MXR),(OTC PINK:MWSNF)

Mawson Gold Limited has distinguished itself as a leading Nordic exploration company. Over the last decades, the team behind Mawson has forged a long and successful record of discovering, financing, and advancing mineral projects in the Nordics and Australia. Mawson holds the Skellefteå North gold discovery and a portfolio of historic uranium resources in Sweden. Mawson also holds 51% of Southern Cross Gold Ltd. (ASX:SXG) which owns or controls three high-grade, historic epizonal goldfields covering 470 km2 in Victoria, Australia, including the exciting Sunday Creek Au-Sb discovery.

About Southern Cross Gold Ltd (ASX:SXG)

Southern Cross Gold holds the 100%-owned Sunday Creek project in Victoria and Mt Isa project in Queensland, the Redcastle and Whroo joint ventures in Victoria, Australia, and a strategic 10% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants SXG a Right of First Refusal over a 3,300 square kilometer tenement package held by NAG in Victoria.

On behalf of the Board,

"Michael Hudson"

Michael Hudson, Interim CEO and Executive Chairman

Further Information

www.mawsongold.com

1305 - 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary

+1 (604) 685 9316 info@mawsongold.com

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson's expectations regarding its ownership interest in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including COVID-19, on the Company's business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on SEDAR. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Figure 1: Sunday Creek Longitudinal Section showing 49 total vein shapes created for the Exploration Target (dark yellow, blue outline). Notably the Exploration Target is constrained to the two main areas along the strike of the dyke breccia host on the project: Rising Sun (over 340 m strike) and Apollo (over 280 m strike) for a total 620 m of strike. This strike represents only 50% strike (light yellow) of the 1.2 km main drill footprint to date at Sunday Creek where high-grade drill intersections have already been made.

Figure 2: Sunday Creek plan view showing area of interest for Exploration Target (dark yellow)

Figure 3: Sunday Creek regional plan view showing LiDAR, soil sampling, structural framework, regional historic epizonal gold mining areas and broad regional areas (Tonstal, Consols and Leviathan) tested by 12 holes for 2,383 m drill program. The regional drill areas are at Tonstal, Consols and Leviathan located 4,000-7,500 m along strike from the main drill area at Golden Dyke- Apollo.

Figure 4: Location of the Sunday Creek project, along with SXG's other Victoria projects and simplified geology.

SOURCE: Mawson Gold Limited

View the original press release on accesswire.com