If you want to be a smart investor…

Not only do you need a solid investment philosophy and a diversified portfolio structure…

You also need the right stock research tools to execute your portfolio strategy.

There are countless tools and resources out there, all claiming to be the best stock research website. Who should you believe?

Who can you turn to as your go-to site … Where you can conduct the majority of your stock analysis?

The truth is that the best stock research site will depend on your investing style and goals. Keep reading to find out some of the top websites for different styles of investing:

The 4 Types of Stock Research Websites & ToolsStock research websites fall into 4 main categories:

- Stock Pickers/Analysts

- Stock Screeners

- Investment Researchers

- News/Basic Quote Information

If you’re not sure where to start, here are a few questions to give yourself some clarity:

- Are you looking to gather financial data to perform your own fundamental analysis calculations?

- Are you looking for stock recommendations from industry professionals or opinions on stocks you already know about?

- Are you looking for a screener tool to help you uncover new stock ideas?

- Are you looking for up-to-date news and basic quote data?

Most likely, you’re looking for some combination of all of these…

Here’s a list of the 9 Best Stock Research Websites & Tools, organized by category, that will meet your needs and goals as an investor.

Plus, a detailed explanation of each site’s best features and limitations, what type of investor it’s right for, and pricing.

Overall - The Best Stock Research WebsitesGiven their well-rounded services and stock research tools, these two sites are great go-to resources for high-quality stock research.

1. StockNews

Source: StockNews

Hey — we’re biased, but we think StockNews is one of the best stock research sites. Why? For one, StockNews has two things that most of the other best stock research websites don’t:

- A proprietary ratings system. StockNews has its own system of rating stocks called the POWR ratings system. It analyzes securities (both stocks and ETFs) by reviewing 118 different factors, then grading them from A (Strong Buy) to F. Those Strong Buy stocks have a great track record — an average annual return of 28.56% or more since 1999.

- Expert trader commentary. At the helm of StockNews is Steve Reitmeister, an investor with 40 years of investing experience, including a nearly 20 year stint leading Zacks.com. Reitmeister shares his commentary and hand-selected stock picks through one of StockNews’ services, Reitmeister Total Return portfolio.

That’s not all the site has to offer. The stock recommendation service mentioned above is only one of the site’s services — there are plenty of others to choose from, such as POWR Stocks Under $10 POWR Value, and POWR Income Insider, which is focused on growth and income investing.

Of course, StockNews also has other research tools that you’ll need, like screeners, watchlists, and, well, stock news.

Who It’s ForInvestors looking for a one-stop-shop for fundamental research and stock ideas.

Pricing

StockNews offers a $1, 30-day trial for both Premium POWR access and for its stock alert services. Premium POWR access is available for $19.97 a month with a 1-year plan.

2. WallStreetZen

Source: WallStreetZen

WallStreetZen is the best stock research site for accessibility — both in terms of how the stock research is expressed and its affordable price point.

WallStreetZen is perfect for serious, part-time investors looking to perform heavy fundamental analysis and get new stock ideas in minutes, not hours. This stock analysis website aggregates and automates key due diligence checks into simple, one-line explanations and intuitive visuals that help you interpret the data to make informed long-term investing decisions.

If you’re looking to perform fundamental analysis, get stock recommendations from top analysts, or use a screener that’s built to handle your personal investing style, WallStreetZen is the site for you. Here are a few of its features:

Zen Score: Zen Score is a summary of a company’s fundamental strengths and weaknesses, generated in seconds, from which you can launch further investigation into a company’s financials, valuation, forecast, dividend and performance.

Top Analysts: WallStreetZen tracks and ranks nearly 4,000 analysts based on the average returns, frequency, and win rate of their stock recommendations over multiple years. So, you get the very best ideas from proven performers in a wide range of industries and sectors.

Plus, the Top Analysts feature lets you dig into the exact reasons why an analyst made their buy/sell/hold recommendation and read analyst narratives on any stock:

You can also create a watchlist, filter and screen for stocks, and more. And if you need ideas for potential investments, its library of pre-built Stock Ideas can help you get started.

Who It’s ForWallStreetZen is the best stock research website overall because it handles nearly every component of the investing process:

- Fundamental analysis ✅

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Zen Score, Top Analysts, Stock Screener and other ancillary features make this the best stock research site in 2024 for fundamental investors.

WallStreetZen may be a good supplement for investors who rely heavily on technical analysis, but it won’t replace their main charting tool.

However, even if you’re a pure day trader, it’s never a bad idea to check the underlying fundamentals of the stocks you’re trading or know what the world’s top analysts have to say about them.

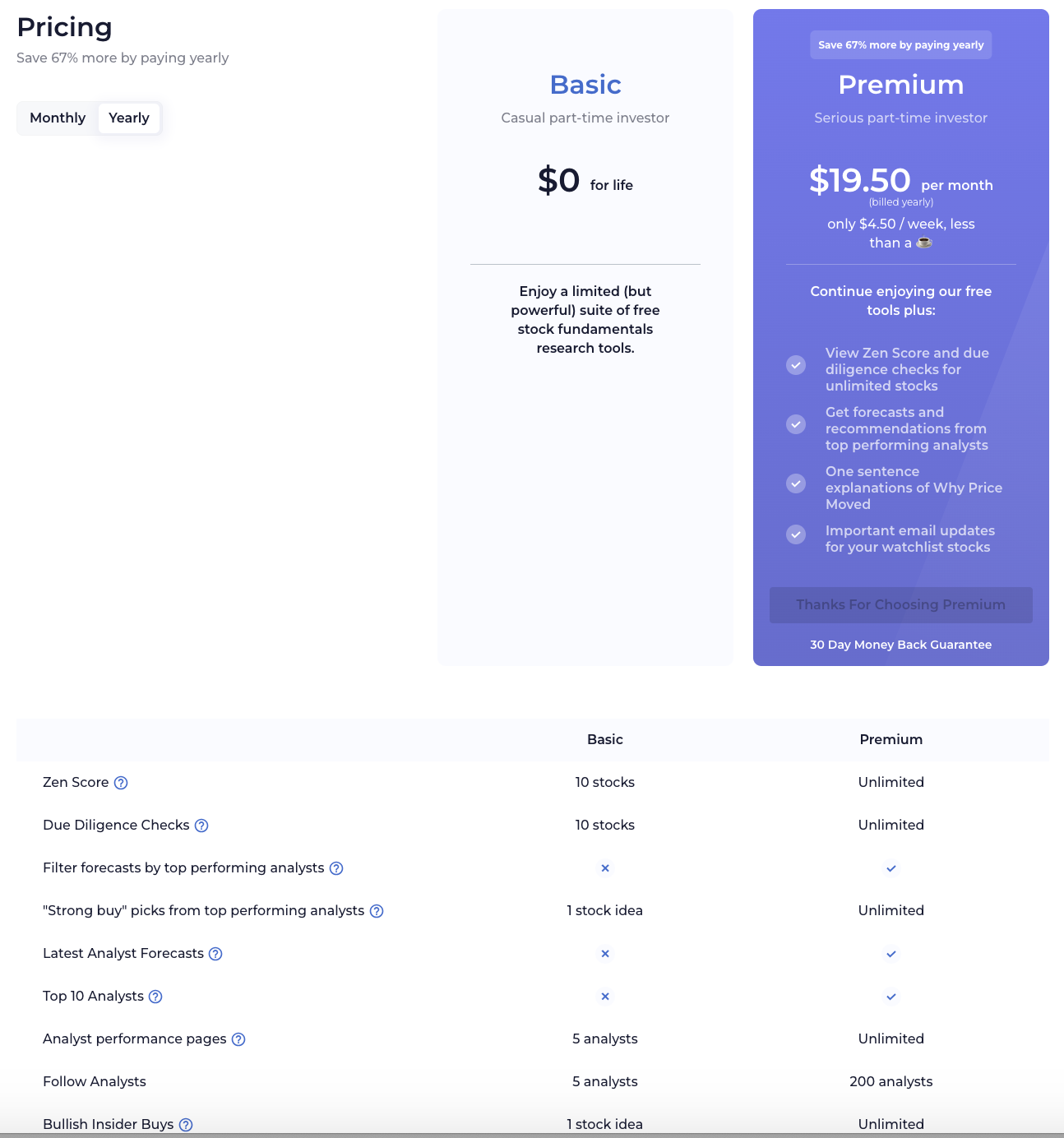

PricingWallStreetZen has two plans: Basic and Premium:

Source: WallStreetZen

Unlike the other sites on this list, the Basic plan is free and includes almost every feature, but power users will want to upgrade to Premium to unlock unlimited access, which is just $19.50/month (billed annually).

