VANCOUVER, BC / ACCESSWIRE / March 22, 2023 / Fabled Copper Corp. ("Fabled" or the "Company") (CSE:FABL)(FSE:XZ7) is pleased to announce that it has entered into two separate letters of intent, and one purchase agreement, all dated March 21, 2023 (the "Agreements") to acquire three separate lithium claim blocks located in Quebec.

OHM Property

Fabled entered into a letter of intent (the "OHM LOI"), dated March 21, 2023, to acquire the "OHM Property" (the "OHM Property") from arm's length vendors (the "OHM Vendors").

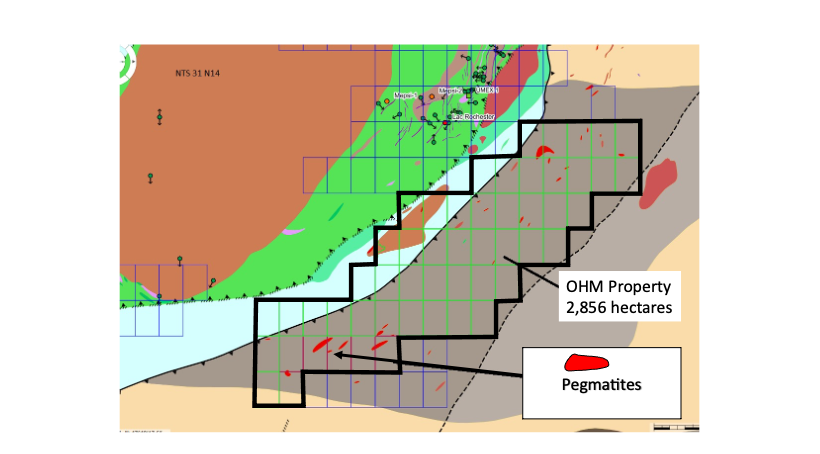

The OHM Property consists of 51 contiguous cells comprising of 2,856 hectares located approximately 70 kms south of Val D'Or. The OHM Property can be easily accessed from the main highway, route 117 and forestry roads 43 and 44.

A minimum of at least 10 pegmatite outcrops have been documented by the vendors. No documented work has been done in the search for lithium within the pegmatite swarms. See Figure 1 below.

Figure 1 - OHM Property

Terms of the OHM LOI

Under the terms of the OHM LOI, Fabled may be granted an option (the "OHM Option") to acquire the OHM Property (the "OHMAcquisition"). In order to exercise the OHM Option and acquire the OHM Property Fabled will, pursuant to the definitive agreement (the "OHM Definitive Agreement") if entered into, require pay to the OHM Vendors:

- cash as follows:

Cash Payment Timing |

Payment Amount |

On the date of execution of the OHM Definitive Agreement (the "OHM Closing Date") |

$50,000 |

By the 12 month anniversary of the OHM Closing Date |

$75,000 |

By the 24 month anniversary of the OHM Closing Date |

$100,000 |

By the 36 month anniversary of the OHM Closing Date |

$125,000 |

By the 48 month anniversary of the OHM Closing Date |

$150,000 |

- common shares of the Company as follows:

Share Issuance Timing |

Number of Shares |

On the OHM Closing Date |

200,000 |

By the 12 month anniversary of the OHM Closing Date |

250,000 |

By the 24 month anniversary of the OHM Closing Date |

350,000 |

By the 36 month anniversary of the OHM Closing Date |

400,000 |

Fabled must also incur cumulative exploration expenses on the OHM Property by the following dates:

Expense Requirement Date |

Amount |

By the 12 month anniversary of the OHM Closing Date |

$50,000 |

By the 24 month anniversary of the OHM Closing Date |

$150,000 |

By the 36 month anniversary of the OHM Closing Date |

$350,000 |

By the 48 month anniversary of the OHM Closing Date |

$650,000 |

Fabled will also grant the OHM Vendors a 3% NSR royalty over the OHM Property. Fabled may purchase 2% of the NSR Royalty at any time for $2,000,000.

VOLT 1 and 2 Properties

Fabled entered into letter of intent (the "VOLT 1 LOI") on March 21, 2023 to acquire the VOLT 1 Property (the "VOLT 1 Property") from arm's length vendors (the "VOLT 1 Vendors").

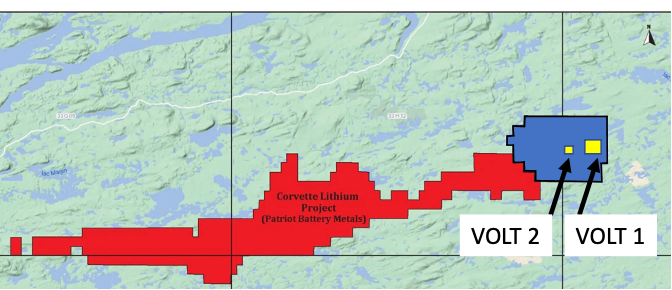

Fabled also entered into a purchase agreement with arm's length vendors on March 21, 2023 to acquire two separate contiguous lithium claims (the "VOLT 2 Property") for a total one-time payment of $1,000. The VOLT 2 Property is approximately 2 km due west of the VOLT 1 Property.

