EDMONTON, AB / ACCESSWIRE / November 16, 2022 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSXV:OSS)(OTCQB:OSSIF) , a North American developer of cloud-based business solutions, announces its financial results for the quarter ended September 30, 2022. Please refer to the interim unaudited condensed Consolidated Financial Statements and Management's Discussion and Analysis (" MD&A ") for the three and nine months ended September 30, 2022 (" Q3 2022 " and " YTD 2022 ", respectively) filed on SEDAR at www.sedar.com for more information. Unless otherwise stated, all dollar amounts are reported in Canadian dollars.

FINANCIAL SUMMARY FOR THREE AND NINE MONTHS ENDED SEPEMBER 30, 2022

The following table summarizes the third quarter ended September 30, 2022, compared to September 30, 2021:

| Three months ended | Nine months ended | |||||||||||||||

(in C$,000, per share in C$) |

Sept. 30, 2022 |

Sept. 30, 2021 |

Sept. 30, 2022 |

Sept. 30, 2021 |

||||||||||||

| $ | $ | $ | $ | |||||||||||||

Revenue |

2,085 | 1,233 | 4,699 | 3,240 | ||||||||||||

Gross profit |

1,541 | 937 | 3,346 | 2,437 | ||||||||||||

Net loss |

(300 | ) | (705 | ) | (2,348 | ) | (2,830 | ) | ||||||||

Exchange (loss) gain on translation of foreign operations |

(96 | ) | (39 | ) | (103 | ) | 14 | |||||||||

Comprehensive loss |

(396 | ) | (744 | ) | (2,451 | ) | (2,817 | ) | ||||||||

Weighted average common shares outstanding - basic and fully diluted (000)'s |

120,640 | 117,187 | 119,238 | 116,436 | ||||||||||||

Net loss per share |

- | (0.01 | ) | (0.02 | ) | (0.02 | ) | |||||||||

FINANCIAL HIGHLIGHTS FOR Q3 2022

- Revenue for Q3 2022 increased 69% over Q3 2021. Backing out $421,410 of revenue earned by our Integrity Management business unit ("IM Operations") acquisition that closed June 30, 2022, revenue growth was 35% for the quarter, year-over-year.

- Revenue for YTD 2022 increased 45% over YTD 2021. Backing out revenue from IM Operations, YTD 2022 revenue increased 32% over YTD 2021. Net loss decreased 57% ($404,851) and 17% ($482,642) for Q3 2021 and YTD 2021, respectively.

- Deferred revenue (prepaid SaaS and services fees) at Q3 2022 was $2.9 million, an increase of 147.4% from December 31, 2021.

- Revenue in Q3 2022 reached a high point for the Company for revenue derived from its software products and related services, due to new customer additions and revenue from IM Operations .

- Gross profit in Q3 2022 increased 65% ($604,347) and 37% ($908,773) over Q3 2021 and YTD 2021, respectively.

- Cash and accounts receivable as at September 30, 2022 totalled $5.8 million, marginally higher than $5.7 million as at December 31, 2021.

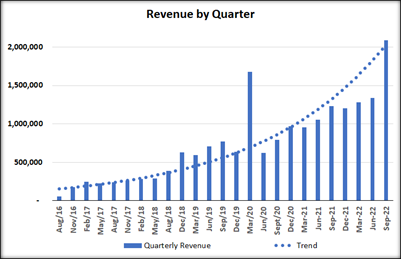

- The chart below shows revenue for the past twenty-five quarters. Q3 2022 SaaS and services revenue was a record high for the Company. The dotted line illustrates CIM's compounded annual revenue growth rate of 80%.

OPERATIONAL HIGHLIGHTS FOR Q3 2022

- The Company continued to add new customers in Q3 2022:

- On August 16, 2022, the Company announced a Fortune 50 oil and gas company had contracted to adopt the CIM platform.

- On August 23, 2022, a second global industry super-major entered into a multi-year agreement to use CIM, following completion of comprehensive RFP and production trial process that was conducted with several vendors globally.

- On October 12, 2022, OneSoft announced that Jemena Asset Management , a large operator of natural gas pipelines in Australia, had entered into a multi-year agreement to use CIM for integrity management of its pipeline assets.

- On September 12, 2022, the Company announced the release of its Corrosion Growth Analysis product, the first phase of its Pipeline Integrity as a Service offering, whereby pipeline operators can submit ILI pipeline assessments to OneBridge for run comparison analysis by CIM. The Company believes this strategy will be of high interest to small and large pipeline operators who seek more efficient ways to conduct ILI run comparisons.

- On September 22, 2022, the Company announced a teaming agreement with Uptake Technologies to provide joint customers an offering to increase operator's safety and operational efficiencies by leveraging the ingestion of key pipeline operational data into CIM.

BUSINESS AND CORPORATE HIGHLIGHTS FOR Q3 2022

- During Q3 2022, the Company integrated the Integrity Management business unit acquisition that closed on June 30, 2022 into its current operations. IM Operations generated revenue of $421,410 in Q3 2022.