Try it out for yourself with a 14-day trial.

Best Stock Pickers/Analysts WebsitesIf you’re looking specifically for stock picking, these are some of the best stock research websites:

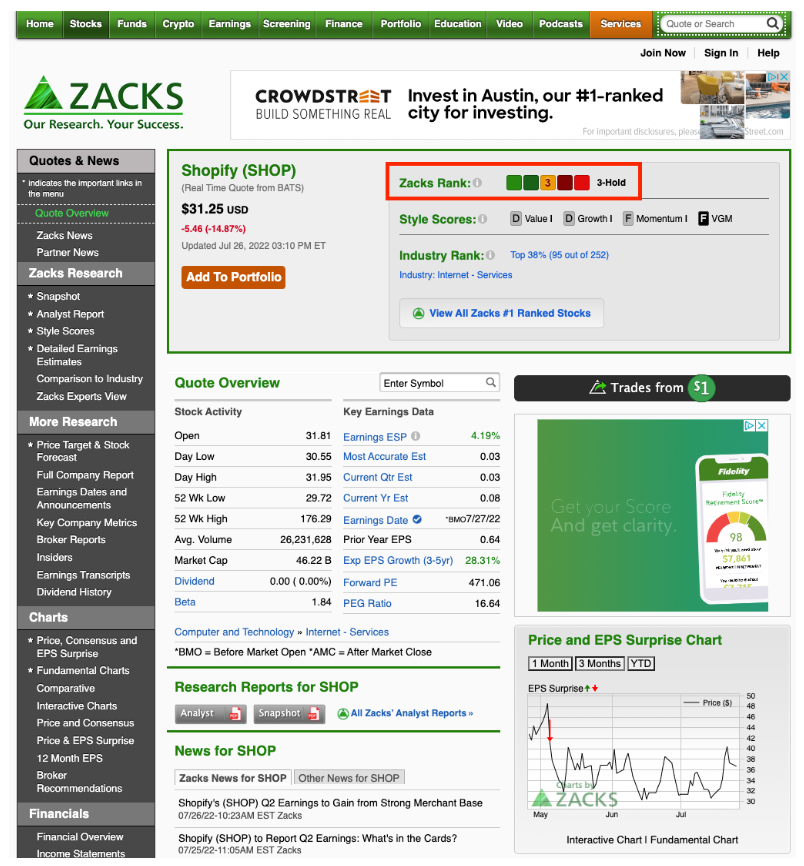

1. Zacks Investment ResearchZacks Investment Research was founded in 1978. It’s currently one of the largest providers of independent stock, ETF, and mutual fund research in the U.S.:

Source: Zacks

The site is best-known for Zacks Rank, a simple rating system ranging from Rank #1 (Strong Buy) to Rank #5 (Strong Sell).

Zacks Premium is its most popular product. It allows investors to unlock all the Zacks Rank features, including:

- Zacks #1 Rank List (which you can filter by sector, industry, price, date, value score, and more)

- Access to a dedicated service team

- An Earnings ESP Filter, which determines the likelihood of an earnings surprise before it’s reported

- Zacks Premium Screens

- A portfolio of 50 long-term gain potential stocks, known as the Focus List

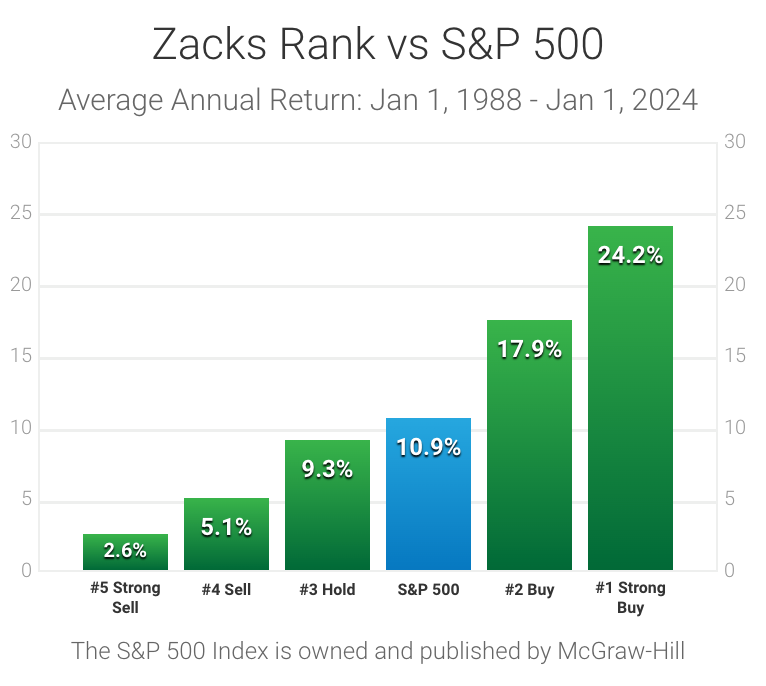

According to the site, Zacks Rank #1 (Strong Buy) stocks have more than doubled the S&P 500 with an average gain of +24% per year from January 1, 1988 through January 1, 2024 — quite a record, which merits its spot on our best stock research sites list:

Source: Zacks

Short-term traders, long-term investors, and those interested in mutual funds and ETFs, can leverage its independent research and the Zacks Rank through a comprehensive suite of daily investment newsletters, including value, growth, income, options and more.

It also has educational, video, and podcast content to learn about investing and to gain insights into current market conditions.

Who It’s ForIf you’re simply looking for premium stock picks using time-tested a strategy, Zacks is a solid choice:

- Fundamental analysis ❌

- Stock screener ❌

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

The site is not built for independent due diligence like WallStreetZen or Morningstar. If you’re not interested in copying other analysts’ trades and having access to their research, look elsewhere.