The VOLT 1 Property is comprised of 9 contiguous cells with a total size of 504 hectares. The VOLT 2 Property is comprised of 2 contiguous cells with a total size of 112 hectares. Both properties are located in the James Bay Lithium District and less than 4 kilometers to the west of Patriot Battery Metals (PMET.V) Corvette lithium project. See Figure 2 below.

Figure 2 - Property Location VOLT 1, 2

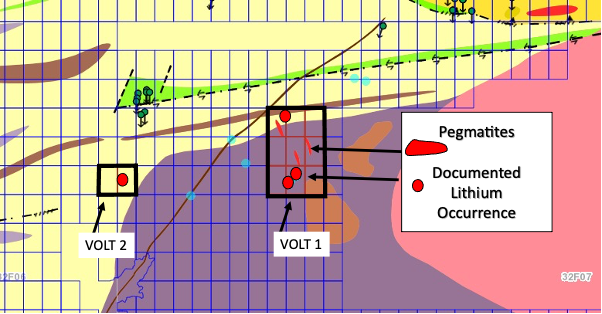

Numerous lithium anomalies directly associated with pegmatites currently suggest a favorable horizon to be explored and tested.

Figure 3 - VOLT 1, 2 Geology

The development of several logging roads over the past few years allows for on site access.

Terms of the VOLT 1 LOI

Under the terms of the VOLT 1 LOI, Fabled may be granted an option (the "VOLT 1 Option") to acquire the VOLT 1 Property (the "VOLT 1 Acquisition"). In order to exercise the VOLT 1 Option and acquire the VOLT 1 Property Fabled will, pursuant to the definitive agreement (the "V1 Definitive Agreement") if entered into, require pay to the VOLT 1 Vendors:

- cash as follows:

Cash Payment Timing |

Payment Amount |

On the date of execution of the V1 Definitive Agreement (the "V1 Closing Date") |

$30,000 |

By the 12 month anniversary of the V1 Closing Date |

$35,000 |

By the 24 month anniversary of the V1 Closing Date |

$40,000 |

By the 36 month anniversary of the V1 Closing Date |

$45,000 |

By the 48 month anniversary of the V1 Closing Date |

$50,000 |

- common shares of the Company as follows:

Share Issuance Timing |

Number of Shares |

On the V1 Closing Date |

200,000 |

By the 12 month anniversary of the V1 Closing Date |

250,000 |

By the 24 month anniversary of the V1 Closing Date |

250,000 |

By the 36 month anniversary of the V1 Closing Date |

300,000 |

By the 48 month anniversary of the V1 Closing Date |

400,000 |

Fabled must also incur cumulative exploration expenses on the VOLT 1 Property by the following dates:

Expense Requirement Date |

Amount |

By the 12 month anniversary of the V1 Closing Date |

$40,000 |

By the 24 month anniversary of the V1 Closing Date |

$90,000 |

By the 36 month anniversary of the V1 Closing Date |

$160,000 |

By the 48 month anniversary of the V1 Closing Date |

$260,000 |

Fabled will also grant the VOLT 1 Vendors a 3% NSR royalty over the VOLT 1 Property. Fabled may purchase 2% of the NSR royalty at any time for $2,000,000.

Entry into the OHM Definitive Agreement and the V1 Definitive Agreement is each conditional upon the Company securing additional financing and all required regulatory approvals.

Until the above conditions are met there is no assurance that either the OHM Acquisition or VOLT 1 Acquisition will be completed as contemplated above or at all.

About Fabled Copper Corp.

Fabled is a junior mining exploration company. Its current focus is to creating value for stakeholders through the exploration and development of its existing drill ready copper properties located in northern British Columbia. The Company's current property package consists of the Muskwa Project and the Bronson Property and comprises approximately 16,219 hectares in three non-contiguous blocks and located in the Liard Mining Division in northern British Columbia.

The Company is seeking to broaden and diversify its portfolio. The Company has acquired the VOLT 2 lithium Property, located in James Bay, Quebec. It is also seeking to acquire the OHM Property, located in Val D'Or, Quebec and the VOLT 1 Property located in the James Bay, Quebec. The Company is also seeking to add an additional high grade gold and silver property, the TJ Ridge Property in British Columbia for which it has entered into a letter of intent.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Copper Corp.

Phone: (819) 316-0919

peter@fabledcopper.org

For further information please contact:

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition, development plans and business plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: the failure of the shareholders of the Company to approve the Consolidation Proposal, impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; inability to obtain drilling permits; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

SOURCE: Fabled Copper Corp.

View source version on accesswire.com:

https://www.accesswire.com/745145/Fabled-Copper-Enters-into-Agreements-to-Acquire-Three-Blocks-of-Lithium-Claims-in-Quebec