- OneSoft continued to engage with current and prospective shareholders during the quarter, including hosting numerous on-line meetings and attending the CEM TSX-V Investor event in July 2022. Subsequent to the quarter end, OneSoft presented at the October 26, 2022 LD Micro Invitational event in Los Angeles and on November 10, 2022 at the Rocky Mountain Microcap Conference event in Denver.

BUSINESS OUTLOOK

Management is pleased with having built a strong foundation for OneSoft's business and increasing our competitive moat, both of which we believe enables continued progress and revenue growth into the foreseeable future. The Company's objective to modernize pipeline asset and integrity management processes by leveraging advanced data science, machine learning and cloud computing was revolutionary when the OneBridge CIM project commenced in 2016 and was embraced by only a small number of visionary pipeline operators. OneSoft has now successfully completed extensive validation efforts with fourteen industry leading pipeline operators who have adopted our CIM platform as their next generation solutions for pipeline asset and integrity management. Additionally, we have forged relationships with three partners to date who we believe will assist us to market our solutions world-wide.

We believe that our first-mover advantage, large financial investment and strongly validated user support collectively result in strong value creation for all stakeholders, including Company shareholders. Although some potential competitors may emerge, it is our view that they will be significantly disadvantaged to compete with our CIM platform, which we believe is becoming the new standard to which potential competing products will be compared.

Since the outset of the CIM project, management has elected to accelerate research and development efforts by maximizing reinvestment of Company resources (and incurring operational losses) to gain first mover technology advantage and a strong competitive moat. We estimate that potential competitors will need at least 5 years and a high financial investment to develop solutions providing CIM's current functionality, particularly when considering that more than a decade of software development by Phillips 66 has been incorporated into the Company's cloud solutions, which is a unique advantage exclusive to OneSoft. We believe that software companies that want to develop competitive products face elevated challenges and risks, including finding and engaging early adopter customers who are willing to conduct the product validations necessary to generate market acceptance over the long term as well as vast amounts of pipeline data required to validate the solution. We believe that OneSoft's first mover advantages regarding technology development and market acceptance, evidenced by the hallmark customers who have entered into multi-year CIM use agreements, is paramount to future success. We are also confident that our customers are unlikely to disengage use of our CIM solutions after they experience the benefits of them.

Management believes that CIM adoption and momentum to replace legacy systems and processes, particularly during the past year, has steadily increased, creating a new standard in the process. OneSoft signed the largest U.S. pipeline operator (based on miles of pipeline operated) in Q3 2021 and several other premier customers in Fiscal 2022, including our first Australian customer and our second super-major customer who decided to adopt CIM following an intensive vetting of several major international vendors as well as an extensive year-long validation of CIM.

The CIM platform continues to garner attention from numerous attendees at major industry trade show events including PPIM and IPC conferences, which both draw international audiences of potential customers and competitors. Based on feedback from these events and other market research, we believe that there is general industry acceptance that the CIM platform is the new industry leader for digital transformation that leverages data science, machine learning and cloud computing technologies. Some industry vendors who previously considered CIM to be a competitor are now exploring collaborative initiatives to potentially deliver CIM capabilities as part of their service offerings to their customers.

As more CIM customers and their differing operating scenarios are on-boarded and better understood, revenue forecasting from existing customers is becoming more predictable and accurate. The Company plans, subject to regulatory compliance, to disclose factors to assist readers to forecast revenue projections in Fiscal 2023.

Management strongly believes in adherence to two key strategies to build value for all stakeholders, including shareholders: (1) to focus on signing of new customers, which we believe will be instrumental in growing revenues, solidifying our first-mover advantage and thwarting potential competitors; and (2) to maximize reinvestment of Company resources into R&D to protect and increase our competitive moat. Management intends to continue to maximize company growth efforts in accordance with current business plans and resources, which does not contemplate raising additional capital in current capital market conditions. Key considerations to meet this objective include monitoring and managing cash (including cash equivalents and accounts receivable) and deferred revenue (prepaid fees committed by customers), which collectively reflect CIM use growth and associated future revenue generation. These factors bode well at this point and Management believes the Company can continue its business and growth plans as currently envisioned without requirement to raise additional capital.

ON BEHALF OF THE BOARD OF DIRECTORS

ONESOFT SOLUTIONS INC.

Douglas Thomson

Chair

For more information, please contact

| Dwayne Kushniruk, CEO dkushniruk@onesoft.ca 587-416-6787 |

Sean Peasgood, Investor Relations Sean@SophicCapital.com 647-494-7710 |

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may," "should," "anticipate," "expects," "believe," "will," "intends," "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers; the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally; which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest rate and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View source version on accesswire.com:

https://www.accesswire.com/726175/OneSoft-Solutions-Inc-Reports-Financial-and-Operational-Results-for-Q3-2022-Revenue-up-69-A-New-Quarterly-High-for-Software-and-Related-Services