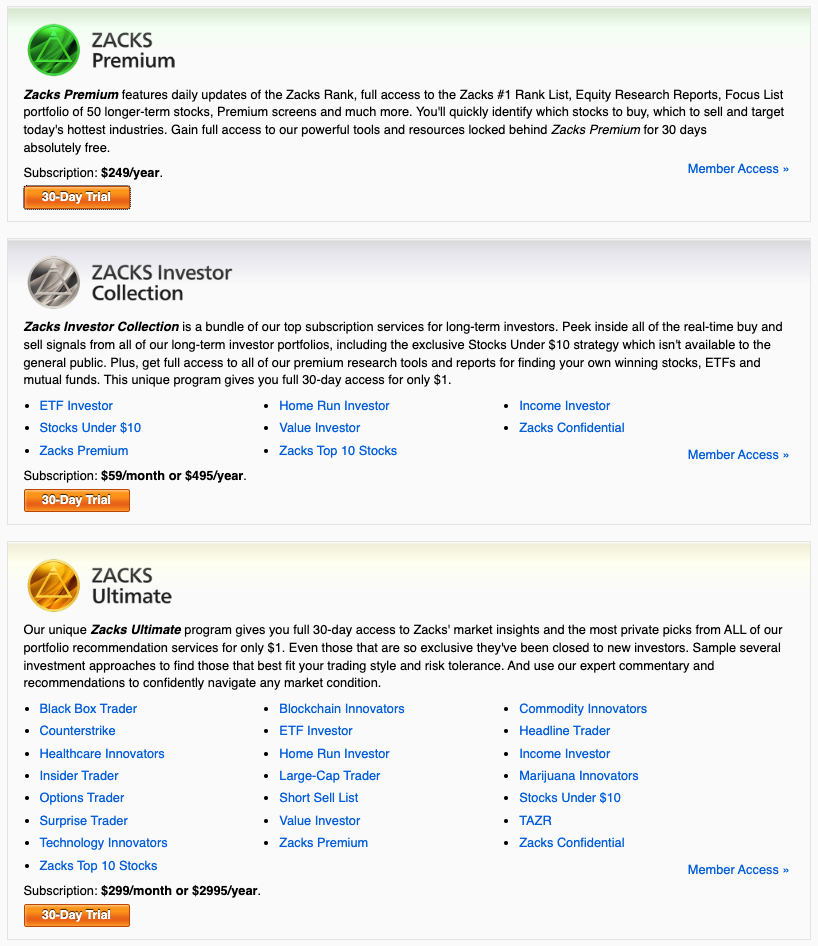

PricingZacks is built as a members-only platform, with quite a few different services. Its most popular options are Premium, Investor Collection, and Ultimate:

After 30-day trials, users can get Premium for $249/year, Investor Collection for $495/year, and Ultimate for $2,995/year.

2. The Motley Fool - Stock AdvisorAt a price of only $199/year, this ranks as one of the best stock picking websites.

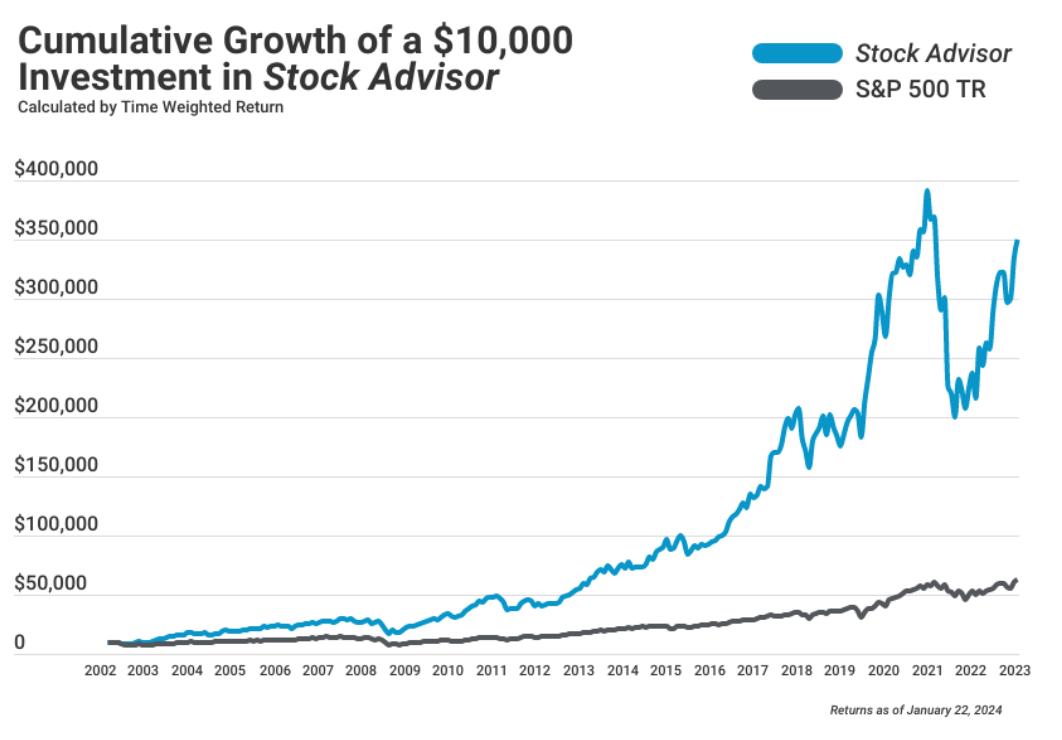

Since its inception in 2002, The Motley Fool Stock Advisor has outperformed the S&P 500 by more than 3-to-1.

Source: The Motley Fool

The Motley Fool offers many of the same features as Zacks Investment Research, though it focuses on just 2 premium services, both of which espouse a buy-and-hold strategy.

The site’s investing philosophy revolves around ignoring short-term volatility, choosing instead to focus on companies’ strong fundamentals and riding market trends:

Source: Motley Fool Stock Advisor

Upon sign-up, Stock Advisor members receive 2 new stock recommendations along with 2 new stock picks each month. Each recommendation comes with an in-depth analysis of the risks and potential upside of each investment. Members also gain access to a knowledge base, market news coverage, and The Motley Fool Community.

Who It’s ForLike Zacks, The Motley Fool is for investors looking to get a few premium stock picks per month, though long-term investors will find the most value here:

- Fundamental analysis ❌

- Stock screener ❌

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Again, you’re paying for stock picks only, not the data/information needed to make buy/sell/hold decisions independently.

PricingThe Motley Fool’s Stock Advisor has an introductory offer of $89 for the first year, followed by $199/year upon renewal:

If you sign up for the annual membership, you have access to a 30-day membership-fee back guarantee.

Best Stock Screener WebsiteIf you’re looking for superior screening tools, check out the best stock screener website:

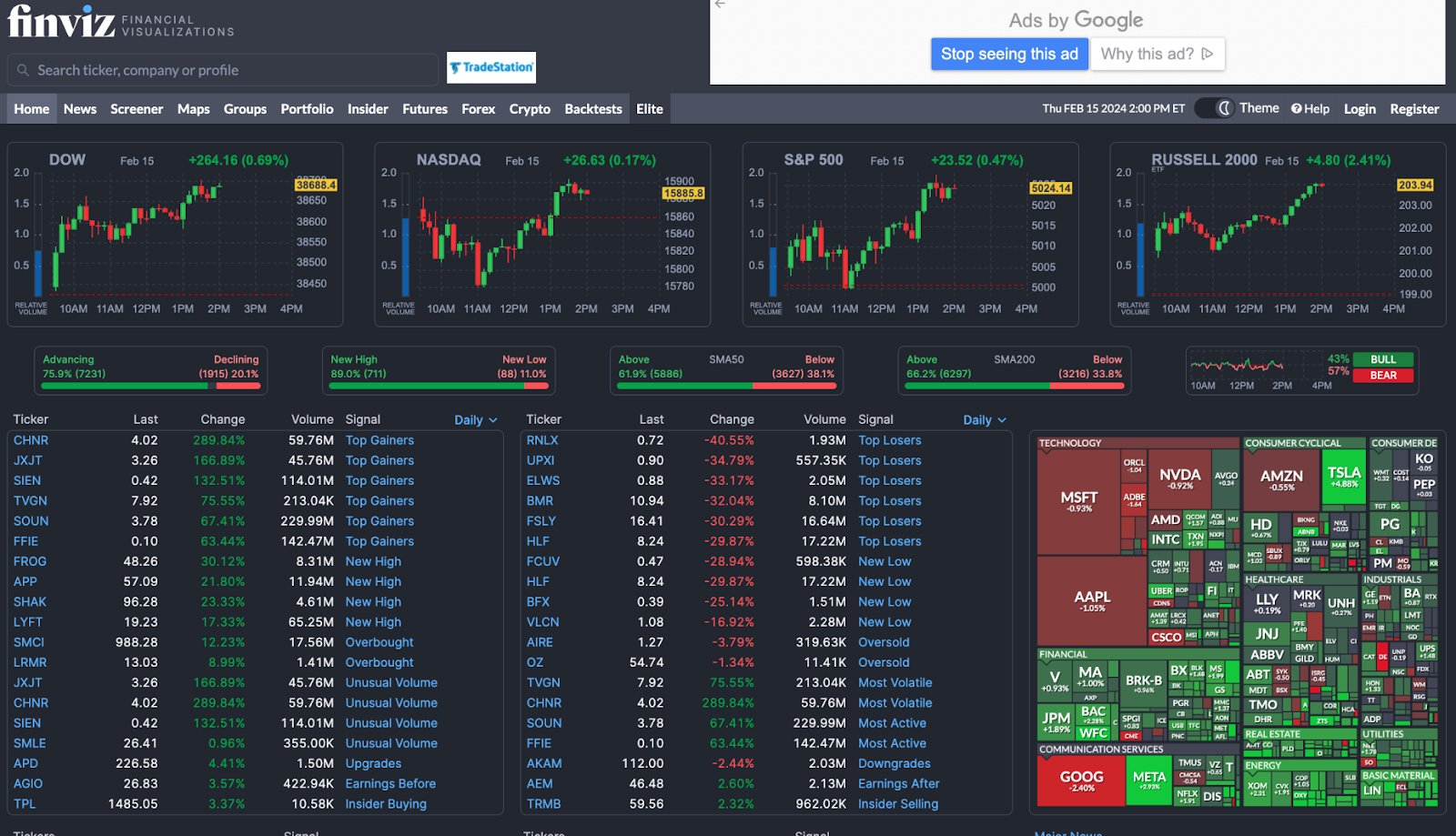

1. FINVIZWhen it comes to researching and screening on vast amounts of statistical information, FINVIZ stands alone, which is why it’s the only true screener on this list of best stock research tools.

There aren’t a lot of bells and whistles, just screens and screens of extensive financial data, charts, and statistics:

Source: Finviz

The FINVIZ screener offers 4 different types of filers: Descriptive, Fundamental, Technical and ETF.

But, unlike WallStreetZen, the interface is not overly user-friendly or ‘sleek’ by any means.

The screener tool allows you to quickly sift through thousands of stocks using key Descriptive, Fundamental and Technical criteria:

- Descriptive - market cap, dividend yield, earnings date, average volume, industry, price, country, etc.

- Fundamentals - greater detail based on the basic P/E ratio, margins, sales growth quarter to quarter, EPS growth, insider ownership, and many more.

(P/E ratio data is important because it shows how a company is expected to perform in the future. )

- Technical - moving averages, gap, RSI, volatility, performance, percentage change, after-hours change, and candlestick patterns.

As you can tell, FINVIZ is very complex and can be intimidating for many users in terms of knowing what to look for within the screener.

Although it offers news reports, blog reports, maps, groups, Portfolios and Insider Tabs, the flagship feature of FINVIZ is its screener, making it a somewhat limited option beyond a niche group of investors.

Who It’s For

FINVIZ is a powerful screener but its usefulness is narrow, making it one of the best stock researching websites available for investors looking for:

- Fundamental analysis ❌

- Stock screener ✅

- Stock pickers/analysts ❌

- Investment research ❌

- News and quote data ✅

- Technical analysis ✅

The site is severely lacking when it comes to the user interface, fundamental analysis and qualitative investment research.

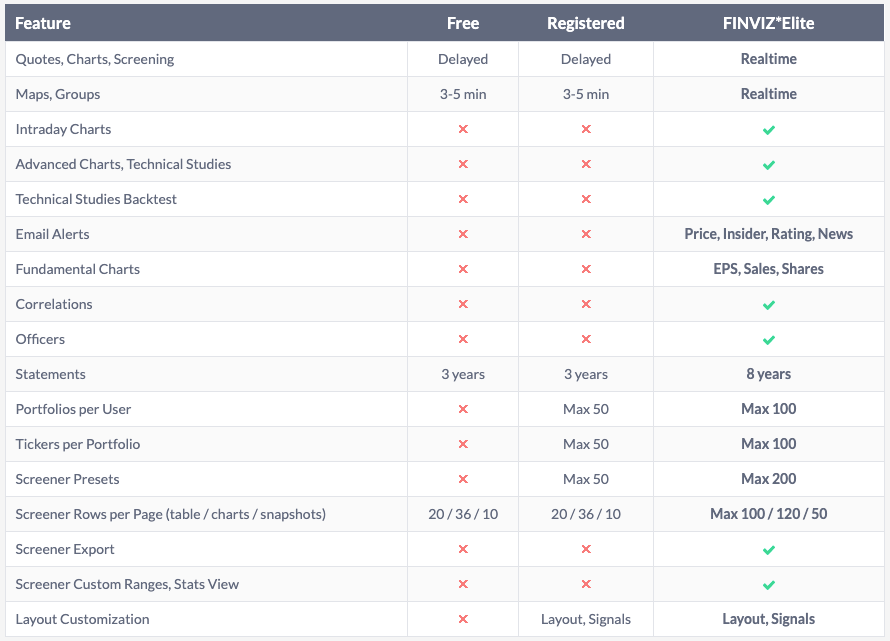

Pricing

Like WallStreetZen, there are two plans to choose from: a free Basic plan and a paid, ad-free plan called Elite:

Source: Finviz

Until you’ve reached a certain experience level, the casual trader can leverage data and charts from the free version to be successful. However, professional traders would find value in the FINVIZ Elite features - like the Realtime data and backtesting.

You can choose to either pay monthly or annually for the Elite version: $299.50/year or $39.50/month.

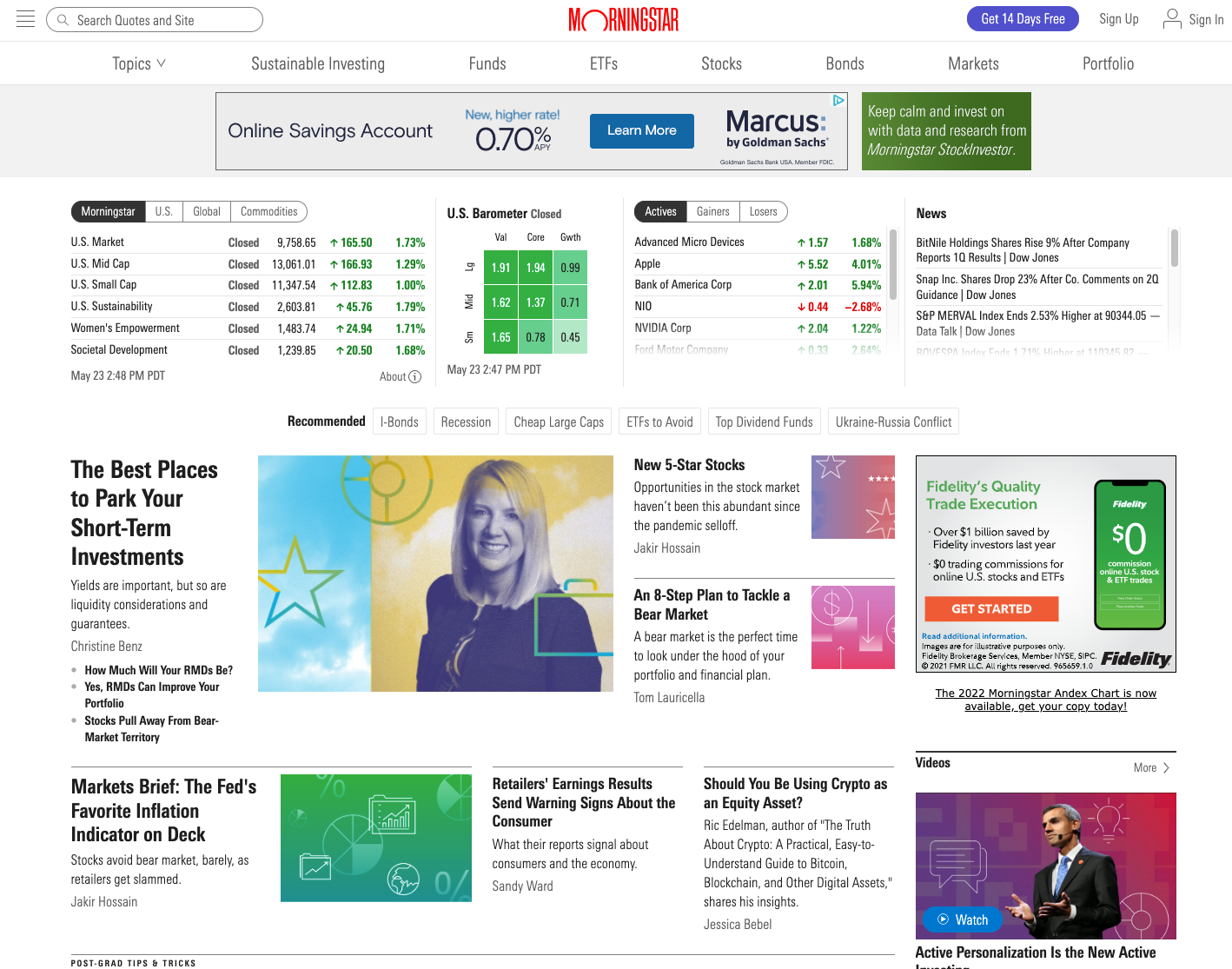

Best Investment Research Websites1. MorningstarMorningstar is one of the world’s most widely respected equity research firms, used by both retail and professional investors alike. It’s one of the best stock research websites because of its focus on hard data and emphasis on the long-term value investor.

If you’ve ever invested in an IRA or 401(k), you might be familiar with mutual fund “Morningstar ratings”, which should give you an idea of the amount of respect Morningstar has earned from its peers.

Beyond financial data, the site is full of content and daily updates via news feeds and multiple newsletters:

Source: Morningstar

While Morningstar allows you to research fundamentals for securities like stocks and bonds, its primary focus is mutual funds.

Morningstar Investor is the platform's main stock picking software. Subscribers can build a portfolio from scratch and access research, data and tools from Morningstar’s investment experts - including commentary, news and their take on thousands of securities with reports.

Additionally, Morningstar Investor has tools for tax planning, asset allocation, personal finance, retirement, and education investing.

Who It’s ForMorningstar is a solid platform for long-term, fundamental investors looking for trusted tools to build a portfolio consisting of stocks, mutual funds and ETFs.

- Fundamental analysis ✅

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Its general website is robust with free resources and can be overwhelming, but it is a widely-trusted resource for daily financial market news.

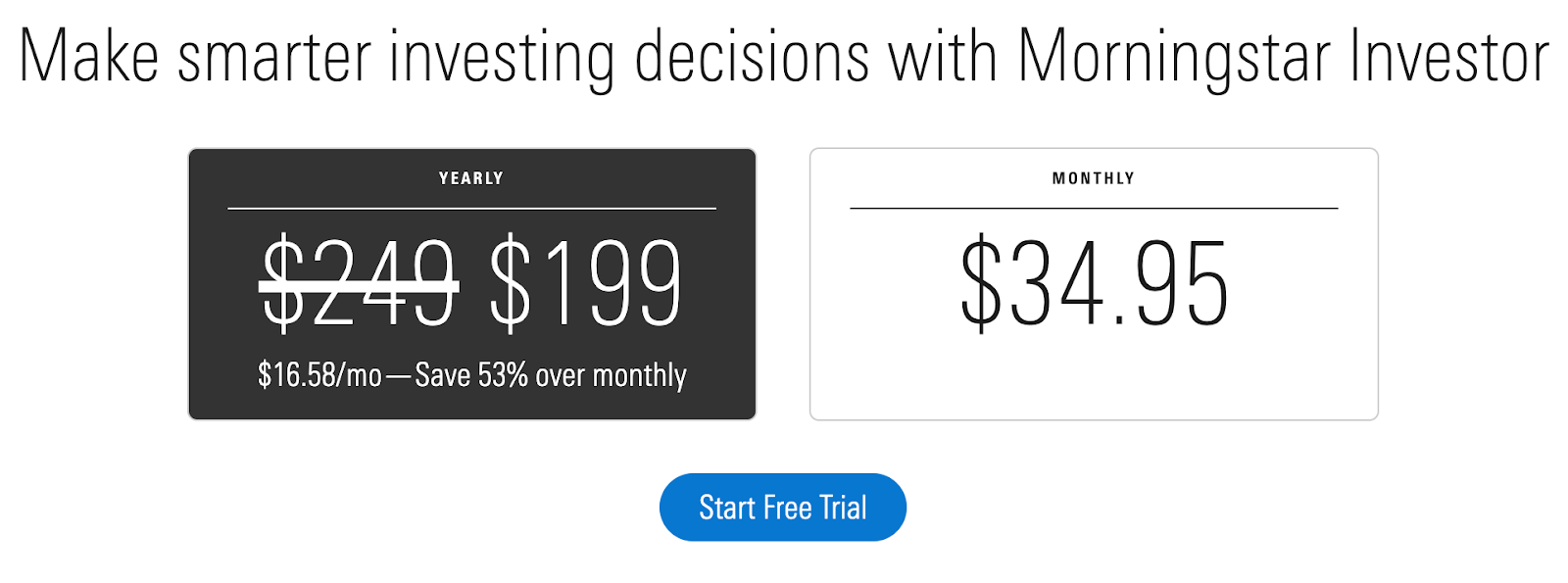

PricingMorningstar Investor pricing provides expertise + analysis + tools and is the comparable option to other stock analysis software:

Source: Morningstar

After a 14-day free trial, Premium costs $199/year.

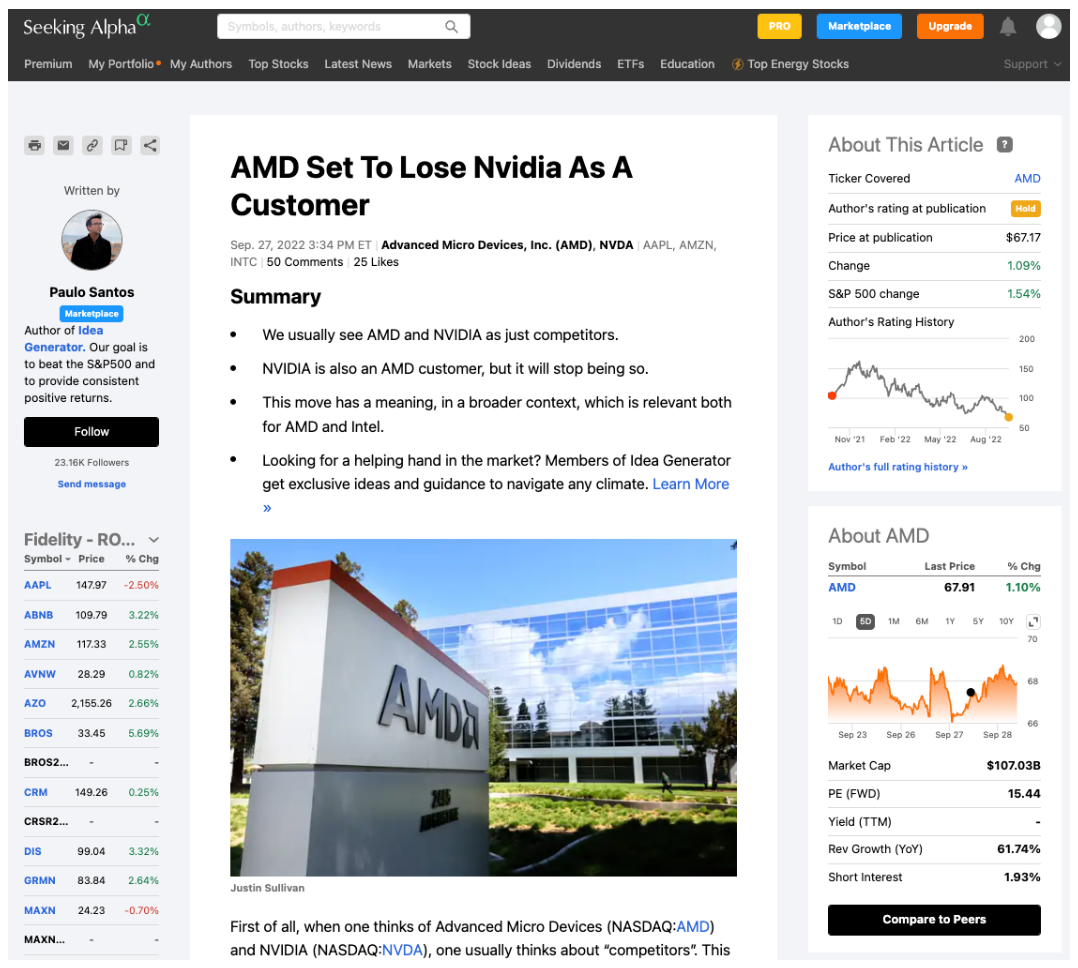

2. Seeking AlphaSeeking Alpha caters to the research-oriented investor and takes a different approach than Motley Fool. Stock picking ideas are crowdsourced from nearly 10,000 contributors, as opposed to an in-house research team.

The result? A community of serious investors with a diverse set of global stock trading opinions.

Source: Seeking Alpha

If you’ve ever typed a ticker into Google, you’ve likely stumbled across one of these analysts’ reports.

Unlike WallStreetZen, however, its articles and blogs (which are typically buy/sell/hold recommendations) are crowdsourced by primarily amateur investors with varying backgrounds - anyone can apply to be a writer.

Each month, Seeking Alpha’s crowdsourced investment analysis draws approximately 20 million visitors and 2.6+ million newsletter subscribers. Over 18,000 people have contributed articles and blog posts over the years, including:

- Institutional investors

- Fund managers

- College students

- Retirees

Users are encouraged to follow their favorite analysts/authors and will typically follow their recommendations for buying and selling equities.

Instead of making your accessing tools make your own investing decisions, Seeking Alpha is built for investors looking for some portfolios to replicate.

In addition to the community and social aspect, there are fundamental analysis components with a premium subscription. This includes ‘Strong Buy’ stock picks, proprietary quant ratings, stock and ETF screeners, earnings and dividend forecasts and for the analytical investor - ten years of downloadable financial statements.

However, unlike Zacks or Motley Fool, there’s much more transparency about why SA’s analysts are making their buy/sell decisions for their own portfolios.

Who It’s ForIf you want stock ideas to follow from experienced investors putting their own money into their recommendations and their thesis on those recommendations, Seeking Alpha is a solid choice:

- Fundamental analysis ❌

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Seeking Alpha is built for investors who want to follow others’ portfolios and ideas, not those looking to make their own decisions based on their own analysis.

Pricing

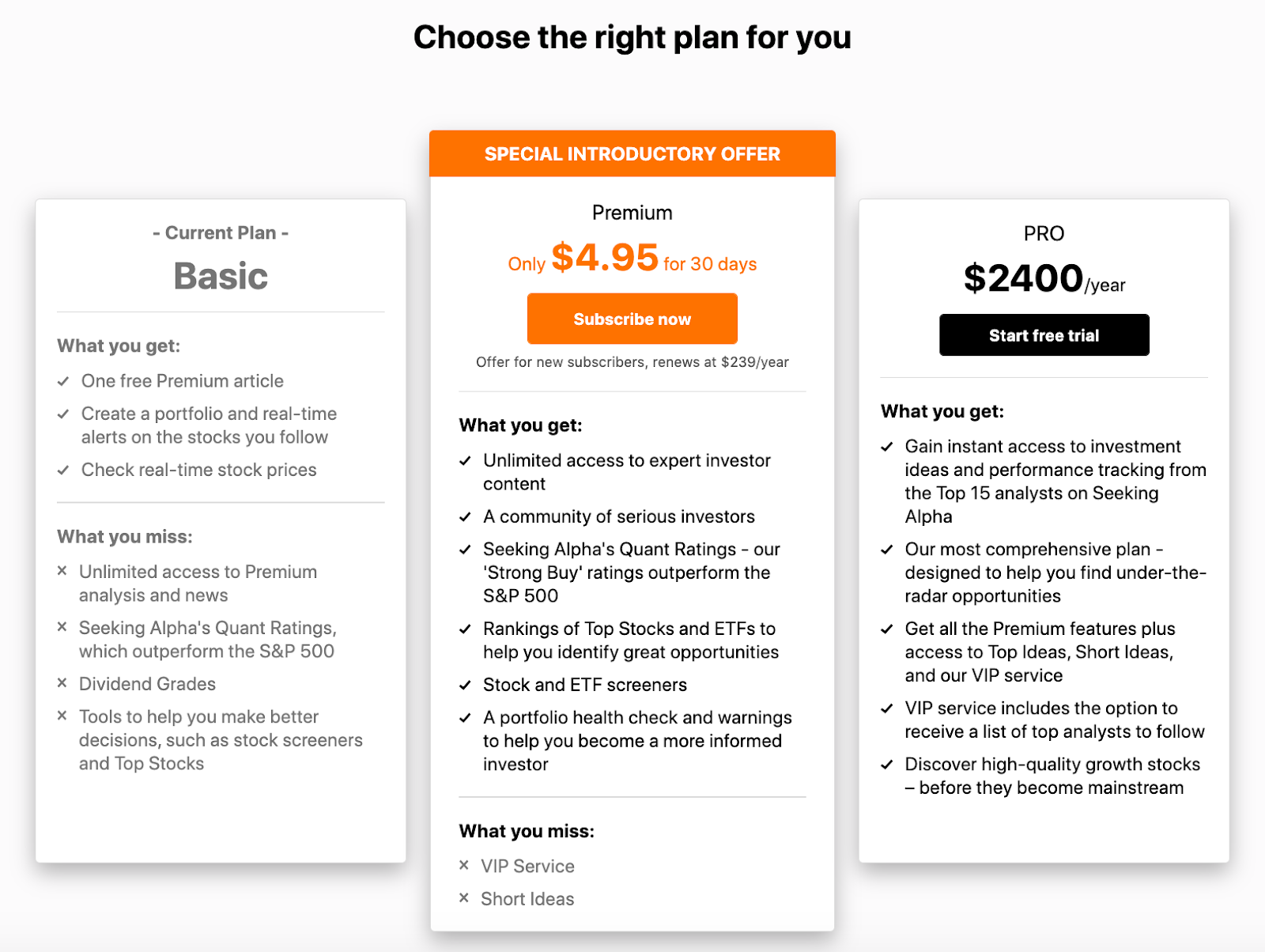

Seeking Alpha has 3 tiers - Basic, Premium (best value) and Pro:

Source: Seeking Alpha

Premium comes out to $29.99/month (or $239.88/year when billed annually) while Pro costs $299.99/month (or $2,399.88/year when billed annually) after free trials.

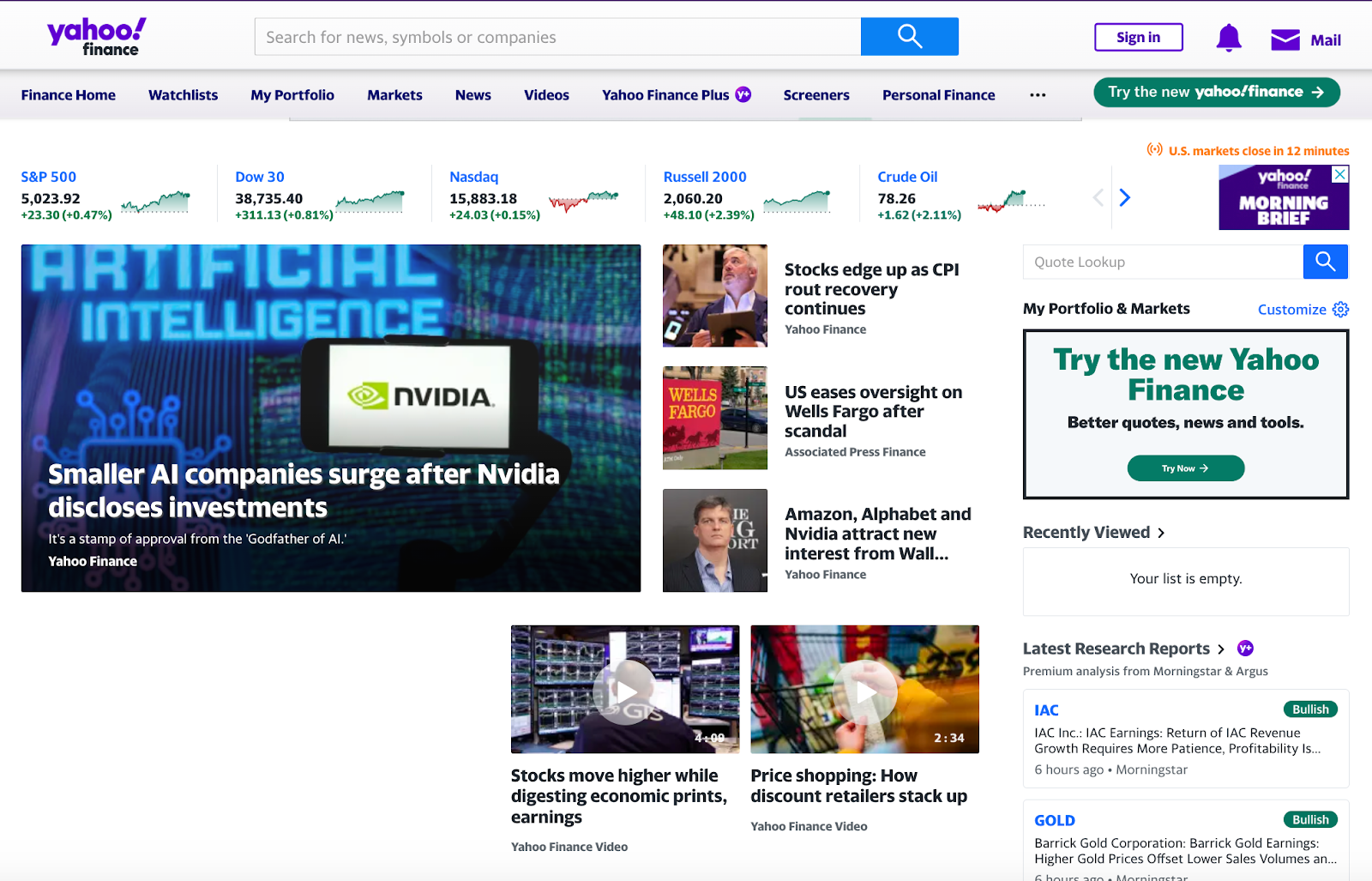

3. Yahoo! FinanceYahoo! Finance is still the most popular destination for tracking the U.S. markets and economy, earning its spot on our best stock market websites list.

Personally, my favorite feature is its news feed. Yahoo! Finance is the largest repository of third-party research reports sourced from analysts all over the world:

Source: Yahoo! Finance

The quantity of news, finance and education content on Yahoo! Finance is challenged by only 1 or 2 others on this list of best stock sites, and drives a lot of traffic to other stock websites like Motley Fool, Seeking Alpha, and Zacks.

Beyond being a news repository, the site has a number of high-quality tools and features which include market data on everything from mutual funds to crypto, watchlists, educational personal finance articles, and premium features like advanced charting and portfolio analytics.

Who It’s ForYahoo! Finance’s straightforward approach attracts experienced investors who know exactly what they’re looking for. Unlike a site like WallStreetZen, its statistics are fixed, numerical data points that lack any interpretation or comparisons.

This works for investors who know exactly what they’re looking for and what represents value for an individual company in a specific industry, but non-professional investors may find themselves looking for additional context.

That said, it’s a solid option for the news-centered, experienced investor:

- Fundamental analysis ✅

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ✅

While it technically does check all of the boxes, some of the features are not entirely helpful while others are hidden behind paywalls or just links to third-party sources, lowering its rank on our list of best stock analysis websites.

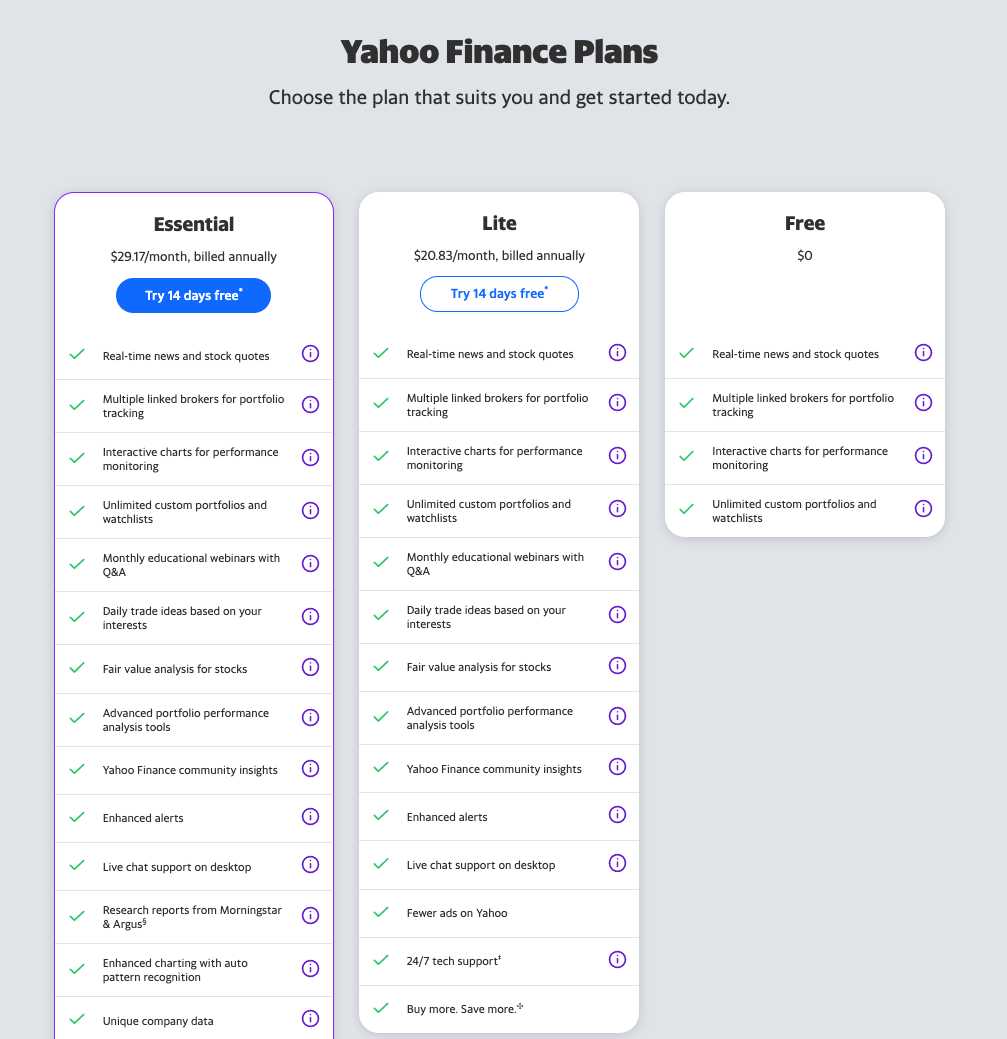

PricingYahoo! Finance offers 3 plan levels, Free, Lite, and Essential:

Source: Yahoo! Finance

After a free 14-day trial, the Lite version costs $20.83/month and Essential costs $29.17/month, both of which are billed annually.

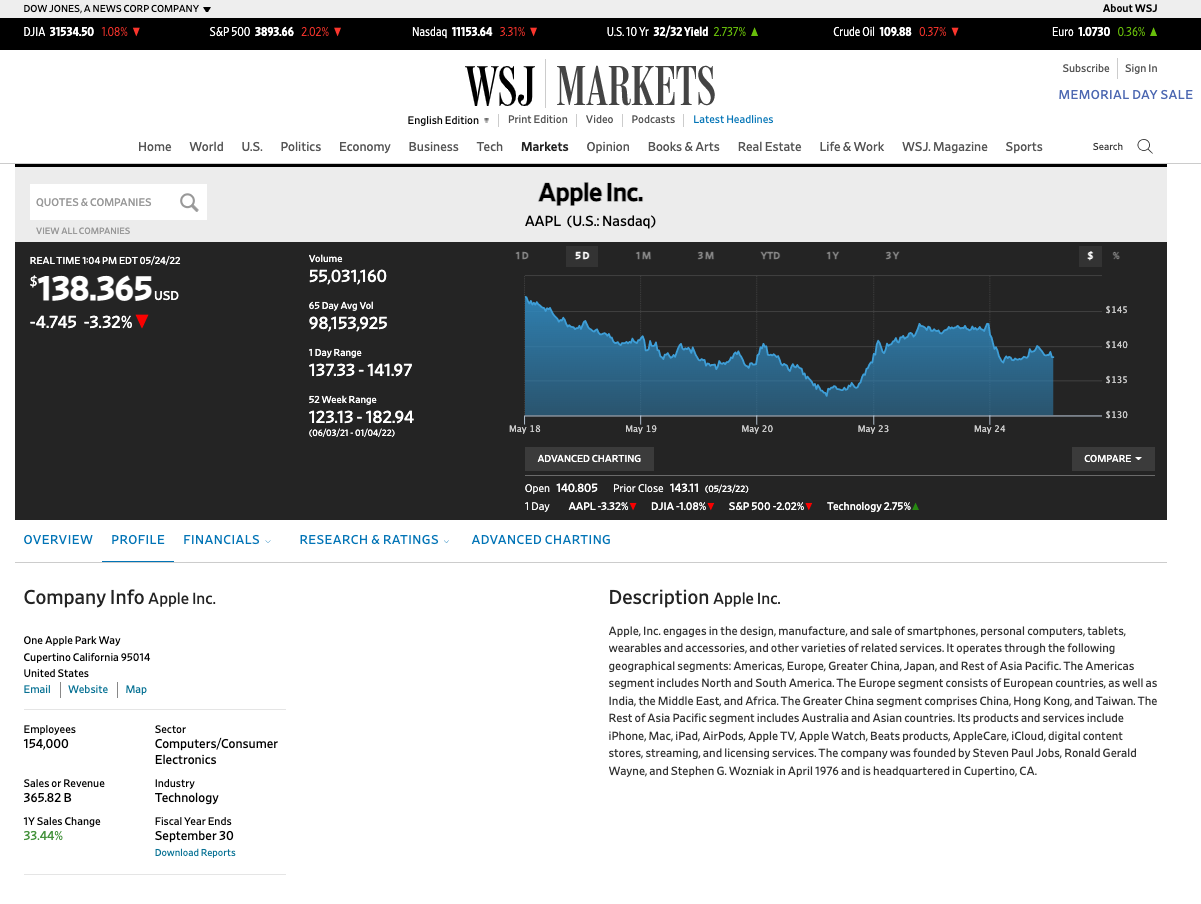

Best Stock News/Basic Quote Information Website1. Wall Street JournalThis one may be a surprise on this list of best stock analysis tools, but the Wall Street Journal has been one of the top-ranked business journals in the world since its first issue in 1889.

You may know The Wall Street Journal as the definitive source on business, finance and money news, but it also has a powerful section for looking up and doing some analysis on individual tickers, earning it a spot on our list of best stock research tools:

Source: Wall Street Journal

The Journal provides news on global stock exchanges and covers up-to-the-minute news from around the world. It also publishes 6 days per week, providing in-depth, well-vetted commentary you can trust.

In many ways, I prefer it to Yahoo! Finance, especially when it comes to its interface (though it lacks the repository of commentaries).

Who It’s For

Stock market coverage is just one aspect of the WSJ site - if you’re looking for a quality, fact-based news reporting and a place to do some light fundamental research, the WSJ is an excellent choice:

- Fundamental analysis ✅

- Stock screener ❌

- Stock pickers/analysts ❌

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Pricing

The Wall Street Journal is typically $38.99/month, but they almost always have a special going where you can lock in a price at a lower rate.

For example, I’ve been paying $4/month to use The Journal for the last 7 years.

Summary: The Best Stock Research Websites & ToolsIn this guide to the best stock research sites, we’ve featured something for every type of investor. Did you find the right stock investing tool for you?

If you’re looking for stock picks, Zacks and Motley Fool are great options.

If you’re looking for a heavy screener, FINVIZ should be your tool.

For investment research, Morningstar, Seeking Alpha, and Yahoo! Finance are all viable sites.

But, if you’re looking for the single, overall best stock research sites, StockNews or WallStreetZen is the place for you.

SPY shares were trading at $511.15 per share on Friday morning, up $3.07 (+0.60%). Year-to-date, SPY has gained 7.54%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Ryan Taylor

Ryan is a Property Financial Analyst and active real estate agent in Michigan. He has worked in the retirement industry for Voya Financial and Alerus Financial as a Retirement Analyst. Ryan holds a bachelor's degree in business from Ferris State University.

The post 9 Best Stock Research Websites & Tools (2024) appeared first on StockNews.com